-

Netflix Blows Away Q1 '10; Adds Almost 1.7 Million Subscribers

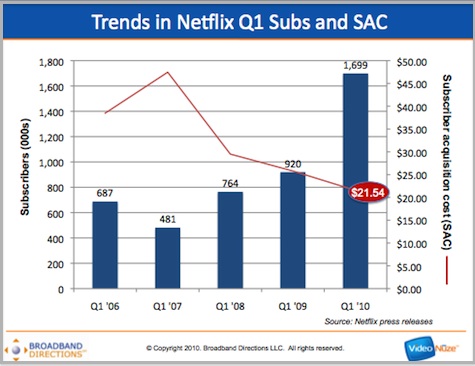

Netflix reported its Q1 '10 results yesterday and they're the best in the company's history, blowing away its own guidance for the quarter. Net subscriber additions totaled 1.699 million, above the high end of the company's own guidance range of 1.232 million to 1.532 million net subs. It's by far the biggest quarter the company has ever reported, and is 85% higher than Q1 '09 net sub adds of 920K. Netflix upped its full year guidance range for ending subs to 16.5 to 17.3 million, from the previous range of 15.5 to 16.3 million.

In addition, the company reported subscriber acquisition cost of $21.54 which is the lowest in the company's history. This continues the downward trend in SAC over the last 4 years. Churn came in at 3.8% which is also a record low, just below Q4' 09's 3.9%.

To get a sense of how big Q1 '10 was, look at the below chart showing net sub adds for the five first quarters back to 2006. Note that net sub adds in Q1 '10 were more than twice as much as just 2 years ago in Q1 '08. The SAC line shows the steady drop over the last 3 years. As I said yesterday, the record low churn in Q1 '10 is strong evidence that all this growth isn't coming at the expense of subscriber quality.

On the earnings call, CEO Reed Hastings and CFO Barry McCarthy gave a very upbeat report on the business and reiterated several themes from prior earnings calls. Increasing the streaming library is clearly the company's number one objective, and the recent 28-day DVD deals with Warner Bros, Universal, Fox and HBO, all serve this purpose. Hastings mentioned a number of times that savings on DVD purchases resulting from these deals is being plowed back into gaining more streaming content.

The company noted that subscribers using its Watch Instantly streaming feature for at least 15 minutes per month in Q1 '10 rose to 55% from 48% in Q4 '09. In fact, Hastings and McCarthy often referenced the positive interplay between improving the streaming value proposition and increasing subs, reducing churn and reducing SAC. This is the fundamental dynamic the company is now in. Three plus years since introducing Watch Instantly, the hybrid offer of DVD rental and streaming has reinvented Netflix's value proposition and propelled its unprecedented growth.

A few other interesting tidbits in no order, from the earnings call and commentary:- New subscribers are disproportionately choosing the $8.99 "1 DVD out" plan.

- A significant number of streaming users have connected their computers to their TVs.

- TV program content available for streaming has grown significantly in last 2 years and now accounts for a significant percentage of weekly viewing hours.

- iPad app has had minor effect on business, but being in Apple ecosystem has generated great PR.

- Wii launch in Q2 is expected to have big impact on streaming usage.

- 28-day DVD deals is prompting some consumer shifting to purchase and VOD, but that was expected and isn't harming Netflix's subscription value.

- Netflix has no interest in setting up a digital storefront for single-use rental or downloads. It believes Amazon, iTunes and others do that model well and it would cause partner conflicts. Subscription is Netflix's only focus.

- Netflix hasn't seen any upside from alleged "cord-cutting" of cable/satellite/telco services and doesn't see itself as a relevant substitute for these services.

- Plan is to continue as a distribution partner for pay channels like HBO, Showtime, Starz and Epix - not to compete with them, or introduce original programming like they do.

- 24% of households in Bay area now Netflix subscribers, and in spite of streaming's growth, DVD shipments in the area still increased in Q1 '10.

- Hastings swapped a large percentage of his cash compensation for stock awards in a vote of confidence in the business.

- Not concerned about reports of Hulu or Redbox subscription offers; Netflix's competitiveness is based on scale, UI, recommendations, content breadth.

- More news on international expansion later this year, but expected to start small.

As I said previously, Netflix is by far the most formidable "over the top" player, and with its continued strong growth is creating many interesting strategic options for itself down the road. The thing that continues to really surprise me about the Netflix story is that no meaningful competitor has emerged. How companies like Apple, Amazon, Walmart, Comcast, DirecTV and Microsoft plus big venture capital/private equity investors have sat on the sidelines and not aggressively introduced subscription DVD/streaming services of their own is both a mystery and a gigantic boon for Netflix. Given Netflix's size and formidable capabilities, it may already be "game over" for any of these potential competitors.

What do you think? Post a comment now (no sign in required).

Categories: Aggregators

Topics: Netflix