-

5 Key Takeaways from Netflix's New Cable TV Partnerships

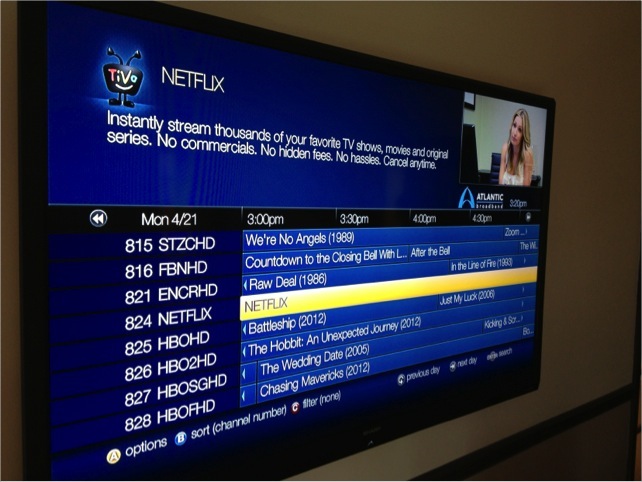

Netflix will be integrated by 3 small U.S. cable TV operators via TiVo, per a joint announcement by the companies. Atlantic Broadband, Grande Communications and RCN will begin integrating Netflix in multiple ways: by assigning Netflix its own channel in their on-screen guides, exposing the Netflix app for quick access to sign-up or login and incorporating Netflix content in recommendations and search results alongside linear, VOD and the subscriber's DVR content.

For Netflix, the deals follow similar implementations in Europe with Virgin and Com Hem. Netflix has avidly pursued inclusion in the primary pay-TV experience, helping it become even more mainstream by eliminating the step of switching inputs to a connected device. Another benefit to Netflix is the cable operators will also integrate with Netflix's Open Connect content delivery platform.

There are many different ways to think about the deals; below are 5 of my key takeaways:Categories: Aggregators, Cable TV Operators, Devices

Topics: Atlantic Broadband, Grande Communications, Netflix, RCN

-

VideoNuze Podcast #224 - HBO-Amazon; Apple TV; Netflix, Comcast, Time Warner Cable Q1 Results

I'm pleased to present the 224th edition of the VideoNuze podcast with my weekly partner Colin Dixon of nScreenMedia. This was an unusually busy week with many industry announcements, so today's format is a roundup discussion of four items that seemed most significant to us.

First up is HBO's exclusive new licensing deal with Amazon, which is the latest evidence of the surging value of high-quality content libraries. Second is Apple's reveal that it has sold 20 million Apple TVs to date, making it more than just a "hobby." Next, we turn to Netflix, which reported stellar Q1 results earlier this week. Finally, we look at Comcast's Q1 and Time Warner Cable's Q1 results. Both companies reported healthier video subscriber numbers (though Verizon reported a much smaller quarter for FiOS video subscribers). The question still looms how meaningful cord-cutting is in reality.

(Note, we had major technical issues with Skype this week, so in the last one-third of the podcast I sound like I'm in a fish tank. Apologies in advance.)

Click here for previous podcasts

Click here to add the podcast feed to your RSS reader.

The VideoNuze podcast is also available in iTunes...subscribe today!Categories: Aggregators, Cable Networks, Cable TV Operators, Devices, Podcasts

Topics: Amazon, Apple TV, Comcast, HBO, Netflix, Podcast, Time Warner Cable

-

Cloud-Based Mosaic for TV Navigation Launched By Liberty Global in Puerto Rico

Ever wonder what your friends and neighbors are watching on TV right now and whether you're missing something hot? Well, cable operator Liberty Cablevision of Puerto Rico is rolling out an HTML5 app to all of its 350K subscribers there, which will allow them to view a customizable mosaic of the most-watched TV networks at any moment, with 1-click access to tune in themselves.

