-

Irdeto Acquires Piracy Detection Firm BayTSP

Software security provider Irdeto is acquiring media anti-piracy firm BayTSP, the companies are announcing this morning. BayTSP's monitoring and business intelligence technology will broaden Irdeto's range of security solutions for studios, pay-TV providers and media companies, including its ActiveCloak renewal security system. BayTSP counts Comcast, Sony and Toshiba among its clients. Martin Sendyk, Irdeto's SVP, Product and Stuart Rosove, BayTSP's CEO briefed me on the details late last week.

Categories: Deals & Financings, DRM, P2P, Technology

-

New Statistics Address Video Piracy, Importance of Quick Online Release of TV Programs

During very informative presentations at my NAB panel discussion yesterday, there were 2 slides that really caught my attention. Both shared statistics, new to me, about video piracy and user behavior patterns. These statistics illustrate the important early online window just following when a TV program is aired. Capturing this audience spike can dampen video piracy and also be a big revenue opportunity for providers.

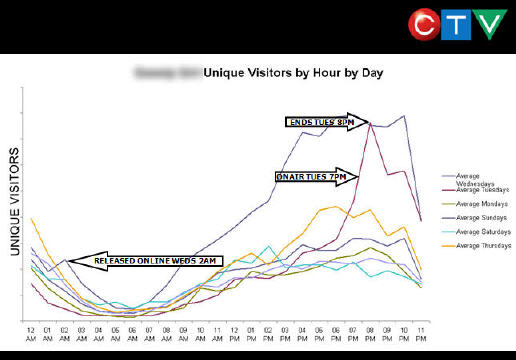

The first slide, shown below, was presented by Rob Adams, director of digital media operations at CTV, Canada's largest broadcaster. CTV offers both clips and full-length streaming episodes from its networks and select partner networks. In the slide below each line represents a single day's unique visitors for a specific TV series CTV offers.

I know the slide is a bit of an eye chart, so I'll summarize the phenomenon Rob explained. In this example a popular network show airs at 7pm on Tuesday. Notice how the purple usage line spikes during the hour of its run. Rob explained that users who go online to find the episode being aired realize it's not yet available and instead begin catching up on previous episodes. That new episode is posted around 2 am, and the spike in usage the following day is shown by the blue line.

Note the far lower behavior in the other lines and it is clear that the 24 hour window during and after airing a new episode is critical. It's also interesting to speculate on whether some users are beginning to look at online availability as pure VOD. If so, that would have implications on DVRs (i.e. why record a show when you've come to expect they'll all be posted quickly online?)

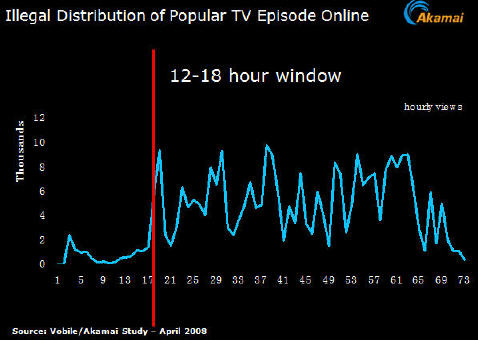

The second attention-getting slide was based on recent research by Akamai and Vobile, which used its digital fingerprinting technology to track the availability of illegal copies of an episode a popular program and their download volume. In the slide below, it is clear that although illegal copies are available immediately, the volume of downloads jumps by more than 500% the following morning (13 hours after broadcast).

What all of this demonstrates is that there is a real window of opportunity for premium video providers to slow video piracy and drive many new video views. By satisfying the obvious demand that users have for this content with legitimate distribution, providers can chip away at, though admittedly not eradicate, illegal sharing. If users gain confidence over time that their favorite programs will be available quickly, in high-quality and with a positive user experience (i.e. not overburdened with ads), the rationale to pursue the illegal route lessens. Conversely, video providers not responding to these viewer needs continue to leave themselves highly vulnerable to illegal behavior.

