-

Research: Frequency is Viewers’ Top Problem With Streaming Ads

Conviva’s new State of Streaming Advertising 2021 report found that frequency is the number one problem viewers have with streaming video ads. The report is based on a survey of 1,944 adults 18+ who watch TV or streaming video, conducted by Dynata, along with Conviva’s proprietary viewer data. 59% of respondents either agreed or strongly agreed that “there are too many streaming ads repeated during the same break/episode.” The next most-cited reason, by 54% of respondents, was “when ads fail or take too long to load.” Over, just 36% of respondents said they were satisfied with advertising in streaming.

Numerous speakers at last week’s Connected TV Ad Summit also said that a lack of frequency capping was the main challenge the industry faces and mentioned how it hurts not only the viewer experience, but also negatively influences ad buyers from moving linear budgets into CTV. Over frequency is an issue partially due to incomplete industry measurement and reporting, and inventory being sold by multiple parties.

Conviva’s research also showed viewers’ ambivalence about ad receptivity. On the one hand 56% said they’re happy to watch ads in return for free streaming services, but on the other, 75% said they agreed or strongly agreed that they usually skip an ad when they have the option. It’s understandable viewers just want to watch their content uninterrupted, and no doubt the widespread use of ad-free SVOD services, ad-skipping in DVR and YouTube’s widely deployed skippable ad format, among other things, have only raised viewers’ expectations.

To further understand viewers’ attitudes towards ads in streaming, Conviva also identified four clusters of viewers: Untapped Potentials (34%), Ad Apathetics (32%), Heavy Viewers (18%) and Ad Lovers (17%). Segmenting viewers will help both ad sellers at content providers and ad buyers better understand how to target the market.

Separately, Conviva also surveyed 608 ad buyers and sellers, including 528 CTV/OTT buyers and 48 linear sellers, which revealed significant dissonance between how the groups perceive streaming ads, leading to a clear need for continued industry education.

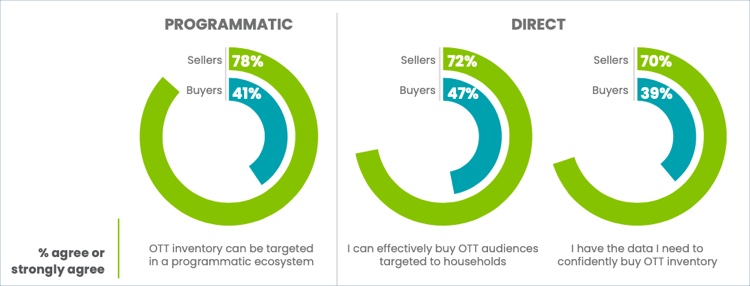

Availability and quality of data for targeting was one particular area of difference. For direct buys, 72% of sellers agreed or strongly agreed with the statement “I can effectively buy OTT audiences targeted to households,” while just 47% of buyers agreed or strongly agreed. 70% of sellers agreed or strongly agreed with the statement “I have the data I need to confidently buy OTT inventory” while just 39% of buyers agreed or strongly agreed.

Buyers surveyed also called out the concern that often they can’t see what programs their ads ran on, and that in programmatic, they can’t see what genres are performing best for them. This in turn led to a brand safety concern: just 8% of buyers agreed that streaming has context that is safe for their brand. This too was an issue often surfaced at last week’s CTV Ad Summit, especially for traditional TV buyers who are accustomed to knowing the exact placement of their ads by program, date, time slot, etc.

As I wrote yesterday, a CTV advertising flywheel already exists, and is likely to accelerate, given all of the strong tailwinds. But the Conviva research highlights genuine issues that viewers, buyers and sellers have with how advertising is currently implemented. All of these are going to have to be overcome if CTV advertising is to reach its full potential.

The State of Streaming Advertising 2021 report is available for complimentary download.Categories: Advertising

Topics: Conviva