-

Amazon Has 75 SVOD Services In Its Streaming Partners Program, Though Some Big Names Missing

Amazon now has 75 SVOD services participating in its Streaming Partners Program (“SPP”), which is approximately three-quarters of all the SVOD services available in the U.S. As of this past April, Parks Associates said there were 98 SVOD services in the U.S. though clearly more have launched since.

The update on SPP was provided by Michael Paull, Amazon’s VP of Digital Video, at last week’s On Demand conference in NYC, as reported by Multichannel News.

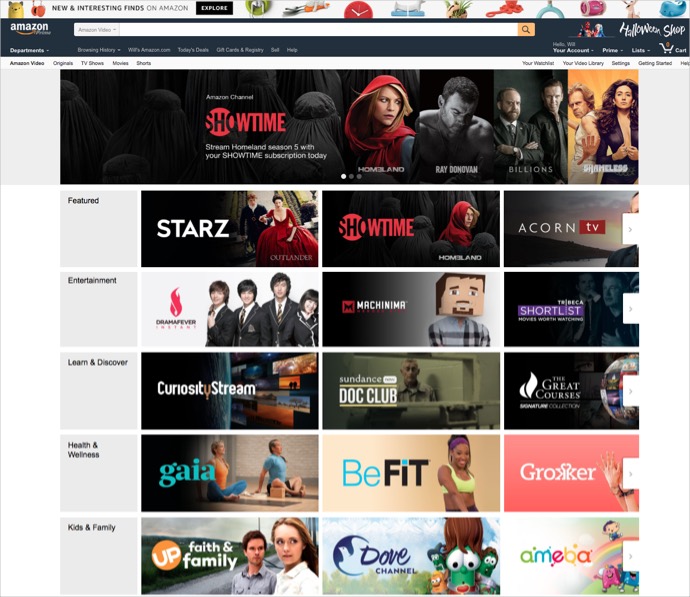

When an SVOD service joins SPP, it is included in a “Channels” section for Amazon Prime members, who can then quickly add it (see below image). All services include a trial period. Once the channel is added, it’s available on all devices that support Prime Video. Amazon provides billing, delivery, operational support as well as periodic promotions and recommendations for the SVOD service, including on Fire TV, all in exchange for a share of the monthly revenue.With 75 SVOD services, Amazon has more than doubled the 30+ which were available just 5 months ago. The SPP only launched last December, so having a majority of SVOD services on board already is pretty strong indicator that SVOD services are benefiting from participation.

Among the better known SVOD services available are Showtime, Starz, Acorn TV, Seeso, Tribeca Shortlist, Drama Fever and Machinima. There are also lots of services I wasn’t familiar with such as Fear Factory, Up Faith & Family, Cross Counter and Powerslam.

SPP has clearly achieved a lot of breadth in a short period, but some the biggest SVOD names are still missing, including Hulu, CBS All Access, HBO Now and MLB.TV. All of these services have spent heavily to build their brands and their content, so are less likely to benefit from SPP.

As Michael noted last week and as he said when I interviewed him at the NABShow Online Video Conference last April, Amazon has millions of Prime users’ profiles so it has the data to surgically recommend services and programs that will be highly relevant. With the free trial feature of SPP and frictionless activate/de-activate, Amazon can drive an enormous amount of trialing for partners and likely a higher conversion rate from free to paid.

I’ve been bullish on SPP since it first launched last December, seeing it as disruptive to the entire SVOD industry and Amazon’s move to aggregate content much like we’ve seen in pay-TV, but with far more user flexibility. SVOD has become an extremely competitive business with dozens of services competing for attention and share of wallet from consumers who are unlikely to subscribe to more than a handful of services.

Amazon gives these SVOD services much-needed promotion in its storefront, while taking over all of the operational, back-end tasks, which challenge lean SVOD providers with limited technology resources.

As I’ve said in the past, Amazon is playing a totally different game in video than Netflix, for example, which is investing billions in content to differentiate itself. Amazon is of course also investing in originals, but has a much broader video strategy. For now, the focus is on using video to help drive Prime subscriptions and retention, critical goals of the company’s business model. As long as it keeps doing that, I expect Amazon to keep building out a more robust video offering.

Categories: SVOD

Topics: Amazon