-

Comcast: A Company Transformed

Three numbers in last week's third quarter Comcast earnings release underscored something I've believed for a while: Comcast is a company transformed, now reliant on business drivers that barely existed just ten short years ago. Comcast's transformation from a traditional, plain vanilla cable TV operator to a digital TV and broadband Internet access powerhouse is profound proof of how consumer behaviors' are changing and value is going to be created in the future.

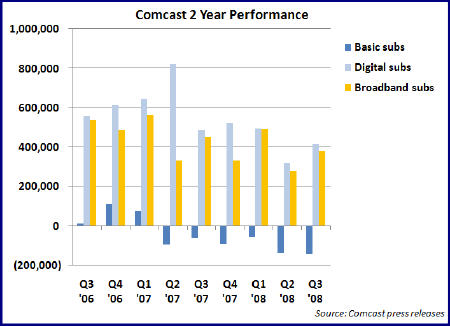

The three numbers that caught my attention were the net additions of 382,000 broadband Internet subscribers and 417,000 digital subscribers, with the simultaneous net loss of 147,000 basic subscribers. The latter number is the largest basic sub loss the company has sustained and, based on the company's own earnings releases, the sixth straight quarter of basic sub contraction. In the pre-digital, pre-broadband days, when a key measure of cable operators' health was ever-expanding basic subscribers, this trend would have caused a DEFCON 1 situation at the company. (see graph below for 2 year performance of these three services)

That it doesn't any longer owes to the company's ability to bolster video services revenue and cash flow through ever-higher penetration of digital services into its remaining sub base (at the end of Q3 it stood at 69% or 16.8 million subs). Years after Comcast and other cable operators introduced "digital tiers," stocked with ever-more specialized channels that consumers resisted adopting, the industry has hit upon a winning formula for driving digital boxes into Americans' homes: layering on advanced services like HD, VOD and DVR that are only accessible with digital set top boxes and then bundling them with voice and broadband Internet service into "triple play" packages. Comcast has in effect gone "up-market," targeting consumers willing and able to afford a $100-$200/month bundle in order to enjoy the modern digital lifestyle.

Still, in a sense the new advanced video services represent just the latest in a continuum of improved video services. Far more impressive to me is the broadband growth that both Comcast and other cable operators have experienced. Comcast's approximately 15 million YE '08 broadband subscribers will generate almost $8 billion in annual revenue for Comcast, up dramatically from its modest days as part of @Home 10 years ago. (It's also worth noting the company now also provides phone service to over 6 million homes today vs. zero 10 years ago)

The cable industry as a whole will end 2008 with approximately 37 million broadband subs, again up from single digit millions 10 years ago. And note that the 387,000 net new broadband subs Comcast added in Q3 '08 compares with just 277,000 net broadband subs that the two largest telcos, AT&T and Verizon added in quarter, combined. As someone who was involved in the initial trials of broadband service at Continental Cablevision less than 15 years ago, observing this growth is nothing short of astounding.

While broadband's financial contribution to Comcast is unmistakable, its real impact on the company is more

keenly felt in its newfound importance in its customers' lives. Broadband Internet access has become a true utility for many, as essential in many homes as heat, water and electricity. A senior cable equipment executive told me recently that research done by cable companies themselves has shown that in broadband households, broadband service would be considered the last service to get cut back in these tough economic times. In these homes cable TV itself - long thought to be recession-resistant - would get cut ahead of broadband.

keenly felt in its newfound importance in its customers' lives. Broadband Internet access has become a true utility for many, as essential in many homes as heat, water and electricity. A senior cable equipment executive told me recently that research done by cable companies themselves has shown that in broadband households, broadband service would be considered the last service to get cut back in these tough economic times. In these homes cable TV itself - long thought to be recession-resistant - would get cut ahead of broadband.But Comcast and other cable operators must not rest on their laurels. Their next big challenge is to figure out how to take this massive base of broadband subs and start delivering profitable video services to it. If Comcast allows its broadband service to be turned into a dumb pipe, with "over the top," on demand video offerings from the likes of Hulu, YouTube, Neflix, Apple and others to ascend to dominance, that would be criminal. Not only would it devalue the broadband business, it would dampen interest in the company's advanced video services (VOD in particular) while making the company as a whole vulnerable in the coming era of alternative, high-quality wireless delivery.

Comcast is indeed a company transformed from what it was just 10 years ago. Technology, changing consumer behaviors and a little bit of "being in the right place at the right time" dumb luck have combined to allow Comcast to remake itself. Comcast itself must fully recognize these changes and aggressively build out Fancast and other initiatives to fully capitalize on its newfound opportunities.

What do you think? Post a comment now.

Categories: Aggregators, Broadband ISPs, Cable TV Operators, Telcos

Topics: Apple, AT&T, Comcast, Netflix, Verizon, Verizon, YouTube

-

Video Usage is Creating a Hairball for Broadband ISPs, Others

The explosion in broadband video consumption is creating a significant and growing hairball for broadband Internet Service Providers, content providers, regulators and others. The core problem is that ISPs' networks are getting overwhelmed by the sheer volume of video being consumed each day.

ISPs have several ways to address the situation, but unfortunately none are perfect. For example, Comcast's approach until recently has been to use network management tools to block or slow certain kinds of traffic, such as peer-to-peer. P2P is a particular issue for cable ISPs because it uses scarce "upstream" bandwidth. Network management is highly technical, making it hard for policy-makers to understand it, let alone legislate it. So Comcast is now facing a sanction from the FCC over its network management practices (which it says it's moving away from anyway), because the FCC didn't consider them "reasonable" by its own vague definition.

