-

Netflix Dodges Qwikster's Bullet in Q3, But Pricing Changes to Kill Q4 Results

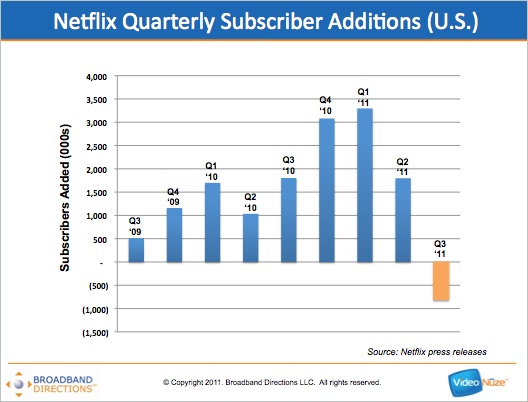

Netflix's Q3 earnings are in, with the company reporting it lost just over 800K U.S. subscribers to end the quarter at approximately 23.8 million subscribers. Although it's a dreadful performance compared with Q3 '10 when it gained 1.8 million subscribers, the reality is it could have been much, much worse. As I wrote earlier today, Netflix had lowered its Q3 U.S. target by 1 million to 24 million, on September 15th. But the Qwikster split-off was only announced 3 days later, unleashing a fury of negative sentiment. The big question was just how that sentiment would translate into subscriber losses. The answer turns out to be "just" another 200K vs. the reforecast.

While that might be taken as modestly good news, the company's Q4 guidance of "slightly negative streaming additions" combined with its statement that "DVD subscriptions will decline sharply this quarter" means that Q4 - which includes the prime holiday season - is going to be a complete washout, primarily due to the summer pricing change.

The reversal of momentum Netflix is experiencing in the 2nd half of 2011 is nothing short of astounding when you stop to consider that in the 4 quarters from Q3 '10 to Q2 '11 Netflix added almost 10 million subscribers in the U.S. (see below) Now, for the 2nd half of this year it will likely lose at least 1 million. And who knows what lurks beyond as the company turns the corner to 2012 and competition further heats up.

Update: following is additional information from the earnings call:

- Clarification that Q4 will see a slight increase in U.S. subscribers when netting out streaming growth and DVD-only and hybrid DVD/streaming losses.

- DVD is now mostly a variable cost business and because of First Sale doctrine costs are mostly postage and labor, not new content. DVD business is expected to continue to shrink, though there will be a long-term residual level, akin to AOL's dial-up operation.

- Streaming content licensing will lean toward more exclusive deals in the future. Most of these deals are fixed-fee. The amount committed to streaming deals now equals $3.5 billion.

- Netflix wouldn't characterize itself as "re-run" TV, but because it offers full back seasons, it believe this is a core part of its value proposition.

- No impact being felt yet from either Amazon Prime or Blockbuster Movie Pass services.

- Once the U.K./Ireland rollout occurs, further international expansion will be on hold pending the company's return to global profitability (no commitment that this will happen in 2H '12).

- Mexico and Brazil are two best performing territories so far in Latin America.

- On track to have many devices with the "Netflix button" on their remote controls in Q4.

Categories: Aggregators

Topics: Netflix