-

New "NCAA Vault" is More Evidence of Archived Assets' Value

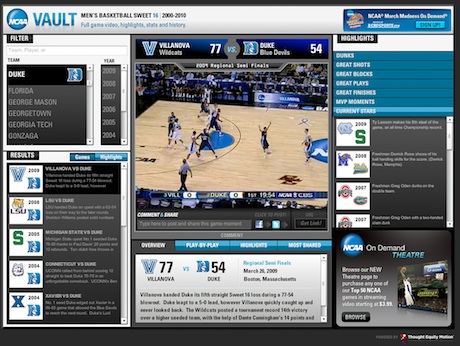

This year's "March Madness" men's college basketball tournament is just around the corner and in addition to the now-customary live streaming of the games (and this year an iPhone app for additional streaming), a new feature was introduced last week: "NCAA Vault" - a video index to every single moment in "Sweet 16" history for the last 10 years. NCAA Vault is powered by Thought Equity Motion, a technology provider that partners with media companies and rights-holders to digitize, deliver and monetize video assets. Last week I spoke with Thought Equity's CEO and founder Kevin Schaff to learn more about how the Vault works and the background of the deal with the NCAA.

Kevin explained that Thought Equity indexed all 150 of the Sweet 16 games' video with rich metadata for players, teams and highlights. This yielded a searchable database of 6,000 moments, which users of the Vault can tap into in a number of different ways. They can search by player, team, year, game or description of the play they're looking for. For more casual use, the Vault also presents lists clips of great shots, blocks, plays and finishes, plus most outstanding players and current stars. In addition to being a standalone site, the Vault is linked to from the March Madness main site.

When you search for a specific play, it will load and when done, the remainder of the game will continue playing until you want to move on. I can say from doing this several times that watching a play quickly and addictively morphs into watching several minutes of the game itself. Below the video window there's a text description of each play in the game. If you scroll the list and begin clicking on different plays what you'll immediately notice is how fast the new video loads and begins playing. Kevin explained that part of the reason is because the system is simply moving to a new cue point in the existing video file (in other words a new video file hasn't been created). This is a similar technique other indexes use; still, I don't think I've ever seen a new clip load as fast as these do. It's comparable to the experience of changing TV channels.

Thought Equity is very mindful of how, for some users, the Vault will be essentially a "stock video" database and so it has done several things to really enhance its value. Most important, it has created a Publishing Guide, which provides URLs to each of the moments so that writers and fans can search for incorporate links to just the plays they want. Conversely, if you're watching a video highlight and want to link to that moment, one click generates a URL for that clip. Thought Equity has even integrated the bit.ly URL shortener, so that you get a Twitter-friendly URL to use. Finally, Thought Equity has created an API so that 3rd parties who want to integrate the database, or pieces of it, with their own services, can do so easily.

Kevin explained that Thought Equity's model is to partner with media companies and rights-holders to license exclusive rights to their archived assets in order to create rich, searchable video databases. In the Vault's case, monetization is through advertising and CBS will sell the new high-value inventory. Thought Equity has worked with other media partners (e.g. Paramount, HBO, NY Times, BBC, etc.) with a monetization mix of advertising and licensing (i.e. the "stock" model). Over 10.5 million hours have been indexed to date with many more on-deck.

From a user's standpoint, the Vault is another exciting example of how the combination of online video and indexing technologies opens up access to memorable sports moments. Consumer usage creates the ad opportunity, but equally interesting are the myriad professional uses of the video. For bloggers and others running sports-oriented sites, the Vault opens a ton of new upside. Last week I wrote about how MovieClips.com is trying to create a similar Vault-like experience for movie clips; no doubt others will follow as the value of archived assets becomes increasingly apparent.

What do you think? Post a comment now (no sign-in required).Categories: Sports, Technology

Topics: CBS, March Madness, NCAA, Thought Equity Motion

-

Synacor Delivers NBC Olympics Video to 14 Cable Operators' 9 Million Subscribers

Overshadowed this week with the launch of HBO Go is that Synacor has been powering access to the

subscriber-only portion of NBC's Olympics video for 14 of its cable operator customers, reaching 9 million subscribers. As Synacor's CEO Ron Frankel told me earlier this week, this is the most extensive TV Everywhere authenticated access instance to date, though it is really just a continuation of the kinds of services Synacor has been offering for years.

subscriber-only portion of NBC's Olympics video for 14 of its cable operator customers, reaching 9 million subscribers. As Synacor's CEO Ron Frankel told me earlier this week, this is the most extensive TV Everywhere authenticated access instance to date, though it is really just a continuation of the kinds of services Synacor has been offering for years. Synacor has flown somewhat below the radar as it has steadily built out its content offerings, with deals with 60 different providers now in place (e.g. MLB, NHL, MTV, etc.). Synacor offers a portal to its customers which provides its cable operator customers with single sign-on access via pre-integrated billing and user ID management. This is the same way that TV Everywhere is intended to work as it rolls out. Given its experience, Synacor looks like it will be a key player in making TV Everywhere happen in 2010.

What do you think? Post a comment now (no sign-in required).

Categories: Cable TV Operators, Sports

Topics: NBC, Olympics, Synacor

-

From an Online Video Perspective, Super Bowl Ads Are a Mixed Bag

The great Super Bowl game last night was once again not matched by the quality of the ads, at least when viewed for how well they leveraged online video. For several years now, I've been arguing that the $2.5-3 million that advertisers spend on their 30 second Super Bowl spots could yield a far higher ROI if they figured out how to extend their experiences through online video. So once again this year I've reviewed all of the Super Bowl ads - not for how funny, creative or gross they were - but for how well they took advantage of the benefits online video offers.

First, some basic stats: of the 58 ads that ran during the game last night (which I viewed this morning at CBSSports.com), 38 of them were tagged with a URL and 20 were not. On a percentage basis that's about equal to last year, when 37 of the 56 ads carried a URL. Of the 38 ads with a URL, only 4 of them explicitly urged the viewer to see more or watch more at their web sites:

-

Focus On the Family - The controversial Tim Tebow advocacy ad invites viewers to visit the Focus web site to see the full Tebow story. The site has a long interview with Tebow's parents along with lots of other video. Regardless of your politics, the ad works well as a friendly teaser for viewers to learn more about the organization.

-

Boost Mobile - Jim McMahon and the hilarious rapping NFL players take it to a new level by actually ending their rap with the line "Go online to find the rest of our jam," then exposing the URL. Further videos at the site continue the fun.

-

GoDaddy - The web site hosting company was back with its ads featuring Danica Patrick and teasing viewers to "See more now at GoDaddy.com." The scantily-clad GoDaddy girls concept is a little stale now, but for the male-dominated game audience, there's no doubting its appeal.