The "Social Content Navigator" app is a new guide concept that Liberty has created with ActiveVideo to enhance the value of cable-TV subscriptions and better compete with both satellite and OTT providers.Categories: Cable TV Operators, Technology

Topics: ActiveVideo Networks, Liberty Global

-

BlackArrow Launches Data Management Platform to Enhance Pay-TV Operators' Ads

Pay-TV operators are in a race to stay competitive and improve their services, rolling out advanced advertising, content recommendations, improved video-on-demand services, TV Everywhere, etc. While data is the foundation for all these types of services, because pay-TV operators have had so many different silos of data, they have been unable to fully tap into them.

To address this problem, BlackArrow has announced that its BlackArrow Audience 2.0 data management platform (DMP) is now available. The platform includes Profile Manager, which enables pay-TV operators to consolidate their first-party subscriber data and third-party data in one place.Categories: Advertising, Cable TV Operators, Technology

Topics: BlackArrow

-

VideoNuze Podcast #223 - Comcast's "Watchathon" On-Demand Success and Changing Viewer Behaviors

I'm pleased to present the 223rd edition of the VideoNuze podcast with my weekly partner Colin Dixon of nScreenMedia. This week we dig into the strong performance of Comcast's recently concluded 2nd annual "Watchathon" on-demand week and more broadly, how viewing behaviors on linear, on-demand and OTT are becoming intertwined.

Comcast revealed that Watchathon week drove 61 million views and 50 million hours watched, with "Game of Thrones," "The Walking Dead" and "The Good Wife" topping the list of most popular shows. Of note was the increase in live ratings for shows that were available on Watchathon. For example, Game of Thrones' season 4 premiere was up 17% in Comcast homes, "The Mindy Project" was up 83%, "Archer" was up 78%, "Parks and Recreation" was up 49%, etc.

Colin and I discuss how this appears to support the idea that allowing easy catching-up via on-demand can be an effective tactic for networks (and pay-TV operators) to drive audience to live viewing. In fact, in a prior survey Comcast did, it found that 82% of U.S. adults are binge-viewing now, with 55% saying they preferred to do so with current season programs. By enabling both, Comcast seems to be finding a sweet spot.

One other related data point we found interesting was from Rentrak, which said fully 66% of viewing of broadcast primetime programs on demand occurred after the C3 window. By Colin's calculations, that could mean for certain shows, 20% or more of total audience isn't being counted for advertisers today.

Click here to listen to the podcast (18 minutes, 27 seconds)

Click here for previous podcasts

Click here to add the podcast feed to your RSS reader.

The VideoNuze podcast is also available in iTunes...subscribe today!Categories: Advertising, Cable TV Operators, Video On Demand

-

Despite Online Video's Massive Growth, Startups Like Back9 Network Still Seek Old School Pay-TV Deals

Signs of online video's growth and vibrancy are everywhere these days, but certain startup content providers still believe the surest road to success is by landing old school distribution (or "carriage") deals with large pay-TV operators. That was the message at last week's Senate Judiciary Committee hearing on the Comcast-Time Warner Cable merger from Jamie Bosworth, Chairman and CEO of golf lifestyle focused Back9 Network.

When asked at the hearing why Back9 Network couldn't just operate as an online video service, Bosworth said that "while online viewership is increasing, the average American still watches 20 times more video content via television and the advertising rates mirror that as well." Bosworth's issue is that because Comcast's NBC Sports group owns and distributes Golf Channel, the big cable operator has little incentive to add another golf-oriented network. Further, if the TWC merger were approved, it would stifle TV competition to a vast part of the American population.Categories: Cable Networks, Cable TV Operators

Topics: Back9 Network, Comcast, Time Warner Cable

-

VideoNuze Podcast #220 - Apple-Comcast is a Head-Scratcher; Aereo Defends the Cloud

I'm pleased to present the 220th edition of the VideoNuze podcast with my weekly partner Colin Dixon of nScreenMedia. First up, we discuss the WSJ report from earlier this week that Apple and Comcast may be collaborating in some way to deliver video through a "managed service" from Comcast. Neither Colin nor I can understand why Comcast would enable anything in its territory that would be remotely competitive with its own video services, but since the WSJ was thin on details, we don't know enough yet to fully judge.

