-

Demo of Wired Magazine Highlights iPad's Appeal

As I wrote several weeks ago, I'm skeptical of the new Apple iPad because it seems like an expensive gadget that will be hard to find mainstream buyers given its price points. Nonetheless, I thought it was a really slick device, and this week's demo of Wired magazine running on it reinforces my belief. The Wired demo, like an earlier one for Sports Illustrated, shows very tangibly how revolutionary iPad - and other tablet computers - are for print publishers. The way the editorial and advertising comes to life and readers can engage with it is quite compelling.Of course, the question still looms, will people pay $500-$800 for all that iPad coolness? Apple itself appears sensitive to the issue, clearly softening the market for possible price reductions soon after the iPad's release if volumes don't materialize. Going out on a limb a little, I for one believe we'll see an approximately $200 price reduction by holiday season '10, if not sooner. The iPad is too important to Apple and Steve Jobs to be allowed to flounder and the coming release of numerous lower-priced tablets from competitors will only add to the pressure on Apple. If iPad prices fall, it could indeed become a game-changer for Wired and other print publishers.

What do you think? Post a comment now (no sign-in required).

Categories: Devices, Miscellaneous

Topics: Apple, iPad, Sports Illustrated, Wired

-

It's Official: Netflix Has Entered a "Virtuous Cycle"

Looking at Netflix's Q4 '09 and full year '09 results released late last Wednesday, plus Netflix's performance over the last 3 years, I have concluded the company has officially entered a "virtuous cycle." For those of you not familiar with the term, a virtuous cycle is when a single change or improvement leads to a cascading series of follow-on benefits which both reinforce themselves and add further momentum to the original change (a hyper "one good thing leads to another" scenario, if you will). Virtuous cycles are extremely rare in business, and when they happen they have profound implications.

The start of Netflix's virtuous cycle is obvious: the company's introduction of its free "Watch Instantly" streaming feature in January, 2007. Streaming has fundamentally changed the Netflix service offering and consumers are increasingly aware of this. Traditionally, Netflix subscription plans were defined by limits - 1 DVD out at a time for $8.99/mo, 2-out for $13.99/mo or 3-out for $16.99/mo. But with the company's decision to remove the confusing original caps it placed on streaming consumption and move to an unlimited model, Netflix is now providing enormous new value at the same DVD rental price points. Netflix has also changed how it advertises its services, strongly emphasizing streaming (see its home page for example). The "unlimited streaming" message is breaking through and Netflix subscriber growth momentum over the last 3 years reflects this.

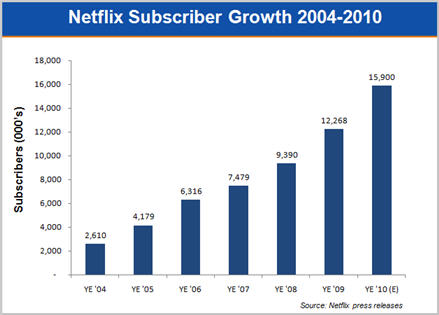

Subscribers grew to 12.3 million at the end of '09, 31% higher than YE '08. To get a sense of Netflix's momentum, '09 growth handily beat '08 (26%) and '07 (18%) growth. The 2.9 million subs added in '09 was 85% above the company's own 2009 beginning year forecast of 1.56 million sub additions. Looking ahead, the mid-point of Netflix's forecast for '10 is for another 30% growth in subs.

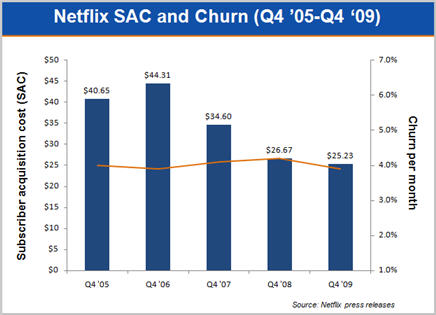

As the streaming benefits have resonated, it's very important to note that subscriber growth is actually getting progressively cheaper for Netflix to accomplish. As the following graph shows, Netflix's subscriber acquisition cost (SAC) has decreased by an impressive 43% from $44.31 in Q4 '06 to $25.23 in Q4 '09 (the 2nd lowest SAC in the company's history). Better still, the quality of these new subs seems high; average monthly churn in Q4 '09 was 3.9%, equal to the lowest churn the company has ever achieved. While Netflix isn't "buying" growth with low-quality additions (an old trick for subscription-oriented businesses), it is however putting more emphasis on the "1-out" service, which, with the addition of unlimited streaming, is an outstanding value for the low-end of the market. Netflix is eager to penetrate this segment, to whom $1 Redbox rentals are very attractive.

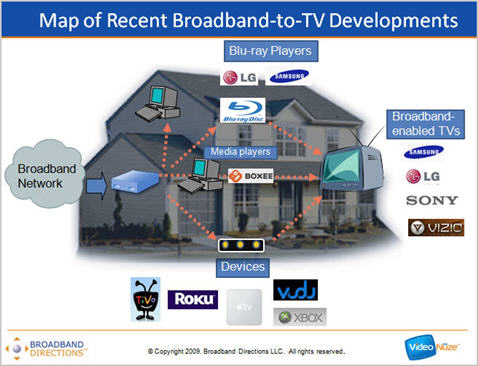

While Netflix's financials already reflect the virtuous cycle impact streaming is having on the business, it is likely there is much more to come as streaming takes further hold. Netflix revealed that 48% of its subscribers streamed at least 15 minutes/mo in Q4 '09, up from 41% in Q3 '09 and 26% in Q4 '08 (Incidentally, I think it's conceivable that 80% or more of recently-added subscribers are streaming). But it's just in the last year that Netflix streaming has begun to make the move from computer-only consumption to TV-based consumption, truly making it a mainstream experience. Netflix has inked deals with all the major game consoles (with a Wii marketing campaign beginning in '10), plus numerous CE devices, Blu-ray players, etc. Just ahead is a future where Wi-Fi will be ubiquitous in all new TVs and Netflix's deals with all the major TV manufacturers will ensure it is even more front and center for consumers.

To make streaming attractive, Netflix has had to essentially build a second content library. As I've suggested in the past, this isn't easy, as the company must navigate a thicket of pre-existing Hollywood rights and business relationships. Most notably, Netflix has run into the premium cable networks (HBO, Showtime, Starz and Epix) which have a monopoly on Hollywood's output for their release window. Netflix's deal with Starz was an important first step but still, I've been skeptical that Netflix would land streaming deals with the others.I'm now gaining more confidence that this will indeed happen, especially for these networks' original productions. Netflix is simply getting too big to ignore. It represents a whole new revenue opportunity for premium channels, plus an important loyalty-building outlet. Further out though, while Netflix CEO Reed Hastings says he wants the company to be a distributor for these premium channels, I think it's nearly inevitable that Netflix will compete head-on with them for Hollywood's output. Economics dictate that eventually it makes more sense for Netflix to bid directly for Hollywood rights than work through a premium channel middleman.

In fact, Netflix already has tons of Hollywood relationships, and its recent deal with Warner Bros, creating a 28-day DVD window is emblematic of how Netflix looks at streaming content acquisition going forward. In that superb deal, which was ludicrously criticized by some, Netflix simultaneously helped a critical partner sustain its DVD sales window, while gaining cheaper access to more DVD copies on day 29 and increased streaming rights for catalog titles. As Hastings pointed out on the Q4 earnings call, given the inconsistencies in DVD release strategies, most consumers have little-to-no idea when a title becomes available on DVD, so, while still early, opening up the 28 day window has caused no subscriber complaints. And the company's analysis of subscriber "Queues" indicates, just 27% of requests are for newly-released titles.

Importantly, Netflix's strategy is to pour savings from its DVD deals into streaming content acquisition. As I noted recently, Netflix's detailed subscriber data and usage analysis gives it a huge asymmetric advantage in negotiating additional streaming licenses from Hollywood. Netflix can surgically concentrate its resources on only those titles it knows its subscribers will value. Over time, as DVD sales continue to collapse, Netflix will be there to offer its subs a broader and broader rental selection.

