-

Cable Affiliate Fees Matter. A Lot.

Over the past week or so, several people have forwarded me a post that Bill Gurley, partner at the Silicon Valley venture capital firm Benchmark Capital recently wrote titled, "When It Comes to Television Content, Affiliate Fees Make the World Go 'Round," in which he correctly observes that "over-the-top" disruption of cable/satellite/telco delivery of premium TV programming isn't going to happen very quickly due to the importance of affiliate fees. His main argument - that cable networks receive $32 billion in annual affiliate fees from cable/satellite/telco distributors that they are loath to jeopardize - is right on the money (no pun).

This of course has been the central reason that cable, as opposed to broadcast, programs have been scarcely available online. I've argued the same point for a while now, going back to "The Cable Industry Closes Ranks" in which I tried to explain how the cable industry works and why it would fight tooth and nail against disruption. Gurley further notes how TV Everywhere cleverly defends the industry against free distribution, which I agree with as well.

While there's plenty of media hype around the prospect of "cord-cutting," it's essential to understand the business dynamics in play and what impact they'll have in slowing this trend. It's rare to see a Silicon Valley VC take such a sober approach to potential disruption (because funding exciting tech start-ups is largely about funding disruption after all), so I thought Gurley's post was both refreshing and worth the read.

What do you think? Post a comment now (no sign-in required).Categories: Cable Networks, Cable TV Operators

Topics: Benchmark Capital

-

Discovery and PointRoll Combine Editorial and Ads in "Dig@torial" In-Banner Video Unit

A new ad unit announced by Discovery and PointRoll and called "Dig@torial" (pronounced "digitorial") caught my attention a few weeks ago, and I've been meaning to write about it since. The unit intrigued me because it dynamically leverages Discovery's video library to enhance an advertiser's message in an easy-to-navigate rich media banner. I hadn't seen anything quite like it before and believe it is yet another indicator of how content and ads are blurring into one seamless experience.

To learn more, I talked to Michael Aronowitz, VP of Channel Development at PointRoll, which is owned by Gannett, and Brent Spitzer, VP and Leigh Solomon, Manager of Activation, both at Discovery Digital Media Advertising Sales.

PointRoll worked with Discovery to build a shell in the requested leaderboard and 160x600 skyscraper formats. In these examples 50% of the space promotes Montana Office of Tourism specifically and the other 50% offers opportunities to engage with Discovery content. When you roll over the ad it unfolds to show a mosaic of photos to look at in the Montana space (plus a link to visit www.visitmt.com), and a choice of relevant articles and videos from Discovery's library in its space. A video begins playing in-banner automatically with 4 thumbnails exposed below, plus a link to view more on a customized landing page. The videos play with a 10 second pre-roll for Montana that is frequency-capped.

Brent and Leigh explained that with the Dig@torial, Discovery works collaboratively with its advertising clients to select the most relevant content to incorporate into the ads. Discovery's team combs through its archive of video clips and proposes a playlist to the client. If the client has its own video that can be incorporated too. The video is fed dynamically into the Dig@torial unit, so it can be updated at any time. The key to making all this possible for Discovery is that it owns all of its programs, so it has a free hand to carve them up and integrate them into ads like these.

It's still early for the Dig@torial unit, but it appears to be succeeding. Michael said that the benchmark "interaction rate" for the PointRoll network (which is the first time someone interacts with a PointRoll ad) over the last 1 1/4 years is 6.4% with a 14 second engagement time. The Dig@torial press release says that regular rich media ads on Discovery's sites exceed the PointRoll benchmark by 70% and that the Dig@torial ads provide another 50% lift. That would imply an approximately 16% interaction rate and 36 second engagement time, both of which are very strong. Attesting to the Dig@torial's appeal, Brent and Leigh said that Dig@torial campaigns for 8 other clients have also recently launched or are being launched (I combed through Discovery's sites, but wasn't able to find them though).

Brands and sites are perpetually trying to identify ways to increase user engagement and conversion. By blending client messages with relevant and strongly branded content, the Dig@torial unit is breaking new ground in delivering value to all parties. It's also a reminder that for content providers, it's worth trying to secure re-use rights to programming and then archiving and tagging them for subsequent retrieval. Dig@torial is showing that content's value can extend well beyond its initial airing.

What do you think? Post a comment now (no sign-in required).Categories: Advertising, Cable Networks

-

Is "Cord-Cutting" a Big Deal or Not?

"Cord-cutting," the idea of disconnecting your cable/satellite/telco video subscription service in favor of online viewing only, got renewed attention this week as new research from a Canadian firm named Convergence Consulting Group said that 800,000 U.S. households have unplugged in the last 2 years. Though that number is a teeny-tiny fraction of the population that still takes subscription TV, the question begs, is this an early indicator of rampant cord-cutting to follow, or a blip that's unlikely to get that much bigger over time?

Back in the fall of '08 I asserted that for most people cord-cutting isn't going to be happening any time soon for 2 key reasons. First, that it's still relatively hard for most mainstream users to connect broadband to their TVs, which is an essential ingredient to long-form viewing. There's no question that this has gotten easier since, and will only get easier still. Eventually broadband to the TV will be ubiquitous. But until it is, cord-cutting raises technical and comfort challenges most people don't want to confront.

The bigger obstacle to cord-cutting is the loss of cable-only programming that isn't available for free online. Back in '08 the concept of TV Everywhere wasn't yet around. Now that it's beginning to rollout (albeit painfully slowly), it's evident that the cable ecosystem is determined to see cable programming remain accessible only to those who maintain a paid subscription.

My take is that cable programming is the key firewall against cord-cutting. For some, losing cable programs won't matter. But my guess is that for most, losing their favorite cable programs by cutting the cord will be a non-starter. As Conan's move this week to TBS illustrates, increasingly the most distinctive shows are on cable. And note the "firewall within the firewall" is marquee sports programming on channels like ESPN, TNT and Fox Sports, which isn't going online for free ever. This precludes virtually all true sports fans from cord-cutting.

Net-net, the debate about cord-cutting's potential needs to focus on how much value audiences place on their favorite cable programs. If it's a lot, then little cord-cutting will ensue; if it's a little - and there are suitable free online substitutes - then we'll see lots more cord-cutting.

(Note - all of this is fodder for our VideoSchmooze panel discussion on April 26th "Money Talks - Is Online Video Shifting to the Paid Model?" Early bird discounted registration expires today!)

What do you think? Post a comment now (no sign-in required).Categories: Cable Networks, Cable TV Operators

Topics: Convergence Consulting Group

-

Wrapping Up the YouTube-Viacom Court Documents Coverage

Wow, based on the extensive coverage of the newly disclosed court documents in the Viacom-YouTube copyright lawsuit, you'd almost think the business press hit the pause button on everything else going on yesterday to spend time reading the details. The combination of 2 heavyweight companies slugging it out, billions of dollars at stake and juicy, behind-the-scenes details finally revealed (like how the $1.6 YouTube acquisition largesse was shared) makes this an irresistible story with lots of legs.

I've only spent a little time reviewing the documents, but for those interested in the 360 degree immersion, following is some of the best coverage I've been reading, in no particular order. No doubt there's plenty more to come. And if you're a real glutton for punishment, just google "Viacom YouTube court documents" and you can spend your entire weekend reading everything!

Viacom Says YouTube Ignored Copyrights - NY Times

YouTube Accuses Viacom of Secretly Uploading Clips - Mediapost

Viacom, YouTube Trade Barbs in Copyright Feud - Multichannel News

Viacom and Google Trade Accusations - WSJ

YouTube Says Viacom Agents Secretly Uploaded Video, Then Lawyers Sued - AdAge

The Numbers Behind the World's Fastest Growing Web Site: YouTube's Finances Revealed - AllThingsD.com

Viacom, Google Air Dirty Laundry in Court Docs - CNET

Did YouTube Jilt Viacom for Google - NewTeeVee

Revealing Docs Emerge in Viacom, YouTube Spat - Variety

What do you think? Post a comment now (no sign-in required)Categories: Aggregators, Cable Networks

Topics: Google, Viacom, YouTube

-

Comedy Central Pulls Out of Hulu - Was This Really a Surprise?