We're also dubious about the fit for Apple given the company's emphasis on global scale for its products and also its premium positioning. And we're both struck by the regulatory red flags a "managed service" would raise for Comcast, at the very time they're trying to gain approval for the TWC deal. More of my thoughts are here.

We then turn quickly to Aereo's Supreme Court filing this week. As expected, it paints the case as being about cloud services in general, not just copyright specifically. We agree it's a clever strategy that positions Aereo as pro-innovation and pro-consumer, making it harder for the Supreme Court to rule against Aereo this summer.

Click here for previous podcasts

Click here to add the podcast feed to your RSS reader.

The VideoNuze podcast is also available in iTunes...subscribe today!Categories: Broadcasters, Cable TV Operators, Devices, Podcasts, Startups

-

5 Reasons to Be Skeptical of Any Apple-Comcast Deal

The Wall Street Journal reported last night that Apple and Comcast are discussing a partnership for Apple to launch a streaming TV, VOD and DVR service, including dedicated Comcast bandwidth (a "managed service" as opposed to one delivered with typical "best efforts").

On the surface, it's a sexy-sounding deal, especially for those who have long-harbored a vision of Apple moving beyond its modest Apple TV device. However, scratch the surface just a little and you'll quickly find many reasons to be skeptical anything will result. Here are my top 5 (I'm sure there are others as well):Categories: Broadband ISPs, Cable TV Operators, Devices

-

Top U.S. Broadband ISPs Add Another 2.6 Million Subscribers in 2013

The 17 largest broadband ISPs in the U.S. added over 2.6 million subscribers in 2013, down almost 105K vs. the approximately 2.7 million subscribers they added in 2012. These ISPs now have 84.3 million subscribers, with cable TV operator ISPs having 49.3 million (58%) and telco ISPs having 35 million (42%). The data comes from Leichtman Research Group.

Categories: Broadband ISPs, Cable TV Operators, Telcos

Topics: Comcast, Leichtman Research Group, Verizon

-

U.S. Pay-TV Industry Loses 105K Subscribers in 2013, First-Ever Loss

The U.S. pay-TV industry lost 105K video subscribers in 2013, the first time in history that the industry has contracted on a year-over-year basis. The industry ended 2013 with approximately 94.6 million subscribers vs. 94.7 subscribers at YE 2012. The 105K loss is a swing of 280K vs. the 175K the industry gained in 2012. (see chart below)

The data comes from Leichtman Research Group, which has tracked the top pay-TV operators' video subscriber numbers for years.Categories: Cable TV Operators, Satellite, Telcos

Topics: Leichtman Research Group

-

A Silver Lining in the Cloud for Pay TV Operators

Monday, March 10, 2014, 9:43 PM ETPosted by:5 Steps to Making Multi-Screen Video Work with the Cloud

As we charge into 2014, pay-TV operators aren't just toying with the idea of granting consumers access to content from a variety of connected devices; it is now the standard. This shift in viewing consumption has driven operators and technology partners to 'look under the hood' of their platforms and re-assess content delivery and management schemes.

The biggest concern facing operators is how the industry can protect content when being delivered over different devices. How can operators achieve the right content protection mix and content management scheme in a scalable fashion while ensuring a consistent user experience? The answer could be found in the cloud. Following are 5 key steps to consider for making multi-screen video work with the cloud:Categories: Cable TV Operators, Satellite, Technology, Telcos

Topics: Akamai, Irdeto, TV Everywhere

-

Millennials Pose a Product Strategy Puzzle for Pay-TV Industry

Do millennials want pay-TV or don't they? This is one of the most hotly-debated topics in the video industry today. The "don't" camp is well-represented by Charlie Ergen, head of DISH Network, who recently said, "We’re losing a whole generation of individuals who aren’t going to buy into that model because they only want one particular show or they want to watch the show wherever they can or they want to watch it on their schedule and so that generation is not signing up to satellite or cable or phone video today."