The biggest challenge to Netflix for streaming content acquisition is how much it chooses to spend. Netflix's relatively small size among giants like Comcast and others is what prompted me to suggest over a year ago that Microsoft would acquire Netflix. I'm officially retracting that prediction now, as 2009 demonstrated how much streaming progress Netflix can make on its own. In fact, I think all rumors of a possible Netflix acquisition are off-base; I see the company remaining independent for some time to come.

Netflix is now riding a serious wave and its executives recognize the mile-wide opportunity ahead of it. The product is immeasurably stronger and more appealing with unlimited streaming included. That's in turn leading to impressive sub growth with much-reduced SAC and improving churn. The number of devices bridging Netflix to the TV is growing and portends ubiquity at some point down the road as these devices further leverage Netflix's platinum consumer brand. Streaming content selection is improving, bringing side benefits of reduced DVD postage and inventory costs. With millions of subscribers Netflix now has both the economics and the scale to be a very significant player in the video ecosystem.

Last but not least is a very favorable competitive climate. Aside from a hobbled Blockbuster, astoundingly, Netflix doesn't have any other direct DVD subscription/online streaming hybrid competitor (Amazon and Apple, are you paying attention?). And while Comcast and other multichannel video programming distributors ("MVPDs") are rolling out TV Everywhere services (5 years later than they should have, in my opinion), these are still early stage, and still encumbered by archaic regional limitations. Indeed, Netflix's growth may well cause these companies to consider their own over-the-top plans, as I've suggested.

For years I have been saying that broadband video is the single most disruptive influence on the traditional video distribution value chain. Netflix's success with streaming and the consequences that are yet to play out are resounding evidence of this. Above and beyond YouTube, Hulu, Amazon, Apple and others, Netflix is by far the most important video distributor to watch.

What do you think? Post a comment now (no sign-in required)

Categories: Aggregators, Devices

Topics: Comcast, Netflix, Warner Bros.

-

VideoNuze Report Podcast #47 - January 29, 2010

Daisy Whitney and I are pleased to present the 47th edition of the VideoNuze Report podcast, for January 29, 2010.

With the old adage that "everything's been said, but not everyone's said it" in mind, in this week's podcast Daisy and I talk about what else but the new Apple iPad. Daisy actually attended the iPad unveiling at the Yerba Buena Center for the Arts on Wednesday and offers her first hand observations.

Generally we're in agreement that the iPad is not going to rock the video universe any time soon, with Daisy's write-up here, and my write-up here. We do however disagree about the role of the e-book reader functionality of the iPad. Daisy thinks that, at least for now, Apple should position the iPad as a better e-book reader to the Kindle and other products, while I think that would be pigeonholing it and, because at 2x the price of the Kindle, the iPad's enhanced features would be unlikely to peel off many Kindle buyers anyway. Regardless, given Steve Jobs's aspirations for the iPad, it is almost certainly out of the question that he would narrow the iPad's positioning so drastically; I'm guessing he'd rather see it wither on store shelves first.

Click here to listen to the podcast (13 minutes, 9 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

-

The New Apple iPad - What's It Mean for Online and Mobile Video?

Steve Jobs finally made it official yesterday, unveiling the iPad before a world breathlessly awaiting the next big thing from Apple's factory of wonders. The device did not disappoint from a coolness perspective. It is a digital Swiss army knife of sorts, capable of browsing the web, playing games, reading books, looking at photos, working on docs, etc. all in a gorgeous ("intimate" in Jobs's words) package. All that aside, my main interest has been how significant will the iPad be for video providers and specifically for the evolution of online and mobile video? For now anyway, I think the answer is "not very."

For the iPad to breakthrough for video providers it has to sell really well, creating an addressable universe of millions, if not tens of millions of users. Only widespread adoption makes it a potential game-changer for

video economics, possibly enhancing the paid business model. That may happen over time, but in the immediate future I think it's doubtful. For as cool as the iPad is, in many ways, it's still a "gadget" - overflowing with novelty and packed with status appeal, but hard-pressed to be defined as a "must have" device like a cell phone or a laptop. Maybe I'm really missing something but I still haven't drunk the Kool-Aid for why tablets are going to be so critical in users' lives.

video economics, possibly enhancing the paid business model. That may happen over time, but in the immediate future I think it's doubtful. For as cool as the iPad is, in many ways, it's still a "gadget" - overflowing with novelty and packed with status appeal, but hard-pressed to be defined as a "must have" device like a cell phone or a laptop. Maybe I'm really missing something but I still haven't drunk the Kool-Aid for why tablets are going to be so critical in users' lives.To me, the question comes down to how many people will be able to identify the distinct value the iPad brings them and deem it worthy of purchase? Apple certainly exceeded expectations by offering a $499 low-end iPad, putting it in spitting distance for those who may have been clamoring just for an e-book reader and are willing to step up a bit more. But the $499 price is somewhat illusory. If you want connectivity beyond your home or sporadic Wi-Fi hotspots, you'll need to buy at least the lowest end 3G-enabled iPad, for $629. And you'll certainly buy the case to protect that gorgeous screen, likely for another $50. So with tax you're in the $700 range. But the real killer is you'll almost certainly need to take the iPad's $30/mo AT&T all-you-can-eat 3G service to get online when you're outside your house or within reach of a Wi-Fi hotspot.

Despite the iPad's claim that its price is "well within reach," I think that for all but a pretty narrow slice of Americans, that's not the case - $700 plus another $30/mo easily puts it in the "considered purchase" zone for most potential buyers. Think about it another way: if the iPhone had not been so heavily subsidized by AT&T and other carriers, bringing its price down to $100-$200, how many iPhones do you think Apple would have sold at $500-$600 apiece? Not many is right. And that's for a device that has at least partial "must have" appeal (it is a cell phone after all). Now I know Apple just reported a blow-out holiday quarter, but America is still mired in a recession, with high joblessness and the vast majority of people cutting back on discretionary purchases.

Meanwhile, in the demo yesterday, Jobs showed off how well a YouTube video looks on the iPad, and of course, as with the iPods and the iPhone you can purchase and download video from iTunes. But is there something new that the iPad specifically does for video, beyond delivering a more intimate experience? Is the iPad going to offer some new, previously unavailable video access? Or some new interactivity? Or something else Jobs will conjure? If there is, it wasn't demo'd yesterday. Maybe in time.

These days video providers are inundated with options for where to focus their attention and allocate their scarce resources. Online distribution (on their own sites and/or syndicated)? Mobile? Over-the-top devices? Aggregators? IPTV? VOD? Short form? Long form? Branded content? The list goes on and on. Resources are tight and the first filter for any new initiative is always, "how many eyeballs and potential dollars does it offer?"

Of course, over time the iPad's price will come down and more people will adopt it, making it incrementally more attractive. Its beautiful screen, enabling a fabulous video experience, will help sell the device itself. But Apple will still need to surmount certain niggly things like what do about lack of Flash (like the iPhone it's not currently supported by the iPad, meaning no watching Hulu, just for starters), limited battery life when watching video and AT&T's already-overloaded 3G network, which is bound to disappoint iPad buyers. And beyond these, the larger question looms: if I'm interested in watching video on the go on a nice large screen, why not just do so on my laptop, which is almost certainly with me already?

The iPad is a revolutionary device and an Apple engineering marvel. But as a consumer proposition, it's a much bigger leap for Apple to succeed. With Macs, the iPod and the iPhone, Apple made better, revolutionary products in categories that already existed. With the iPad, Apple is trying to create a whole product new category, looking for daylight where none may exist. Maybe it will be big, maybe not. In the near term, I'm skeptical that it will have any major impact for video providers and for the evolution of online and mobile video.

What do you think? Post a comment now (no sign-in required).

Categories: Devices

-

VideoNuze Report Podcast #46 - January 22, 2010

Daisy Whitney and I are pleased to present the 46th edition of the VideoNuze Report podcast, for January 22, 2010.

Daisy gets us started today, discussing recent smartphone research from eMarketer. According to the research, in Q4 '09, the percentage of people saying they're interested in purchasing an Android phone jumped from 6% to 21%, while the iPhone's dropped from 32% to 28%, creating a narrow 7% gap. In addition, research on how the phones are actually used revealed extremely similar behavior, with usage skewed toward reading news on the Internet, using apps, social networking and IM.