- HomeAway.com - My personal favorite, this vacation home rental company bought back Chevy Chase and Beverly D'Angelo as The Griswolds for "Hotel Hell," a spoof of the famous "Vacation" movie series. The ad is totally focused on getting viewers to see the film at HomeAway.com. Chase is a classic and the videos are very clever.

Outside of these four, a handful of others are on my honorable mention list. From a user involvement standpoint, CareerBuilder's provocative ad with workers walking around in their underwear (which was the result of its "Hire My TV Ad" contest) was a winner and built on the success Doritos has had with its own $1 million user-generated contest. Monster.com has an interesting engagement opportunity at its site, allowing users to create their own "Fiddle a Friend" music videos with their violin-playing beaver. Speaking of animals, you had to love Bridgestone Tires' "Whale of a Tale" ad featuring 3 guys trying to drive a whale back to the ocean - Bridgestone makes behind the scenes clips here.For more behind the scenes, Dove's new Men Care line features an interview with MVP Drew Brees, who's also shown lathering up in the shower (a blatant pitch to women as well as men). E-Trade was back with its talking babies, but this year with a twist, allowing site visitors to send their own "Baby Mail" emails. The new Honda Accord Crosstour features a well-produced video of the car, though no mention of the video is made in its game ad. And how about the futuristic Vizio ad trumpeting its Internet-connected TVs? It's surely a sign of many more connected device ads to come in future years.

Lastly, a few real misses. First up, what's the deal with Budweiser? It ran 9 ads and not one of them carried a URL. These folks are mistaken in thinking that viewers wouldn't be interested in more about the Clydesdales on the web. Beyond the horses, it would have been cool to learn more about how Bud made the human bridge ad, or did the voice effects in the T-Pain spot. Ditto for Denny's which was promoting its Grand Slam breakfast hard, but didn't do any web tie-ins. The movie ads make me nuts too. They roll the credits so fast at the end of the ad and the text is so small that it's nearly impossible to find a URL to learn more about the movie, even if you wanted to.

The Super Bowl is the biggest event on the sports and advertising calendars, yet as evidenced by this year's performance, most brands and agency creative types still don't fully understand the power of online video. Sure, the post-game galleries drive millions of additional views, but I continue to contend they could be so much more. Oh well, onto Super Bowl XLV.

What do you think? Post a comment now (no sign-in required).

Categories: Advertising, Sports

Topics: Boost Mobile, Focus on the Family, GoDaddy, HomeAway.com, Super Bowl

-

-

Will This Year's Super Bowl Ads Finally Leverage Online Video?

It's Super Bowl time again, which means it's time for me to write my annual post wondering whether this will

be the year that Super Bowl advertisers really embrace online video and social networking opportunities. Four years ago, I speculated that at some point a Super Bowl ad could go for $10 million apiece, because the online video extensions could drive the ROI so much higher than what a traditional 30 second ad alone delivers. Nonetheless, advertisers and their agencies have been painfully slow to get with the online video program, and I've been ranting about the missed opportunities (see here and here) year after year.

be the year that Super Bowl advertisers really embrace online video and social networking opportunities. Four years ago, I speculated that at some point a Super Bowl ad could go for $10 million apiece, because the online video extensions could drive the ROI so much higher than what a traditional 30 second ad alone delivers. Nonetheless, advertisers and their agencies have been painfully slow to get with the online video program, and I've been ranting about the missed opportunities (see here and here) year after year.As this NY Times piece describes though, this could finally be a breakthrough year. I like the way that Kathy O'Brien, VP for personal care at Unilever put it, "The Super Bowl is an element of a complete, 360-degree campaign." That's smart thinking. On Monday I'll tally up the score to see how this year's Super Bowl advertisers did with their online video and social networking extensions.

What do you think? Post a comment now (no sign-in required).

Categories: Advertising, Sports

Topics: Super Bowl

-

Exclusive: FreeWheel Serving Almost 2 Billion Video Ads/Mo, MLB is Newest Customer

FreeWheel is on a roll, now serving almost 2 billion video ads/month, doubling its volume just since November, 2009. In addition, the company has added Major League Baseball Advanced Media to its customer roster and began implementing ads during the fall playoff season. The MLB win comes on top of recently announced customers Turner Broadcasting System and VEVO. FreeWheel's co-CEO/co-founder Doug Knopper brought me up to speed on all the news late last week.

Doug said that part of the increase in FreeWheel's volume is attributable to the additional customers that have come on board, but he's also very excited about the year-over-year growth in ad volume FreeWheel is

seeing for longer-term customers ("same store sales" if you will). FreeWheel is seeing big increases due to 3 factors: customers posting greater quantities of video, plus deepening viewership of that video (all of this borne out by comScore's '09 video consumption data); customers' improving ability to actually sell ads against these videos (reflecting the shift of budgets to the online video medium); and reduced friction through the emergence of "accepted practices" in ad operations.

seeing for longer-term customers ("same store sales" if you will). FreeWheel is seeing big increases due to 3 factors: customers posting greater quantities of video, plus deepening viewership of that video (all of this borne out by comScore's '09 video consumption data); customers' improving ability to actually sell ads against these videos (reflecting the shift of budgets to the online video medium); and reduced friction through the emergence of "accepted practices" in ad operations. FreeWheel is also benefiting from its specialization in helping content providers monetize their video on third-party sites (e.g. YouTube, AOL, MSN, Fancast, etc.). More and more content executives are realizing that sizable viewership opportunities exist by syndicating their video outside of their own properties. Doug said that every content company FreeWheel is now talking to is interested in some kind of syndication.

Doug described 3 types of syndication he's seeing: (1) across a family of sister corporate sites, such as PGA.com providing CNN.com video, which are both owned by Turner; (2) between affiliated entities like local MLB teams providing video to the main MLB.com hub and (3) externally, to unaffiliated 3rd parties, such as WMG music providing videos to YouTube. Given all this syndication activity, I was interested to learn from Doug what percentage of the ads FreeWheel serves fall into each of these 3 buckets vs. what percentage are served on the customer's sites themselves. Doug said that FreeWheel is pulling those numbers together in a way that ensures its customers privacy and will get back to me when he has them.

In addition to the above syndication activity, FreeWheel is seeing experimentation with delivering ads to mobile devices, convergence/CE players and Internet-enabled TVs. In all these cases, customized ad policies determine who sells what ad inventory and how revenue is shared and reported. Powering all of this has been part of FreeWheel's core mission from inception, making it a key player in what I've called the 'syndicated video economy."