Last week, Ergen and DISH took an important step toward re-imagining pay-TV to make it more relevant to millennials by securing OTT distribution rights to key Disney/ESPN channels. Bloomberg reported that a new OTT service from DISH could sell for $20-30/month, far less than today's typical pay-TV bundle. BTIG's Rich Greenfield subsequently fleshed out what a new lower-priced personal subscription service or "PSS" could look like: a limited access one-stream-at-a-time model geared to single-adults or light TV viewers.Categories: Cable TV Operators, Satellite, Telcos

Topics: BTIG, Comcast, DISH Network, Disney, Verizon

-

Watch a Demo of Comcast's X1 Set-Top Box Delivering the NBC Olympics "Live Extra" App [VIDEO]

Since Comcast announced its plan to acquire Time Warner Cable, there have been a number of articles about how broadband is really the main driver of the deal. No doubt broadband is very important, but Comcast still believes there's a lot of life left in its video service. To that end, the company has invested heavily in its X1 set-top box platform.

X1 is a hybrid box, delivering video via traditional "QAM" technology, while including a guide and other interactivity/content via web-based IP technology. Comcast said that X1 played a significant role in Comcast adding subscribers in Q4 '13, for the first time in 6+ years.

I've had an X1 since July, 2012, and to give a sense of its potential, I've shot an 11-minute demo of how X1 handles the NBC Olympics "Live Extra" authenticated app which is tightly integrated with its Xfinity on Demand service for highlights. First, for a little context, I show how "Live Extra" and the NBC Olympics apps work on an iPad.Categories: Cable TV Operators, Devices, Sports

Topics: Comcast, NBC Sports, Olympics

-

VideoNuze Podcast #214 - Parsing the Comcast-TWC Deal

I'm pleased to present the 214th edition of the VideoNuze podcast with my weekly partner Colin Dixon of nScreenMedia. Note the interesting coincidence that we're publishing our 214th podcast on 2-14-14; hopefully it's some sort of good omen :-)

In today's podcast Colin and I parse the $45 billion Comcast-Time Warner Cable merger, announced yesterday. As I wrote, I see the deal as all about helping Comcast achieve further scale that is required in order to succeed in today's video environment. Colin notes that after TWC's bruising battle with CBS, during which it lost hundreds of thousands of subscribers, the merger will shift some power away from broadcast and cable networks.

We also discuss regulatory issues, net neutrality, the companies' bet that cord-cutting won't accelerate any time soon and lots more. There are many angles to the merger, which we'll continue discussing as the merger review unfolds.

Listen in to learn more!Click here for previous podcasts

Click here to add the podcast feed to your RSS reader.

The VideoNuze podcast is also available in iTunes...subscribe today!Categories: Cable TV Operators, Deals & Financings, Podcasts

Topics: Comcast, Podcast, Time Warner Cable

-

Apple Looks Like the First Casualty of Comcast-TWC Deal

It looks like Apple will be the first casualty of the Comcast-TWC deal. Just yesterday Bloomberg reported that Apple was negotiating with TWC for it to become the first pay-TV operator to make its programming accessible in a new, upgraded Apple TV device. Assuming the report is accurate (and who knows, given the spin game TWC was playing to rebuff Charter's bid), it's pretty fair to say that Comcast will have no interest in Apple getting its nose under the TWC tent.

Categories: Cable TV Operators, Deals & Financings, Devices

Topics: Apple TV, Comcast, Time Warner Cable

-

Comcast-TWC Deal Highlights Importance of Scale In the Broadband Age

Comcast has announced that it will acquire Time Warner Cable in an all-stock transaction valued at $45.2 billion. Comcast is already the biggest video and broadband provider in the U.S. and will now get even bigger, assuming the deal is approved. Comcast has committed to divest around 3 million of TWC's video subscribers to stay below 30% of the total U.S. pay-TV market, so the combined company would have approximately 30M video subscribers. Broadband subscribers would be a little less than 30M.

