-

First Intel-Powered Convergence Device Being Unveiled in Europe

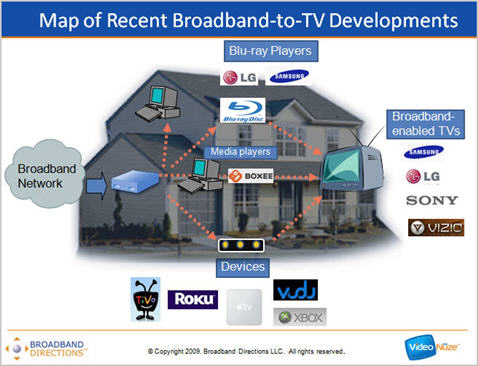

Convergence devices that bring broadband video and Internet applications to the TV (e.g. Roku, Xbox, Apple TV, Vudu, etc.) are a white-hot area of interest as many industry participants - including me - believe their eventual mass adoption will provide a major catalyst to broadband video usage and prompt further disruption in the value chain.

Intel has eyed a big role in this emerging market for a while, becoming a strong public proponent of the "digital home" concept. Building momentum over the past year, Intel has made announcements with Yahoo (for the "Widget Channel" framework), Adobe (to port and optimize Flash for TV viewing) and with a number of large content providers (demonstrating enhanced viewer experiences).

At the heart of Intel's early initiatives is the company's much-heralded Media Processor CE3100, the first in a family of "system on a chip" convergence-oriented processors. Next week the first CE3100-powered device, the "Mediaconnect TV" will be shown at the IBC show in Amsterdam. The box is a collaboration between a Dutch company, Metrological Media Innovations and a British interactive services provider, Miniweb (a spinoff of BSkyB). This has been previewed recently and is sure to gain more visibility next week. To learn more about Intel's convergence vision, yesterday I spoke to Wilfred Martis, the GM of Connected AV Products for Intel's Digital Home Group.

Intel sees 4 different types of home products that can be fitted with its media processor chips: set-top boxes, digital TVs, optical players (e.g. Blu-ray devices) and "connected AV" products, which are defined as standalone boxes that connect broadband to the TV, but without any guaranteed quality of service (QoS) for the video. This segmentation actually closely follows a slide I've been presenting lately which maps the various efforts for bringing broadband to the TV.

The connected AV devices are of course what "over-the-top" providers like Netflix, Amazon, iTunes, YouTube, etc. are counting on to deliver their services into the home over open broadband connections. On the one hand, Intel seems to be looking to empower these providers. As Wilfred says, Intel is trying to create a standard toolset and app environment akin to what we've seen on leading smartphones (mainly the iPhone) that helps drive creative new TV-based applications. Yet at the same time, as Wilfred notes, Intel wants to be a friend to incumbent video service providers, allowing them to deliver broadband content side-by-side with their walled-garden channels in their set-top boxes.

While Intel is clearly in this for the long haul, and has the resources to cultivate the market, other non-Intel devices continue to get a foothold. It's interesting to contrast, for example, the success that Roku is enjoying to date and ponder how the convergence device market will develop over the next several years. As I detailed a few weeks ago, Roku is successfully pursuing a classic "Crossing the Chasm" strategy, leveraging low pricing and loyalty to its content partners' brands to move lots of its product.

Still, integrating with Roku - and other current convergence devices - requires a one-off integration that assumes resources and prioritization (even when APIs exist). Some content providers will determine integrating is worthwhile, while others will not.

Intel's strategy is meant build on existing technologies and applications, making it more straightforward for content providers and applications developers to deploy on its devices (it's worth noting that Amazon, Blockbuster, Facebook and others plan to launch Widget Channel apps imminently). As Wilfred explains, when Intel's architecture is in convergence devices, incumbent software like browsers, plug-ins, drivers and the like are intended to work seamlessly. In addition, by providing abundant processing power, developers don't have to go through the arduous task of de-optimizing their apps for slower environments. And they get the performance headroom to continuously add updates.