This week brought news that Comedy Central was pulling its programs, including its hits "The Daily Show with Jon Stewart" and "The Colbert Report," from Hulu on March 9th. Both had been available on Hulu since the summer of 2008 in what Comedy Central had initially positioned as a test. Both will still be freely available at ComedyCentral.com.

The Daily Show in particular had been enormously popular on Hulu since launch, so in this respect losing it is a setback for Hulu. Still, Comedy Central's decision should come as a surprise to nobody. As I've been saying since I wrote "The Cable Industry Closes Ranks" in November '08, a bright line is being drawn in the broadband world between programs that consumers currently pay for and those that they don't. The industry is determined make sure the former stay that way and don't leak out onto the free Internet (in this sense, it's actually amazing to me that the Comedy programs are still available for free on its own site, but that's another story).

Central's decision should come as a surprise to nobody. As I've been saying since I wrote "The Cable Industry Closes Ranks" in November '08, a bright line is being drawn in the broadband world between programs that consumers currently pay for and those that they don't. The industry is determined make sure the former stay that way and don't leak out onto the free Internet (in this sense, it's actually amazing to me that the Comedy programs are still available for free on its own site, but that's another story).

The free ad-only Hulu model is bumping up against the industry's big TV Everywhere push (another effort to maintain the subscription model) and so it was inevitable that Comedy's programs would get pulled. Hulu could make itself more attractive to networks - and open up new opportunities for itself - if it offered a subscription model. This is something I've suggested for some time, however I'm somewhat skeptical that anything will happen on this front until the Comcast-NBCU deal closes. Comcast would then become an approximately 20% owner of Hulu and will surely want to influence its strategic direction.

What do you think? Post a comment now (no sign-in required).Categories: Aggregators, Cable Networks

Topics: Comedy Central, Hulu

-

4 Items Worth Noting for the Jan 11th Week (Real's Rob Glaser, ESPN Mobile, Broadband's impact, Vail goes 360)

1. Goodbye to RealNetworks' Rob Glaser - For broadband veterans like myself, this week's news that RealNetworks' founder and CEO Rob Glaser is stepping down from the CEO role after 16 years brought to mind how far the online video and audio worlds have come, in a relatively short time. Having done a fair amount of work with Real back in my Continental Cablevision days, some of my first memories of seeing video delivered through the Internet were with the RealPlayer.

There is no question Rob was one of the pioneers of the online video industry, and everyone working in the industry today owes him and Real a debt of gratitude. In the Internet's first wave, Real was out ahead of everyone in audio and video. Unfortunately for the company, Microsoft's decision to roll out its own media player (and to bundle WMP with Windows) scrambled Real's future and set off years of antitrust litigation. Over the years Real has tried many things, some of which worked and some of which were serious head-scratchers (Ryan Lawler recounts 5 of the company dumbest moves here).

Personally, it's been a while since any video I wanted to watch required the RealPlayer download. And the last time I did download it, I was so incessantly bombarded with offers that I uninstalled it and swore I'd never download it again. Nonetheless, Real remains one of the largest digital media and technology companies, with $140 million in Q3 '09 revenues and almost $400 million in cash and short term investments. The new CEO will inherit all this, plus the challenge of how to make Real a more significant player in a broadband-dominated world that Rob envisioned so many years ago.

2. ESPN: "Mobile will be bigger than the web" - I'm always on the lookout for insights from content executives charged with building their company's mobile initiatives (and mobile video more specifically) and so I found MocoNews.net's interview with John Zehr, ESPN's SVP and GM of Mobile a worthwhile read. ESPN has made a ton of progress in mobile since its MVNO was shut down and the post provides growth stats on some of ESPN mobile's most successful efforts.

Reflecting the key shift in mobile away from "on-deck" carrier-focused distribution deals to a more open Internet-like environment, Zehr said ESPN's mobile revenue model is built on payments from aggregators like FLO TV and MobiTV, advertising and app sales. That sounds a lot like the traditional cable model of affiliate fees, advertising and ancillary revenues like commerce. And just like in cable ad sales, ESPN sells all of its mobile ads itself, avoiding third-party ad networks that it believes would commoditize the ESPN brand. ESPN is clearly bullish on mobile, with Zehr saying "Not too far in the future, mobile will be bigger than the web." With the Apple vs. Google mobile war getting underway there's a lot of momentum building. Still, to keep things in perspective, we're a long way from mobile eclipsing the web.

3. Does broadband help the economy or not? - I was intrigued by this piece in Network World, reviewing a new study, "Does Broadband Boost Economic Development?" which makes the case that where broadband connectivity is available, it helps local economies, though it doesn't necessarily help the individuals who live there. I'll admit, this is pretty wonky stuff, but as broadband becomes ever more central to our economy and to video in particular, it's important to understand broadband's impact. This is true all the more so as we have a major net neutrality debate looming this year, which could have far-reaching consequences for both content providers and network operators.

4. Vail introduces 360 degree video, it's almost like being there - Finally, on a lighter note, if you've been itching for that ski trip to Colorado this winter, or just want to escape the daily grind for a few minutes of pleasure, check out Vail's new virtual video clips, shot in 360 degree splendor with partner Immersive Media. The company's Dodeca spherical camera system captures video from 11 different sensors, allowing the viewer to click on the controls to switch angles.

Immersive caught my attention recently with music concerts they've captured and plus their work with brands like Red Bull, Armani and Mercedes. The company offers a full suite of capture, production and distribution services. In Vail's case, you get to experience some of the mountain's best runs alongside other skiers. It's great marketing for Vail and though it's no substitute for actually being there, your legs won't hurt afterwards either!

Enjoy the weekend!

(Note - The VideoNuze Report podcast with Daisy Whitney will resume next week)

Categories: Cable Networks, Mobile Video, People, Technology

Topics: ESPN, Immersive Media, RealNetworks, Vail

-

Recapping 2010 CES Video-Related News

The 2010 Consumer Electronics Show (CES) is now behind us. There were tons of announcements to come out of this year's show, including many in the online and mobile video areas. Increasingly a core focus of new devices is how to playback online and mobile-delivered video, how to move it around the consumer's house and how to make it portable. Following is a filtered list of the product announcements (or pertinent media coverage if no release was available) that I found noteworthy. They are listed in no particular order and I'm sure I've missed some important ones - if so, please add a comment with the relevant link.

Boxee box internals revealed. NVIDIA Tegra 2 FTW

Syabas Announces Popbox for Big Screen Everything

Sling Media Announces Support for Adobe Flash Platform in Hardware and Software Products

LG Electronics Expands Access to Content-on-Demand with New High-Performance Blu-ray Disc Players

ESPN 3D to show soccer, football, more

TV Makers ready to test depths of market for 3D

DirecTV is the First TV Provider to Launch 3D

DISH Network Introduces TV Everywhere

Microsoft Unites Software and Cloud Services to Power New TV Experiences

FLO TV and mophie to Bring Live Mobile TV to the Apple iPhone and iPod Touch

Broadcom Drives the Transition to Connected Consumer Electronics at 2010 International CES

New NVIDIA Tegra Processor Powers the Tablet Revolution

Digital Entertainment Content Ecosystem (DECE) Announces Key Milestones

Disney offers KeyChest, but where is the KeyMaster?