FreeWheel's growth echoes what I've been hearing lately from both video ad network executives and video content providers. They too are talking about rapidly rising volumes and improving monetization. As I wrote recently, I've been impressed lately by efforts to make video ads more engaging and provide a better ROI, a trend I see continuing. Taken together, while it's still relatively early days, online video advertising seems to be making great strides.

What do you think? Post a comment now (no sign-in required)

Categories: Advertising, Sports

Topics: FreeWheel, MLB, Turner, VEVO

-

4 Items Worth Noting for the Dec 7th Week (boxee's box, AT&T's iPhone woes, Nielsen data, 3D is coming)

Following are 4 items worth noting for the Dec 7th week:

1. Boxee's new box with D-Link - It was hard to miss the news from boxee this week that it will be launching its first box, in partnership with D-Link, in early 2010. Boxee has gained a rabid early adopter following, but the high hurdle requirement of downloading and configuring its software onto a 3rd party device meant it was unlikely to gain mainstream appeal. Strategically, the new box is the right move for the company.

For other standalone box makers such as Roku, boxee's box, with its open source ability to easily offer lots of content, is a new challenge (though note, still no Hulu programming and little cable programming will be available on the boxee box). The indicated price point of $200 is on the high side, particularly as broadband-enabled Blu-ray players are already sub-$150 and falling. Roku has set a high standard for out-of-the-box usability whereas D-Link's media adaptors have never been considered ease-of-use standouts. Boxee's snazzy, but very unconventional sunken-cube design for the D-Link box is also risky. While eye-catching, it introduces complexity for users already challenged by how to squeeze another component onto their shelves. If boxee only succeeds in getting its current early adopters to buy the box it will have gained little. This one will be interesting to watch unfold.

2. AT&T tries to solve its iPhone data usage problem - In the "be careful what you ask for, you might just get it" category, AT&T Wireless head Ralph de la Vega revealed an interesting factoid this week at the UBS media conference: 3% of its smartphone (i.e. iPhone) users consume 40% of its network's capacity. Of course video and audio capabilities were one of the big ideas behind the iPhone, so AT&T should hardly be surprised by this result. AT&T, which has been hammered by Verizon (not to mention its users) over network quality, thinks the solution to its problem is giving heavy users unspecified "incentives" to reduce their activity. No word on what that means exactly.

Mobile video has become very hot this year, largely due to the iPhone's success. But the best smartphones in the world can't compensate for lack of network capacity. While AT&T is adding more 3G availability, it's questionable whether they'll ever catch up to user demand. That could mean the only way to manage this problem is to throttle demand through higher data usage pricing. That would be unfortunate and surely stunt the iPhone's video growth. Verizon, with its line of Android-powered phones, could be a key beneficiary.

3. Q3 '09 Nielsen data shows TV's supremacy remains, though early slippage found - Nielsen released its latest A2/M2 Three Screen Report this week, offering yet another reminder that despite online video's incredible growth, TV viewing still reigns supreme. Nielsen found that TV viewing accounted for 129 hours, 16 minutes in Q3. While that amount is more than 40 times greater than the 3 hours, 24 minutes spent on online video viewing, it is actually down a slight .4% from Q3 '08 of 129 hours 45 minutes.

How much weight should we give that drop of 29 minutes a month (which equates to just less than a minute/day)? Not a lot until we see a sustained trend over time. There are plenty of other video options causing competition for consumers' attention, but good old fashioned TV is going to dominate for a long time to come. This is one of the key motivators behind Comcast's acquisition of NBCU.

4. 3D poised for major visibility - In my Oct. 30th "4 Items" post I mentioned being impressed with a demo from 3D TV technology company HDLogix I saw while in Denver for the CTAM Summit. This Sunday the company will do a major public demonstration, broadcasting the Cowboys-Chargers in 3D on the Cowboys Stadium's 160 foot by 72 foot HDTV display. HDLogix touts its ImageIQ 3D as the most cost-effective method for generating 3D video, as it upconverts existing 2D streams in real-time, meaning no additional production costs are incurred.

Obviously those watching from home won't be able to see the 3D streaming, but it will surely be a sight to see the 80,000 attendees sporting their 3D glasses oohing and aahing. Between this and James Cameron's 3D "Avatar" releasing next week, 3D is poised for a lot of exposure.

Enjoy the weekend!

Categories: Devices, Mobile Video, Sports, Technology, Telcos

Topics: AT&T, Boxee, D-Link, HDLogix, iPhone, Nielsen, Roku

-

Tiger Woods Scandal Gets Animated Video Treatment

It's hard not to be fascinated by the Tiger Woods "transgressions" scandal and the drip-drip-drip revelations that are keeping the story alive. Amid the hubbub, the big mystery remains what actually happened on the fateful night that Tiger plowed his Escalade into a neighbor's fire hydrant and tree.

As the NY Times reported over the weekend, the animation unit of the Taiwanese "infotainment" newspaper Apple Daily (owned by Hong Kong-based media company Next Media) has created an animated video re-enactment of the events. The video is available on YouTube, where it has already drawn 2 million+ views. Non-Chinese speakers are out of luck on what the narrator's saying, but the animation provides the gist. As many suspect to be the case, there's Elin chasing Tiger's car down the street bashing its rear window with a golf club, causing a distracted Tiger to lose control and run off the road.

Compared to animated feature films, the quality is pretty amateurish. But that's the least of its problems; more significant is that the events shown are not based on the police reports or known facts, but rather on the animators' conception of what happened. So while Daisy Li, the Apple Daily manager overseeing the animated videos is quoted as saying that the idea of the animated videos is to make news more accessible to young people who don't like to read newspapers, by any standard, the video cannot be considered a journalistic pursuit.

Notwithstanding, the significance of the Tiger animated video and the whole idea of animated video re-enactments in general is that they have the potential to hugely influence public opinion about actual news events. By publishing videos like this to sites such as YouTube that have global reach, non-journalistic animators can vie with bona fide news outlets to inform audiences. For purists that will feel alarming, though it should be remembered that this is hardly the first time performance has influenced opinion - consider for example, that many people formed an opinion of Sarah Palin last year not on her remarks, but on Tina Fey's imitation of them on SNL.

Whether it is fact, fiction or something in between, video's power lies in its ability to tell a story better than any other medium. The animators at Apple Daily appear to understand this, as will others who will inevitably try to emulate their success. Audiences beware.

What do you think? Post a comment now.

Categories: International, Newspapers, Sports

Topics: Next Media, Tiger Woods

-

VideoNuze Report Podcast #41 - November 20, 2009

Daisy Whitney and I are pleased to present the 41st edition of the VideoNuze Report podcast, for November 20, 2009.