The price for all this is of course, price. I don't know what the unit cost of the CE3100 is at volume, but my guess is that whatever it is would quickly sink any manufacturer's prospects of selling their box at anything close to a $99 price point, as Roku is. It's an age-old computing dilemma: beneficial as it is to have lots of processing power, there's a cost to it.

This raises the fundamental question of how the convergence device market will shape up over the next several years: will low-cost, "powerful-enough" devices continue to gain, or will boxes with robust processing render them obsolete at some point soon? My guess is that in the short term at least, low cost is going to lead the way. However, over the long term, it's hard to avoid the idea of significant computing power sitting next to the TV. However the business model for who pays to get it there remains in question.

What do you think? Post a comment now.

Categories: Devices, International

Topics: Adobe, Intel, Metrological Media Innovations, Miniweb, Roku, Yahoo

-

Catching Up on Last Week's Industry News

I'm back in the saddle after an amazing 10 day trip to Israel with my family. On the assumption that I wasn't the only one who's been out of the office around the recent July 4th holiday, I've collected a batch of industry news links below so you can quickly get caught up (caveat, I'm sure I've missed some). Daily publication of VideoNuze begins again today.

Hulu plans September bow in U.K.

Rise of Web Video, Beyond 2-Minute Clips

Nielsen Online: Kids Flocking to the Web

Amid Upfronts, Brands Experiment Online

Clippz Launches Mobile Channel for White House Videos

Prepare Yourself for iPod Video

Study: Web Video "Protail" As Entertaining As TV

In-Stat: 15% of Video Downloads are Legal

Kazaa still kicking, bringing HD video to the Pre?

Office Depot's Circuitous Route: Takes "Circular" Online, Launches "Specials" on Hulu

Upload Videos From Your iPhone to Facebook Right Now with VideoUp

Some Claims in YouTube lawsuit dismissed

Concurrent, Clearleap Team on VOD, Advanced Ads

Generating CG Video Submissions

MJ Funeral Drives Live Video Views Online

Why Hulu Succeeded as Other Video Sites Failed

Invodo Secures Series B Funding

Comcast, USOC Eye Dedicated Olympic Service in 2010

Consumer Groups Push FTC For Broader Broadband Oversight

Crackle to Roll Out "Peacock" Promotion

Earlier Tests Hot Trend with "Kideos" Launch

Mobile entertainment seeking players, payment

Netflix Streams Into Sony Bravia HDTVs

Akamai Announces First Quarter 2009 State of the Internet Report

Starz to Join Comcast's On-Demand Online Test

For ManiaTV, a Second Attempt to be the Next Viacom

Feeling Tweety in "Web Side Story"

Most Online Videos Found Via Blogs, Industry Report

Categories: Advertising, Aggregators, Broadcasters, Cable Networks, Cable TV Operators, CDNs, Deals & Financings, Devices, Indie Video, International, Mobile Video, Technology, UGC

Topics: ABC, C, Clearleap, Clippz, Comcast, Concurrent, Hulu, In-Stat, Invodo, iPod, Kazaa, Nielsen, Office Depot, Qik, VideoUp, YouTube

-

Lessons from Two Recent Deals: NBCU-60Frames and Microsoft/MSN Video-Disney/Stage 9

I always hesitate to conclude too much from just a couple data points, but two deals in the last week - between NBCU and 60Frames and between Microsoft/MSN Video and Disney/Stage 9 - feel to me like leading indicators of more deals of this kind to come.

In case you missed the news, last Tuesday, NBCU and 60Frames, an independent broadband-only studio I've written about, announced a comprehensive content development and ad sales deal. Critically, NBCU will take original broadband-only shows from 60Frames to brands/agencies with which it has relationships to pursue both upfront sponsorships and possible brand integration.