DivX Launches New Internet TV Platform to Redefine the Future of Entertainment

Blockbuster, ActiveVideo Announce Agreement for Cloud-based Online Navigation

Skype Ushers in New Era in Face-to-Face Online Video Communication

Aside from CES, but also noteworthy last week:

Apple Acquires Quattro Wireless

AT&T Adds Android, Palm to Its Lineup

Tremor Media Launches New Video Ad Products That Enhance Consumer Choice and Engagement

Categories: 3D, Advertising, Aggregators, Cable Networks, Devices, FIlms, Mobile Video, Satellite, Telcos

Topics: CES

-

4 Items Worth Noting for the Jan 4th Week (Netflix-WB Continued, comScore Nov. '09 stats, TV Everywhere, 3D at CES)

Following are 4 items worth noting for the Jan 4th week:

1. TechCrunch disagrees with my Netflix-Warner Bros. deal analysis - In "Netflix Stabs Us In The Heart So Hollywood Can Drink Our Blood," (great title btw) MG Siegler at the influential blog TechCrunch excerpts part of my post from yesterday, and takes the consumer's point of view, decrying the new 28 day "DVD window" that Netflix has agreed to in its Warner Bros deal. Siegler's main objection is that "Hollywood thinks that with this new 28-day DVD window deal, the masses are going to rush out and buy DVDs in droves again." Instead, Siegler believes the deal hurts consumers and is going to touch off new, widespread piracy.

I think Siegler is wrong on both counts, and many of TechCrunch's readers commenting on the post do as well. First, nobody in Hollywood believes DVD sales are going to spike because of deals like this. However, they do believe that any little bit that can be done to preserve the appeal of DVD's initial sale window can only help DVD sales which are critical to Hollywood's economics. Everyone knows DVD is a dying business; the new window is intended to help it die more gracefully. And because new releases are not that critical to many Netflix users anyway, Netflix has in reality given up little, but presumably gotten a lot, with improved access for streaming and lower DVD purchase prices.

The argument about new, widespread piracy by Netflix users is specious. With or without the 28 day window, there will always be some people who don't respect copyright and think stealing is acceptable. But Netflix isn't running its business with pirates as their top priority. With 11 million subscribers and growing, Netflix is a mainstream-oriented business, and the vast majority of its users are not going to pirate movies - both because they don't know how to (and don't want to learn) and because they think it's wrong. Netflix knows this and is making a calculated long-term bet (correctly in my opinion) that enhancing its streaming catalog is priority #1.

2. comScore's November numbers show continued video growth - Not to be overlooked in all the CES-related news this week was comScore's report of November '09 online video usage, which set new records. Key highlights: total video viewed were almost 31 billion (double Jan '09's total of 14.8 billion), number of videos viewed/average viewer was 182 (up 80% from Jan '09's 101) and minutes watched/mo were approximately 740 (more than double Jan '09's total of 356).

Notably, with 12.2 billion views, YouTube's Nov '09 market share of 39.4% grew vs. its October share of 37.7%. As I've previously pointed out, YouTube has demonstrated amazingly consistent market dominance, with its share hovering around 40% since March '08. Hulu also notched another record month, with 924 million streams, putting it in 2nd place (albeit distantly) to YouTube. Still, Hulu had a blowout year, nearly quadrupling its viewership (up from Jan '09's 250 million views). But with 44 million visitors, Hulu's traffic was pretty close to March '09's 41.6 million. In '10 I'm looking to see what Hulu's going to do to break out of the 40-45 million users/mo band it was in for much of '09.

3. Consumer groups protest TV Everywhere, but their arguments ring hollow - I was intrigued by a joint letter that 4 consumer advocacy groups sent to the Justice Department on Monday, urging it to investigate "potentially unlawful conduct by MVPDs (Multichannel Video Programming Distributors) offering TV Everywhere services." The letter asserts that MVPDs may have colluded in violation of antitrust laws.

I'm not a lawyer and so I'm in no position to judge whether any actions alleged to have taken place by MVPDs violated any antitrust laws. Regardless though, the letter from these groups demonstrates that they are missing a fundamental benefit of TV Everywhere - to provide online access to cable TV programming that has not been available to date because there hasn't been an economical model for doing so. In the eyes of people who think that making money is evil, the TV Everywhere model of requiring consumers to first subscribe to a multichannel video service seems anti-consumer and anti-competitive. But to people trying to make a living creating quality TV programming, the preservation of a highly functional business model is essential.

These advocacy groups need to remember that consumers have a choice; if they don't value cable's programming enough to pay for it, then they can instead just watch free broadcast programs.

4. 3D is the rage at CES - I'll be doing a CES recap on Monday, but one of the key themes of the show has been 3D. There were two big announcements of new 3D channels, from ESPN and Discovery/Sony/IMAX. LG, Panasonic, Samsung and Sony announced new 3D TVs. And DirecTV announced that it would launch 3 new 3D channels by June 2010, with Panasonic as the presenting sponsor. 3D sets will be an expensive proposition for consumers for some time, but prices will of course come down over time.

Something that I wonder about is what impact will 3D have on online and mobile video? Will this spur innovation in computer monitors so that the 3D experience can be experienced online as well? And how about mobile - will we soon be slipping on 3D glasses while looking at our iPhones and Android phones? It may seem like a ridiculous idea, but it's not out of the realm of possibility.

Enjoy your weekend!

Categories: 3D, Aggregators, Broadcasters, Cable Networks, Cable TV Operators, FIlms, Studios

Topics: 3D, comScore, Netflix, TV Everywhere, Warner Bros.

-

Back from the Vacation? Here Are 7 Video Items You May Have Missed

Happy New Year. If you're just back from a holiday vacation and have been partially or totally off the grid for the last week or two, here are 7 video-oriented items you may have missed:

1. Time Warner Cable and News Corp fight over fees, then settle - Two behemoths of the cable and broadcast TV ecosystem spatted publicly during the holidays over the size of "retransmission consent" fees that News Corp (owner of the Fox Broadcast Network and cable channels like Fox News) wanted TWC (the 2nd largest U.S. cable operator) to pay to carry its 14 local stations. While a last minute deal averted the channels going dark, broadcasters' interest in dipping into cable's monthly subscription revenues will only intensify as audience fragmentation accelerates and ad revenues are pressured.

For my part I wish Fox and other broadcasters were as focused on building new and profitable digital delivery models for their programs as they were on trying to redistribute cable's revenues. Even as Rupert Murdoch continues advocating the paid content model, the freely-available Hulu is seeing its traffic skyrocket (see below). But if Hulu's viewership isn't incrementally profitable, then all that growth is pointless. Urgency is mounting too; in '10 convergence devices that bridge broadband to the TV are going to get a lot of attention. In the wake of their adoption, consumers are going to want Hulu on their TVs. If Hulu doesn't allow this it will be marginalized. But if it does without first solidifying its business model, it could hurt broadcasters further.

2. Hulu has a big traffic year, but no further information provided on its business model - Hulu's CEO Jason Kilar pulled back the curtain a bit on the company's strong progress in 2009, citing 95% growth in monthly users, to 43 million, 307% growth in monthly streams, to 924 million (both as measured by comScore) and a doubling of available content, to 14,000 hours. While noting that its advertisers increased from 166 to 408 during the year, with respect to performance, Jason only said that "we are extremely excited about atypically strong results we have been able to drive for our marketing partners."

Though Hulu is under no obligation to disclose details of its business model, I think it would dramatically increase the company's credibility if it shared some metrics about how its lighter ad load model is working (e.g. improved awareness, click throughs, leads, conversions, etc.). Per the 1st item above, as Hulu grows, a lot of people have a lot at stake in understanding what effect it may have on broadcast economics. In addition, as I pointed out recently, it is important to understand whether Hulu thinks it may have already saturated its U.S. audience. After a jump in Q1 '09 from 24.6 million to 41.6 million users, traffic actually dipped below 40 million until October. What does Hulu do from here to gain significantly more users?

3. Cable networks' primetime audience is nearly double broadcasters' - Punctuating the ascendancy of cable over broadcast, this Multichannel News article pointed out that in 2009, ad-supported cable networks as a group captured 60.7% of primetime audience vs. 32% for the 4 broadcast networks. That's a major change from 2000 when the broadcasters had a 46.8% share vs. cable's 41.2%. Cable increased its share every single year of the last decade, powered by its innovative original programming. NBCU's USA Network in particular has become the real standout performer, winning its second consecutive ratings crown, with 3.2 million average primetime viewers, up 14% vs. 2008.