This week Daisy leads off with thoughts on what the NFL is doing with both online and mobile video, based on her recent interview with Laura Goldberg, GM of NFL.com.

I then dig deeper into my post from yesterday, "YouTube Direct is Yet Another Smart Move" in which I explained why YouTube Direct, a new initiative which was unveiled earlier this week, makes a lot of sense for both YouTube and its content partners. I've been impressed with how YouTube continues to evolve away from its wild-west UGC roots, finding ways to add value for both its users and also for its partners. Listen in to learn more.

Click here to listen to the podcast (12 minutes)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Aggregators, Podcasts, Sports

-

Clearleap Fuses Broadband Video and VOD in MaxPreps-Comcast Deal

Yesterday's Multichannel News described a deal between MaxPreps.com and Comcast that shows how well broadband video and video-on-demand fit together, a notion I suggested earlier this year. In the deal, MaxPreps, a provider of high-school sports content (which is owned by CBS), is producing video content in the Houston market for exclusive distribution on Comcast's VOD system. The deal gives Comcast a local sports differentiator vs. satellite and telco competitors, while for MaxPreps it gives valuable access to TV viewers.

Gluing the parties together is Clearleap, a technology provider I last wrote about here. As Braxton Jarratt,

Clearleap's CEO explained to me, MaxPreps uses a team of freelance videographers to shoot and edit the video. They're given access to dedicated Clearleap accounts so that they can upload the video for a local MaxPreps content manager to review their work.

Clearleap's CEO explained to me, MaxPreps uses a team of freelance videographers to shoot and edit the video. They're given access to dedicated Clearleap accounts so that they can upload the video for a local MaxPreps content manager to review their work. The content manager uses Clearleap to make edits, set the release schedule, create playlists if desired, and approve the final package. Clearleap then transcodes the video to the appropriate format and pushes it to Comcast for general availability. Braxton said an hour-long football game could be live within 15 minutes for VOD viewing and that the deal was operationalized in just a few weeks, with very limited capex. In effect the process helps turn VOD into a dynamically programmed content outlet much the way we think of the web.

For those accustomed to working solely online, constant, near real time content updates are routine. But for anyone who has worked with VOD systems, which are characterized by long lead times to get content ingested, prepared and made live, this workflow is a breakthrough. In fact, the MaxPreps-Comcast deal and workflow provides a possible glimpse into how a hybrid broadband-VOD model could work in the future and again why incumbent video providers who already have a set-top box sitting in the living room enjoy certain advantages.

As I illustrated in last week's post about Comcast's results over the last 3 years, incumbent video providers are in a steel cage match for subscribers, particularly higher-spending ones who value digital options. Yet it has become exceptionally difficult to differentiate through exclusive content, as most channels now seek as wide distribution as they can get.

For cable companies, whose roots are in their local communities, local sports VOD content could be a meaningful point of difference. And sports are just a starting point. One can imagine local entertainment, events, and localized versions of national programs all created/managed via the web, but viewed by consumers on VOD. The key is having the technical ability to cost-effectively collect and manage the video, and then insert it into the VOD system.

If the MaxPreps-Comcast deal in Houston scales to additional territories, and Comcast rolls out additional VOD content, I expect other video providers will adopt a similar model.

What do you think? Post a comment now.

Categories: Cable TV Operators, Sports, Video On Demand

Topics: Clearleap, Comcast, MaxPreps

-

4 Items Worth Noting for the Oct 12th Week (Bell's TMN, BlackArrow-Comcast, Net neutrality opposition, hockey's wunderkind)

Following are 4 items worth noting from the week of Oct 12th week:

1. Bell Canada is first to offer "TV Everywhere" type service - While U.S. operators have been busy with their TV Everywhere trials, Bell Canada, which has 1.8 million linear video subscribers, has jumped into the lead, announcing this week the launch of "TMN Online." The service, available through the Bell TV Online portal, allows subscribers to The Movie Network premium channel to gain online access to about 130 hours of content.

I spoke briefly with Peter Wilcox, Bell TV's director of product strategy, who explained that ExtendMedia's OpenCASE is being used for content management, in conjunction with Microsoft's Silverlight and PlayReady DRM. Users login with their Bell user name and password and are authenticated against the billing database as valid TMN subs. Only 1 simultaneous log-in is allowed, and Bell is also geo-blocking, so for example, there's no accessing TMN Online from outside Canada. The launch is part of what Bell calls "TV Anywhere" - a broader context for eventual distribution to its mobile subscribers, and further content being added. The deployment is the first milestone in what promises to be a busy 2010 on the TV Everywhere news front.

2. BlackArrow launches ad insertion for Comcast video-on-demand - BlackArrow, the multiplatform ad technology provider, announced its first customer deployment this week, with Comcast's Jacksonville, FL operation. I talked to company CEO Dean Denhart and President Nick Troiano, who gave me an update on how the company dynamically inserts ads in long-form premium content across TV, broadband and mobile. As I wrote 2 years ago, BlackArrow has bitten off the hardest challenge first: working with cable operators to get its system into their headends/data centers. Dean and Nick believe that if the company can succeed in this goal then it will have created formidable differentiation that can be leveraged for the other two platforms.

The key risk is that cable operators are famous for grinding down promising technology startups with their endless testing and brutal negotiating tactics (I say this from personal experience with a promising technology startup earlier this decade, Narad Networks). Robust VOD ad insertion is plenty strategic for the industry, but years since cable operators launched free VOD, the fact that it still isn't widely deployed is a telling sign, particularly while ad insertion technology in broadband is now fully mature. Comcast's role as an investor in BlackArrow should help its odds of success. I'm rooting for BlackArrow; their holistic approach to multiplatform advertising is right on. Whether they have the juice to fully succeed remains the big question.

3. Political battle over net neutrality is heating up - This week brought fresh complaints from Republican Senators who are coalescing to fend off new FCC chairman Julius Genachowski's plan to introduce net neutrality regulations for both broadband ISPs and wireless carriers. B&C reported that 18 Republican senators wrote to Mr. Genachowski concerned that the FCC's process is "outcome driven" and unsupported by data.

I rarely find my views aligning with Republicans, but net neutrality is an exception. As I wrote last month in "Why the FCC's Net Neutrality Plans Should Go Nowhere," Mr. Genachowski's plan is deeply flawed and completely illogical. The core premise of the new regulations - that they're needed to ensure continued broadband investment and innovation - misses the reality that the market is already functioning well. As one example, investment in broadband-related technology is continuing apace. By my calculations, over $180 million was raised in Q3 '09 by video-related companies whose very viability depends on open broadband and wireless networks. The sector's potential is amplified by the fact that venture capital fundraising itself is at its lowest level since 2003, with new capital raised by the industry in 2009 down 58% from 2008. Despite the VC industry's troubles, it continues to bet big on video. Why do we need new Internet regulations to sustain innovation?