Then this past Monday, Disney and Microsoft announced at MIPCOM that Stage 9, Disney's in-house broadband-only studio which I've also written about, would begin syndicating its shows to MSN Video for European viewers. While smaller in scope, the Disney-MS deal is no less noteworthy.

I see at least three underlying threads to these deals that suggest broader market implications. First, the

deals are further evidence that the broadband-only video model is still nascent and in need of market validation and financial support. If these deals are in fact harbingers, this support will come from established players like NBCU and Microsoft who have significant reach and access to ad dollars. Somewhat ironically these are also companies that have financial stakes (either through direct ownership of or important customer/strategic relationships with) the very incumbent media properties that the broadband-only crowd is trying to grab eyeballs away from.

deals are further evidence that the broadband-only video model is still nascent and in need of market validation and financial support. If these deals are in fact harbingers, this support will come from established players like NBCU and Microsoft who have significant reach and access to ad dollars. Somewhat ironically these are also companies that have financial stakes (either through direct ownership of or important customer/strategic relationships with) the very incumbent media properties that the broadband-only crowd is trying to grab eyeballs away from.Second, the down economy is a catalyst for more of these types of deals. Last week, in "5 Conclusions About the Bad Economy's Effect on Broadband Video," I asserted that the broadband-only studios would tighten their belts a bit to conserve resources in this uncertain climate. One way to mitigate their financial risk and uncertainty is through these linkups with deep pocketed partners. NBCU's backing of the 60Frames slate appears to be the most extensive of these types of deals to date. That Stage 9 - owned by well-funded Disney - is also hunting down big distribution partners which have brand relationships is still further evidence that risk mitigation is a key priority.

Third, the deals point to an acceleration of the trend toward broadband video syndication. In a presentation I give periodically to industry executives, I have a slide titled "Syndicated Video Economy Accelerates" which lists the reasons as: (1) Ongoing video explosion causes heightened need to break through to audiences, (2) Device proliferation causes even more audience fragmentation, (3) Ad model firms up, improving ROI for free, widely distributed video and (4) Social media use means surging user-driven syndication. That slide needs to be updated for a new #1 reason motivating syndication: "In a down economy, syndication could mean the difference between success and failure for broadband-only studios and even big media backed broadband initiatives."

Third, the deals point to an acceleration of the trend toward broadband video syndication. In a presentation I give periodically to industry executives, I have a slide titled "Syndicated Video Economy Accelerates" which lists the reasons as: (1) Ongoing video explosion causes heightened need to break through to audiences, (2) Device proliferation causes even more audience fragmentation, (3) Ad model firms up, improving ROI for free, widely distributed video and (4) Social media use means surging user-driven syndication. That slide needs to be updated for a new #1 reason motivating syndication: "In a down economy, syndication could mean the difference between success and failure for broadband-only studios and even big media backed broadband initiatives."Here's something else to consider: what role might YouTube, the market's undisputed 800 pound gorilla, play as an emerging distributor and financial backer of broadband-only video? Despite its much-avowed

disinterest in being a content provider, YouTube, with Google's abundant balance sheet, is in a Warren Buffet-like position to become the go-to resource for financial backing and key distribution. (Readers who are cable industry veterans will also see a potential parallel to the M.O. of TCI back in the 1980's and 90's.) Couple Google's billions with YouTube's massive reach, desire to move up the quality ladder from its UGC roots, pursuit of new ad models and commerce models and its budding GCN initiative, and the company really is superbly positioned to play a role in the development of broadband-only programming.

disinterest in being a content provider, YouTube, with Google's abundant balance sheet, is in a Warren Buffet-like position to become the go-to resource for financial backing and key distribution. (Readers who are cable industry veterans will also see a potential parallel to the M.O. of TCI back in the 1980's and 90's.) Couple Google's billions with YouTube's massive reach, desire to move up the quality ladder from its UGC roots, pursuit of new ad models and commerce models and its budding GCN initiative, and the company really is superbly positioned to play a role in the development of broadband-only programming. Anyway, I digress. For now, it's fair to say that these two deals do not yet make a trend. But still, I think it's extremely likely that we'll see many more of these kinds of linkups in the months to come. We're living in a hunker down time, when starry-eyed creatives enticed by broadband's no-rules freedom will be tempered by business executives' no-nonsense pursuit of financial viability.