The surging popularity of cable programming is a crucial barrier to consumers cutting the cord on cable. Since cable networks are highly invested in the monthly multichannel subscription model, they are unlikely to disrupt themselves by offering their best shows to others under substantially different terms than how they're offered today. So to the extent cable programs are either unavailable to over-the-top alternatives or offered less attractively (e.g. less choice, higher cost, delayed availability), little cord-cutting can be expected. And if TV Everywhere achieves its online access goals, the cable ecosystem will only be further strengthened.

4. YouTube is working to drive higher viewership - Amidst the turmoil in the traditional ecosystem and Hulu's growth, YouTube, the 800 pound gorilla of the online video world, is working hard to deepen the site's viewership. As this insightful NYTimes article explains, a team of YouTube developers is analyzing viewing patterns and tweaking its recommendation practices to encourage more usage. YouTube says time on the site has increased by 50% in the last year, and comScore reports that the average number of clips viewed per user per month jumped to 83 in October, up from 53 a year earlier. Still, as comScore also reports, duration of an average session has yet to crack 4 minutes, meaning video snacking on YouTube is still the norm. YouTube's moves must be watched closely in '10.

5. Showtime's "Weeds" available online before on DVD - This WSJ article (reg req'd) pointed out that Lionsgate, producer of Showtime's hit "Weeds" series is offering episodes online before they're available on DVD. By putting the digital "window" ahead of DVD's, Lionsgate is further pressuring DVD's appeal. We've seen periodic experimentation in this regard, and I anticipate more to come, especially as the universe of convergence devices expands and consumers can watch on their TVs instead of just their computers. Until a tipping point occurs though, "Weeds" like initiatives will be the exception, not the rule.

6. Netflix goes shopping in Hollywood - And speaking of reversing distribution windows, this Bloomberg Businessweek piece was the latest to highlight Netflix's efforts to woo studios into giving it more recent releases. Netflix has of course made huge progress with its Watch Instantly streaming feature, but its appeal to heaviest users will slow at some point unless it can dramatically expand its current slate of 17K titles available online. Hollywood is understandably wary of Netflix given all the variables in play and a desire to avoid Netflix becoming master of Hollywood's post-DVD, digital future. Whether Netflix will spend heavily to obtain better rights is a major question.

7. Get ready for Google's Nexus One and Apple's "iSlate" - Unless you've really been off the grid, you're probably aware by now that two very significant mobile product releases are coming this month. Tomorrow (likely) Google will unveil the Nexus One, its own smartphone, powered by its Android 2.1 operating system. The Nexus One will be "unlocked," meaning it can operate on multiple providers using GSM networks. The device will further fuel the mobile Internet, and mobile video consumption along with it. Separately, Apple is widely rumored to introduce its tablet computer later in the month, which many believe will be called the "iSlate." The tablet market is completely virgin territory, and while it's early to make predictions, I believe Apple could have most of the ingredients needed to make the product another big hit. The prospect of watching high-quality video on a thin, light, user-friendly device is extremely compelling.

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Devices, Mobile Video, Studios

Topics: Apple, FOX, Google, Hulu, Lionsgate, Netflix, News Corp, Showtime, Time Warner Cable, YouTube

-

Goodbye 2009, Hello 2010

It's time to say goodbye to 2009 and begin looking ahead to 2010.

2009 was yet another important year in the ongoing growth of broadband and mobile video. There were many exciting developments, but several stand out for me: the announcement and launches of initial TV Everywhere services, the raising of at least $470 million in new capital by video-oriented companies, YouTube's and Hulu's impressive growth to 10 billion streams/mo and 856 million streams/mo, respectively, the iPhone's impact on popularizing mobile video, the Comcast-NBCU deal, the maturing of the online video advertising model, the proliferation of Roku and other convergence devices and the growth of Netflix's Watch Instantly, just to name a few.

Looking ahead to next year, there are plenty of reasons to be optimistic about video's growth: the rollout of TV Everywhere by multiple providers, the proliferation of Android-powered smartphones and buildout of advanced mobile networks, both of which will contribute to mobile video's growth, the launch of Apple's much-rumored tablet, which could create yet another category of on-the-go content access, the introduction of new convergence devices, helping bridge video to the TV for more people, new made-for-broadband video series, which will help expand the medium's appeal, and wider syndication, which will make video ever more available.

In the midst of all this change, monetization remains the fundamental challenge for broadband and mobile video. More specifically, for both content providers and distributors, the challenge is how to ensure that the video industry avoids the same downward revenue spiral that the Internet itself has wrought on print publishers.

Regardless of all the technology innovations, high-quality content still costs real money to produce. If consumers are going to be offered quality choices, a combination of them paying for it along with advertising, is essential. While it's important to be consumer-friendly, this must always be balanced with a sustainable business model. In short, no matter what the size of the audience is, giving something away for free without a clear path for effectively monetizing it is not a strategy for long-term success.

VideoNuze will be on hiatus until Monday, January 4th (unless of course something big happens during this time). I'll be catching my breath in anticipation of a busy 2010, and hope you will too.

Thank you for finding time in your busy schedules to read and pass along VideoNuze. It's incredibly gratifying to hear from many of you about how important a role VideoNuze plays in helping you understand the disruptive change sweeping through the industry. I hope it will continue to do so in the new year.

A huge thank you also to VideoNuze's sponsors - without them, VideoNuze wouldn't be possible. This year, over 40 companies supported the VideoNuze web site and email, plus the VideoSchmooze evenings and other events. I'm incredibly grateful for their support. As always, if you're interested in sponsoring VideoNuze, please contact me.

Happy holidays to all of you, see you in 2010!

Categories: Advertising, Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Devices, Mobile Video

Topics: Android, Comcast, Hulu, iPhone, NBCU, Netflix, YouTube

-

The Fuzzy Math of Apple's TV Subscription Service Doesn't Add Up

Yesterday's Wall Street Journal story, suggesting that CBS and Disney may participate in Apple's planned TV subscription service, caused was yet another tremor in the already chaotic video industry. Though Apple's plans are still preliminary, when I consider the numbers the Journal reported, the company's fuzzy math suggests incumbent distributors have little to worry about just yet.

The Journal said that in "In at least some versions of the proposal, Apple would pay media companies about $2 to $4 a month per subscriber for a broadcast network like CBS or ABC, and about $1 to $2 a month per subscriber for a basic-cable network..." Let's assume the mid-points for both: $3/mo for broadcast networks and $1.50/mo for cable networks. With 4 broadcast networks (assuming NBC participates, which under Comcast ownership is itself unlikely), that would be $12 in fees/mo. Say Apple signed up 12 cable networks, that would be another $18 in fees/mo. Together the $30 in fees/mo equals what Apple is reportedly looking to charge consumers. And this package would only deliver 16 channels, which would induce few consumers to cut the cord. And by the way, there's zero chance that one of those 16 cable channels would be Disney's ESPN, which already gets north of $3/mo/sub in all of its existing affiliate deals.

Given the broadcast networks' woes, it's within the realm of possibility that they would be enticed by the $2-$4/mo, considering it's above the $1/mo/sub that is often bandied about in retransmission consent discussions. Yet, Apple is supposedly talking about delivering the programs commercial-free, which means broadcasters' total revenue per month has to equal or exceed what they're already making per month for the plan to be interesting to them. With $60 billion/year in TV advertising revenue at stake, that's a big gamble for broadcast networks to make. Even the notion that consumers would pay for broadcast programs simply because they're commercial-free is speculative. Most research I've seen suggests the opposite consumer preference (they'd rather stomach ads in exchange for free content).

An even bigger challenge for Apple is to get cable networks to play ball. Starting with my post over a year ago, "The Cable Industry Closes Ranks," I've continued to assert that, despite ongoing skirmishes, cable networks and cable operators are joined at the hip in their desire to defend the traditional multichannel subscription model. In the model, big owners of cable networks bundle smaller channels with bigger, more popular ones, and require that cable operators, telcos and satellite operators take these as a package. This is the backdrop for why consumers often grouse that there are lots of channels, but little on that interests them personally. Meanwhile, TV Everywhere is intended to preserve this model as online viewing expectations build.

