-

80 Billion Reasons Why Pay-TV Will Become Even More Expensive

If you think your monthly pay-TV bill is already pretty expensive, then brace yourself for rate increases that will definitely be happening over the next several years, particularly in certain geographic areas of the U.S. Why? Because the cost of programming continues to spiral, led by sports. In fact, over the past 24 months, at least $80 billion has been committed by broadcast and cable TV networks to televise sports in the U.S. (note this includes $6 billion, the minimum either News Corp. or Time Warner Cable will likely pay for TV rights to the L.A. Dodgers' games).

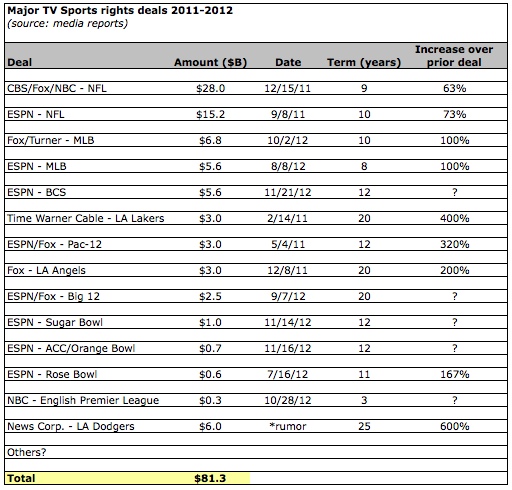

The chart below itemizes all of the deals that I'm aware of; no doubt there are others as well that aren't included. Also not included are the expected increased costs of renewals for some of sports' highest-profile events like the Super Bowl and NCAA March Madness in coming years.The numbers are truly staggering, both in their sheer size and also in their percentage increases. For example, the $28 billion committed by 3 broadcast networks last December for 9-year NFL rights is a 63% increase over their previous broadcast deal, while ESPN's $15.3 billion NFL deal from Sept. '11 is 73% more than its current one. Those increases pale in comparison to the 400% increase Time Warner Cable agreed to in its 20-year, $3 billion deal to carry the L.A. Lakers, or the 320% increase ESPN and Fox will pay for their $3 billion deal with the Pac-12, struck in May '11.

But all of these are poised to be eclipsed by the mother of all current sports deals - the rumored $6-7 billion that either News Corp. or Time Warner Cable is likely to pay for the TV rights to the L.A. Dodgers over the next 25 years. At these levels, the lucky winning network will be paying around $280 million per year, 600% more than the $40 million per year that Prime Ticket currently pays the Dodgers. Assuming the deal is done in this range, it will be a resounding validation of Guggenheim Partners' decision to pay a record $2.15 billion for the Dodgers last March.

Guggenheim's financial victory, and the riches that are flooding the rest of the sports ecosystem of players, coaches, owners and agents are plainly obvious. To give just one example of what it has come to with player salaries, the Yankees last night agreed to pay Kevin Youkilis $12 million for one season to play backup 3rd baseman while starter Alex Rodriguez ($28 million next season) recovers from hip surgery. We all still love Youk here in Boston, but $12 million for a 34 year-old player who hit .258 and .238 in his last 2 seasons?? Adding Youkilis means the Yankees will be paying $40 million to staff just one fielding position in 2013!

The problem with sports' TV gains is that they will certainly come at the cost of rising monthly rates for ALL pay-TV subscribers, fans or not. In fact, as I've written numerous times over the last 2 years, the dirty little secret of the TV sports world is that, due to the bundling of sports networks, non-fans actually pay the majority of the fees. At last week's VideoSchmooze, Sanford Bernstein analyst Craig Moffett estimated that over 50% of a pay-TV operators' programming costs are now sports related, while just 20% of audience time viewing is sports related. Pay-TV operators are scrambling to figure out how to deal with this squeeze; just this week the L.A. Times reported that DirecTV has begun assessing $3/month sports-related surcharges on certain subscribers.

The reasons why sports' rights fees are skyrocketing are well understood; as the last bastion of live TV viewing, sports draws an elusive younger male-skewing audience and the ads shown during broadcasts cannot be skipped. Contributing also are the turf battles being fought by the largest pay-TV operators and programmers for negotiating leverage with one another. So, as in all economic situations where supply is limited and demand is high, prices rise. That is of course, until their weight becomes so great that the foundation beneath them collapses.

This then is the $64,000 question: will the skyrocketing tax on pay-TV's non-fans, coupled with the availability of improved OTT content (e.g. Disney's latest distribution deal with Netflix), inevitably mean that a growing percentage of economically-challenged and entertainment-centric consumers will simply drop out of the pay-TV ecosystem?

It is impossible to predict, but as Craig also noted at VideoSchmooze, Los Angeles, which has become ground-zero for rising TV sports rates, is the "canary in the coal mine" for how this cord-cutting and cord-nevering dynamic will play out (as I've speculated on in the past as well). In 2013, watch what happens with pay-TV in L.A. and you'll get a sense of what might be coming to the rest of the country given the bubble in sports' TV rights fees.Categories: Cable Networks, Cable TV Operators, Sports

Topics: CBS, ESPN, FOX, MLB, NBC, NFL, Turner Sports

Related Posts

- Not a Sports Fan? Then You're Getting Sacked For At Least $2 Billion Per Year

- Disney, Comcast and Why TV Everywhere Alone Is Not Enough

- Will L.A.'s Non-Sports Fans Revolt Over Dodgers' Mega-Deal?

- Here's The REAL Problem DOJ Should Be Focusing On In Its New Cable Probe

- VideoSchmooze [VIDEO]: Top Wall St. Analysts Debate Industry's Tectonic Changes