What do you think? Post a comment now.

(Btw, for a deeper dive into how broadband-only studios ride out the economic storm, join me for the Broadband Video Leadership Breakfast Panel in Boston on Nov 10th. One of our panelists will be Fred Seibert, creative director and co-founder of Next New Networks, arguably the granddaddy of the broadband-only crowd, having raised over $23 million to date. Early bird pricing ends on Friday.)

Categories: Advertising, Aggregators, Broadcasters, International, Portals, Syndicated Video Economy

Topics: 60Frames, Disney, Google, Microsoft, MSN Video, NBCU, Stage 9, YouTube

-

BBC's iPlayer a Model for U.S. Networks?

Today, I'm pleased to welcome the first post from Colin Dixon, Practice Manager, Broadband Media at The Diffusion Group, who is also a longtime industry executive.

I also want to highlight that as part of The Diffusion Group's 4th anniversary today, it is offering a special promotion for new clients of 4 reports for $4,000 (reports are usually $2,500 apiece) which also includes a 30 minute consult with founder/principal analyst Michael Greeson. The opportunity will be available for 4 hours, 4 minutes, from 12 noon U.S. Central Time today. Enjoy!

BBC's iPlayer a Model for U.S. Networks?

by Colin Dixon, The Diffusion Group

There's a lot of angst in Hollywood at the moment over broadband video. With video advertising models online in their infancy, the content providers are rightfully concerned about cannibalizing their linear channel ad revenue for unproven broadband models. Will eyeballs follow if a content provider puts all of its shows online? What's the right balance between too little and too much online content? With the variable quality of broadband connections, should a viewer be able to download the show for free rather than streaming it? Questions such as these are the source of much hand-wringing.

But what would happen if a major network were to throw caution to the wind and put everything they broadcast online and let their viewers download the shows for free to watch when and where they liked? Perhaps we can learn some lessons from the UK where the BBC, unfettered by the profit motive, is doing just that.

Late last year the BBC released its iPlayer through broadband connections to the British public. This proprietary client, available on PCs and iPods throughout the UK, makes available for free download every show broadcast on all of the BBC's many radio and television channels. Once downloaded, a show can be watched, ad free, anytime over the following 30 days (although once you start to watch a show, you have 7 days to finish viewing it.)

The British public, apparently, love it. In January, they downloaded some 11 million shows with usage of the service peaking at over a half million downloads in one day. Over 2 million people are perfectly comfortable relaxing in front of the PC catching up with the latest episode of "Doctor Who" or "EastEnders." And because the show is downloaded, not streamed, the quality is always great and the shows can be watched when and where it's convenient.

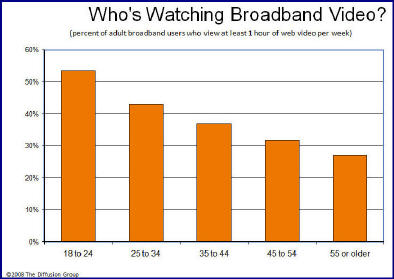

But perhaps this is just a British thing. Surely the same rules don't apply to the US market? Far from it. As we found when we surveyed broadband video users, there is strong evidence that US users will embrace online delivery with the same fervor as their UK brethren. When we surveyed nearly 2000 US broadband users, we found that 40% were watching an hour or more of broadband video. More amazing still is that 12% of broadband users were watching 25% or more of their television online. If you have a teenager in your home, I'm sure this will not come as a surprise to you!

