-

Research: TV Networks' Viewership Continues Falling, With Structural Shift to SVOD Looming

Bernstein Research has introduced a new weekly tracking report analyzing ad-supported U.S. TV networks' viewership on a year-over-year basis. The first version, released today, shows that for the week of November 10-16, audiences fell again across the board: down 8% for cable networks, 9% for broadcast and 17% for kids-oriented networks specifically. The declines were similar on a quarter-to-date basis as well.

Bernstein has previously calculated that ad-supported TV networks' audiences declined by around 13 minutes per day in Q3, while SVOD viewership increased by around 12 minutes per day, making SVOD the dominant driver of the TV networks' audience erosion.Categories: Advertising, Aggregators, Broadcasters, Cable Networks

Topics: Amazon, Netflix, Sanford Bernstein

-

Drip, Drip, Drip - Video Apps Slowly Get Added to Connected TV Devices

There's no doubt connected TV devices will be one of the hottest gifts this holiday season, as online video continues to evolve from an early adopter desktop behavior to a mainstream living room experience. But even the prices of connected TV devices plunge and consumers' enthusiasm builds, the space continues to be marked by the drip, drip, drip inefficient process of one-off additions of video apps to specific connected TV devices.

In fact, if you follow the market closely, you'll notice that seemingly each week there are a handful of announcements regarding a specific video app (or group of them) becoming available on a certain connected TV device(s). For example, in last week's news, Amazon Instant Video became available on TiVo Roamio/Mini devices, and HBO Go became available on Xbox One.Categories: Devices, Technology

Topics: Amazon, Apple, Google, Roku

-

VideoNuze Podcast #251 - Nielsen to Measure SVOD; OTT Initiatives in Europe

I'm pleased to present the 251st edition of the VideoNuze podcast with my weekly partner Colin Dixon of nScreenMedia.

First up this week we dig into Nielsen's new plan to measure viewership on SVOD services. Both Colin and I believe this holds a lot of potential for TV networks and studios, though we're cautious until we learn more about the data that is produced (for more, Nielsen's SVP, Client Insights Dounia Turrill will be speaking at the Dec. 4th VideoSchmooze and this will be a topic of discussion).

We then transition to talking about specific OTT initiatives underway in Europe. Colin was in London this week attending a conference where he had a number of valuable conversations with broadcasters and pay-TV operators. He shares some specifics.

(Apologies - our recording quality is a little shaky this week due to connection issues)

Listen in to learn more!

Click here for previous podcasts

Click here to add the podcast feed to your RSS reader.

The VideoNuze podcast is also available in iTunes...subscribe today!Categories: Advertising, Analytics, Broadcasters, International, Podcasts

Topics: Amazon, Netflix, Nielsen, Podcast, VideoSchmooze

-

Study: Netflix Dominates Wired Internet Usage, YouTube Tops on Mobile

Sandvine has released its latest Global Internet Phenomena Report based on data collected in March, 2014 across leading wired and mobile broadband networks. Focusing just on North America, Netflix once again dominates primetime usage, accounting for 34.9% of downstream bandwidth, more than the next 6 services combined. YouTube was second with 14.04% of bandwidth.

It's a different story on mobile however, where YouTube remains the top downstream provider, eating up 19.75% of bandwidth, up from 17.7% a year ago, with Netflix in 5th place with just 4.51%. The usage pattern largely reflects the difference between Netflix's long-form content focus vs. YouTube's short-form focus. YouTube's CEO Susan Wojcicki recently disclosed that 50% of YouTube's usage is now on mobile.Categories: Broadband ISPs, Mobile Video

Topics: Amazon, Hulu, Netflix, Sandvine, YouTube

-

Why Nielsen Measuring SVOD Viewership is Potentially a Very Big Deal

The WSJ reported last night that next month Nielsen will begin measuring viewership of programs on Netflix and Amazon. This would represent the first time that any sort of granular viewing data by program would be available, offering potentially huge benefits to the ecosystem. According to the WSJ, Nielsen will use its people meters to analyze the audio components of programs. A key caveat is that mobile viewing would not yet be measured.

Categories: Aggregators, Analytics, Broadcasters, Cable Networks

Topics: Amazon, Netflix, Nielsen

-

8 Initial Reactions to HBO's New OTT Service

HBO has dropped a bombshell, announcing plans to launch a standalone over-the-top service in the U.S. in 2015. The announcement was extremely short on details, except to say it was targeted to the 80 million U.S. homes that do not currently subscribe to HBO. Here are my 8 quick reactions to the news. Many more thoughts to follow as more details are released.