Categories: Broadcasters, P2P

-

CES 2008 Broadband Video-Related News Wrap-up

CES 2008 broadband video-related news wrap-up:

Panasonic and Comcast Announce Products With tru2way™ Technology

Panasonic And Comcast Debut AnyPlay™ Portable DVR

NETGEAR® Joins BitTorrent™ Device PartnersD-Link Joins BitTorrent™ Device Partners

Vudu Expand High Definition Content Available Through On-Demand Service

Sling Media Unveils Top-of-Line Slingbox PRO-HD

Open Internet Television: A Letter to the Consumer Electronics Industry

Paid downloads a thing of the past

Samsung, Vongo Partner To Offer Movie Downloads For P2 Portable Player

Comcast Interactive Media Launches Fancast.com

New Year Brings Hot New Shows and Longtime Favorites to FLO TV

P2Ps and ISPs team to tame file-sharing traffic

ClipBlast Releases OpenSocial API

Categories: Advertising, Aggregators, Broadband ISPs, Broadcasters, Cable Networks, Cable TV Operators, Devices, Downloads, FIlms, Games, HD, Mobile Video, P2P, Partnerships, Sports, Technology, UGC, Video Search, Video Sharing

Topics: ABC, BitTorrent, BT, Comcast, D-Link, Disney, Google, HP, Microsoft, NBC, Netgear, Panasonic, Samsung, Sony, TiVo, XBox, YouTube

-

Highlighting 3 Partnerships Announced at CES

Among the many partnership announcements at CES this week, there are a number worth highlighting. Today I focus on the following three:

Viacom syndication - Viacom announced syndication deals for MTV Networks' stable of content with five leading broadband video sites: Dailymotion, GoFish, Imeem, MeeVee and Veoh. As those of you who have been following my previous posts know, I believe syndication is a critical engine in driving the advertising business model, which itself is the key to broadband video succeeding. As a result, I follow these syndication deals closely.

I've previously been critical of MTVN which appeared reluctant about syndicating its content when it launched its DailyShow.com destination site. However, with its recent deal with AOL, and now these five deals, it appears that MTVN does in fact believe syndication is the way to go. As one of the biggest cable network groups, MTVN is a key barometer for other networks' moves, so I view this as a real positive for the market.

Panasonic/Google - In this deal, Google and Matsushita announced that YouTube videos and Picasa photos would be directly accessible on new model Panasonic HDTVs launching in Q2 '08. Ordinarily I wouldn't be

too excited about a deal like this, a permutation of which we've seen with other TV makers such as Sony.

too excited about a deal like this, a permutation of which we've seen with other TV makers such as Sony. Yet this one rises in potential importance because YouTube is not just the most popular video site - with 40% of all video traffic - but because Google is determined to turn YouTube into a platform for legitimate content distribution. This was underscored by the Sony mini-sode deal also announced this week, and the

many partnerships YouTube has already struck with premium content providers. If successful (and there are many if's to be sure), YouTube would be far more than a scraggly collection of UGC. So, marry a broad-based premium video aggregator to HDTVs and you could see a new device/content model emerge.

many partnerships YouTube has already struck with premium content providers. If successful (and there are many if's to be sure), YouTube would be far more than a scraggly collection of UGC. So, marry a broad-based premium video aggregator to HDTVs and you could see a new device/content model emerge.BitTorrent device deals Netgear and D-Link - In a less publicized move, BitTorrent announced expanded deals with Netgear and D-Link covering a range of home networking products, with an emphasis on HD distribution. BitTorrent, which has been steadily legitimizing itself from its P2P file-sharing roots, has launched an aggressive SDK program called BitTorrent Device Partners, intended to permeate the market with its client software. BitTorrent also integrates easy access to its digital download store with these partners as well.

While I'm not very bullish about the market potential of bridge devices from companies like Netgear and D-Link, I do believe that P2P distribution has a real role to play in content distribution, especially for heavy HD files. I continue to see P2P as more of a "peer assist" play. To the extent that BitTorrent can continue getting its software into multiple devices, it gains validation and strengthens its potential to be a meaningful partner in the larger content distribution ecosystem.

Share your thoughts on these deals, and suggest others you think are noteworthy from CES!