4. Have you seen the 9 year-old hockey player's trick goal? On a lighter note, you have to love the serendipity of online video sharing. For example, though I don't consider myself a hockey fan, when a friend sent me this video clip of a 9 year-old hockey player pulling off this incredible trick shot, I was reminded just how much fun online video is and promptly passed the clip on to my circle (it's also now all over YouTube). See for yourself, it's just amazing. And nothing fake about it either.

Enjoy the weekend!

Categories: Advertising, Broadband ISPs, Cable TV Operators, International, Regulation, Sports, Technology, Video Sharing

Topics: Bell Canada, BlackArrow, Comcast, ExtendMedia, FCC, Microsoft, Net Neutrality

-

Big Ten Network Gives thePlatform the Ball for Domestic and International Online Video

The Big Ten Network has selected thePlatform to manage its two main streaming video initiatives - "BigTen Ticket," a live and on-demand package of all televised men's football and basketball games, available exclusively for international (non-US, Canada and Caribbean) audiences, and a package of 200 webcasts of other sports (women's basketball, volleyball, etc), for domestic audiences. Big Ten Ticket is available for single game pay-per-view and for school and conference-based subscriptions.

The Big Ten Network is a joint venture of Fox Cable Networks and subsidiaries of the Big Ten conference. It has been operating since August 2007 and gained carriage into 30 million U.S. homes within 30 days of

launch, attesting to the appeal of its big-name conference members. The network's increased commitment to online video delivery is part of a broader trend in major sports to augment broadcast/cable TV rights deals with consumer paid live and on-demand delivery.

launch, attesting to the appeal of its big-name conference members. The network's increased commitment to online video delivery is part of a broader trend in major sports to augment broadcast/cable TV rights deals with consumer paid live and on-demand delivery. Online sports distribution represents a new level of complexity for video publishing and management platforms because they are live, not just on-demand, require multiple monetization paths, involve unpredictable audience sizes and must implement strict access rights, by both geography and package. Sports are on the leading edge of online video with widespread syndication and distribution to multiple mobile devices still ahead.

At VideoSchmooze on Oct 13th, we'll get great insight into online sports from 2 of our 4 panelists, Perkins Miller, SVP, Digital Media and GM, Universal Sports, NBCU Sports and Olympics and George Kliavkoff, EVP & Deputy Group Head, Hearst Entertainment & Syndication (and formerly EVP, Business at Major League Baseball Advanced Media).

Categories: Cable Networks, Sports, Technology

Topics: Big Ten Network, thePlatform

-

Titans-Steelers on NBCSports.com Last Night Was Impressive

I was only able to catch a little bit of the Titans-Steelers came last night on NBCSports.com, but what I did see was pretty impressive. This was the first of the "Sunday Night Football Extra" games that NBC Sports

and the NFL plan to stream live this season. NBC Sports is using Silverlight for the first time, and the live HD broadcast included 5 different camera angles to choose from. Akamai is providing CDN services and Microsoft's Smooth Streaming for delivery.

and the NFL plan to stream live this season. NBC Sports is using Silverlight for the first time, and the live HD broadcast included 5 different camera angles to choose from. Akamai is providing CDN services and Microsoft's Smooth Streaming for delivery. NBC has been a pioneer in the delivery of online sports content, and with the 2008 Beijing Olympics setting a new standard. The NFL is not alone in pushing into online delivery though. As I noted recently in "2009 is a Big Year for Sports and Broadband/Mobile Video," there have been a ton of new initiatives this year across baseball, basketball, football, golf, tennis, auto racing, etc.

I'm looking forward to having Perkins Miller, SVP, Digital Media and GM, Universal Sports, NBCU Sports and Olympics on my discussion panel at VideoSchmooze on Mon evening, Oct 13th in NYC. No doubt he'll have lots of great insights and data to share about how the season is progressing.

The next game on NBCSports.com is this Sun night, Bears vs. Packers, 8pm ET.

Categories: Broadcasters, Sports, Technology

Topics: Akamai, Microsoft, NBC Sports, NFL, Silverlight

-

VideoNuze Report Podcast #30 - September 4, 2009

Daisy Whitney and I are pleased to present the 30th edition of the VideoNuze Report podcast, for September 4, 2009.

This week Daisy shares more detail from her most recent New Media Minute, concerning what broadcast networks are doing this Fall with online video extensions of their shows. For example, CW is launching an original series in conjunction with "Melrose Place." ABC is doing a 3rd season of an "Ugly Betty" web series and a tie-in for "Lost." CBS is launching its first web series, via TV.com, with Julie Alexandria, focused on recapping highlights from various shows. Daisy notes that these efforts are focused mainly on marquee shows and when advertisers are already on board.

In the 2nd part of the podcast we discuss my post from yesterday, "2009 is a Big Year for Sports and Broadband/Mobile Video." In that post I observed that many big-time sports, and the TV networks that have the rights to televise them have realized this year that broadband and mobile distribution are friend, not foe. As a result they've rolled out many different initiatives. We also touch on the various lessons other content providers can take away from what's happening with sports and broadband/mobile distribution.

Click here to listen to the podcast (13 minutes, 54 seconds)Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Broadcasters, Podcasts, Sports

Topics: ABC, CBS, CW, Podcast, TV.com

-

2009 is a Big Year for Sports and Broadband/Mobile Video

Pick your favorite sport - baseball, basketball, football, golf, tennis, auto racing, etc. and it's likely that in 2009 some part of the action has been available via broadband or mobile video. 2009 is looking like the year that sports executives - and the TV network honchos that pay dearly for sports' broadcast rights- concretely realized that broadband and mobile complement traditional sports broadcasting and that they should be embraced, not spurned.

In VideoNuze's News Roundup, I've been keeping track of all the broadband and mobile sports headlines this year. Here's just a partial list of what I've captured, along with links:

- PGATour.com to Offer Live Video Streams of Key Holes for Tour Playoffs (B&C)

- U.S. Open to Stream Almost All Matches Online (PaidContent)

- DirecTV Offers NFL Sunday Ticket via Internet in NY Trial (USA Today)

- "Live at Wimbledon" Streaming Coverage Announced by NBC (Sports Media News)

- Cablevision Subs Will Gain Access to In-Market Streaming of YES's Yankee Telecasts (Multichannel News)

- MLB.com Streams Live Baseball Games to the iPhone (NYTimes Bits)

- NBA Playoffs to Stream on Android App (Online Media Daily)

- Speedtv.com to Stream Part of Le Mans 24 Hours (Multichannel News)

- NHL to Launch Daily Stanley Cup Pre-game Web Series (Mediaweek - reg required)

- Follow the Masters on Your iPhone (Electronic House)

- March Madness! YouTube Gets Live Video via Silverlight (NewTeeVee)

In some cases the initiatives provide specially-produced video, while in other cases they offer streams that are already available on TV. The former type isn't that surprising as supplementary video can add a lot of value to the main event (the analog in entertainment are the popular "behind-the-scenes" extras that come with DVDs).