Categories: Cable Networks

-

The Future of TV: 4 Reasons Why It Will Keep Getting Better

Monday, October 6, 2014, 12:56 PM ETPosted by:A new wave of viewers has emerged: they're connected, they know what they want to watch, when they want to watch it, and most importantly, how they want to watch it. They are chomping at the bit for premium content that is both accessible and affordable. At the same time, the advent of OTT and connected TV devices has made way for a whole new viewing experience where "television" simply refers to the largest screen in the house.

We all know the TV ecosystem of tomorrow will look vastly different than today's current landscape, but what changes can we expect? Here are four predictions for what trends will emerge over the next few months and years:Categories: Broadcasters, Cable Networks

Topics: Amazon, AOL, HBO, Netflix

-

VideoNuze Podcast #243 - AT&T Promotes OTT and Broadband With New Amazon Offer

I'm pleased to present the 243rd edition of the VideoNuze podcast with my weekly partner Colin Dixon of nScreenMedia.

Earlier this week both Colin and I were intrigued to see AT&T in the market with a new $39 per month offer putting broadband and OTT front and center, with HBO/HBO Go plus a year of Amazon Prime. Just the low tier of U-verse U-basic TV is included. Colin and I both interpreted this as an aggressive move to attract millennials/cord-nevers.

The offer is also the latest by a pay-TV operator using OTT services as a lure. We've seen several European and smaller U.S. pay-TV operators promote Netflix as well. Colin and I discuss how operators are clearly becoming more flexible with regard to OTT services. We wrap up with a preview of some of the new OTT pay-TV services coming to market and whether a linear TV style package makes sense and whether they too should incorporate OTT services.

Click here for previous podcasts

Click here to add the podcast feed to your RSS reader.

The VideoNuze podcast is also available in iTunes...subscribe today!Categories: Aggregators, Podcasts, Telcos

Topics: Amazon, AT&T, HBO GO, Podcast

-

Roku Has Sold 10 Million Players as Connected TV Category Surges

Roku has announced that it has sold over 10 million of its players in the U.S. cumulatively since it shipped its first one in 2008. Roku last reported sales of 8 million units in January '14, which means the company has sold approximately 2 million units year-to-date (Roku has previously said it sold around 3 million units for all of 2013).

Roku was an early entrant in what has developed into an intensely competitive connected TV space. Apple, whose Apple TV device was famously referred to as a "hobby" by the company (though no longer) has over 20 million users. Google hasn't released any numbers for Chromecast yet, but undoubtedly its sales are well into the millions also (Google is also launching Android TV). And Amazon launched Fire TV this past spring.Categories: Devices

Topics: Amazon, Apple TV, Chromecast, Google, Roku

-

The 10 Biggest Online Video Stories of Summer 2014

September is here and that means summer 2014 is in the rear-view mirror. For online video and the broader video ecosystem, it was another busy few months, as viewers around the world continue to shift their consumption patterns, with many companies scrambling to keep pace. Below I've distilled my list of the 10 biggest online video stories of the summer - read on and let me know if I've missed something!

Categories: Advertising, Aggregators, Cable Networks, Cable TV Operators, Deals & Financings, Live Streaming, Sports, TV Everywhere

Topics: 21st Century Fox, Aereo, Amazon, Facebook, LiveRail, MoffettNathanson LLC, Netflix, NFL Now, Ooyala, PewDiePie, RTL, SpotXchange, Telstra, Time Warner, Twitch, World Cup, Xbox, YouTube

-

Could Twitch Become For Amazon What YouTube Now Is For Google?

Amazon will acquire Twitch, the live-streaming video game platform, for $970 million. Until very recently Google was heavily rumored to be acquiring Twitch. Twitch is Amazon's 2nd-biggest acquisition ever, after its $1.2 billion purchase of Zappos in 2009. Twitch enables users to live-stream and record themselves playing video games, which tens of millions of monthly visitors watch.

Twitch is Amazon's biggest investment in online video to date and follows other video initiatives including Prime Instant Videos, an escalating slate of original programs, numerous high-profile licensing deals (including for various HBO programs and for the PBS drama "Downton Abbey") as well as the recent launch of the Fire TV connected TV device.Topics: Amazon, Google, Twitch, YouTube

-

How Binge-Viewing Became a Cultural Phenomenon - A Brief History

Binge-viewing is surely one of the most notable cultural phenomena of the past few years. Barely registering as a concept less than 3 years ago, many recent research reports now cite binge-viewing as having been adopted - if not regularly practiced - by a majority of TV viewers (examples here, here, here, here, here, here).