Categories: Cable Networks, Devices, HD, Indie Video, P2P, Partnerships, UGC

Topics: BitTorrent, D-Link, DailyMotion, GoFish, Google, Imeem, MeeVee, MTVN, Netgear, Panasonic, Veoh, YouTube

-

Net Neutrality in 2008? Let's Hope Not.

Network or "net" neutrality, a confusing legislative concept being promoted by large online and content players, may be the hottest broadband video topic in 2008, at least according to Jeff Richards, VP of VeriSign's Digital Content Services, who makes his case at his blog Demand Insights.

I had the pleasure of informally debating net neutrality's merits with Jeff (who's officially neutral on the subject by the way) over cocktails at a VeriSign customer event I just spoke at. Jeff is persuasive about why net neutrality is such a hot button issue, and that its resolution - one way or another - has broad repercussions across the technology, content and Internet industries.

First, a primer for those not familiar with net neutrality. To date the Internet has functioned as a level playing field of sorts. Anyone putting up a web site could be confident in the knowledge that broadband ISPs would neither favor nor disadvantage one player's access to users over another's.

Big online content and technology companies now want to codify this tradition in legislation commonly referred to as net neutrality. Big broadband ISPs (i.e. cable operators and telcos) regard this as needless regulatory meddling, a classic "solution in search of a problem" that would unnecessarily limit their future business dealings and influence their investment decisions.

Interest in net neutrality legislation has waxed and waned, as lobbyists for the pro-net neutrality side (content and technology firms) try to convince legislators that this really is an important issue for constituents and that this isn't just a "rich vs. richer" debate that should be left to the industry's participants to figure out, while anti-net neutrality lobbyists (cable and telco firms) argue the opposite point of view.

So what might precipitate the resurgence of interest in passing net neutrality legislation? In two words, broadband video.

As Jeff points out, the massive adoption of broadband video, which still disproportionately comes from illegal video file-sharing networks, is motivating ISPs to reevaluate current policies. Stoking this reevaluation is the awakening that the really big money is now being made by legitimate companies like Google (current market cap $200+ billion) which ride freely over ISPs' networks. As such, ISPs are wondering whether the balance of economics has gotten out of whack and if they can get a bigger share of the pie.

Some ISPs are now blocking or "shaping" certain types of traffic. The most recent example that came to light was Comcast, who the AP recently found is blocking BitTorrent's traffic in the Bay Area. Comcast's vague response, coupled with ill-thought out earlier remarks from telco executives about their own business intentions, have inflamed conspiracy theorists' worst fears about what kind of world could result absent immediate net neutrality action.

Yet for me, preemptive net neutrality legislation can only be justified if you buy into one or both of the following two assumptions.

First, that any new premium tier of service ISPs may want to sell to certain preferred providers (e.g. Google is search engine of choice, so its results somehow load faster) must, by definition, mean that some other provider is disadvantaged as a result. But this presupposes a zero-sum ISP network, which is not true. To enable a high quality-of-service ("QOS") tier for preferred partners does not technically necessitate a degrading other non-preferred services. Not to mention degrading other services would be a foolish, provocative thing for ISPs to do.

The second assumption is that regardless of whether ISPs create QOS-enabled premium tiers, they cannot be trusted not to block or harmfully shape traffic, whether it's legitimate or not. While there have been random acts of blocking by smaller ISPs, this does not seem to be a rampant problem right now. And it's important to distinguish between blocking legitimate vs. illegitimate traffic. For instance, when Comcast blocks illegitimate P2P file-sharing traffic then to me that's a good thing. It frees up network resources for the rest of us who are paying to use the network for legitimate purposes. I'm not going to cry for some 15 year-old kid who can't speedily download a pirated copy of the latest Hollywood thriller, nor should you.

While the pro-net neutrality folks obviously believe ISPs will be bad actors, to my mind, even if you make the above assumptions, this does not form the basis for preemptive net neutrality action now. Sure it's tempting to believe that cable and telco companies, still with plenty of monopolistic DNA flowing through their corporate veins, would indeed act unfairly, for now it is most appropriate to give them the benefit of the doubt.