Daisy's takeaway is that this could be early signals that the smartphone market may be getting commoditized. I add that with the proliferation of Android phones, and the disproportionate amount of retail shelf space they'll soon take up, Apple could well find itself in the familiar spot of competing against a large and growing ecosystem of well-aligned competitors (i.e. similar to competing against the Windows ecosystem). Time will tell.

We then switch gears and I add some more detail to Boxee's plan to offer a payment platform, which it unveiled this week. Boxee's move is yet another effort to shift the online video model from advertising, which has of course accounted for the dominant share of the online video industry's revenue to date. In addition to Boxee, this week we've also seen additional paid model initiatives: YouTube dipped its toe into rentals, rumors resurfaced of Hulu's subscription plans, and, outside the video space, the NYTimes.com's announced plans to erect a pay wall early next year. And that's all on top of TV Everywhere's rollout.

Click here to listen to the podcast (11 minutes, 47 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Devices, Mobile Video, Podcasts

Topics: Android, Apple, Boxee, iPhone, Podcast

-

Boxee to Support Paid Options by End of Q2

Boxee is announcing this morning that it plans to support paid options for premium video by the end of Q2. To date, Boxee has been delivering mostly free, often ad-supported, video, though users of subscription services like Netflix and MLB could also access these. The new initiative means that Boxee will process transactions itself, so Boxee will become a legitimate option for content providers who want to charge for their programming. Avner Ronen, Boxee's CEO and co-founder told me more about the plan yesterday.

Avner likened Boxee's approach to Apple's App Store, in that content providers will be able to set their own pricing and business model (e.g. rental, subscription, etc.). Boxee will work with a payment partner (not yet disclosed) which will provide the platform itself, with Boxee developing a 1-click UI for consumers as well as a content partner console. Avner said Boxee hasn't decided on the transaction percentage it aims to charge, but did say it will be less than the 30% or so that others like iTunes and Amazon ordinarily keep.

Boxee has attracted a strong early adopter following and has unveiled plans to launch its first convergence device, the Boxee Box, with partner D-Link. The move to support paid video is significant because as Boxee

reaches into more mainstream homes, it could be yet another meaningful "over-the-top" alternative for consumers to pay for just the content they want, further pressuring the traditional multichannel subscription model. Microsoft's Xbox Live Marketplace with the Xbox 360 is probably the closest comparable set up, although it supports downloading, whereas Boxee is focused solely on streaming.

reaches into more mainstream homes, it could be yet another meaningful "over-the-top" alternative for consumers to pay for just the content they want, further pressuring the traditional multichannel subscription model. Microsoft's Xbox Live Marketplace with the Xbox 360 is probably the closest comparable set up, although it supports downloading, whereas Boxee is focused solely on streaming. While digital delivery offers new convenience, an issue for both streaming and downloading is limited portability. Avner said that one way Boxee intends to address this is to offer authentication options to third-party web sites, so that if a user has rented an episode of "Mad Men" for example, through Boxee, they would subsequently be able to go to AMC's web site and watch it again without paying for it a second time. This is somewhat similar to what TV Everywhere providers are also thinking about doing in their second phase, extending user authentication to content providers' sites themselves.

From Avner's perspective, Boxee's ability to support multiple business models, in a content partner and user-friendly approach, is key to success. It is still very early days for over-the-top delivery, and with TV Everywhere now rolling out, incumbent video service providers are fighting hard to maintain their positions.

Still, news this week that Disney is negotiating with Microsoft to extend some of ESPN's programming to Xbox is a potent reminder that premium video providers are exploring (albeit gingerly) all their options for getting into the living room. If Boxee's new box becomes widely adopted, it could become an important player in the unfolding over-the-top drama.

What do you think? Post a comment now (no sign-in required)

Categories: Devices

-

ActiveVideo Networks Helping Blockbuster on Demand Deliver a Converged Experience

Amid all of the attention Netflix has been receiving for embedding its streaming software in one consumer electronics device after another (the Wii just yesterday) and its recent Warner Bros. deal, it's been easy to overlook the fact that Blockbuster has been getting some online traction itself. One announcement at CES last week, by ActiveVideo Networks, caught my attention as it has the potential to leapfrog Blockbuster On Demand's user experience past Netflix's Watch Instantly.

Much as I'm a big fan of Netflix's Watch Instantly streaming feature, one of its limitations is that the user experience is very segregated between computer and TV. You browse and search online for titles - just as you would for DVDs - and then when you've made your choices, they show up in your Instant Queue online and on your connected TV (via Roku, Blu-ray, Xbox or other device). While it's a perfectly functional approach, wouldn't it be nice if you could do the entire process of search, discovery, previewing, selection and viewing on the TV itself?

That's the experience that ActiveVideo Networks' CloudTV will be helping Blockbuster on Demand deliver to its users. As ActiveVideo's CEO Jeff Miller explained to me yesterday, when deployed, the Blockbuster on Demand app (developed using ActiveVideo's JavaScript/HTML authoring kit), will give Blockbuster's users a web-like experience of search, discovery and previewing on their TVs, via connected devices. In addition, it will present viewing options - streaming, download-to-own and in-store rental (via an API it will even show current availability in selected stores).

The requirements are that ActiveVideo's thin client has been integrated with the device, and that Blockbuster has its own deal with to distribute through the specific device manufacturer. Navigation is via the remote control using an on-screen keypad (see example screen shots below from last week's CES demos).

To date, Blockbuster has announced CE device deals with Samsung, 2Wire, and through its deal with Sonic Solutions, the ecosystem of devices already working with Roxio CinemaNow, such as TiVo. For now, that's small in comparison to Netflix's constellation of device partners, but it's still early in the convergence game. Outside of CE devices - and in a case of somewhat strange bedfellows - Blockbuster is also focused on cable operators. It recently announced partnership deals with top 10 cable operators Suddenlink and Mediacom to enhance their VOD offerings.

To date, Blockbuster has announced CE device deals with Samsung, 2Wire, and through its deal with Sonic Solutions, the ecosystem of devices already working with Roxio CinemaNow, such as TiVo. For now, that's small in comparison to Netflix's constellation of device partners, but it's still early in the convergence game. Outside of CE devices - and in a case of somewhat strange bedfellows - Blockbuster is also focused on cable operators. It recently announced partnership deals with top 10 cable operators Suddenlink and Mediacom to enhance their VOD offerings.Similarly, ActiveVideo is also focused both on CE (currently through a partnership with middleware provider Videon Central) and on cable. It has deployed on set-top boxes with Cablevision and Oceanic Time Warner Cable in Hawaii, reaching an audience of 5 million homes. Content providers that have developed apps include Showtime, HSN and Fox, among others. No doubt ActiveVideo and Blockbuster will synch up their biz dev activities to proliferate the Blockbuster on Demand app as widely as possible.

I have to admit that I haven't been paying too much attention to Blockbuster, as it has worked to re-position itself, aiming to close another 1,000 stores by the end of the year and installing more kiosks to compete with Redbox. Of course, it can ill afford to allow Netflix to get too far out in front of it in digital delivery as DVD rentals are poised to be supplanted by streaming down the road.

But Blockbuster has an ubiquitous, if somewhat dated, brand that could be skillfully leveraged into the digital era, provided it has the right services in its arsenal. In this respect, the potential to bring a converged user experience between online and connected TVs is a meaningful differentiator. No initial joint customers have yet been announced by Blockbuster and ActiveVideo, though I expect that soon. And, as online video and TV continue to converge, ActiveVideo is likely to find itself in the middle of a lot of action. All of this is worth keeping an eye on.

Update: Looks like I'm 1 step behind on Netflix's Xbox implementation. Apparently in Aug '09 it was updated to allow full browsing and search for the Watch Instantly catalog. I'm used to the Roku and Blu-ray experiences. Hat tip to Brian Fitzgerald for bringing to my attention.

What do you think? Post a comment now.(Note - ActiveVideo Networks is a VideoNuze sponsor)

Categories: Aggregators, Devices, FIlms, Partnerships

Topics: ActiveVideo Networks, Blockbuster, Mediacom, Netflix, Suddenlink, Videon

-

Recapping 2010 CES Video-Related News

The 2010 Consumer Electronics Show (CES) is now behind us. There were tons of announcements to come out of this year's show, including many in the online and mobile video areas. Increasingly a core focus of new devices is how to playback online and mobile-delivered video, how to move it around the consumer's house and how to make it portable. Following is a filtered list of the product announcements (or pertinent media coverage if no release was available) that I found noteworthy. They are listed in no particular order and I'm sure I've missed some important ones - if so, please add a comment with the relevant link.