Time Warner Cable is experimenting with another approach: tiers of service carrying bandwidth caps for users. This is a little bit like today's cell phone model - you buy a package of minutes, and if you go over, you pay extra. Though that may sound reasonable, it invites all kinds of confusion for consumers (e.g. "do I watch that show on CBS.com? Maybe I'd better not, I think my kids have watched a lot of YouTube clips this week and I don't want to go over my cap."). Content providers are justifiably concerned about this potential scenario. Separately, for its part, AT&T recently tried to clarify what its users can and cannot expect from their broadband subscriptions.

Yet another route is for broadband ISPs to adopt a much more expansive technical approach to how content is hosted in their networks and delivered to their users. Equipment vendors like Alcatel-Lucent and Cisco believe that ISPs could convert the current bandwidth problem into a full-fledged business opportunity. This would involve ISPs deploying hardware and software that would enable "managed services," each to be delivered at a specified quality level and for a specified price. So rather than a consumer buying a tier, they would buy a specific service offering (e.g. unlimited Hulu, with HD delivery guaranteed).

This wouldn't be a totally unfamiliar concept. Content providers have been buying managed hosting/delivery services for years from CDNs like Akamai, Limelight, Level 3 and others which guarantee certain delivery metrics. But these CDNs' guarantees can't reach into the "last mile" the ISPs' networks serve. So as ever-more bandwidth intensive content is launched such as HD and long-form, content providers should have an increasing motivation to see last mile ISPs offer comparable managed services offerings from ISPs as well.

However, ISP managed services would require fundamental changes in how these companies currently work together, and also invites concerns from "net neutrality" advocates that ISPs could bias in favor of one content provider or another when making their deals. Though compelling in concept, there are many details to sort out in the managed services approach, making it a longer-term option.

All of this just scratches the surface of the growing bandwidth hairball. Layer on the free-speech advocates like Free Press and Public Knowledge and the politicians looking to make hay with constituents and it's evident that the debate over bandwidth is only going to intensify.

What do you think? Post a comment now.

Categories: Broadband ISPs, Regulation

Topics: Alcatel-Lucent, AT&T, Cisco, Comcast, FCC, Net Neutrality, Time Warner

-

Net Neutrality Rears Its Head Again

Last November, Jeff Richards, VP of VeriSign's Digital Content Services, suggested to me that "net neutrality" would be the hottest broadband video topic in 2008. I was skeptical, believing that this was a classic "solution in search of a problem" and that yet again this topic would fail to gain traction among regulators and policy-makers. Based on events of the past week, it looks like Jeff may be right and I may be wrong.

Before getting to what happened this week, let's quickly understand what net neutrality means, and why it's important to all of us. To date the Internet has functioned as a level playing field of sorts. Anyone putting up a web site could be confident in the knowledge that broadband ISPs would neither favor nor disadvantage one player's access to users over another's.

Big online content and technology companies now want to codify this tradition in legislation commonly referred to as net neutrality. Big broadband ISPs (i.e. cable operators and telcos) regard this as needless regulatory meddling that would insert the government in network and technical matters it can barely understand, let alone figure out how to regulate.

This week brought news that Congressmen Ed Markey and Chip Pickering have introduced the "Internet Freedom Preservation Act of 2008" which would make net neutrality the guiding U.S. broadband policy, give the FCC additional oversight powers to ensure broadband ISPs weren't discriminating against certain traffic, require the FCC to hold 8 public "broadband summits" to bring together parties to "assess competition, consumer protection and consumer choice issues related to broadband Internet access services" and finally to report all this to Congress along with any recommendations for how to "promote competition, safeguard free speech, and ensure robust consumer protections and consumer choice relating to broadband Internet access services."

Broadband ISPs have precipitated some of this renewed interest in net neutrality with the recent news that they're de-prioritizing or blocking illegal video file-sharing traffic from services like BitTorrent (all of which was already widely understood in the Internet community). Net neutrality proponents have publicly seized on these incidents as evidence that broadband ISPs have discriminatory tendencies in their DNA, and that we're on a slippery slope to a world where broadband ISPs willy-nilly block certain traffic (i.e. their competitors) while favoring other traffic (i.e. their own services).

Last November in "Net Neutrality in 2008? Let's Hope Not." I wrote that there is no substantive current evidence to support this concern and that preemptive net neutrality legislation is unwise and unwarranted. In fact, I believe it's a net positive that broadband ISPs are proactively trying to manage their networks to ensure that legal traffic, generated by paying subscribers, is not adversely affected by the few heavy video file-sharers who diminish the network's performance for everyone. Broadband ISPs' actions help them run more efficient networks and better manage their investments, to the benefit of paying users.

Unfortunately, like many things in Washington, net neutrality is boiling down to a PR battle about how to shape policy-makers' perceptions, regardless of the underlying facts. For its part, Google is unabashedly framing this debate in populist terms, saying "net neutrality is...about what's ultimately best for the people, in terms of economic growth as well as the social benefit of empowering individuals to speak, create, and engage one another online." Huh? How does all that patriotic-sounding babble address the reality that network operators are grappling with 15 year-old kids downloading pirated HD movies, causing real and serious network congestion for everyone?

To defeat net neutrality, broadband ISPs better sharpen up their PR efforts. Congress is notoriously IQ-challenged and politically-motivated. My cynical belief is that its knee-jerk reaction will always be to do what looks best, rather than what actually is best. Then there's the current FCC chairman Kevin Martin, who has a serious anti-cable bias and will likely welcome an opportunity to smack operators. Regrettably, when taken together, Jeff Richards may indeed be right. This might be the hottest broadband video topic of 2008 and the year when net neutrality legislation finally does succeed.

Categories: Broadband ISPs, Regulation

Topics: AT&T, Comcast, FCC, Net Neutrality, Time Warner

Posts for 'AT&T'

Previous |