-

CBS TV Stations Get Broadband Under Leess

(Note: This is the third in a series of posts with companies participating in the 2008 Media Summit, a premier industry event starting tomorrow in NYC. VideoNuze has partnered with Digital Hollywood, the Media Summit's producer, to provide select analysis and news coverage.)

A few months ago, in a post I wrote called "Broadcast TV Stations Most Threatened By Broadband/On-Demand," I asserted that broadband was bringing a perfect storm to the world of local TV stations.

These thoughts were in the background when I spoke last week with Jonathan Leess, President and GM of CBS TV Stations Digital Media Group. CBS owns 29 stations around the U.S. mostly in bigger markets. Leess has been in his role since April '04 and by all accounts has done an admirable job leading the CBS stations into the broadband era.

Most significant is the delicate balance he's tried to strike in centralizing certain online/broadband responsibilities while keeping others at the local level. This is no easy feat. Succeeding online requires scale and common technology platforms. Yet historically local stations enjoy wide autonomy in decision-making as long as they meet their numbers.

Leess explained that in broadband he's focused his corporate group on accessing and providing new non-local content, creating an internal syndication network for stations, developing technology and tools for all stations to use, focusing on national ad sales and training for local sales reps, and importantly generating new viewership by syndicating local stations' video to third parties.

A key part of executing the balancing act has been a relentless focus on work-flow and supporting technologies. Leess explained that the broadband activities at CBS TV Stations are a 24/7 operation involving hundreds of people around the country. Turning all of this into a well-oiled operation, particularly in the context of long-standing operational biases, has been an enormous operational challenge that Leess seems to have embraced.

His efforts seem to be paying off. CBS TV Stations drove 89 million video views from their own sites in '07, an average of around 8 million video views/mo from their own sites, a 71% increase over '06. It's gaining an additional 10 million video views/mo through syndication partners. The primary current contributor to

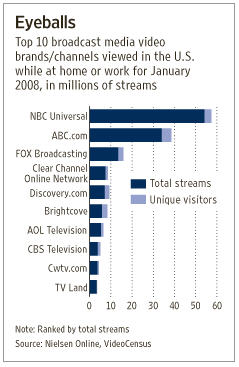

syndication is Yahoo, with whom CBS TV Stations partnered in Oct '06. To put this in context, today's WSJ carried the adjacent graphic of select broadcasters' video views. Putting aside CBS TV Stations' 10 million monthly syndication streams, its '07 monthly average traffic would appear to rank it in the top 5, right around Discovery.com.

syndication is Yahoo, with whom CBS TV Stations partnered in Oct '06. To put this in context, today's WSJ carried the adjacent graphic of select broadcasters' video views. Putting aside CBS TV Stations' 10 million monthly syndication streams, its '07 monthly average traffic would appear to rank it in the top 5, right around Discovery.com. In addition, video clips are a big part of CBS TV Stations' success, as it is posting around 520/day and now offers a searchable library of 350K clips.

Meanwhile the Yahoo deal has been so successful that CBS TV Stations has clearly gotten syndication religion, with several significant announcements planned for the coming weeks. Leess explained how these syndication deals drive unprecedented consumption from out-of-market viewers while also creating valuable ad inventory. For pre-rolls, CBS is getting between $28-75 CPM, with banners fetching $8-18 CPM. Importantly, CBS TV Stations are aggressively bundling on-air/online/broadband packages, having sworn off broadband as a pure "value-add" some time ago.

While I stand by my assertion that local TV stations are most vulnerable to broadband's rise, it is also true that broadband offers stations fresh opportunities. CBS TV Stations' offensive approach shows that with the right leadership, strategy and operational plan, executing a successful transition to the broadband era is quite possible.

What do you think? Post a comment and let everyone know!

Categories: Broadcasters, Portals

Topics: CBS, CBS TV Stations Digital Media Group, Yahoo