It stretches my imagination to believe that big cable network owners (Disney included) are going to allow Apple to cherry-pick which cable networks they want and disrupt the traditional model, especially at a time when cable networks want more, not less control. That cable networks would be willing to put Steve Jobs in the driver's seat of their digital futures is very unlikely. Analogies to the music business only go so far: remember, music companies were already under assault from rampant piracy and reeling under financial pressure when Apple came riding to their rescue. Cable networks feel no such urgency; they've been the brightest star in the media landscape as the recession has worn on.

I've learned never to underestimate Steve Jobs or Apple. But based on what's been reported so far, Apple's subscription TV math seems very fuzzy and any service that emerges from it is likely, for the most part, to be non-threatening to incumbent distributors. And that's before getting to the issues of Apple being a closed system and requiring consumers to buy a proprietary Apple TV box to get their programs onto their TVs. In the budding 'over-the-top" sweepstakes, Apple is one to watch for sure. But there are a lot of variables in play here. It will be fun to see if Jobs has yet another rabbit up his sleeve.

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators

Topics: ABC, Apple, CBS, Disney

-

VideoNuze Report Podcast #44 - December 18, 2009

Daisy Whitney and I are pleased to present the 44th edition of the VideoNuze Report podcast, for December 18, 2009. This will be the last podcast for 2009, and we'd both like to say a huge thanks to everyone who's been listening in this year.

This week I start things off by providing further detail on my experience so far with Comcast's TV Everywhere initiative, Fancast Xfinity TV (or "FXTV" as I call it for short), which was released in beta to 14 million subscribers this week at no additional charge. On the whole I think it's a respectable effort, and in the big picture, is exactly what the company should be doing with online distribution. The main challenge for improving it is getting lots more content from ad-supported and premium cable networks, so that users are more likely to find what they're looking for. For all kinds of reasons, this won't be easy, but if any company can make it happen, it's surely Comcast.

Then Daisy reviews her '09 predictions and shares her "New Media Minute Awards for Excellence." She recognizes Kaltura, 5Min, boxee, Quantcast, and number 1 pick, MyDamnChannel. All have excelled this year, attracting new venture financing, signing new deals and growing their business. Daisy is particularly proud of MyDamnChannel because it also achieved profitability this year. Listen in to find out more.

Click here to listen to the podcast (14 minutes, 18 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Cable Networks, Cable TV Operators, Indie Video, Podcasts

Topics: 5Min, Boxee, Comcast, Kaltura, MyDamnChannel, Quantcast

-

My Review of Fancast Xfinity TV: Respectable Start With Room for Improvement

Amid much anticipation, Comcast launched its "Fancast Xfinity TV" (my shorthand will be "FXTV") service yesterday. FXTV is Comcast's TV Everywhere offering and it will initially be available only to the company's approximately 14 million "dual play" (digital cable + broadband Internet access) subscribers. Comcast is keeping a "beta" label on FXTV for now, to give it some time to work out the kinks. As a Comcast triple-play customer, I have access to FXTV and I played around with it yesterday and last night. While there's plenty of room for improvement, overall FXTV is off to a respectable start.

When dual play customers now visit Fancast they are immediately notified through a prominent pop-up that there's "Great News for Comcast Customers" about online access to over a 1,000 new shows and movies. "Get started" prompts the user to enter their Comcast.net email address and password, then a 17.5MB download begins which includes the Move Networks player and an Adobe Air application. After naming your computer (you're allowed up to 3 devices to access FXTV), the site reloads with the new FXTV Beta branding. All of that worked fine for me.

A prominent window at the top of the page promotes 4 current TV shows, but FXTV misses a big opportunity to immediately demonstrate its value by oddly showcasing just 1 program (TNT's "Men of a Certain Age,") that's not sourced from Hulu. Savvy users will know the rest are already freely available there. Why not promote 4 programs that are only available to FXTV users? And why not include messaging like "Exclusively for FXTV Users!" to remind users of the payoff for having just gone through a download process?

On the positive side, below this window, FXTV promotes programming from premium channels HBO, Starz and Cinemax. As a non-subscriber to Cinemax, when I clicked on "Juno," which had a little key icon, FXTV's authentication process kicked in, prompting a message to subscribe to Cinemax to watch. However, when I clicked "Learn more" my popup blocker interceded which meant I needed to disable it and then reload the page. The Cinemax promotional page that loads is generic from the Comcast.com web site, featuring a graphic of "Gran Torino" and promotions for 3 other movies. Comcast has a golden upsell opportunity when FXTV users click on premium content. It would no doubt improve its conversion ratio if the landing page were customized to load a graphic of the original movie or show selected at FXTV, well merchandised with trailers, clips and other information. A special offer/reward for FXTV users would also help.

Back on the FXTV site, below the premium channel promotions is an area for Full Episodes, categorized by "Celeb News," "The Hot List," "Dramas," etc. Once again, many of the thumbnails link to content that is freely available online and to all other Fancast users. Once again, I'm surprised that Comcast isn't doing more to promote programs that are only available to FXTV users, making it more explicit what's special about FXTV.

I clicked and watched parts of a number of shows and in general my experience was positive. I've read other reviews describing buffering delays, but I didn't experience any issues, or at least anything different than I typically do when starting videos at other sites. One thing Comcast disclosed on the press call yesterday was that FXTV would be available to dual play subscribers outside their homes. Recall that in the 5,000 person trial, users could only access the service from within their homes, so this is a major step forward. I haven't yet tested FXTV remotely, but will do so while in Florida next week.

The biggest challenge FXTV faces is content availability, particularly from the ad-supported cable networks. For example of last week's top 10 rated cable shows, only TNT's "The Closer" and "Men of a Certain Age" are available on FXTV. Among the top 10, there are no sports (football or WWE) or kids shows like "Sponge Bob" (Nick) or "Phineas and Ferb" (Disney) available. Even for #10 show "Keeping up With the Kardashians" the most recent episodes are from Season 2, back in May 2008 - and this is a show that's on E! Entertainment, a channel that Comcast itself owns! There are no episodes offered of my favorite cable show, AMC's "Mad Men."

The content selection on the premium channels HBO, Starz and Cinemax (note Showtime is not yet available on FXTV) is better, but not eye-popping. For example, the only episodes of HBO's "Entourage" that are available are from Season 2 in 2005, despite the fact that Comcast's CEO Brian Roberts specifically demonstrated and highlighted the idea that all episodes of Entourage would be available when he showed the service at the Web 2.0 conference less than 2 months ago. For some reason HBO must have pulled the rights to Entourage in this time.

A lot of the questions on the press call Comcast conducted yesterday focused on content availability and it's clear that obtaining the rights to distribute the full slate of cable programs online is devilishly complex. To be sure, Comcast has made progress, saying it has 27 networks are supplying programming, totaling 12K titles. There's no distributor in a better position to make online distribution happen than Comcast, yet as I wrote last week about Nielsen not yet being able to collect and then synthesize online viewership, Comcast (and other TV Everywhere providers) are subject to forces beyond their control.

Yet another complicating factor is how advertising in FXTV will work. Comcast said that for now, while "nobody really knows what works best," each network will be permitted to experiment with ad loads. It's not clear how long this will go on, nor what role Comcast will play to guide networks to a certain load. In the meantime though, the downside is that the user experience is inconsistent from one network to another. For an offering that's free to subscribers that's not a big drawback, but the lack of consistency does chip away at least a little bit from the overall experience.

Taken together, Comcast deserves credit for getting FXTV out the door just 6 months since announcing it this summer, which is light speed in cable TV terms. There are lots of ways it can and will be improved upon. Gaining credibility with content providers, so that FXTV can beef up its library is priority #1. As I've been saying for a while now, conceptually FXTV is right on all fronts - it preserves the paid consumer model for content providers, offers users enhanced value and helps Comcast and other providers defend against cord-cutting. Hopefully Comcast and other providers will sufficiently invest in these services to let them reach their full potential.

What do you think? Post a comment now.