Boxee box internals revealed. NVIDIA Tegra 2 FTW

Syabas Announces Popbox for Big Screen Everything

Sling Media Announces Support for Adobe Flash Platform in Hardware and Software Products

LG Electronics Expands Access to Content-on-Demand with New High-Performance Blu-ray Disc Players

ESPN 3D to show soccer, football, more

TV Makers ready to test depths of market for 3D

DirecTV is the First TV Provider to Launch 3D

DISH Network Introduces TV Everywhere

Microsoft Unites Software and Cloud Services to Power New TV Experiences

FLO TV and mophie to Bring Live Mobile TV to the Apple iPhone and iPod Touch

Broadcom Drives the Transition to Connected Consumer Electronics at 2010 International CES

New NVIDIA Tegra Processor Powers the Tablet Revolution

Digital Entertainment Content Ecosystem (DECE) Announces Key Milestones

Disney offers KeyChest, but where is the KeyMaster?

DivX Launches New Internet TV Platform to Redefine the Future of Entertainment

Blockbuster, ActiveVideo Announce Agreement for Cloud-based Online Navigation

Skype Ushers in New Era in Face-to-Face Online Video Communication

Aside from CES, but also noteworthy last week:

Apple Acquires Quattro Wireless

AT&T Adds Android, Palm to Its Lineup

Tremor Media Launches New Video Ad Products That Enhance Consumer Choice and Engagement

Categories: 3D, Advertising, Aggregators, Cable Networks, Devices, FIlms, Mobile Video, Satellite, Telcos

Topics: CES

-

Google and Apple Collide in Mobile; Video Poised to Benefit

Google and Apple both unveiled key mobile initiatives yesterday, underscoring the collision path the two companies are on, and how long-term, video is poised to benefit from their battle.

First, as you no doubt already know, Google introduced the Nexus One, an Android-powered smartphone that it is selling directly to consumers. It is Google's first foray into consumer devices and many more products sure to follow. Meanwhile, Apple, in a rare significantly-sized deal, acquired Quattro Wireless, a mobile advertising company, for around $300 million. Quattro represents Apple's first real push into advertising, an important shift from its traditional iTunes-driven paid media model.

With its own device, Google is primarily looking to compete against Apple's iPhone, which has practically owned the U.S. smartphone market since its introduction 2 years ago. And Apple, with a toehold in the

exploding mobile advertising market, is positioning itself to disrupt Google's planned dominance of mobile advertising through its pending $750 million AdMob acquisition. If Apple were to make additional acquisitions, particularly in the online video advertising space, that would further strengthen its position.

exploding mobile advertising market, is positioning itself to disrupt Google's planned dominance of mobile advertising through its pending $750 million AdMob acquisition. If Apple were to make additional acquisitions, particularly in the online video advertising space, that would further strengthen its position. Mobile video is poised to be a real winner in the Google vs. Apple face-off. At a minimum, the two companies' considerable marketing spending (plus those of competitors Palm, RIM, Nokia and others) will mean smartphones in millions more consumers' hands, dramatically expanding the video-ready universe. In addition, the experience of watching mobile video will just keep getting better. For example, the Nexus One's screen resolution (480x800) surpasses the iPhone's (320x480), which only means Apple will need to up the ante even further with its next generation. The range of video applications is sure to surge as more and more players stake out their ground.

Importantly, because there are no powerful incumbent distributors in mobile video - as there are in the living

room, with cable/satellite/telco - I believe there is more flexibility in how premium video can be distributed to smartphones. Until recently mobile was an "on-deck" world where everything had to be approved and carried by the wireless carrier. But mobile is quickly evolving to take on open Internet-like characteristics, where applications and services are not gatekeeped by a distributor. In short, mobile looks to be more like online distribution than traditional video distribution. As power in mobile shifts to players like Apple and Google, it should also be a wake-up call to the FCC, whose planned wireless carrier-focused net neutrality paradigm already looks out of date.

room, with cable/satellite/telco - I believe there is more flexibility in how premium video can be distributed to smartphones. Until recently mobile was an "on-deck" world where everything had to be approved and carried by the wireless carrier. But mobile is quickly evolving to take on open Internet-like characteristics, where applications and services are not gatekeeped by a distributor. In short, mobile looks to be more like online distribution than traditional video distribution. As power in mobile shifts to players like Apple and Google, it should also be a wake-up call to the FCC, whose planned wireless carrier-focused net neutrality paradigm already looks out of date.While there have been recent rumbles about Apple doing something with subscription video for the living room, instead the company likely has more latitude in mobile to go well beyond the pay-per-use iTunes model, especially if it can also bring in advertising. Meanwhile, by having its own device and operating system, Google is optimizing the YouTube mobile experience. As this YouTube blog post points out, the Nexus One is an improved way to search, view and upload YouTube videos. With YouTube enjoying such benefits not just on Nexus One, but on all Android phones, YouTube becomes an even more valuable partner for premium content providers looking to generate mobile usage.

Google and Apple will be jousting for years to come in the mobile space. The opportunities for growth for both companies are sizable. I fully expect that video is a going to be an increasingly important part of the battle.

What do you think? Post a comment now.

Categories: Advertising, Deals & Financings, Devices, Mobile Video

Topics: Android, Apple, Google, Nexus One, YouTube

-

Back from the Vacation? Here Are 7 Video Items You May Have Missed

Happy New Year. If you're just back from a holiday vacation and have been partially or totally off the grid for the last week or two, here are 7 video-oriented items you may have missed:

1. Time Warner Cable and News Corp fight over fees, then settle - Two behemoths of the cable and broadcast TV ecosystem spatted publicly during the holidays over the size of "retransmission consent" fees that News Corp (owner of the Fox Broadcast Network and cable channels like Fox News) wanted TWC (the 2nd largest U.S. cable operator) to pay to carry its 14 local stations. While a last minute deal averted the channels going dark, broadcasters' interest in dipping into cable's monthly subscription revenues will only intensify as audience fragmentation accelerates and ad revenues are pressured.

For my part I wish Fox and other broadcasters were as focused on building new and profitable digital delivery models for their programs as they were on trying to redistribute cable's revenues. Even as Rupert Murdoch continues advocating the paid content model, the freely-available Hulu is seeing its traffic skyrocket (see below). But if Hulu's viewership isn't incrementally profitable, then all that growth is pointless. Urgency is mounting too; in '10 convergence devices that bridge broadband to the TV are going to get a lot of attention. In the wake of their adoption, consumers are going to want Hulu on their TVs. If Hulu doesn't allow this it will be marginalized. But if it does without first solidifying its business model, it could hurt broadcasters further.

2. Hulu has a big traffic year, but no further information provided on its business model - Hulu's CEO Jason Kilar pulled back the curtain a bit on the company's strong progress in 2009, citing 95% growth in monthly users, to 43 million, 307% growth in monthly streams, to 924 million (both as measured by comScore) and a doubling of available content, to 14,000 hours. While noting that its advertisers increased from 166 to 408 during the year, with respect to performance, Jason only said that "we are extremely excited about atypically strong results we have been able to drive for our marketing partners."

Though Hulu is under no obligation to disclose details of its business model, I think it would dramatically increase the company's credibility if it shared some metrics about how its lighter ad load model is working (e.g. improved awareness, click throughs, leads, conversions, etc.). Per the 1st item above, as Hulu grows, a lot of people have a lot at stake in understanding what effect it may have on broadcast economics. In addition, as I pointed out recently, it is important to understand whether Hulu thinks it may have already saturated its U.S. audience. After a jump in Q1 '09 from 24.6 million to 41.6 million users, traffic actually dipped below 40 million until October. What does Hulu do from here to gain significantly more users?

3. Cable networks' primetime audience is nearly double broadcasters' - Punctuating the ascendancy of cable over broadcast, this Multichannel News article pointed out that in 2009, ad-supported cable networks as a group captured 60.7% of primetime audience vs. 32% for the 4 broadcast networks. That's a major change from 2000 when the broadcasters had a 46.8% share vs. cable's 41.2%. Cable increased its share every single year of the last decade, powered by its innovative original programming. NBCU's USA Network in particular has become the real standout performer, winning its second consecutive ratings crown, with 3.2 million average primetime viewers, up 14% vs. 2008.