It's the latter type - where broadcast streams are delivered via broadband or mobile, either live or on-demand - that is much more intriguing as it represents a big step forward in sports and TV network executives' thinking about multi-platform distribution. Traditionally the approach has been to tell fans when the sporting event was on and on which network to find it. But with these broadband and mobile efforts, increasingly we're seeing executives scrap that model and replace it with a more fan-friendly approach that seeks to bring the action to fans, on-demand and wherever they might be.

In my view, this is a welcome change. Regrettably, big-time sports are now all about big-time money. To understand the stakes, I'm fond of reminding people to do the math on what just ESPN rakes in on just its U.S. monthly affiliate fee of approximately $3.75 from cable operators, satellite operators and telcos carrying the channel into 90 million + homes (your calculator may run out of zeros if you try). With that kind of money on the line, it's imperative that networks and sports themselves figure out how to harness new technologies to deliver more value. From the looks of 2009's initiatives, they appear to be well on their way.

What do you think? Post a comment now.

Categories: Broadcasters, Cable Networks, Sports

Topics: ESPN

-

VideoNuze Report Podcast #29 - August 28, 2009

Daisy Whitney and I are pleased to present the 29th edition of the VideoNuze Report podcast, for August 28, 2009.

In this week's podcast we discuss comScore's rankings of video ad networks' potential reach for July, 2009. I offered a first look at these rankings in Wednesday's post. As I pointed out, these rankings represent the aggregate reach of each ad network's publisher list. This is different from a ranking of actual reach, which comScore is working on, and plans to begin releasing at some point in the near future. Daisy and I remind listeners that potential reach is an imperfect measure, but it is still an important filter for media buyers trying to gain insight into who the major video networks are.

Unrelated, I touch base on last week's podcast in which Daisy and I discussed the Southeastern Conference's shortsighted ban on fan-generated video in stadiums. I raise the topic because earlier this week I had the pleasure of taking my 9 year-old daughter to Fenway Park to see a Red Sox-White Sox game. All around us were people taking pictures and video. And go to YouTube and you'll find plenty of fan video of key Red Sox moments.

Somehow fan video doesn't seem to bother MLB as it does the SEC. I don't claim to understand the difference in thinking, but Daisy notes that MLB has been among the most forward-looking sports leagues around. Daisy is so peeved at the SEC that she's protesting by vowing never to attend an SEC game (a relatively insignificant threat since she's in fact never attended an SEC game and lives on the other side of the country!)

Click here to listen to the podcast (13 minutes, 53 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Podcasts, Regulation, Sports

Topics: comScore, MLB, Southeastern Conference

-

4 Items Worth Noting from the Week of August 17th

Following are 4 news items worth noting from the week of August 17th:

CBS's Smith says authentication is a 5 year rollout - I had a number of people forward me the link to PaidContent's in-depth coverage of CBS Interactive CEO Quincy Smith's comments at the B&C/Multichannel News panel in which he asserted that TV Everywhere/authentication won't gain critical mass until 2014.

I was asked what I thought of that timeline, and my response is that I think Smith is probably in the right ballpark. However, these rollouts will happen on a company by company basis so timing will vary widely. Assuming Comcast's authentication trial works as planned, I think it's likely to expect that Comcast will have its "On Demand Online" version of TV Everywhere rolled out to its full sub base within 12 months or so. Time Warner Cable is likely to be the 2nd most aggressive in pursuing TV Everywhere. For other cable operators, telcos and satellite operators, it will almost certainly be a multi-year exercise.

NFL makes its own broadband moves - While MLB has been getting a lot of press for its recent broadband and mobile initiatives, I was intrigued by 2 NFL-related announcements this week that show the league deepening its interest in broadband distribution. First, as USA Today reported, DirecTV will offer broadband users standalone access to its popular "Sunday Ticket" NFL package. The caveat is that you have to live in an area where satellite coverage is unattainable. The offer, which is being positioned as a trial, runs $349 for the season. With convergence devices like Roku hooking up with MLB.TV, it has to be just a matter of time before the a la carte version of Sunday Ticket comes to TVs via broadband as well.

Following that, yesterday the NFL and NBC announced that for the 2nd season in a row, the full 17 game Sunday night schedule will be streamed live on NBCSports.com and NFL.com. Both will use an HD-quality video player and Microsoft's Silverlight. They will also use Microsoft's Smooth Streaming adaptive bit rate (ABR) technology. All of this should combine to deliver a very high-quality streaming experience. But with all these games available for free online, I have to wonder, are NBC and the NFL leaving money on the table here? It sure seems like there must have been some kind of premium they could have charged, but maybe I'm missing something.

Metacafe grows to 12 million unique viewers in July - More evidence that independent video aggregators are hanging in there, as Metacafe announced uniques were up 67% year-over-year and 10% over June (according to comScore). I've been a Metacafe fan for a while, and their recent redesign around premium "entertainment hubs" has made the site cleaner and far easier to use. Metacafe's news follows last week's announcement by Babelgum that it grew to almost 1.7 million uniques in July since its April launch. Combined, these results show that while the big whales like YouTube and Hulu continue to capture a lot of the headlines, the minnows are still making swimming ahead.

Kodak introduces contest to (re)name its new Zi8 video camera - It's not every day (or any day for that matter) that I get to write how a story in a struggling metro newspaper had the mojo to influence a sexy new consumer electronic product being brought to market by an industrial-era goliath, so I couldn't resist seizing this opportunity.

It turns out that a review Boston Globe columnist Hiawatha Bray wrote, praising Kodak's new Zi8 pocket video camera, but panning its dreadful name, prompted Kodak Chief Marketing Officer Jeffrey Hayzlett to launch an online contest for consumers to submit ideas for a new name for the device, which it intends to be a Flip killer. Good for Hayzlett for his willingness to change course at the last minute, and also try to build some grass roots pre-launch enthusiasm for the product. And good for the Globe for showing it's still relevant. Of course, a new name will not guarantee Kodak success, but it's certainly a good start.

Enjoy your weekend!