Categories: Cable Networks, Cable TV Operators

Topics: Comcast, Fancast Xfinity TV, Hulu

-

Lack of Viewership Data Could Stall TV Everywhere

Based on a number of conversations I've had with cable programming executives, Nielsen's current inability to measure online viewing of TV programs and meld that data effectively with on-air viewing is emerging as a key stumbling block to successful rollouts of TV Everywhere services.

Cable networks are justifiably concerned that any viewership that potentially shifts from on-air to online that they are not credited for will adversely impact their ratings and therefore their advertising revenue. Until the issue is fixed cable networks will be reluctant to offer their most popular programs to TV Everywhere providers, in turn diluting TV Everywhere's appeal to consumers.

Nielsen, the de facto standard in TV ratings measurement, is well aware of these concerns and as

Multichannel News reported this past Monday, it plans to accelerate the deployment of its "TVandPC" software which measures online viewing to 7,500 of its National People Meter households by Aug. 31, 2010. While that's a start, as industry executives have told me, it's not just the online viewing data that's needed, but also the proper blending of that data with the on-air data that's critical.

Multichannel News reported this past Monday, it plans to accelerate the deployment of its "TVandPC" software which measures online viewing to 7,500 of its National People Meter households by Aug. 31, 2010. While that's a start, as industry executives have told me, it's not just the online viewing data that's needed, but also the proper blending of that data with the on-air data that's critical. Among the issues is how online viewing, which offers consumers the potential of much-delayed on-demand viewing, should be aligned with Nielsen's "C3" ratings, which captures up to 3 days playback on DVRs. Another issue is understanding and measuring new TV Everywhere viewership patterns (e.g. college students remotely watching shows on a laptop which has been authenticated by Mom and Dad's cable account). Then there's the question of whether the online ad loads are going to be comparable to those on-air (e.g. if the online share of a program's overall viewership carried far fewer ads than the on-air viewership, advertisers and media planners will want to know this). No doubt other issues loom as well.

Add it all up and the process of collecting and then blending online and on-air viewership data is non-trivial and will require a significant investment and testing on Nielsen's part to accomplish. From Nielsen's standpoint, it could be reluctant to make such an investment in overhauling its measurement service unless there were pre-commitments from some of its clients to accepting and buying the enhanced ratings service.

On the one hand, it would seem that cable networks' reluctance to embrace TV Everywhere until adequate measurement systems were in place would be a strong incentive for TV Everywhere providers to support Nielsen's enhancements. However, I've been told that when Nielsen previously made improvements to track Video-on-Demand viewership, not many service providers implemented necessary mechanisms to denote programs were VOD-based, and therefore Nielsen's investment yielded little return. Particularly given the tough economic times, that could make Nielsen more cautious about how it proceeds with online ratings. For now Nielsen has not disclosed its plans.

Still, Nielsen is under pressure to move forward given the formation of the Coalition for Innovative Media Measurement (CIMM), which is comprised of 14 TV networks, agencies and advertisers. CIMM's goal is to explore new methodologies for audience measurement, particularly for set-top box data and cross-platform media consumption. While some in the industry have tagged CIMM as a Nielsen challenger, its members have said they have no intention of trying to replace Nielsen. Regardless, the presence of an industry-backed group trying to wrap its arms around cross-platform audience measurement is likely to only accelerate Nielsen's online tracking efforts.

As VideoNuze readers know, I've been quite enthusiastic about TV Everywhere's potential, though I'm plenty cognizant of the challenges it faces. Measurement is surely near the top of that list. One of the benefits to Comcast of owning NBCU is that, if it chooses to, it can release NBCU's cable networks' programs for TV Everywhere viewing, absent complete online tracking. This would be comparable to what Hulu's owners have chosen to do by distributing their broadcast network shows online (they're at least partly motivated by the belief that online viewing augments on-air viewing). But Comcast won't take ownership of NBCU for another year or so. By that time Nielsen may well be close to rolling a blended online/on-air offering.

In sum, it could well be that 2010 ends up being more a year of experimentation for TV Everywhere while building blocks like audience measurement get put in place. VOD, which years since its launch still lacks many primetime programs as well as dynamic advertising insertion, offers a cautionary example for TV Everywhere providers of how a lack of investment can block the realization of a new medium's full potential. Cable networks in particular will keep looking for signals that TV Everywhere will be more robust than VOD before they get too enthusiastic about online distribution.

What do you think? Post a comment now.

Categories: Cable Networks, Cable TV Operators

-

VideoNuze Report Podcast #42 - December 4, 2009

Daisy Whitney and I are pleased to present the 42nd edition of the VideoNuze Report podcast, for December 4, 2009.

Today's sole topic is of course the big news of the week, Comcast's acquisition of NBCU. Daisy and I chat about the winners/losers/unknowns that I detailed in my post yesterday. There are a lot of aspects to the Comcast-NBCU deal and the new entity will have wide-ranging implications for the media industry. Listen in to learn more.

Click here to listen to the podcast (15 minutes, 24 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Broadcasters, Cable Networks, Cable TV Operators, Deals & Financings, Podcasts

Topics: Comcast, GE, Hulu, NBCU, Podcast

-

Comcast-NBCU: The Winners, Losers and Unknowns

With Comcast's acquisition of NBCU finally official this morning (technically, it's not an acquisition, but rather the creation of a JV in which Comcast holds 51% and GE 49%, until GE inevitably begins unwinding its position), it's time to assess the winners, losers and unknowns from the deal, the biggest the media industry has seen in a long while. I listened to the Comcast investor call this morning with Brian Roberts, Steve Burke and Michael Angelakis and reviewed their presentation.

Here's how my list shakes out, based on current information:

Winners:

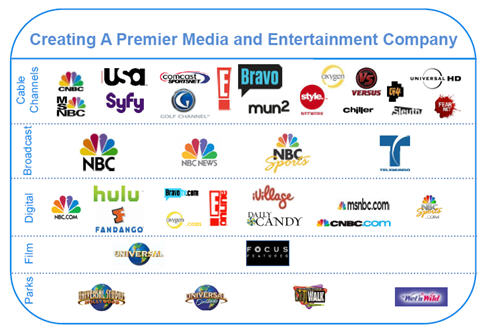

1. Comcast - the biggest winner in the deal is Comcast itself, which has pulled off the second most significant media deal of the decade (the first was its acquisition in 2002 of AT&T Broadband, which made Comcast by far the largest cable operator in the U.S.), for a relatively small amount of upfront cash. Comcast has long sought to become a major player in cable networks, but to date has been able to assemble an interesting, but mostly second tier group of networks (only one, E! has distribution to more than 90 million U.S. homes).

The deal moves Comcast into the elite group of top 5 cable channel owners, alongside Disney, Viacom, Time Warner and News Corp, with pro-forma 2010 annual revenues of $18.2 billion and operating cash flow of $3 billion. It also provides Comcast with a huge hedge on its traditional cable/broadband/voice businesses, as the JV, on a pro-forma basis would be 35% of Comcast's overall 2010 revenue of $52.1 billion, though importantly only 18% of its cash flow of $16.5 billion. On the investor call, Roberts emphasized that the deal should not be seen as the company diminishing its enthusiasm for the traditional cable business, but given the downward recent trends in fundamentals (vividly shown in slides from my "Comcast's Digital Transformation Continues" post 3 weeks ago), the conclusion that Comcast will be relying on its content business for future growth is inescapable.

2. Cable networks' paid business model/TV Everywhere - With Comcast's executives' platitudes about cable networks being "the best part of the media business," the fact that cable networks will contribute 80%+ of the JV's cash flow and the ongoing travails of the ad-supported broadcast TV business, the deal puts an exclamation mark on the primacy of the dual-revenue stream cable network model and Comcast's commitment to defending it (see "The Cable Industry Closes Ranks" for more on this.)

The deal can also be seen as cementing the paid business model for online access to cable networks' programs. Comcast is committed to having online distribution of TV programs emulate the cable model, where access is only given to those consumers who pay for a multichannel subscription service. Much as they may resist acknowledging it, Hollywood and the larger creative community must see Comcast as doing them a huge service by preserving the consumer-paid model, helping the video industry avoid the financial fate of newspapers, broadcasters and music. To be sure, some consumers will cut the cord and be satisfied with what they can get for free online, however it is unlikely to be a large number any time soon. As for aspiring over-the-top providers, they'll need to look outside the cable network ecosystem to generate competitive advantage.

