-

Netflix is Likely to Become the Largest U.S. Video Subscription Service When It Reports Q1 '11 Today

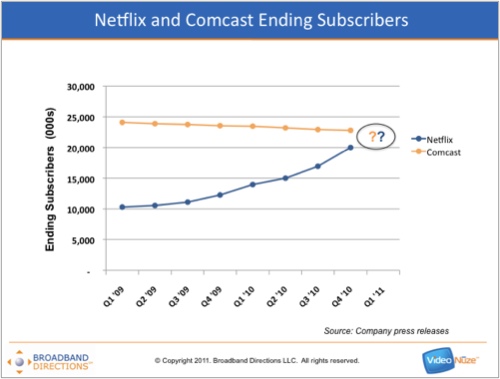

Netflix is likely to become the largest U.S. video subscription service - as measured by total subscribers - when it reports its Q1 '11 results at 4:05pm ET today. The milestone would be the latest evidence of Netflix's rapid accent as a major force in online distribution of Hollywood films and TV programs, as well as a central player in the unfolding battle for the digital living room.

Netflix ended 2010 with just over 20 million subscribers, and provided Q1 domestic ending subscriber guidance of between 21.9 million and 22.8 million subscribers. If Netflix slightly beats the high end of its guidance range it will eclipse Comcast, currently the largest video service provider, which ended 2010 with 22.802 million video subscribers.

So will Netflix exceed its own high-end forecast? For what it's worth, Netflix has in fact beaten its high-end (which it has consistently raised) in each of the past four quarters, and is fast becoming Apple-esque in its "under-promise and over-deliver" approach. Q1 also has significant upside potential as Netflix benefits from the volume of people who received connected devices (e.g. Apple TV, Roku, etc.) during holiday season 2010 and then activated Netflix subscriptions in Q1. On the flip side, to top Comcast would require Netflix adding about 2.8 million subscribers, which would be a huge 65% increase over the 1.699 million subscribers it added in Q1 '10. Though it's impossible to predict, I'd bet on a slight beat.

Even if Netflix doesn't surpass Comcast's 22.802 million subscribers later today, it will have another shot as becoming the largest next Tuesday, May 3rd when Comcast reports its Q1 '11. Comcast will almost certainly shed video subscribers, as it has done each quarter for several years (in Q1 '09 it dropped 78K subscribers, and in Q1, 82K). Comcast, like all other incumbent cable TV operators, continues to tussle with satellite TV providers DirecTV and DISH, plus new telco entrants AT&T and Verizon. So Netflix's gain and Comcast's loss could combine to provide the difference.

To be fair though, Comcast has consistently increased its average revenue per subscriber (ARPU) by driving adoption of new services (e.g. Digital, DVR, VOD, etc.), more than offsetting, from a profitability standpoint, its subscriber losses. And of course there's no comparing the ARPU of the two companies; Netflix's is decreasing each quarter due to its shift to streaming, with Q4 '10 coming in at $11.64, whereas Comcast's is at least 5-6x this amount from video alone. Comcast's overall ARPU is even higher when factoring in broadband Internet and phone services, not to mention all the revenue the company derives from its content, business and advertising services.

Still, the notion that Netflix is in the zone of having the most video subscribers in the U.S. is a somewhat mind-boggling concept, considering that at the end of Q3 '09 (the last quarter before its streaming service became the company's key growth driver), it had just 11.1 million subscribers. Netflix has been all about streaming ever since, and the payoff has been amazing: including Q1 '11, it will have gained approximately 12 million subscribers in just 6 quarters. For reference's sake, 12 million is approximately the same number of total video subscribers Time Warner Cable, the fourth-largest pay-TV provider in the U.S., had at the end of 2010.

Netflix has become a force by offering the right product, at the right time, at the right price point and executing brilliantly. But not to be overlooked in this growth story is that Netflix has benefited from an unimaginably friendly competitive landscape; not a single one of its main potential online rivals (Google, Amazon, Apple, Microsoft, etc.) has introduced a viable online video subscription service, instead focusing on free or pay-per-view strategies. Amazon in particular, which was probably in the best position to challenge Netflix given its extensive retail DVD, warehouse/distribution infrastructure, and online VOD efforts, recently gave Netflix a huge competitive gift by choosing the ridiculously tepid approach of bundling video as a feature in its Prime shipping service.

While these companies have dallied, Netflix has spent heavily on content, device integrations and marketing, making it the default choice for millions of consumers seeking an inexpensive yet robust premium online video experience. Pay-TV operators are only now starting to get in the game with their TV Everywhere efforts. Looking further ahead into 2011, Netflix's growth should continue to be strong, especially as it shifts from relationships with "homes," as the pay-TV industry does, to "individuals," as is common in online, further broadening its addressable market.

Check back in at 4:05pm ET today for Netflix's results.

What do you think? Post a comment now (no sign-in with our new DISQUS commenting system).

Categories: Aggregators, Cable TV Operators

Topics: Amazon, Comcast, Netflix