The surging popularity of cable programming is a crucial barrier to consumers cutting the cord on cable. Since cable networks are highly invested in the monthly multichannel subscription model, they are unlikely to disrupt themselves by offering their best shows to others under substantially different terms than how they're offered today. So to the extent cable programs are either unavailable to over-the-top alternatives or offered less attractively (e.g. less choice, higher cost, delayed availability), little cord-cutting can be expected. And if TV Everywhere achieves its online access goals, the cable ecosystem will only be further strengthened.

4. YouTube is working to drive higher viewership - Amidst the turmoil in the traditional ecosystem and Hulu's growth, YouTube, the 800 pound gorilla of the online video world, is working hard to deepen the site's viewership. As this insightful NYTimes article explains, a team of YouTube developers is analyzing viewing patterns and tweaking its recommendation practices to encourage more usage. YouTube says time on the site has increased by 50% in the last year, and comScore reports that the average number of clips viewed per user per month jumped to 83 in October, up from 53 a year earlier. Still, as comScore also reports, duration of an average session has yet to crack 4 minutes, meaning video snacking on YouTube is still the norm. YouTube's moves must be watched closely in '10.

5. Showtime's "Weeds" available online before on DVD - This WSJ article (reg req'd) pointed out that Lionsgate, producer of Showtime's hit "Weeds" series is offering episodes online before they're available on DVD. By putting the digital "window" ahead of DVD's, Lionsgate is further pressuring DVD's appeal. We've seen periodic experimentation in this regard, and I anticipate more to come, especially as the universe of convergence devices expands and consumers can watch on their TVs instead of just their computers. Until a tipping point occurs though, "Weeds" like initiatives will be the exception, not the rule.

6. Netflix goes shopping in Hollywood - And speaking of reversing distribution windows, this Bloomberg Businessweek piece was the latest to highlight Netflix's efforts to woo studios into giving it more recent releases. Netflix has of course made huge progress with its Watch Instantly streaming feature, but its appeal to heaviest users will slow at some point unless it can dramatically expand its current slate of 17K titles available online. Hollywood is understandably wary of Netflix given all the variables in play and a desire to avoid Netflix becoming master of Hollywood's post-DVD, digital future. Whether Netflix will spend heavily to obtain better rights is a major question.

7. Get ready for Google's Nexus One and Apple's "iSlate" - Unless you've really been off the grid, you're probably aware by now that two very significant mobile product releases are coming this month. Tomorrow (likely) Google will unveil the Nexus One, its own smartphone, powered by its Android 2.1 operating system. The Nexus One will be "unlocked," meaning it can operate on multiple providers using GSM networks. The device will further fuel the mobile Internet, and mobile video consumption along with it. Separately, Apple is widely rumored to introduce its tablet computer later in the month, which many believe will be called the "iSlate." The tablet market is completely virgin territory, and while it's early to make predictions, I believe Apple could have most of the ingredients needed to make the product another big hit. The prospect of watching high-quality video on a thin, light, user-friendly device is extremely compelling.

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Devices, Mobile Video, Studios

Topics: Apple, FOX, Google, Hulu, Lionsgate, Netflix, News Corp, Showtime, Time Warner Cable, YouTube

-

Goodbye 2009, Hello 2010

It's time to say goodbye to 2009 and begin looking ahead to 2010.

2009 was yet another important year in the ongoing growth of broadband and mobile video. There were many exciting developments, but several stand out for me: the announcement and launches of initial TV Everywhere services, the raising of at least $470 million in new capital by video-oriented companies, YouTube's and Hulu's impressive growth to 10 billion streams/mo and 856 million streams/mo, respectively, the iPhone's impact on popularizing mobile video, the Comcast-NBCU deal, the maturing of the online video advertising model, the proliferation of Roku and other convergence devices and the growth of Netflix's Watch Instantly, just to name a few.

Looking ahead to next year, there are plenty of reasons to be optimistic about video's growth: the rollout of TV Everywhere by multiple providers, the proliferation of Android-powered smartphones and buildout of advanced mobile networks, both of which will contribute to mobile video's growth, the launch of Apple's much-rumored tablet, which could create yet another category of on-the-go content access, the introduction of new convergence devices, helping bridge video to the TV for more people, new made-for-broadband video series, which will help expand the medium's appeal, and wider syndication, which will make video ever more available.

In the midst of all this change, monetization remains the fundamental challenge for broadband and mobile video. More specifically, for both content providers and distributors, the challenge is how to ensure that the video industry avoids the same downward revenue spiral that the Internet itself has wrought on print publishers.

Regardless of all the technology innovations, high-quality content still costs real money to produce. If consumers are going to be offered quality choices, a combination of them paying for it along with advertising, is essential. While it's important to be consumer-friendly, this must always be balanced with a sustainable business model. In short, no matter what the size of the audience is, giving something away for free without a clear path for effectively monetizing it is not a strategy for long-term success.

VideoNuze will be on hiatus until Monday, January 4th (unless of course something big happens during this time). I'll be catching my breath in anticipation of a busy 2010, and hope you will too.

Thank you for finding time in your busy schedules to read and pass along VideoNuze. It's incredibly gratifying to hear from many of you about how important a role VideoNuze plays in helping you understand the disruptive change sweeping through the industry. I hope it will continue to do so in the new year.

A huge thank you also to VideoNuze's sponsors - without them, VideoNuze wouldn't be possible. This year, over 40 companies supported the VideoNuze web site and email, plus the VideoSchmooze evenings and other events. I'm incredibly grateful for their support. As always, if you're interested in sponsoring VideoNuze, please contact me.

Happy holidays to all of you, see you in 2010!

Categories: Advertising, Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Devices, Mobile Video

Topics: Android, Comcast, Hulu, iPhone, NBCU, Netflix, YouTube

-

4 Items Worth Noting for the Dec 7th Week (boxee's box, AT&T's iPhone woes, Nielsen data, 3D is coming)

Following are 4 items worth noting for the Dec 7th week:

1. Boxee's new box with D-Link - It was hard to miss the news from boxee this week that it will be launching its first box, in partnership with D-Link, in early 2010. Boxee has gained a rabid early adopter following, but the high hurdle requirement of downloading and configuring its software onto a 3rd party device meant it was unlikely to gain mainstream appeal. Strategically, the new box is the right move for the company.

For other standalone box makers such as Roku, boxee's box, with its open source ability to easily offer lots of content, is a new challenge (though note, still no Hulu programming and little cable programming will be available on the boxee box). The indicated price point of $200 is on the high side, particularly as broadband-enabled Blu-ray players are already sub-$150 and falling. Roku has set a high standard for out-of-the-box usability whereas D-Link's media adaptors have never been considered ease-of-use standouts. Boxee's snazzy, but very unconventional sunken-cube design for the D-Link box is also risky. While eye-catching, it introduces complexity for users already challenged by how to squeeze another component onto their shelves. If boxee only succeeds in getting its current early adopters to buy the box it will have gained little. This one will be interesting to watch unfold.

2. AT&T tries to solve its iPhone data usage problem - In the "be careful what you ask for, you might just get it" category, AT&T Wireless head Ralph de la Vega revealed an interesting factoid this week at the UBS media conference: 3% of its smartphone (i.e. iPhone) users consume 40% of its network's capacity. Of course video and audio capabilities were one of the big ideas behind the iPhone, so AT&T should hardly be surprised by this result. AT&T, which has been hammered by Verizon (not to mention its users) over network quality, thinks the solution to its problem is giving heavy users unspecified "incentives" to reduce their activity. No word on what that means exactly.

Mobile video has become very hot this year, largely due to the iPhone's success. But the best smartphones in the world can't compensate for lack of network capacity. While AT&T is adding more 3G availability, it's questionable whether they'll ever catch up to user demand. That could mean the only way to manage this problem is to throttle demand through higher data usage pricing. That would be unfortunate and surely stunt the iPhone's video growth. Verizon, with its line of Android-powered phones, could be a key beneficiary.

