-

Digital Movie Purchase and Rental Activity Remains Anemic

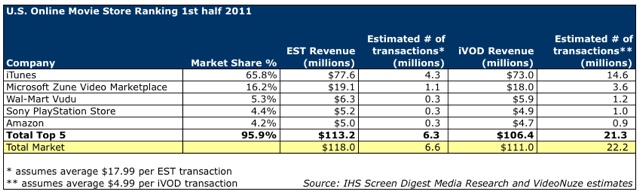

Earlier this week IHS Screen Digest Media Research released market share information for the top 5 U.S. digital/online movie stores for the first half of 2011, which together represent approximately 96% of the market. In addition, IHS released information on revenues generated for both purchase/download (Electronic sell-through or "EST") and rental (Internet video on demand or "iVOD").

In the chart below, I've taken the IHS data a step further to estimate each of the top 5 stores' revenues and transaction volume from EST and iVOD (note IHS only provides combined EST+iVOD market share information so for simplicity I have assumed each individual store's share is the same for both EST and iVOD though no doubt there are some variations). The data leads to a clear conclusion that years after movies have been available for digital purchase/download and rental, activity remains anemic, suggesting very low levels of consumer interest, particularly as compared with DVD purchase or rental/subscription options.

IHS said that in the first half of 2011, total EST and iVOD revenues equaled $229 million, with the amount roughly split between the two (EST of $118 million and iVOD of $111 million). Applying each of the top 5 store's market share percentages to these amounts, I estimate that iTunes, as the leader, generated approximately $77.6 million in EST revenue, while Amazon, in distant 5th place, generated just $5 million. Doing the same for iVOD, iTunes gained $73 million in revenue, while Amazon gained just $4.7 million. Given that all of the top 5 stores are part of multi-billion dollar companies, these amounts are practically rounding errors. Especially for Amazon, its lagging position makes its shift to include streaming as part of Amazon Prime no surprise.

Taking things a step further, by assuming an average transaction size of $17.99 for EST and $4.99 for iVOD, I calculated the approximate number of transactions by store. Once again, the numbers of amazingly low. Take iTunes for example; its EST transactions for the first half of the year are about 4.3 million and its iVOD transactions are about 14.6 million, despite the fact that there are tens of millions of iTunes users in the U.S. Clearly only a small fraction of users are buying or renting movies.

More broadly, the $229 million in first half '11 EST+iVOD revenue is a fraction of the multi-billion dollar DVD market, and even more modest when compared with Netflix for example, which had over 24 million U.S. subscribers as of June 30th and total revenues of nearly $800 million.

The challenges facing both EST and iVOD aren't a secret; EST suffers from incompatibility among devices plus a lack of portability, particularly as compared with DVDs and ubiquitous, low-cost DVD players. iVOD has highly restrictive playback/expiration policies, connectivity requirements to stream in high-quality and a relatively small universe of connected TVs.

IHS noted that Apple's AirPlay, which provides wireless streaming to TVs and other devices, was a contributor to Apple's market share gains. Other technology advances such as digital lockers like UltraViolet and Disney's KeyChest will address some of the EST issues, and innovation in devices and mobile connectivity will surely help iVOD.

Still, consumer acceptance of both EST and iVOD has a long, long way to go in order to approach DVD. And then there's the competition of subscription services from providers like Netflix and pay-TV operators, which offer the benefit of paying one fixed price and watching as often as the viewer wants. For EST and iVOD the challenges ahead remain steep.Categories: Aggregators, Commerce, FIlms

Topics: Amazon, IHS, iTunes, Microsoft, Sony, VUDU, Wal-Mart