Categories: Aggregators, Broadcasters, Cable TV Operators, Devices, Indie Video, Sports

Topics: Babelgum, Boston Globe, CBS, Comcast, Kodak, MetaCafe, MLB, NFL, Roku, Time Warner Cable

-

VideoNuze Report Podcast #28 - August 21, 2009

Daisy Whitney and I are pleased to present the 28th edition of the VideoNuze Report podcast, for August 21, 2009.

In this week's podcast, Daisy and I first tackle the subject of the Southeastern Conference's new media policy fumble that I wrote about on Wednesday this week. For the upcoming football season, the SEC first banned all social media in the stadiums by game attendees, and later revised it to just exclude fan-generated video of game action.

I took the SEC to task, suggesting that the policy was wrongheaded because it limits the role that fan video could play in expanding the game experience and incorrectly assumes that fan video might actually compete with live game feeds from partners ESPN and CBS. Further, the policy is completely impractical to enforce, requiring security officers to frisk entering students and examine cell phones for video capability.

Daisy raises the example of when YouTube posted the infamous SNL "Lazy Sunday" clip, and NBC ordered it to take the clip down, foregoing tons of free promotion. That incident occurred almost 4 years ago, and since then major media companies have come a long way in adopting the role of user-generated video and video sharing as a promotional tool (see this week's Time Warner-YouTube clip deal as further evidence). On the other hand, the SEC still appears to be living in the stone ages. Somebody there needs to get their game on.

Shifting gears, Daisy explores the idea of how technology is helping video producers collaborate far more extensively than ever before. Producers and creators are now able to share images and raw footage to an unprecedented degree, which is making the creative process far more efficient. That in turn leads to more extensive creative output. Daisy identifies a slew of technology providers who are active in this emerging space.

Click here to listen to the podcast (13 minutes, 50 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Podcasts, Sports, Technology

Topics: CBS, ESPN, Southeastern Conference, XOS

-

Fan Video is Odd Man Out in Southeastern Conference's Confusing New Media Policy

The college football season hasn't yet officially begun, but the Southeastern Conference (SEC) has already fumbled the ball a couple of times with its confusing new media policy which bans fan-generated videos at games.

The confusion began when the SEC told its member universities that "Ticketed fans can't produce or disseminate (or aid in producing or disseminating) any material or information about the Event, including,

but not limited to, any account, description, picture, video, audio, reproduction or other information concerning the Event." As Mashable and others noted, the policy effectively - and bizarrely - barred all social media activity at games. The policy was widely translated to mean that Facebook updates, Tweets, photo uploads and of course YouTube clips would be verboten.

but not limited to, any account, description, picture, video, audio, reproduction or other information concerning the Event." As Mashable and others noted, the policy effectively - and bizarrely - barred all social media activity at games. The policy was widely translated to mean that Facebook updates, Tweets, photo uploads and of course YouTube clips would be verboten. But, faced with a sharp backlash, the SEC softened its stance, allowing "personal messages and updates of scores or other brief descriptions of the competition throughout the Event." Further, it allowed photos to be taken, as long as their "distributed solely for personal use..." But while Twitter, Facebook and the like would be allowed under the new policy, fan-recorded game action videos would still be prohibited.

In an interview with The Buzz Manager Blog, Charles Bloom, the SEC's Associate Commissioner of Media Relations explained, "the intent of the policy....is trying to protect our video rights, as they pertain to our television and media partners. So, someone in the stadium can enter Twitter feeds or Facebook entries and photographs, but the game footage video is something that we will try to protect." He added further "We're in the new year, the first year of our television and digital rights agreement, so there was a feeling that we needed to push this through pretty quickly..."

The SEC indeed has two big money contracts - a $2 billion, 15 year deal with ESPN, and an $800M+, 15 year deal with CBS, which includes an assortment of wireless, VOD, and data rights. The SEC also recently announced a partnership with XOS Digital to launch the SEC Digital Network, intended to be the "largest online library of exclusive and comprehensive SEC sports content available anytime, anywhere." With so much on the line, the SEC pursued the hardline path - pre-emptively prohibiting fan-generated video.

Is this a smart policy? Does fan-generated video really "compete" with professionally-captured video? And is the policy even enforceable? I'd argue the answers are no, no and no, making the SEC look both paranoid and out of touch.

First off, fan video serves to enhance the overall event experience, a key goal of the sports-crazy SEC. One can imagine fans at various locations in the stadium capturing compelling new angles that the TV producers may have missed or edited out. A curated collection of these clips could be added to the SEC Digital Network, possibly in a well-marked, "Fan Zone." Note this would be free content the SEC would be getting, that could also be monetized.

Second, it's ridiculous to think fan-generated video "competes" with the networks' feed. The limited zoom and audio capabilities of an iPhone or Flip video camera mean the fan videos captured in a raucous 90,000+ seat stadium are going to be iffy at best. That's not to say these videos won't have value, but please - nobody is going to turn off their HDTV to watch some fan's live stream. At some point technology may evolve so that a fan's inexpensive video camera can produce comparable video to a professional's; but that point is still a ways off.

Third, the video policy is impossible to enforce. Is security at the stadiums going to frisk students before entering and then confiscate phones with video capabilites, while letting others pass through? All while it tries to hustle tens of thousands of rambunctious fans through the gates? Bedlam would result.

While the SEC rightfully wants to protect the value of its TV contracts, its lack of understanding for how its policy plays out in the real world is plainly obvious. If the SEC - and others - looked at social media and user-generated video as an opportunity rather than a threat then the policies they created would make a lot more sense.

What do you think? Post a comment now.

Topics: CBS, ESPN, Southeastern Conference, XOS

-

4 Items Worth Noting from the Week of August 10th

Following are 4 news items worth noting from the week of August 10th:

Discovery Channel signs onto Comcast On Demand Online trial - Comcast added yet another cable programmer this week to the roster of those participating in its TV Everywhere trial. Discovery will make available episodes of "Man vs. Wild," "Swords," "Stormchasers" and "Verminators" though with some delayed windows that take a little edge off their appeal. Comcast has made a ton of progress corralling networks for its trial, but 4 of the big 5 cable network owners - Disney, Fox, NBCU and Viacom - remain holdouts. No coincidence that the first 3 are Hulu's owners.

Swarmcast powers MLB.TV on Roku, introduces "Autobahn Live for CE" - Following on Roku's announcement this week that it is offering MLB.TV, Swarmcast announced it was powering the service through a new offering called "Autobahn Live for CE." Swarmcast's COO Chad Tippin explained to me that integrating with CE devices that drive broadband/TV convergence is a key company goal. Chad is confident that Swarmcast's high-quality, scalable HTTP streaming service will work on these various CE devices, and that as the number of them deployed swells, a new "long tail of live sports" will flourish. Live sports and events (e.g. concerts) could be a significant contributor to device adoption. For example, picture getting a coupon for $50 off the purchase of a Roku when you buy a pay-per-view of a streaming blockbuster concert.