3. Q3 '09 Nielsen data shows TV's supremacy remains, though early slippage found - Nielsen released its latest A2/M2 Three Screen Report this week, offering yet another reminder that despite online video's incredible growth, TV viewing still reigns supreme. Nielsen found that TV viewing accounted for 129 hours, 16 minutes in Q3. While that amount is more than 40 times greater than the 3 hours, 24 minutes spent on online video viewing, it is actually down a slight .4% from Q3 '08 of 129 hours 45 minutes.

How much weight should we give that drop of 29 minutes a month (which equates to just less than a minute/day)? Not a lot until we see a sustained trend over time. There are plenty of other video options causing competition for consumers' attention, but good old fashioned TV is going to dominate for a long time to come. This is one of the key motivators behind Comcast's acquisition of NBCU.

4. 3D poised for major visibility - In my Oct. 30th "4 Items" post I mentioned being impressed with a demo from 3D TV technology company HDLogix I saw while in Denver for the CTAM Summit. This Sunday the company will do a major public demonstration, broadcasting the Cowboys-Chargers in 3D on the Cowboys Stadium's 160 foot by 72 foot HDTV display. HDLogix touts its ImageIQ 3D as the most cost-effective method for generating 3D video, as it upconverts existing 2D streams in real-time, meaning no additional production costs are incurred.

Obviously those watching from home won't be able to see the 3D streaming, but it will surely be a sight to see the 80,000 attendees sporting their 3D glasses oohing and aahing. Between this and James Cameron's 3D "Avatar" releasing next week, 3D is poised for a lot of exposure.

Enjoy the weekend!

Categories: Devices, Mobile Video, Sports, Technology, Telcos

Topics: AT&T, Boxee, D-Link, HDLogix, iPhone, Nielsen, Roku

-

Flip's New FlipShare TV Will Likely Flop

With today's unveiling of FlipShare TV, the folks behind the enormously popular Flip video cameras are betting that users want to watch their personal videos on their big-screen TVs and also be able to share their videos with friends and family. I think Flip is 100% right about users' interests, but the company's proprietary and expensive FlipShare TV approach is off the mark, and will likely flop. Flip would have had more success by partnering with key players in the video ecosystem, benefiting from both their momentum and numerous co-branding opportunities, while also avoiding costs incurred to develop and market FlipShare TV.

FlipShare TV consists of 3 items: a small base station that connects to the TV via HDMI or composite cables; a USB stick that has a proprietary 801.11n wireless interface so that videos on the computer can be

streamed to the base station (and hence viewed on the TV); and a remote control. Included FlipShare software lets users create "Flip Channels" which are groups of videos. FlipShare TV costs $150, a not-insignificant amount given Flip video cameras themselves have MSRPs of $150-$230, but can often be found for far less via online deals (I bought my daughter one for $60 recently).

streamed to the base station (and hence viewed on the TV); and a remote control. Included FlipShare software lets users create "Flip Channels" which are groups of videos. FlipShare TV costs $150, a not-insignificant amount given Flip video cameras themselves have MSRPs of $150-$230, but can often be found for far less via online deals (I bought my daughter one for $60 recently).The problem with FlipShare TV is that it takes a grounds-up approach to solving problems that could have been solved instead through smart partnerships and relatively straightforward integrations. Flip should have created a free or nearly free TV viewing and sharing feature that would have helped distinguish Flip's video cameras from the extensive list of competitive products hitting the market rather than creating a whole new product.

FlipShare TV's core proposition is of course making users' videos viewable on their TVs. The most obvious approach to doing so would have been to just partner with convergence product companies who are jockeying for position in the living room. The first partner in this space would have been Roku, which just released open APIs to support its Channel Store. I anticipate many other convergence players (e.g. Blu-ray, Internet TVs, gaming consoles, etc.) will similarly offer APIs to inexpensively broaden their offerings. As this occurs, Flip could have piggybacked on these devices. Netflix is doing this pre-emptively in the absence of APIs through brute force integrations; if it had wanted to, Cisco, Flip's parent, could have afforded to do so as well.

FlipShare TV's other value proposition of sharing could have been addressed through partnerships with companies such as Motionbox, iMemories and Pixorial which are targeting the family's "Chief Memory Officer." Motionbox is in fact already on Roku's Channel Store, which would have meant one less Flip integration. These companies are agnostic about how users capture their video, but all would have likely been eager to partner with well-known Flip to add to their brand awareness and their own value propositions.

YouTube would have been another obvious partner to enhance sharing. Granted YouTube lacks a strategy for getting onto the TV, but its online reach is unparalleled and features that would have enhanced YouTube uploading which is already prevalent among Flip users could have been valuable.

A major kink in FlipShare TV's sharing approach is that the sharee (e.g. grandma and grandpa) themselves also have to buy a FlipShare TV so they have the base station to connect to their TVs. Pew recently estimated 30% of seniors now have broadband Internet access (a number that's likely far higher for grandparents who have tech-forward, Flip-buying kids and grandkids). My guess is that sharing videos via a private YouTube channel would have been adequate for most of them if faced with the alternative of spending $150 for a proprietary setup.

All of these potential opportunities somehow didn't register with the Flip team. Their focus on a proprietary approach seems so complete that they didn't even choose to leverage existing wireless home networks among their target audience (Pew estimates home wireless penetration at about 40% for all broadband homes; it's likely double that or more in homes where a Flip camera's been purchased). Instead, additional cost was added to FlipShare TV system with the proprietary USB wireless stick.

I could be way off base on this and underestimating consumers' willingness to buy proprietary hardware, but I suspect I'm not. FlipShare TV's underlying concept of viewing on TVs and sharing is right on, but my guess is that its execution will yield little success. The lesson here: when partnerships are readily available, capitalize on them.

What do you think? Post a comment now.

Categories: Devices

Topics: Flip, FlipShare TV, iMemories, Motionbox, Pixorial, Roku, YouTube

-

Roku's Channel Store Launches, Positioning Player as Open Platform

Roku is launching its Channel Store today with 10 free channels, bidding to become the must-have broadband-to-the-TV video player in an increasingly crowded space. With the Channel Store Roku is releasing a free software developer kit (SDK) that further content partners can use to create an application to run on Roku players. Up until now Roku has selected its content partners (Netflix, Amazon VOD and MLB.TV), but the SDK helps Roku re-position itself as an open platform, available for all legal and non-adult content providers. Existing Roku players will get a software upgrade to enable the Channel Store, while new players receive the software upon initial install.

I got a sneak peak at the Channel Store over the weekend using the new Roku HD-XR player which itself was recently released. The 10 channels include Pandora, Facebook Photos, Revision3, Mediafly, TWiT, blip.tv, Flickr, Frame Channel, Motionbox and MobileTribe. The Content Store is a new icon on the Roku home screen, alongside the 3 existing partners. After selecting it, the 10 new channels' icons are visible along with their respective shows and their episodes.

The video quality is terrific; as with prior Netflix movies I've watched there's no buffering, the audio and video are in synch, it's possible to pause, fast-forward and rewind and come back later and resume at the same spot. The only issue I had was that the start-up time for new shows was very slow, sometimes taking up to 5 minutes while the screen said "retrieving...." I'm chalking this up to using the Channel Store pre-release, as Netflix movies I also retrieved over the weekend loaded quickly as they always do.

One other minor annoyance was that to watch Revision3 shows I had to first create an account at Revision3. Only after doing so and linking my Roku to that account was I able to start watching. I guess I understand that Revision3 wants to know who's watching via Roku, but the hurdle will suppress sampling of its shows when users are in channel surfing mode. Plus, online I'm able to watch Revision3 shows like Tekzilla without an account. I'd like to see the Roku process streamlined to emulate online.

Roku's spokesman Brian Jaquet explained to me that these 10 channels are just the start. Just as Apple has done with the App Store, Roku imagines letting a thousand flowers bloom, with an expanding variety of popular content helping drive sales of Roku players. The company has set up an affiliate program so that content partners that help sell players get a commission. It is also experimenting with different internal discounts that incent partners to sell players.