The shift toward binge-viewing has immense implications for the TV and video industries, touching everything from the creative process to programming/distribution decisions to monetization approaches. Some companies are fully embracing binge-viewing and riding its wave, while others are taking a more cautious approach.

Stepping back though, how exactly did binge-viewing become such a cultural phenomenon? I believe there are at least 5 key contributing factors, with the relationships among them creating a perfect storm of growth.Categories: Aggregators, Cable Networks

Topics: Amazon, Apple TV, Chromecast, Comcast, Fire TV, HBO GO, Hulu, Netflix

-

VideoNuze Podcast #224 - HBO-Amazon; Apple TV; Netflix, Comcast, Time Warner Cable Q1 Results

I'm pleased to present the 224th edition of the VideoNuze podcast with my weekly partner Colin Dixon of nScreenMedia. This was an unusually busy week with many industry announcements, so today's format is a roundup discussion of four items that seemed most significant to us.

First up is HBO's exclusive new licensing deal with Amazon, which is the latest evidence of the surging value of high-quality content libraries. Second is Apple's reveal that it has sold 20 million Apple TVs to date, making it more than just a "hobby." Next, we turn to Netflix, which reported stellar Q1 results earlier this week. Finally, we look at Comcast's Q1 and Time Warner Cable's Q1 results. Both companies reported healthier video subscriber numbers (though Verizon reported a much smaller quarter for FiOS video subscribers). The question still looms how meaningful cord-cutting is in reality.

(Note, we had major technical issues with Skype this week, so in the last one-third of the podcast I sound like I'm in a fish tank. Apologies in advance.)

Click here for previous podcasts

Click here to add the podcast feed to your RSS reader.

The VideoNuze podcast is also available in iTunes...subscribe today!Categories: Aggregators, Cable Networks, Cable TV Operators, Devices, Podcasts

Topics: Amazon, Apple TV, Comcast, HBO, Netflix, Podcast, Time Warner Cable

-

VideoNuze Podcast #221 - Pros and Cons of Amazon's New Fire TV

I'm pleased to present the 221st edition of the VideoNuze podcast with my weekly partner Colin Dixon of nScreenMedia. This week we assess Amazon's new Fire TV connected device. As I wrote earlier this week, I see it as a double, but not a home run, and I further explain some of my main points.

Colin believes Amazon also over-stated the problems with existing connected TV devices in its effort to differentiate the Fire TV. Those 3 differentiators were Fire TV's openness, improved search and better performance. Colin only sees the performance as meaningful, with Fire TV's new "ASAP" content pre-loading feature - but with the caveat that it has to actually work (and not just for Amazon's own video).

We also discuss Fire TV's gaming features, which Amazon is clearly betting on, though we're not quite certain exactly where they'll fit in the market. On the positive side, Colin likes how Fire TV will prioritize searched-for content by price and availability.

Click here for previous podcasts

Click here to add the podcast feed to your RSS reader.

The VideoNuze podcast is also available in iTunes...subscribe today!Topics: Amazon, Fire TV, Podcast

-

ACC Digital Network App Gets Quick Launch on Fire TV Using 1 Mainstream Platform

Among the apps launched this week on Amazon's new Fire TV was the ACC Digital Network, a joint venture between Silver Chalice and Raycom Sports. ACC Digital Network is the Atlantic Coast Conference's multimedia destination featuring live streaming and other original programming. In addition to being online, it also recently launched on Apple TV.

To get up and running quickly on Fire TV, SportsLabs, a division of Silver Chalice, turned to 1 Mainstream, a platform for deploying HD video services on a variety of connected TV and mobile devices that launched last December. I caught up with Rajeev Raman, 1 Mainstream's CEO (and previously head of product at Roku), to learn more about how the company is helping content providers quickly build and deploy apps.Categories: Devices, Sports, Technology

Topics: 1 Mainstream, ACC Digital Network, Amazon, Fire TV, Sky

-

Amazon's Fire TV Looks Like a Double, Not a Home Run

In baseball terms, Amazon's new Fire TV connected device will be neither a home run nor a strikeout; more likely it looks like it will be a solid double. Amazon deserves credit for some clever new features that will distinguish the Fire TV in an increasingly crowded connected TV landscape. But, by beefing up its specs - and therefore its own costs - Amazon has priced the device relatively high at $99. That in turn will likely limit its appeal mainly to certain segments of the market: families with younger kids and/or casual gamers.