Babelgum grows to nearly 1.7 million unique visitors in July, 2009 - I heard from Michael Rosen, EVP and Chief Revenue Officer at Babelgum this week, with news that the site has grown to nearly 1.7 million unique visitors in July (comScore), following its U.S. launch in April. I profiled Babelgum back in April and was cautiously optimistic about its approach to curate high-quality, independently-produced video into 5 channels (music, film, comedy, Our Earth and Metropolis). The site is fully ad-supported. Babelgum's growth comes on top of a slew of made-for-broadband video initiatives I detailed recently. The NY Times also had a great story this week on how independent filmmakers are taking distribution into their own hands. Despite the recession, this corner of the broadband market seems to be hanging in there.

Zune HD coming Sept 15th - Microsoft at last announced this week that the Zune HD digital media player will be in retail on Sept 15th, with pre-orders now being accepted. Zune HD introduces a touch-screen interface, 720p video playback, HD radio and other goodies. It is sure to raise the visibility of high-quality portable video another notch. But I find myself wondering: as the iPhone and other smartphones incorporate video playback (and recording) into one device, how large is the market for standalone high-end media players like Zune? Related, the iPhone's risk of cannibalizing the iPod has become a hot topic recently. Things to ponder: will users want to carry 2 devices? Or might they appreciate the ability to drain their battery watching video without risking the loss of their cell phone? Lots of different things in play.

Categories: Aggregators, Cable Networks, Cable TV Operators, Devices, Indie Video, Sports, Technology

Topics: Apple, Babelgum, Comcast, Discovery, iPhone, iPod, Microsoft, MLB.TV, Roku, Swarmcast, Zune

-

MLB.TV Comes to Roku; 3 Key Takeaways

Roku has announced this morning that MLB.TV Premium subscribers will now be able to access the service on their TVs via the $99 Roku video player. MLB.TV joins Netflix, Amazon, and blip.tv programs already

accessible via Roku. According to Brian Jaquet, Roku's director of corporate communications, who I spoke to last week, dozens of other partners will be added to the service by the end of '09. The MLB.TV integration is obviously an exciting value proposition for its subscribers and for Roku adds live programming for the first time.

accessible via Roku. According to Brian Jaquet, Roku's director of corporate communications, who I spoke to last week, dozens of other partners will be added to the service by the end of '09. The MLB.TV integration is obviously an exciting value proposition for its subscribers and for Roku adds live programming for the first time. To go a level deeper than the headlines about the deal that you're likely reading elsewhere this morning, here are 3 key takeaways:

1. Roku's textbook "Crossing the Chasm" marketing strategy could make it a big-time winner - I've long said that as remarkable as the growth in broadband viewership has been over the past few years, what's more remarkable is that virtually all of this viewership has occurred not on consumers' primary viewing device - the TV - but rather on computers. As such, the last and most significant catalyst in broadband video's evolution and for its disruptive power to be realized is broadband connections bridging to the TV, for the masses.

The problem is that while avid market watchers and participants like you and me know what the above buzzword gobbledygook means, average consumers not only don't know, but they don't care. For technology marketers seeking to penetrate mainstream buyers, this is in fact the central challenge described in Geoffrey Moore's classic book, "Crossing the Chasm" (which I highly recommend if you want to understand the technology product marketing further). I have a lot of respect for Roku because it understands all of this and because it is following a textbook chasm-crossing marketing strategy tailored to the pragmatist mindset of its target market.

Roku's strategy reads right out of Moore's book: piggybacking off popular existing brands (Netflix, MLB, etc.), focusing on the "whole product," pursuing niche applications first and presenting its benefits "face-forward" as Moore says (e.g. see Roku's home page that blares "50,000+ videos to watch. INSTANTLY"). By doing all of the above and also pricing low ($99) and keeping the product radically simple, Roku is speaking strongly to its prospects and minimizing their purchase risk (a critical barrier in mainstream technology adoption). All of this means Roku could be a big-time winner in the convergence race.

2. Rapid technology changes are driving broadband video innovation - I asked Brian last week if Roku has any plans to add a hard drive to the box, which would allow both storage/downloading and possibly an ability to cache content for higher-quality delivery. His response, that "we believe streaming is robust enough to accomplish all of our objectives," dramatically illustrated for me how quick technology change is in the broadband market. I say this because just 6 short years ago, I consulted with Maven Networks, whose whole original value proposition was built around a desktop app for video downloading. The point of it was to work around streaming limitations to offer content providers and users a breakthrough experience. Streaming technology advances have quickly and completely eradicated Maven's whole initial reason for being.

This example illustrates how broadband market participants must never accept today's technologies as the defining parameters of future services (or as a wise CTO mentor of mine used to say, "Never fight technology progress. It's relentless and it will always win."). I try to constantly remind clients and other industry colleagues that it is crucial to understand the strands of technology progress - where key challenges lay, how quickly they might be resolved, what motivations are at work in fueling or stymying progress. What Roku is doing today would have been impossible just 5 years ago. The same goes for YouTube, the iPhone, etc, etc. To succeed in broadband it is crucial to acknowledge current technology limitations, but simultaneously look beyond them and stay aligned with technology's relentless progress.

3. A major video industry PR battle for consumers' hearts and minds is about to explode - As players like Roku bring well-loved brands like Netflix, Amazon and MLB to the TV, the degree of consumer awareness and interest in convergence or "over-the-top" services is going to grow considerably. It will be increasingly common to go to a cocktail party and hear 2 neighbors carry on about how cool it was to watch this show, or that game, or this movie, all without their incumbent video service provider involved. To be sure "cord-cutting" is not going to skyrocket any time soon, but what is going to happen is the kind of buzz-building that can lay the groundwork for major future change (e.g. remember when you first started hearing about how fast or accurate this new thing called "Google" was? Pretty soon everyone was using it for search).

Cable companies in particular know this, and are preparing an all-out response with TV Everywhere. I've been critical of Time Warner CEO Jeff Bewkes's hyping of TV Everywhere, though I'm beginning to appreciate more why he's doing it. The cable/satellite/telco ecosystem must not only stay relevant in the coming convergence era, they must remain consumers' preferred providers. The money at stake is in the tens of billions of dollars. All that means that as consumers we should anticipate a dramatic increase in the decibel level for promotion of various video alternatives. A pitched PR battle for our hearts and minds lies ahead.

What do you think? Post a comment now.