Numbers like this are noteworthy in themselves. But it's important to remember that, in comparison to the BBC's iPlayer, the online viewing experience in the US is a mess. Shows are scattered over multiple websites and free ad supported show downloads are rare indeed. Broadband video viewing is an incredibly variable, often frustrating experience. What is clear is that given the same circumstances, the BBC's experience is likely to be repeated here.

The message for US content providers is clear: if you put it all online for free, and let people download and watch whatever, wherever and whenever they want, the eyeballs will follow. But with large numbers of people already devoting 25% or more of their TV viewing online, the issue of cannibalizing existing linear broadcast ad revenues is rapidly becoming irrelevant. The ad revenues will migrate to the Internet anyway!

One can only speculate what can happen when, as we predict for 2011, there are over 100 million households worldwide that are watching broadband video not from their PCs, but from broadband-enabled TVs.

What do you think? Post a comment and let everyone know!

Categories: Broadcasters, Downloads, International

Topics: BBC, iPlayer, The Diffusion Group

-

Microsoft Flexes Broadband Muscles at CES

Microsoft grabbed the early PR spotlight at the Consumer Electronics Show (CES), now underway in Las Vegas, announcing a variety of deals across the broadband video spectrum. The deals, announced by Bill Gates in his traditional night 1 keynote, reinforce Microsoft's intentions to play multiple roles in what Gates calls the "first true Digital Decade."

Here's a look at Microsoft's deals and why they matter:

NBCU 2008 Olympics on MSN, using Silverlight

Microsoft and NBC, which has the broadcast rights to the '08 Summer Games from Beijing, announced that MSN would be the exclusive partner for NBCOlympics.com including thousands of hours of live video

coverage, and that Silverlight, which is Microsoft's "Flash-killer", would be used. As I mentioned in my "6 Predictions for 2008", the '08 games are going to be the biggest broadband video event yet. The deal gains MSN lots of traffic and Silverlight lots of exposure and downloads, not to mention serious validation as a live streaming platform if it executes well.

coverage, and that Silverlight, which is Microsoft's "Flash-killer", would be used. As I mentioned in my "6 Predictions for 2008", the '08 games are going to be the biggest broadband video event yet. The deal gains MSN lots of traffic and Silverlight lots of exposure and downloads, not to mention serious validation as a live streaming platform if it executes well.ABC/Disney and MGM content on XBox LIVE

In a further move to bolster the premium-quality content available in XBox LIVE (the content offering that accompanies XBox 360), Microsoft announced that both ABC/Disney and MGM would now be providing both SD and HD content. These moves bring XBox LIVE's catalog closer to parity with iTunes, while

keeping up the competition with Amazon Unbox and other stores. Separately, Microsoft said that XBox racked up 17.7 million units sold during the '07 holiday season.(correction, Microsoft press release misstated this number. Holiday sales were actually 4.3 million units, bringing cumulative units sold to date to 17.7 million, thx Karl)

keeping up the competition with Amazon Unbox and other stores. Separately, Microsoft said that XBox racked up 17.7 million units sold during the '07 holiday season.(correction, Microsoft press release misstated this number. Holiday sales were actually 4.3 million units, bringing cumulative units sold to date to 17.7 million, thx Karl)XBox users have been remarkable active purchasers and downloaders using XBox LIVE, and previous briefings I've conducted with XBox executives suggest that the initiative has been particularly successful with HD. Since Xbox is purchased primarily as a gaming platform, it serves as a great Trojan horse opportunity for Microsoft to gain broadband access to the TV.

Meanwhile, XBox LIVE has served as the deal unit for Zune's library as well, so these moves are important to watch as they benefit Microsoft's efforts to dislodge iPod from its perch as the leading digital media player. Only disappointment here is no ad-supported counterpart was announced for ABC programs, leaving AOL as ABC's only announced broadband syndication partner, as best I can tell.