3. Jeff Zucker - The current head of NBCU will migrate into the role of CEO of the JV, greatly expanding his portfolio and influence. Zucker has fought the good fight to preserve the NBC network's status, rotating in new creative heads, shifting Leno to primetime, backing Hulu, etc, but the reality, as he pointed out earlier this year, is that NBCU in his mind has long since become a cable programming company. I've been a Zucker fan since seeing him speak at NATPE in '08 when he laid out a sober assessment of the broadcast business. Through solid acquisitions and execution, Zucker has proved himself to be far more than the wonderboy of "Today" - he's going to fit in well at Comcast and be a great addition to its executive team.

Losers:

1. NBC broadcast network and the JV's 10 owned and operated stations - While Comcast executives said they "don't anticipate any need or desire to divest any businesses" and "take seriously their responsibility" to the iconic NBC brand, the reality is that with the broadcast business contributing just 10% of the JV's pro-forma annual cash flow, the network, and especially the stations, are not just in the back seat of the JV, they're in the third row. Though broadcast contributes 38% of the JV's pro-forma revenue and the deal is being struck near the bottom of the advertising recession, it's hard to see things improving much. Exceptions are the sports division (more on that below), the TV production arm and possibly the news division. The only thing saving the stations is retrans and Comcast's need to appease regulators to get the deal done and keep the regulators at bay thereafter.

2. Other cable operators, telcos and satellite operators - It's never good news when one of your main competitors owns the rights to a good chunk of the key ingredients in your product, yet that's the reality for all other cable operators, telcos and satellite operators. Sure Comcast must be disciplined about throwing its weight around too much, but if these distributors cried when NBCU (and other big network owners) forced bundling and drove fee increases, they haven't seen anything until Comcast runs the renewal processes. With 6 channels having 90+ million homes under agreement plus many others in the JV's portfolio, Comcast is in a very strong negotiating position. As the world moves online, the threat that Comcast eventually says to hell with other distributors and goes over the top itself (a scenario I described here), other distributors have even bigger problems ahead.

3. GE - Yes GE gets about $15 billion in cash and a graceful exit from NBCU, but 20 years since incongruously acquiring NBC, the question burns even brighter, what was GE doing in the entertainment business in the first place? Hasta la vista GE, time to focus on manufacturing turbines and unraveling the woes at GE Capital.

Unknowns:

1. Do content and distribution go together any better this time around - With the disastrous results of AOL-Time Warner still fresh in the mind, it's fair to ask whether vertical integration will work any better this time around. Sensitive to the issue and no doubt anticipating questions on it, Roberts said on the call that this is "a different time and a different deal" and, pointing to News Corp-DirecTV, noted that sometimes vertical integration does work. In addition, he highlighted that the deal's financials are not predicated on achieving any elusive synergies. Still, aside from the obvious benefits of getting bigger in cable networks, the primary reasons cited for Comcast pursuing the deal still have synergy at their core: a slide that clearly says that "Distribution Benefits Content" and "Content Benefits Distribution." As always there are plenty of opportunities to pursue in theory; the challenge is executing on them given the rampant conflicts and turf battles that inevitably ensue.

2. Hulu's future - the online aggregator was literally not mentioned once in the Comcast presentation and its logo only appears on just one of the 36 slides in the deck, yet its presence is hard to underestimate. Hulu is the embodiment of the free, ad-supported premium video model that Comcast is so fiercely committed to combating. So how does it fare when one of its controlling partners soon will be Comcast? In response to a question, Steve Burke said he sees "broadcast content going to Hulu" and that "Hulu and TV Everywhere are complementary products." He also tersely dismissed the much-rumored idea of a Hulu subscription offering. It's impossible to know what becomes of Hulu, but with such divergent interests among the owners, it wouldn't surprise me if Hulu is unwound at some point post closing.

3. ESPN's role - With the JV's NBC Sports assets, plus Comcast's Versus, regional sports networks and Golf Channel, the new JV is primed to play a bigger role in national sports. While Fox Sports and TNT have skirmished for high-profile rights deals with ESPN, the new JV has a much stronger hand to play. It's fair to wonder whether Comcast, which likely sends Disney a check for $70-80 million each month to carry ESPN to its 24 million subscribers, won't at some point say, "hey we can do some of this ourselves" and move to become a bona fide ESPN competitor. In fact, ESPN figures into a far larger Comcast vs. Disney story line in the media industry going forward. The two companies are incredibly dependent on each other, and yet are poised to become even tougher rivals. Expect to hear much more about this one.

4. Consumers - last but not least, what does the deal mean for consumers? Likely very little initially, but over time almost certainly an acceleration of digitally-delivered on-demand premium content - but at a price. Comcast has the best delivery infrastructure, with the JV, soon premier content assets and a persistent, if sometimes incomplete (as with VOD, for example) commitment to shape the digital future. I expect that will mean lots of experimentation with windows, multiplatform distribution and co-promotion across brands. Washington will scrutinize the deal thoroughly, but with continued public service assurances from Comcast, will eventually bless it. Then it will be vigilant for anything that smacks of anti-competitiveness. Consumers should buckle up, the next stage of their media experience is about to begin.

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Deals & Financings

Topics: Comcast, GE, Hulu, NBCU

-

Oprah's New Channel Reinforces Value of Paid Distribution Model

Oprah Winfrey's decision last week to voluntarily wrap up her long-running talk show captured the biggest headlines, but a more subtle takeaway message should also be noted: even in the broadband age where content providers can connect directly to their audiences, there's still enormous value in working through distributors who are willing to pay a guaranteed monthly fee to carry a 24/7 linear channel. In this case the channel is new Oprah Winfrey Network (OWN), which is a 50-50 joint venture with Discovery Communications and will be Oprah's main business focus.

OWN is actually taking over the 70 million home (U.S.) carriage that Discovery established for its digital channel Discovery Health Channel which didn't generate much ratings success. This allows OWN to count on an established revenue stream from its distributors before a single program has been put on air or a single ad has been sold. As a result, a portion of the new venture's financial risk is mitigated from the start. Of course there will still be huge pressure on OWN to create programs that have sustainable audience appeal (the bread and butter of all networks, cable or broadcast), but the cushion of those monthly distributor payments cannot be underestimated.

I've said for a long time that the fundamental differentiating aspect of broadband video is that it is the first open video delivery platform. By open I mean that content providers are able to reach their intended audiences without requiring deals with any third party cable operator, satellite operator, telco, cable network, broadcast network, local broadcast TV station, etc. If you're a producer, that's incredibly liberating: just put your video up on a server and online audiences have immediate access to it. YouTube's 10 billion+ monthly streams, many of which are user-generated, attest to how powerful a concept open video delivery is.

Of course the problem is that just because you can produce video and make it available, doesn't mean it has any economic value to an advertiser or to a distributor. By definition distributors only seek to take on products that they believe have value in the retail marketplace. In cable's early days, operators were desperate to differentiate themselves as more than retransmitters of broadcast stations and were willing to take on channels with untested and often quizzical formats: 24 hour news (CNN), music videos (MTV) and low-popularity sports (ESPN), among others. Over time the fees these channels and others command have grown significantly, helping fuel their programming budgets and in turn their audience popularity.

But as anyone who has more recently tried pitching a new cable network to a cable, satellite or telco operator knows, the standards for getting distribution have become insanely high. It's not just that these cable/satellite/telco operators need to keep their costs down because they have limited ability to raise their monthly rates, it's also that they recognize very few new channels can generate bona fide new value in their lineups. This is part of why the few recent channel success are sports-driven startups like the NFL Network or regional sports outlets like the Big Ten Network.