As I wrote in back in August, I continue to be bullish about Roku's prospects. Though I'm generally not a fan of new special purpose boxes, Roku has a few key things going for it that make it appealing to all-important mainstream buyers: piggybacking on existing well-known brands (e.g. Netflix, Amazon, MLB, Pandora, Facebook, etc.) to drive awareness, a low price-point that neutralizes much of the buyer's purchase risk, and a dead simple process of connecting and getting started. While boxee, for example, has for now appealed mainly to early adopters, Roku has from day 1 been positioned as a mainstream product (note boxee plans to launch its own box shortly along with its beta version). The Channel Store will only help broaden Roku's appeal. If Roku could clinch a promotional deal with Netflix, that would be a killer this holiday season, especially as a stocking stuffer.

Nonetheless, I still don't expect Roku or any of the other Internet-connected devices to incite a wave of cord-cutting any time soon. These are still "fill-in-the-gaps" kinds of value propositions; access to linear broadcast and cable programming is required for any of them to be considered bona fide substitutes to cable/satellite/telco. The risk to the incumbent providers is that new devices continue getting stronger, making them appealing as "good enough" alternatives to some portion of viewers. The Channel Store gives Roku that potential, as well as a leg up on the myriad other connected devices currently hitting the market. It will be worth watching over time.

What do you think? Post a comment now.

Categories: Devices

-

4 Items Worth Noting for the Nov 9th Week (Flip ads, YouTube ad-skipping, NY Times video, Nielsen data)

Following are 4 items worth noting for the Nov 9th week:

1. Will Cisco's new Flip Video camera ad campaign fly? - Cisco deserves credit for its new "Do You Flip" ad campaign for its Flip Video camera, a real out-of-the-box effort comprised entirely of user-generated video clips shot by ordinary folks and celebrities alike. As the campaign was described in this Online Media Daily article, finding the clips and then editing them together sounds like heavy lifting, but the results perfectly reinforce the value proposition of the camera itself. The ads are being shown on TV and the web; there's an outdoor piece to the campaign as well.

Cisco acquired Flip for nearly $600 million earlier this year in a somewhat incongruous deal that thrust the router powerhouse into the intensely competitive consumer electronics fray. Cisco will have to spend aggressively to maintain market share as other pocket video cameras have gained steam, like the Creative Vado HD, Samsung HMX and Kodak Z series. There's also emerging competition from smartphones (led by the iPhone of course) that have built-in video recording capabilities. I've been somewhat skeptical of the Cisco-Flip deal, but with the new campaign, Cisco looks committed to making it a success.

2. YouTube brings ad-skipping to the web - Speaking of out-of-the-box thinking, YouTube triggered a minor stir in the online video advertising space this week by announcing a trial of "skippable pre-roll" ads. On the surface, it feels unsettling that DVR-style ad-skipping - a growing and bedeviling trend on TV - is now coming to the web. Yet as YouTube explained, there's actually ample reason and some initial data to suggest that by empowering viewers, the ads that are watched could be even more valuable.

One thing pre-roll skipping would surely do is up the stakes for producing engaging ads that immediately capture the viewer's attention. And it would also increase the urgency for solid targeting. Done right though, I think pre-roll skipping could work quite well. At a minimum I give YouTube points for trying it out. Incidentally, others in the industry are doing other interesting things improve the engagement and effectiveness of the pre-roll. I'll have more on this in the next week or two.

3. Watching the NY Times at 30,000 feet - Flipping channels on my seat-back video screen on a JetBlue flight from Florida earlier this week, I happened on a series of highly engaging NY Times videos: a black and white interview with Oscar-winning actor Javier Bardem, then a David Pogue demo of the Yoostar Home Greenscreen Kit and then an expose of Floyd Bennett Field, the first municipal airport in New York City. It turned out that all were running on The Travel Channel.

Good for the NY Times. Over the past couple of years I've written often about the opportunities that broadband video opens up for newspapers and magazines to leverage their brands, advertising relationships and editorial skills into the new medium. By also running their videos on planes, the NY Times is exposing many prospective online viewers to its video content, thereby broadening what the NY Times brand stands for and likely generating subsequent traffic to its web site. That's exactly what it and other print pubs should be doing to avoid the fate of the recently-shuttered Gourmet magazine, which never fully mined the web's potential. I know I'm a broken record on this, but video producers must learn that syndicating their video as widely as possible is imperative.

4. Nielsen forecast underscores smartphones' mobile video potential - A couple of readers pointed out that in yesterday's post, "Mobile Video Continues to Gain Traction" I missed relevant Nielsen data from just the day before. Nielsen forecasts that smartphones will be carried by more than 50% of cell phone users by 2011, totaling over 150 million people. Nielsen assumes that 60% of these smartphone owners will be watching video translating to an audience size of 90 million people. Its research also shows that 47% of users of the new Motorola Droid smartphone are watching video, vs. 40% of iPhone users. Not a huge distinction, but more evidence that the Droid and other newer smartphones are likely to increase mobile video consumption still further.

Enjoy your weekends!

Categories: Advertising, Aggregators, Devices, Mobile Video, Newspapers, UGC

Topics: Cisco, Droid, Flip, iPhone, Nielsen, NY Times, YouTube

-

Sony Gets It Wrong with "Meatballs" Promotion

On Monday, Sony Electronics announced a holiday promotion in which buyers of select Internet-connected Sony Bravia TVs and Blu-ray players would receive a free 24 hour rental of the Columbia/Sony Pictures film

"Cloudy with a Chance of Meatballs." In addition, current owners of these devices would be able to rent the film for $24.95. For all of these consumers, the film would be available from Dec. 8th to Jan 4th, the month leading up to the film's DVD release.

"Cloudy with a Chance of Meatballs." In addition, current owners of these devices would be able to rent the film for $24.95. For all of these consumers, the film would be available from Dec. 8th to Jan 4th, the month leading up to the film's DVD release. Ordinarily I would applaud any move by Hollywood to modify its rigid release "windows" to benefit broadband delivery of films. Yet in this case I think Sony's promotion is ill-conceived and is extremely unlikely to contribute any real momentum to studios' future broadband delivery plans. In fact, it may actually have the opposite effect and further stunt the broadband medium's emergence. Here's why:

The release window is too tight - Release windows allow Hollywood studios to mine new value from the same content given each successive distribution medium's unique attributes and audience. But by trying to squeeze in this promotional window, Sony is exacerbating an already very tight windowing plan for "Meatballs" that called for DVD release less than 2 months following its theatrical run. Remarkably, even as Sony is trumpeting this new promotion, the film is actually still playing in theaters nationwide. Given it's already only 27 days until Dec 8th, there will be virtually no gap between theatrical and promotional windows. That undermines the theatrical value proposition, in turn ticking off exhibitors who are threatening to pull the film early, according to The Hollywood Reporter.

Theatrical to DVD windows have been getting progressively tighter as studios have sought to bolster sagging DVD sales. The problem is that like a good wine, lengthy windows allow a film to age and increase in value for both those consumers who saw the movie and those who did not. With this promotion, Sony is giving consumers an in-home opportunity to see the film immediately adjacent to the DVD's availability. That can do nothing but also hurt the DVD's sales.

The promotional offer isn't strong enough - For Sony Electronics, trying to differentiate its devices in a brutally competitive landscape is key. But do the marketing pros at Sony really believe that giving away a 24 hour rental is going to have a big impact? Personally I doubt it. The prices of the Sony TVs in the promotion are in the $1,000-$2,000 range, so a $25 incentive is easily swamped by the rampant deep discounts found in Sunday circulars (not to mention even deeper online deals). Further, I don't see any retailer incentives included in the promotion that would influence the sales process.

The "Meatballs" offer might have a stronger effect on sales of Sony's Blu-ray players, though here too, it's unlikely to be profound. With Blu-ray player sales lagging, manufacturers and retailers have largely decided that hitching their wagons to Netflix's Watch Instantly streaming is the best way to bump up sales. But with sub-$100 Netflix-capable Blu-ray players now available, a "Meatballs" rental valued at $25 on a $200-250 Sony player will have a hard time breaking through. Last but not least, it's important to remember, Sony's promotion is for a 24 hour rental. Not offering consumers ownership of "Meatballs" makes the promotional value ephemeral. And with Walmart, Target and Amazon now offering top DVDs for just $10 apiece, a 24 hour rental valued at $25 is underwhelming, not to mention somewhat specious, given it is Sony that's setting the "price." Given all of this, I suspect Sony would have done better by just offering a free "Meatballs" DVD with purchase.