Washington's laissez-faire attitude toward Internet regulation has been one of the key reasons for the Internet's continued innovation and growth. Attacking broadband video and the Internet, which are among the last few bastions of economic growth left in America is unwise, particularly given the fact that the "law of unintended consequences" is virtually synonymous with all recent telecommunications regulation. Preemptively impose network neutrality and who knows what the actual result will be.

So for now net neutrality regulation should stay on the backburner. When and if it's appropriate, it can be re-prioritized. Instead, I'd prefer keeping Washington's focus on cleaning up a separate, larger and far more pressing problem caused by another rush to preemptive government action (hint, it starts with an "I" and ends with a "Q").

Categories: Broadband ISPs, P2P, Regulation

Topics: BitTorrent, Comcast, VeriSign

-

Prognosticating P2P's Possibilities and Pitfalls - May E-Newsletter

With Joost's launch upon us, BitTorrent going mainstream, Akamai buying Red Swoosh and a raft of other peer-to-peer (P2P) initiatives underway, it's time to consider legitimate P2P's possibilities and pitfalls.First a disclaimer: I don't pretend to know all of the technical ins-and-outs of P2P, but I think I know enough to be dangerous. Here's my current take: P2P has a ton of potential as a legitimate distribution platform, but has to navigate some significant challenges if it is to succeed.A P2P PrimerFor those of you new to the P2P game, in essence, P2P's big advantage is that it allows users themselves to become servers of content to other users. In doing so, the load for delivering content is shifted from central servers to the "nodes" or users on the P2P network. Until relatively recently, P2P was popularly associated with the illegal "file sharing" networks (Napster, KaZaa, etc.), most of which were (and still are) used by users to swap audio or video files without permission of the copyright holder. Users could look up where certain content resided and then download it accordingly.What's new about P2P is that many (e.g. Joost, BitTorrent, others) see it as an important, if not essential, way for video to be legitimately distributed. P2P companies argue that the Internet's current architecture cannot effectively scale to deliver large quantities of video (especially live streams) in an economic manner. Since P2P gives users the ability to directly share with other users, P2P also has a potentially disruptive effect on the overall value chain and how video aggregators continue to establish value for themselves. P2P requires users to install client software on their computers. These clients are then available on the P2P network, sending files to subsequent users requesting content that they have already stored. In the case of video or audio, files can be delivered for either download or streaming.All of this is intended to happen invisibly to the average broadband video user. Of course, to nobody's surprise, the average user couldn't care less how video actually gets to his or her computer, as long as it gets there quickly and in reasonably good shape.Potential AboundsP2P is a potentially big deal for the biggest broadband video content providers. That's because delivering large volumes of video in the traditional client-server paradigm is still pretty expensive, notwithstanding the significant declines in content delivery networks' (CDN) pricing. With everyone forecasting huge increases in broadband video consumption, together with larger video files (due to better encoding, High Definition, etc.), getting a handle on delivery costs is a key challenge for content providers.Compounding matters is that broadband video business models remain relatively immature, so expense containment is all the more important. P2P allows these content providers to shift all or some of the responsibility for video distribution to the users themselves, while establishing direct connections with users (i.e. no 3rd party distribution costs). The users' computers are leveraged for both storage and delivery, while the bandwidth is essentially free, since users upload content using the local broadband ISP's network, not the content provider's CDN service. If P2P succeeds, its potential to cut content providers' delivery costs, while delivering high-quality video, is obviously very significant.Important Challenges Lie AheadOf course, potential is one thing, reality is another. From my vantage point, consumers' willingness to become P2P nodes and ISPs' restraint in blocking P2P traffic represent the biggest obstacles to P2P's future success. First the consumer acceptance challenge. Getting the P2P client on millions of users' computers or into their living rooms is not trivial. In this era of spyware, malware, viruses and other technical nuisances, mainstream Internet users are becoming more reluctant than ever about loading anything onto their machines that doesn't come from a recognized and trusted brand. Since P2P's whole promise relies on files being propagated to many users, anything that limits this from happening is obviously very detrimental to P2P's success.Then there