A comparable paid distribution model has not yet developed for broadband video. For a time I believed that sites like Hulu, Joost and Veoh might be able to develop such a model given the amount of capital that each had raised. Only Hulu now has the potential to do so, though there's no indication as yet that it intends to. Absent a paid distribution model, the vast majority of broadband-only video producers are reliant on advertising, just like broadcast TV networks. Some broadband producers are proving that an ad-only model works, yet there's no question a viable paid distribution model would be a tremendous boost for the industry.

Watching Revision3's Tekzilla on TV the other night via Roku, I was reminded that until broadband video is widely available on TVs it will remain hard for any new paid distribution model to take root. That's because consumers will require a comparable living room viewing experience before many of them show a willingness to pay. The good news is that this experience is coming, as millions of TVs will soon have broadband access, either on their own or through a connected device (e.g. Roku, Xbox, Apple TV, etc.). Until then though, the paid distribution model will only be available to Oprah and others with gold-plated appeal.

What do you think? Post a comment now.

Categories: Cable Networks, Cable TV Operators, Indie Video, Satellite, Telcos

Topics: Discovery, Oprah Winfrey Network

-

thePlatform Enables TV Everywhere for TV Networks, Lands New Customers

TV Everywhere is getting another shot of momentum this morning as thePlatform, one of the leading online video platform companies (and a subsidiary of Comcast) is rolling out new features aimed at giving TV networks greater control of their programs in the coming TV Everywhere world.

The key new feature is what thePlatform calls an "Authentication Adaptor," which is a mechanism for networks that want to offer their programs on their own web sites to authenticate users as current paying video subscribers of a multichannel video provider (recall that under current TVE plans it is a requirement to be a multichannel video subscriber in order to access programs online). The authentication adaptor works by instantly checking with appropriate multichannel providers' billing systems and returning a yes/no authentication response for that user.

If the user is authenticated, then the adaptor verifies that the specific program is available for viewing to that user, depending on what tier of service the user subscribes to. thePlatform does this by mapping each

individual show to specific channels that each have an ID. The channel IDs are in turn mapped to the multichannel provider's subscription packages. For example if you were to try watching "Entourage" on HBO.com, but you didn't subscribe to HBO the linear channel via your service provider (e.g. Comcast, Time Warner Cable, etc.), your request would be denied. As one can imagine, with the endless permutations of shows, networks, subscription packages and multichannel providers, linking all of this together and delivering fast response times to the user is quite a challenge.

individual show to specific channels that each have an ID. The channel IDs are in turn mapped to the multichannel provider's subscription packages. For example if you were to try watching "Entourage" on HBO.com, but you didn't subscribe to HBO the linear channel via your service provider (e.g. Comcast, Time Warner Cable, etc.), your request would be denied. As one can imagine, with the endless permutations of shows, networks, subscription packages and multichannel providers, linking all of this together and delivering fast response times to the user is quite a challenge. What's also interesting here is that if indeed a request has been denied, a marketing opportunity has been created for both the TV network and the multichannel provider. In the Entourage example above, the denial message could be accompanied by offers to watch now on a pay-per-view basis or to instantly become a subscriber to HBO via Comcast, or to buy the DVD, etc. Or maybe the offer is just to watch free clips to improve sampling. thePlatform supports the creation of these types of rules and integration to appropriate 3rd parties. This is a great example of how TV Everywhere also opens up the instant-gratification online economy to networks and video providers.

The new features gain in importance as thePlatform is also announcing this morning more than 20 TV networks have recently become customers including Fox Sports Networks, E!, G4, Style, Comcast Sports Group (a group of regional sports networks), Travel Channel, Big Ten Network and others yet to be named. As TV Everywhere rolls out next year, TV networks will become increasingly interested in offering their programs themselves, in addition to offering access on their distributors' web sites.

Separate, thePlatform is also announcing today that it is working with Rogers, which is Canada's leading multichannel video provider, on an online video initiative. Though details aren't provided, Rogers recently disclosed that is also pursuing TV Everywhere, so it's probably logical to put two and two together. thePlatform also provides video management services to large American operators Cablevision, Cox, Time Warner Cable, in addition to parent company Comcast. Between the video provider deals and the TV networks deals, thePlatform finds itself squarely in the middle of the TV Everywhere action.

What do you think? Post a comment now.

Categories: Cable Networks, Cable TV Operators, Technology

Topics: Comcast, Rogers, thePlatform

-

4 Items Worth Noting for the Nov 2nd Week (Q3 earnings review, Blu-ray streaming, Apple lurks, "Anywhere" coming)

Following are 4 items worth noting for the Nov 2nd week:

1. Media company and service provider earnings underscore improvements in economy - This was earnings week for the bulk of the publicly-traded media companies and video service providers, and the general theme was modest increases in financial performance, due largely to the rebounding economy. The media companies reporting - CBS, News Corp, Time Warner. Discovery, Viacom and the Rainbow division of Cablevision - showed ongoing strength in their cable networks, with broadcast networks improving somewhat from earlier this year. For ad-supported online video sites, plus anyone else that's ad-supported, indications of a healthier ad climate are obviously very important.

Meanwhile the video service providers reporting - Comcast, Cablevision, Time Warner Cable and DirecTV all showed revenue gains, a clear reminder that even in recessionary times, the subscription TV business is quite resilient. Cable operators continued their trend of losing basic subscribers to emerging telco competitors (with evidence that DirecTV might now be as well), though they were able to offset these losses largely through rate increases. Though some people believe "cord-cutting" due to new over-the-top video services is real, this phenomenon hasn't shown up yet in any of the financial results. Nor do I expect it will for some time either, as numerous building blocks still need to fall into place (e.g. better OTT content, mass deployment of convergence devices, ease-of-use, etc.)

2. Blu-ray players could help drive broadband to the TV - Speaking of convergence devices, two articles this week highlighted the role that Blu-ray players are having in bringing broadband video to the living room. The WSJ and Video Business both noted that Blu-ray manufacturers see broadband connectivity as complementary to the disc value proposition, and are moving forward aggressively on integrating this feature. Blu-ray can use all the help it can get. According to statistics I recently pulled from the Digital Entertainment Group, in Q3 '09, DVD players continue to outsell Blu-ray players by an almost 5 to 1 ratio (15 million vs. 3.3 million). Cumulatively there are only 11.2 Blu-ray compatible U.S. homes, vs. 92 million DVD homes.

Still, aggressive price-cutting could change the equation. I recently noticed Best Buy promoting one of its private-label Insignia Blu-ray players, with Netflix Watch Instantly integrated, for just $99. That's a big price drop from even a year ago. Not surprisingly, Netflix's Chief Content Officer Ted Sarandros said "streaming apps are the killer apps for Blu-ray players." Of course, Netflix execs would likely say that streaming apps are also the killer apps for game devices, Internet-connected TVs and every other device it is integrating its Watch Instantly software into. I've been generally pessimistic about Blu-ray's prospects, but price cuts and streaming could finally move the sales needle in a bigger way.

3. Apple lurks, but how long will it stay quiet in video? - The week got off to a bang with a report that Apple is floating a $30/mo subscription idea by TV networks. While I think the price point is far too low for Apple to be able to offer anything close to the comprehensive content lineup current video service providers have, it was another reminder that Apple lurks as a major potential video disruptor. How long will it stay quiet is the key question.

While in my local Apple store yesterday (yes I'm preparing to finally ditch my PC and go Mac), I saw the new 27 inch iMac for the first time. It was a pretty stark reminder that Apple is just a hair's breadth away from making TVs itself. Have you seen this beast yet? It's Hummer-esque as a workstation for all but the creative set, but, stripped of some of its computing power to cost-reduce it, it would be a gorgeous smaller-size TV. Throw in iTunes, a remote, decent content, Apple's vaunted ease-of-use and of course its coolness cachet and the company could fast re-order the subscription TV industry, not to mention the TV OEM industry. The word on the street is that Apple's next big product launch is a "Kindle-killer" tablet/e-reader, so it's unlikely Steve Jobs would steal any of that product's thunder by near-simultaneously introducing a TV. If a TV's coming (and I'm betting it is), it's likely to be 2H '10 at the earliest.