Meanwhile, XBox LIVE has served as the deal unit for Zune's library as well, so these moves are important to watch as they benefit Microsoft's efforts to dislodge iPod from its perch as the leading digital media player. Only disappointment here is no ad-supported counterpart was announced for ABC programs, leaving AOL as ABC's only announced broadband syndication partner, as best I can tell.BT and XBox 360 Integration

Microsoft leveraged Xbox 360 for another convergence play, announcing with BT that the company's "BT Vision" IPTV service would be available for XBox 360 owners as an integrated service offering. This means that no separate set-top box would be required for BT Vision subs. Though the box won't roll out until mid '08, this concept has compelling upside for both sides and could be a nice blueprint for future IPTV deals. It eliminates set-top capex for BT, while providing strong marketing benefits to both parties, helping drive broadband/TV convergence on the back of the popular XBox gaming console.

Showtime, TNT and CNN with new apps on Mediaroom, Samsung supporting Extender

Elsewhere, Microsoft announced that Showtime, TNT and CNN would be creating new apps for Microsoft's Mediaroom IPTV platform, which it says is now installed on 1M set-tops globally. And lastly, that Samsung will support Extender for Windows Media Center, which means that HD content can be sent over wired or wireless-N networks from PC to TV. Extender hasn't caught on yet, but Microsoft is continuing to push it as a bridge device. I've yet to test it, but have that on my list of to-do's.

Taken together, these announcements from Microsoft show the company's vast resources allow it to play a role in all aspects of the broadband era - software, devices, services, content, gaming, etc. Less pronounced in these deals was the company's recently added online advertising prowess, which will soon be applied to broadband video as well. Stay tuned for news on this front as '08 unfolds.

Categories: Aggregators, Broadcasters, Cable Networks, Downloads, FIlms, Games, HD, International, IPTV, Partnerships, Sports

Topics: ABC, BT, CNN, Disney, MGM, Microsoft, NBC, Olympics, Samsung, Showtime, TNT, Xbox 360, Xbox LIVE

-

Warner Bros. International Television's On-Demand Rollout Seems On Track

A piece in Variety yesterday describing WBITD's aggressive new strategy to mine on-demand opportunities in cable, satellite and broadband underscores how technology is driving new distribution options and revenue opportunities, while at the same time posing new challenges to traditional business models.

The article, entitled "WB Shows Go On-Demand" outlines how WBITD is launching "Warner TV" branded on-demand initiatives in Europe and Asia. That Warner will be offering its library of films and TV programs Warner entirely on-demand is a clear acknowledgement that consumer behavior has shifted beyond the "appointment viewing" paradigm of linear TV.

This shift, along with scarce channel capacity and resistant service providers, have all contributed to the fact that launching new cable networks here in the U.S has all but dried up. The recently unveiled Fox Business Channel is a huge exception; behind the scenes there are scores of people who aspired to launch their own cable networks who have now shifted their focus to on-demand, or increasingly to broadband.

Jeffrey Schlesinger, WBITD's president put his finger on why the on-demand and broadband models make so much sense, "The costs here are much lower than creating a linear channel. You don't have as much on-air promotion that you have to do. You don't have as much scheduling or advertising sales infrastructure. You don't have to worry about commercial insertion."

Building a new programming franchise today is more about nimbleness and experimentation than big structure and deliberative scheduling. WBITD seems to recognize this and also seems to be willing to test lots of different models depending on the opportunities and circumstances it encounters in each local market.

Of course the key balancing act for WBITD here is pursuing these new initiatives without disrupting existing revenue streams and relationships. That's the first thing I hear from all content providers who have a vested interest in existing models, but a hunger for new revenues. WBITD is sensitive to this: its plan is to offer library titles or a secondary window on current programming,

Add WBITD to your "watch list" of companies pioneering how distribution will work in the broadband era.

Categories: International

Topics: Warner Bros.

Posts for 'International'

Previous |