-

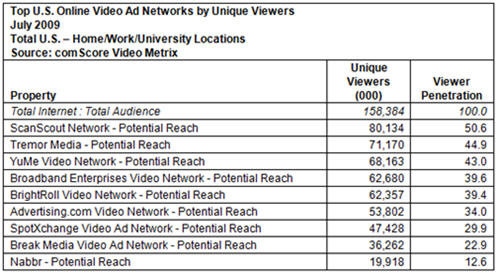

First Look at comScore's July '09 Video Ad Networks' Rankings

Below is a first look at comScore's rankings for video ad networks' "potential" reach for July '09. The rankings, which have not yet been publicly shared, reveal a relatively tight clustering of 5 video ad networks - ScanScout, Tremor Media, YuMe, Broadband Enterprises and BrightRoll - with ScanScout capturing the number 1 spot in its first month being fully measured by comScore.

The "potential reach" aspect of these rankings is important to understand. As I explained in June in "Unraveling comScore's Monthly Viewership Data for Online Video Ad Networks," the potential reach numbers account for the aggregate number of viewers of all the sites that the ad network has the right to place ads on. However, as I discussed with Tania Yuki, comScore's director of product management, it's not a perfect measure, though comScore is continually trying to improve it.

The rankings are determined through a combination of the ad networks' self-reported publisher list and comScore's own tracking. If a video network reports that any one publisher accounts for 2% or more of its viewers, comScore requires a letter proving the business relationship. There is also a self-policing mechanism as comScore provides a "dictionary" of all publishers that each ad network reports. Competitors can review the dictionary and appeal to comScore if something appears amiss. Still, there's some looseness in the methodology, and having spoken to a number of industry executives, also a fair amount of concern that it is accurately portraying the industry's true performance.

comScore recognizes the limitations of the potential reach approach and that it is just one way of understanding a video ad network's value. Actual monthly performance is equally important, and comScore has been working with ad networks to implement this reporting as well. As I wrote in June, the "hybrid" approach requires ad networks to insert a 1x1 beacon in their video players. Though this approach also has its limitations, many of the biggest video ad networks are now implementing the beacon, and soon comScore will likely begin reporting actual as well as potential reach.

Video ad networks are a very important part of the online video ecosystem, responsible for placing millions of dollars of ads each month. Importantly they allow a level of targeting and reach that brands seek, but are often unable to attain on their own with a handful of direct site relationships. With the online video medium still relatively new, buyers require data helping them understand their options. However, the comScore data is just a first filter, diligent buyers still must dig in to understand how each network, or individual site meets their needs.

What do you think? Post a comment now.

Categories: Advertising

Topics: BrightRoll, Broadband Enterprises, ScanScout, Tremor Media, YuMe

-

My Reflections on NATPE Conference

Last week's NATPE conference brought numerous opportunities for attendees to learn about broadband and digital media. Based on the Q&A I heard, plus the hallway chatter, there is intense interest - especially from independent producers - about how to take advantage of the rapidly changing video landscape. Today I want to spend a few minutes reviewing some of what I learned at the conference.

A big chunk of my time was spent hosting a day-long Digital Briefing track, during which 10 companies presented for 30 minutes each, back-to-back throughout the day. The companies that presented were:

Leichtman Research Group, Joost, SpotStock.com, Broadband Enterprises, Livid Media, Vuze, Enticent, Teletrax, PermissionTV and Digital Fountain.These companies offered a highly diverse range of products, services and solutions, all aimed at growing the broadband video industry. Joost, Vuze and Broadband Enterprises in particular drew lots of audience questions, focused on distribution and monetization, 2 key items for indie broadband producers. Similarly PermissionTV received lot of interest for how it can help large and small content providers build out their broadband presence. And Digital Fountain's demos of its high-quality video distribution network garnered a lot of attention (btw, it's soliciting participants for its beta trial here).

The other companies also showed valuable products and services: Livid Media demonstrated its personality-based content and Enticent its loyalty programs. SpotStock premiered its new digital stock footage library aimed at helping indie producers quickly and legitimately gain access valuable resources. And Teletrax explained how its watermarking technology helps broadcasters secure and track their digital streams. Last but not least, Bruce Leichtman of Leichtman Research demystified what's really happening with consumer behavior changes based on his firm's extensive market research.

Outside of the Digital Briefings day, the advertising-related sessions provided lots of needed information to attendees about how monetization is unfolding for broadband delivery. I've already written about Shelly Lazarus branded entertainment speech. Tim Armstrong, head of sales at Google provided insights on how the company is approaching YouTube monetization. Another session elicited reactions from big-time brand marketers about issues with pre-rolls and explored alternatives. And as I previously wrote, NBCU's Jeff Zucker delivered a candid wake-up call to the industry about challenges ahead. Even as someone who follows this stuff pretty closely, I thought there was a lot of new info and perspectives being shared.

All in all, these sessions all served as another reminder to me about how broadband video is becoming a vibrant part of the overall economy. There is so much entrepreneurial energy going into developing all the pieces of the overall broadband ecosystem. A consistent theme I heard at NATPE was that people recognize broadband is challenging incumbent media distribution, but it is also expanding producers' options in unprecedented ways. For me that's the real potential ahead.

If you want to discuss the specifics of any of these, just drop me a line!

Categories: Advertising, Events

Topics: Broadband Enterprises, Enticent, Joost, Leichtman Research Group, Livid Media, NATPE, PermissionT, SpotStock.com, Teletrax, Vuze

Posts for 'Broadband Enterprises'

|