Of course a connected TV device from Amazon has been long-rumored and highly expected since it complements so well numerous other initiatives such as Prime, Kindle, Prime Instant Video, Amazon Studios, etc. How exactly Amazon would execute on the opportunity was debated. Would it roll out an inexpensive stick or more polished box (or both)? Which devices would it compete directly with? What content strategy would it use (free! pay-TV!)? And what features would differentiate it?Categories: Devices

Topics: Amazon

-

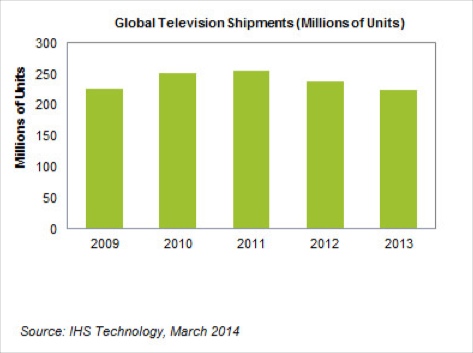

Global TV Shipments Down 6% in 2013 As Streaming Sticks Raise New Challenges

These are highly uncertain times for global TV manufacturers. As IHS reported last week, sales of TVs declined by 6% in 2013 to 225.1 million units, following a 7% contraction in 2012, creating first ever back-to-back down years for the global TV industry. IHS pinned the blame for the declines mainly on market saturation and difficult economic times.

To rebound from the doldrums, TV manufacturers are betting heavily on consumers upgrading to 4K TV and Smart TVs. 4K, or Ultra-High Definition TV, has significant challenges with content availability, price and picture quality differentiation it must overcome to go mainstream. Meanwhile, although the price premium for Smart TVs has shrunk, bringing them closer to conventional HDTVs, their value proposition is still not widely understood by consumers and access to online content is still very limited.

In this already difficult climate, another challenge for TV manufacturers is now taking shape from a whole new category of devices: low cost streaming sticks.Categories: Devices

Topics: Amazon, Chromecast, IHS, Roku

-

BrightRoll is Using Amazon Web Services to Process 30 Billion Ad-Related Data Points Per Day

For a glimpse into cloud computing's significant contribution to the successful scaling of online video advertising, yesterday BrightRoll shared some details of its relationship with Amazon Web Services (AWS) which it has been working with since 2008. According to BrightRoll, AWS now processes 30 billion data points per day in order to deliver 3 billion video ads per month. BrightRoll said in 2013 it delivered over 23 petabytes of content, which will double in 2014. In a related case study, Kenneth Cheung, BrightRoll's senior director of engineering said that "If AWS didn't exist, BrightRoll would be a different company."

Categories: Advertising, Technology

Topics: Amazon, BrightRoll

-

VideoNuze Podcast #213 - The All-Amazon Edition

I'm pleased to present the 213th edition of the VideoNuze podcast with my weekly partner Colin Dixon of nScreenMedia. Today we focus on Amazon, which is already an important player in video, and is poised to become more so. Among the topics we discuss:

- plans to increase the price of its Prime service (and the role of expensive video licensing in driving this)

- the possibility video could be split off from Prime and become a more pure competitor to Netflix and others

- the many roles that video advertising could play as part of a new deal with FreeWheel

- why an Amazon connected TV device (widely rumored) would be highly strategic

- whether Amazon will enter the pay-TV business (as has also been widely rumored)

- the role of Amazon's original online productions

All in all, Amazon is circling the video space in many different ways, with potential to be quite disruptive. It's still very early in the game for Amazon and 2014 could be a big year. We'll see how it plays out.

Listen in to learn more!Click here for previous podcasts

Click here to add the podcast feed to your RSS reader.

The VideoNuze podcast is also available in iTunes...subscribe today!Categories: Advertising, Aggregators, Devices, Indie Video, Podcasts

Topics: Amazon

-

Amazon's Deal With FreeWheel Opens Many Video Advertising Options

Yesterday, FreeWheel quietly announced that it's powering video ads for Amazon. Though the announcement was light on details, anytime Amazon moves into a new space, as it's doing with video ads, it's noteworthy. I spoke to Doug Knopper, co-CEO of FreeWheel, who noted this is the company's first customer that isn't a pure media company, underscoring for him how ubiquitous video and video advertising are becoming.

Though under tight constraints from Amazon about what he could say, Doug emphasized that, as with all Amazon initiatives, the focus is on creating a better customer experience. In FreeWheel's release, Lisa Utzschneider, Amazon's VP of Global Ad Sales positioned video ads as a discovery vehicle, helping customers learn about related products.Categories: Advertising, Aggregators