For me, the big takeaway from the deal is that in the broadband era, scale matters a lot - and to compete effectively, a company simply has to have it. Nearly ubiquitous broadband and wireless connectivity, plus massive proliferation of devices, have enabled online-only players to have easy access to massive global audiences. This context has helped fuel the rise of companies including Google, Facebook, Amazon, YouTube, Netflix, Twitter and many others. With innovative services and solid execution, it's now possible to create huge businesses quicker than ever.Categories: Cable TV Operators, Deals & Financings

Topics: Comcast, HBO, Netflix, Time Warner Cable, YouTube

-

VideoNuze Podcast #212 - Comcast Gains Video Subscribers; Can Roku Replace Set-Top Boxes?

I'm pleased to present the 212th edition of the VideoNuze podcast with my weekly partner Colin Dixon of nScreenMedia.

Earlier this week, Roku CEO and founder Anthony Wood, who I interviewed at NATPE, described his long-term vision for Roku to replace pay-TV operators' set-top boxes. Anthony believes that as online video apps become more prevalent, and pay-TV operators want to seamlessly offer them, the logistics for doing so will be so complex, that alternative approaches like using Roku, will become more attractive. Colin and I debate the pros and cons of this vision.

Then Colin walks us through Comcast's stellar Q4 '13 results, announced earlier this week. Of particular note, Comcast added video subscribers in the quarter, the first time in over 6 years. Colin has crunched the numbers and concludes that Comcast will likely have more broadband subscribers than video subscribers by mid-to-late 2014, a stunning development. We explore what this means.

Listen in to learn more!Click here for previous podcasts

Click here to add the podcast feed to your RSS reader.

The VideoNuze podcast is also available in iTunes...subscribe today!Categories: Broadband ISPs, Cable TV Operators, Devices, Podcasts

Topics: Comcast, Podcast, Roku

-

Comcast Adds Video Subscribers in Q4, So Are Cord-Cutting Concerns Reduced?

Comcast reported its Q4 '13 and full-year results this morning, which included the company adding 43K video subscribers vs. a loss of 7K in Q4 '12. It was the first time Comcast added video subscribers since Q1 '07. When the biggest pay-TV operator in the U.S. reports a glimmer of health in its core video business, the question begs, are fears about cord-cutting reduced?

While I've always believed that cord-cutting was over-hyped, the reality is that Comcast's positive move does not in and of itself mean concerns about cord-cutting are lessened. That's because Comcast's gain likely says less about cord-cutting dynamics than it does about pay-TV industry share-shifting. For years, the industry pattern has been that telcos and satellite operators have been taking video subscribers from cable TV operators.Categories: Cable TV Operators

Topics: Comcast

-

Risk to Net Neutrality is Minimal Even Though FCC's Open Internet Has Been Overturned

Earlier today the DC Court of Appeals threw out the FCC's Open Internet net neutrality rules. Net neutrality advocates are upset with the FCC for pursuing an illogical regulatory path from the start. They are deeply worried that now, unencumbered by net neutrality regulations, big broadband ISPs (which also happen to be the biggest pay-TV providers) will begin to discriminate against third-party online video services by shunting them to "slow lanes" and charging new delivery "tolls."

I completely understand these concerns, but I for one don't envision any of this happening, at least not in the foreseeable future. Some of you are no doubt thinking - Will's naive, he's an idiot, he's a shill, etc. so let me explain.Categories: Broadband ISPs, Cable TV Operators, Regulation, Telcos

-

Innovid and Cisco Power Contextual Video Ads on Second Screens Using Voice-Based Metadata

Interactive video advertising provider Innovid and Cisco are building on their previously announced partnership, announcing an initiative to have ads dynamically delivered to second screens using voice-based metadata from TV programs. Innovid's CTO and co-founder Tal Chalozin showed me a demo last week of Cisco's cloud-based technology analyzing words spoken in TV programming to generate keywords and context. The information was then passed to Innovid which delivered a relevant, interactive ad to the viewer's second screen within a few seconds.

Categories: Advertising, Cable TV Operators, Technology