Device audience too small to prove broadband delivery's appeal - Looked at differently, the small base of connected Sony Bravia and connected Blu-ray players, plus the new device sales over the promotional period, is unlikely to generate a large volume of "Meatballs" streaming anyway. That means that the promotion will do little to encourage Sony or other studios to more strongly embrace broadband delivery of their films. In fact, when the weak results of the promotion come in (as I expect they will), "Meatballs" could become future industry shorthand for "broadband delivery isn't ready for prime-time." That would be a shame, because I believe consumers very much want on-demand access to films in their homes. Netflix's success with Watch Instantly certainly proves that, as does the success VOD is having.

From my perspective, rather than setting up half-baked promotions like this one, studios should take a step back and think through how to do broadband delivery (for both rental and download-to-own) correctly. There are a lot of moving pieces, but clearly addressing what to do about the DVD window is critical. Studios are rightfully worried about killing off this cash cow. But compressing the DVD window and then trying to insert a new broadband delivery window isn't going to be the answer. Rather than seeing more "Meatballs" like promotions, I'd prefer to see a cohesive strategy out of Hollywood for how it can fully tap into broadband delivery's potential.

What do you think? Post a comment now.

Categories: Devices, FIlms, Studios

-

4 Items Worth Noting for the Nov 2nd Week (Q3 earnings review, Blu-ray streaming, Apple lurks, "Anywhere" coming)

Following are 4 items worth noting for the Nov 2nd week:

1. Media company and service provider earnings underscore improvements in economy - This was earnings week for the bulk of the publicly-traded media companies and video service providers, and the general theme was modest increases in financial performance, due largely to the rebounding economy. The media companies reporting - CBS, News Corp, Time Warner. Discovery, Viacom and the Rainbow division of Cablevision - showed ongoing strength in their cable networks, with broadcast networks improving somewhat from earlier this year. For ad-supported online video sites, plus anyone else that's ad-supported, indications of a healthier ad climate are obviously very important.

Meanwhile the video service providers reporting - Comcast, Cablevision, Time Warner Cable and DirecTV all showed revenue gains, a clear reminder that even in recessionary times, the subscription TV business is quite resilient. Cable operators continued their trend of losing basic subscribers to emerging telco competitors (with evidence that DirecTV might now be as well), though they were able to offset these losses largely through rate increases. Though some people believe "cord-cutting" due to new over-the-top video services is real, this phenomenon hasn't shown up yet in any of the financial results. Nor do I expect it will for some time either, as numerous building blocks still need to fall into place (e.g. better OTT content, mass deployment of convergence devices, ease-of-use, etc.)

2. Blu-ray players could help drive broadband to the TV - Speaking of convergence devices, two articles this week highlighted the role that Blu-ray players are having in bringing broadband video to the living room. The WSJ and Video Business both noted that Blu-ray manufacturers see broadband connectivity as complementary to the disc value proposition, and are moving forward aggressively on integrating this feature. Blu-ray can use all the help it can get. According to statistics I recently pulled from the Digital Entertainment Group, in Q3 '09, DVD players continue to outsell Blu-ray players by an almost 5 to 1 ratio (15 million vs. 3.3 million). Cumulatively there are only 11.2 Blu-ray compatible U.S. homes, vs. 92 million DVD homes.

Still, aggressive price-cutting could change the equation. I recently noticed Best Buy promoting one of its private-label Insignia Blu-ray players, with Netflix Watch Instantly integrated, for just $99. That's a big price drop from even a year ago. Not surprisingly, Netflix's Chief Content Officer Ted Sarandros said "streaming apps are the killer apps for Blu-ray players." Of course, Netflix execs would likely say that streaming apps are also the killer apps for game devices, Internet-connected TVs and every other device it is integrating its Watch Instantly software into. I've been generally pessimistic about Blu-ray's prospects, but price cuts and streaming could finally move the sales needle in a bigger way.

3. Apple lurks, but how long will it stay quiet in video? - The week got off to a bang with a report that Apple is floating a $30/mo subscription idea by TV networks. While I think the price point is far too low for Apple to be able to offer anything close to the comprehensive content lineup current video service providers have, it was another reminder that Apple lurks as a major potential video disruptor. How long will it stay quiet is the key question.

While in my local Apple store yesterday (yes I'm preparing to finally ditch my PC and go Mac), I saw the new 27 inch iMac for the first time. It was a pretty stark reminder that Apple is just a hair's breadth away from making TVs itself. Have you seen this beast yet? It's Hummer-esque as a workstation for all but the creative set, but, stripped of some of its computing power to cost-reduce it, it would be a gorgeous smaller-size TV. Throw in iTunes, a remote, decent content, Apple's vaunted ease-of-use and of course its coolness cachet and the company could fast re-order the subscription TV industry, not to mention the TV OEM industry. The word on the street is that Apple's next big product launch is a "Kindle-killer" tablet/e-reader, so it's unlikely Steve Jobs would steal any of that product's thunder by near-simultaneously introducing a TV. If a TV's coming (and I'm betting it is), it's likely to be 2H '10 at the earliest.

4. Get ready for the "Anywhere" revolution - Yesterday I had the pleasure of listening to Emily Green, president and CEO of tech research firm Yankee Group, deliver a keynote in which she previewed themes and data from her forthcoming book, "Anywhere: How Global Connectivity is Revolutionizing the Way We Do Business." Emily is an old friend, and 15 years ago when she was a Forrester analyst and I was VP of Biz Dev at Continental Cablevision (then the 3rd largest cable operator), she was one of the few people I spoke to who got how important high-speed Internet access was, and how strategic it would become for the cable industry. 40 million U.S. cable broadband homes later (and 70 million overall) amply validates both points.

Emily's new book explores how the world will change when both wired and wireless connectivity are as pervasive as electricity is today. No question the Internet and cell phones have already dramatically changed the world, but Emily makes a very strong case that we ain't seen nothing yet. I couldn't help but think that TV Everywhere is arriving just in time for video service providers whose customers increasingly expect their video anywhere, anytime and on any device. "Anywhere" will be a must-read for anyone trying to make sense of how revolutionary pervasive connectivity is.

Enjoy your weekends!

Categories: Aggregators, Books, Broadcasters, Cable Networks, Cable TV Operators, Devices

Topics: Best Buy, Bl, Cablevision, CBS, Comcast, DirecTV, Netflix, News Corp, Rainbow, Time Warner Cable, Time Warner. Discovery, Viacom

-

Seeking Cable's Formula for Success in Broadband Video

Yesterday VideoNuze hosted a breakfast at the annual CTAM Summit where I moderated a discussion titled, "How Cable Succeeds in the Broadband Video Era." Panelists included Ian Blaine, CEO, thePlatform, Rebecca Glashow, SVP, Digital Media Distribution, Discovery Communications, Bruce Leichtman, President & Principal Analyst, Leichtman Research Group and Chuck Seiber, VP, Marketing, Roku. Following are some of my observations from the discussion.

Against a backdrop of rapidly rising broadband video consumption, cable operators and networks are trying to strike a balance between preserving their traditional, and highly profitable business model, while still keeping pace with consumers' desire for more flexible and on-demand viewing options. A nagging question is whether full-length cable programs should be made available online for free, solely supported by advertising (the Hulu model), or if the cable industry's dual subscription/advertising model should be extended online (the TV Everywhere concept).

On the panel, Rebecca likely reflected many cable networks' current thoughts, saying, "We are in an ecosystem with our distribution partners that works....It (the free model) is going to kill all of our business; it's certainly going to kill our ability to produce high quality programming." These sentiments echo concerns I've raised about the viability of ad-supported long-form video. Even as Rebecca was critical of the free model, she noted that Discovery is taking a measured approach to TV Everywhere.

Chief among Rebecca's concerns regarding TV Everywhere is the need to accurately measure online viewership, crucial for ensuring that if viewership were to shift to online, that Discovery's ratings would not be hurt in the process. As Rebecca further pointed out, measurement issues have limited the appeal of cable operators' Video-on-Demand offerings.

Bruce went a step further to suggest that cable operators should learn from VOD's shortcomings when crafting their TV Everywhere plans. Bruce said that VOD rollouts "were led by engineers on a node-by-node basis" when they should have been led by marketers, and that "some operators introduced VOD only with trepidation." He believes that the problems that VOD had in the early days, "are still impacting consumers' perception of the on-demand platform."