-

Netflix's Revenue Per Subscriber is Steadily Declining While Free Subscribers Are Soaring

It isn't news that Netflix has been on a huge growth spurt; over the last 5 quarters the company has added an astounding 6.3 million subscribers, increasing its total subscribers by 60% from 10.6 million at the end of Q2 '09 to over 16.9 million at the end of Q3 '10. What's less well understood though is that as the company has shifted its focus to streaming and to adding subscribers at its entry level $8.99/mo tier, several of the company's key metrics have changed substantially. I sensed this was happening with each passing quarter, but I finally got some time to crunch the numbers and see how things have actually been playing out.

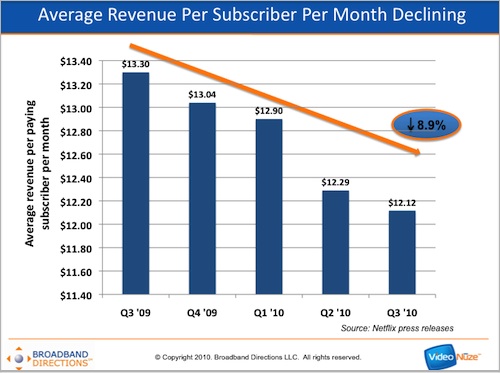

No surprise, Netflix's emphasis on the $8.99/mo entry tier is resulting in a steady quarterly decrease in its average revenue per paying subscriber, which has declined 8.9% from $13.30 in Q3 '09 to $12.12 in Q3 '10 (Note I calculated this by excluding average quarterly free subscribers, and by assuming a straight average monthly revenue per quarter. Since Netflix doesn't release monthly information, this is as close an approximation as possible). Netflix management has been candid in explaining that as $8.99/mo subscribers dominate growth (and even lower priced streaming-only Canadian subs are now added), average revenue per subscriber will trend down. At $12.12 in Q3 '10 though, and millions of $8.99/mo subs being added, further decreases should be expected.

Further, as streaming content selection improves, many 3 DVD-out and 2 DVD-out subs will downgrade their service to the 1-out $8.99/mo plan (I've experienced this personally; my family has been a 3-out subscriber for years and now as we watch more streaming, we've decided to downgrade). It's not clear what the mix of subs has been historically, but each 3-out at $16.99/mo that moves to $8.99 is a loss of $8/mo. So for every 1 million 3-out subs that downgrade, that would result in an $8 million/mo or $24 million/quarter top line reduction. To put that in context, $24 million would be about 4.5% of Netflix's Q3 '10 revenue (update: see my comment below outlining postage cost savings for these downgraded subs).

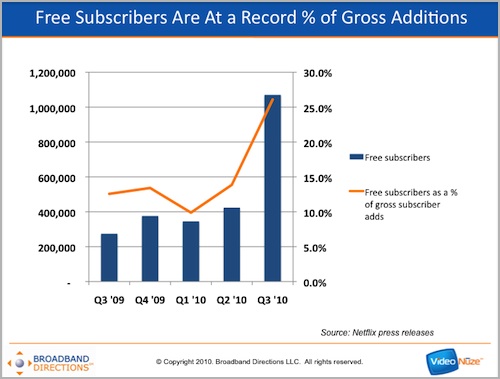

Aside from paying subs, Netflix also reported 1,070,000 free trial subs in Q3, which is a record number and more than 2.5x as many as the 424,000 in Q2 '10, which itself was a new record. As the chart below shows, free trial subs at the end of Q3 amounted to over 26% of the 4,101,000 gross subs added in the quarter. That too is by far the highest ratio in the last 5 quarters and is almost double. On the earnings call, Netflix CFO Barry McCarthy explained the spike as being due to faster sub growth in the U.S. and the recent entry to Canada. He added that he doesn't expect to see the free trial sub level normalize next quarter.

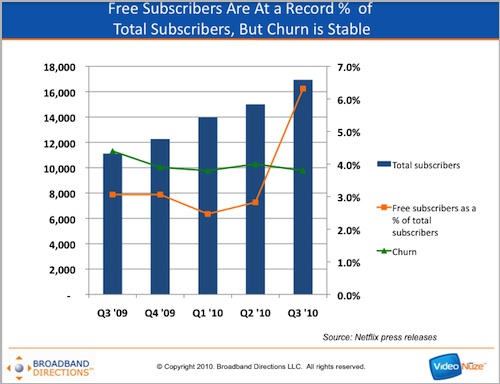

The higher level of free trial subscribers is certainly the result of heavily promoting the $8.99/mo plan, plus all the visibility that Netflix has gained this year and the widespread adoption of online video in general. But while it's expected, it definitely introduces a new risk to Netflix that didn't exist when steadily-growing DVD-by-mail was the company's dominant model. As the chart below shows, outstanding free trial subs represented about 6.3% of Netflix's total 16,993,000 Q3 ending subs, by far the highest percentage in the last 5 quarters. In fact, those 1,070,000 outstanding free trial subs at the end of Q3 '10 are actually almost double the total 510,000 net subscribers Netflix added a year earlier, in Q3 '09.

The higher free trial sub amount means greater pressure on Netflix to convert trial subs to paying subs in order to continue its smooth paid growth. Conversion has always been a key Netflix focus, but now with the preponderance of free subs drawn to the lower $8.99/mo entry price, there are no doubt many more people casually giving Netflix a try, feeling they have little to lose. That in turn means Netflix will have to learn new tactics for how to manage conversion. Though Netflix doesn't break out its conversion numbers, the good news is that on the Q3 earnings call McCarthy noted that newer trial subs are converting to paid at same rate as they did historically.

Beyond conversion, it's crucial that Netflix retains a high percentage of newly added subs to maintain growth. By this measure, Netflix seems to be doing very well so far, as the trend line in quarterly churn is almost flat over the last 5 quarters at around 4% (in fact in Q3 it actually notched down to 3.8%, equaling the record low from Q1 '10). If churn stays level, that will be a very good sign that many of the millions of newer subs recognize the value in Netflix's service and are staying on board.

In 2010 Netflix has made a huge and virtually seamless transition from its DVD-by-mail roots to streaming, and is now arguably the most successful paid provider of streaming video. I've been tracking Netflix's growth for years and have been a huge fan, pointing out earlier this year that it has entered a "virtuous cycle." However, the rapid growth has pushed the company into unchartered territory. How well Netflix continues to manage the interplay of revenue per paying subscriber, free trial users, free-to-pay conversions and churn, plus its skyrocketing streaming content costs, is going to heavily influence its continued success.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators

Topics: Netflix