is the even thornier issue of how broadband ISPs are going to react to users clogging up precious upstream bandwidth by serving as nodes. Virtually all American broadband ISPs offer "asymmetric" Internet access, meaning that the amount of bandwidth offered in the upstream path is usually only a fraction of that provisioned for the downstream path (this is due to some fundamental limitations related to the way that ISPs' networks are allocated). Re-architecting these networks for potentially burgeoning upstream traffic flows would be cost-prohibitive and a non-starter.To date, broadband ISPs have used "traffic shaping" technology to identify and limit P2P traffic. They have also kicked customers off their networks who have used too much bandwidth (a little secret in the industry). All of this has been sort of OK to do when most P2P use was for illegitimate file sharing. But what happens when it's for legitimate use, such as Joost or the newly legitimate BitTorrent? Limiting users' access to their full broadband service is going to evoke howls of protest.And of course, remember that the net neutrality proponents are waiting to pounce on any sign of broadband ISPs de-prioritizing or worse, blocking, certain types of traffic. Net, net, a big wildcard in P2P's success is how ISPs are going to react.Planning for P2P SuccessP2P proponents need a game plan to overcome these looming issues. Here's what I think makes sense: Well-established branded content players will need to take on the primary role for P2P client distribution. Of course, this approach has been used for previous media players' distribution (i.e. Real, WMP, Flash, etc.) and for updates. We've all had the experience of being asked to download player software or an updated version of previously installed software. P2P client distribution could be no different.But what will incent major content providers to assume this responsibility on a mass scale? They'll have to see real (not theoretical) business cases for delivery cost reductions and quality improvement. Of course, getting paid to become P2P client distributors (either in cash, or as part of distribution deal discounts, or some hybrid of the two) would also clear the way. Companies like Joost and BitTorrent need to remember that while their brand awareness among the Internet's cognoscenti is high, among more mainstream users it is still low. So leveraging their content partners' brands to turbo- charge distribution is key.BitTorrent, for one, is already doing this with their BitTorrent DNA technology. Another opportunity for P2P client distribution is embedding it in various consumer devices. For example, BitTorrent also offers a software development kit (SDK) that consumer electronics and chip makers can use to embed the P2P client in devices. This removes P2P download complexities for users, and is intended to make P2P usage completely invisible. The ISP solution seems more complex.Some believe that ISPs should look at P2P as a business opportunity to deliver a quality-of-service (QOS)-guaranteed platform to the P2P application providers such as Joost and BitTorrent. This would be accomplished by installing caching servers in broadband ISPs' facilities. These would essentially allow ISPs to serve content locally, mainly relying on the P2P protocols to deliver from the caches when appropriate, instead of from the nodes. This approach would preserve upstream bandwidth and limit ISPs' need to increase their peering capabilities to handle video coming in from the Internet backbone, while also leveraging P2P's scalability.This "peer-assisted" approach may be the optimal migration path to P2P adoption from an ISP perspective. Though the economics still need to be fully fleshed out, I've heard a pretty persuasive argument for this model from a company named PeerApp (disclaimer, they're a client), which is worth understanding further if P2P affects your business. One way or another, ISPs need to be brought into the P2P fold. Simply ignoring them or relying on their reluctance to tempt the net neutrality gods is not a sound business approach.Wrapping UpP2P offers very exciting potential to enhance users' broadband video experiences. For content providers, it holds the promise of profitably scaling up their broadband video activities. It will be very interesting to see how key P2P players navigate impending challenges to their success.Categories: Broadband ISPs, Cable TV Operators, P2P, Telcos

Topics: BitTorrent, Joost, Net Neutrality, PeerApp

-

Bandwidth Issue Looms as Video Usage Rises

This article in today's Boston Globe points out the looming bandwidth issue that cable ISP customers will be facing as usage of video becomes more widespread. Most people don't realize there are "acceptable use" policies in the user agreements we all sign. That's because today the vast majority of us (99%+) don't come anywhere close to crossing the maximum usage line. However, as this story points out, some people are getting snagged. How many more will cross the line as video usage (particularly from P2P services like Joost and BitTorrent) rises in the coming years?

Categories: Broadband ISPs, P2P

Topics: BitTorrent, Joost

Posts for 'P2P'

|