-

FreeWheel is Close to Managing 1 Billion Video Ads Per Month

In a quick call yesterday with FreeWheel Co-CEO and Co-Founder Doug Knopper, who was on his way to NYC for tonight's VideoSchmooze, he told me that the company is poised to manage 1 billion video ads next month, all against premium video streams.

In addition, FreeWheel has now been integrated by AOL, MSN and Fancast, among others, with Yahoo testing currently and ready to go live soon. It looks like the major portals are being encouraged to integrate with FreeWheel's Monetization Rights Management system by the company's premium content customers.

The benefit to the content providers is better control and monetization of their ad inventory across their portal distribution deals. The portal activity comes on top of FreeWheel's recently-reported implementation with YouTube, allowing the site's premium content partners to sell and insert ads against their YouTube-initiated streams.

The benefit to the content providers is better control and monetization of their ad inventory across their portal distribution deals. The portal activity comes on top of FreeWheel's recently-reported implementation with YouTube, allowing the site's premium content partners to sell and insert ads against their YouTube-initiated streams.FreeWheel is another great example of the Syndicated Video Economy (SVE) I've frequently talked about. Doug says FreeWheel's progress is proof that the SVE is really "hitting its stride."

It is hard though to put FreeWheel's 1 billion number into perspective. One way of thinking about it is comparing it to the data that comScore reported for August '09 for the top 10 video sites. Assuming only 5-10% of YouTube's views are from its premium partners and maybe half of Fox Interactive's are (due to MySpace's user-generated videos being included in its 380M streams) the top 10 video providers would account for about 3.5B videos. If each video had an average of 2 ads (which is a decent assumption when averaging short clips vs. full programs), then the top 10 video sites would account for about 7B video ads.

Relative to the top 10 then, FreeWheel's 1B ads managed look pretty healthy. To get a fuller picture, you'd also have to consider how many premium streams are in the 12B+ video views that fall outside of comScore's top 10 video sites, and how many ads run against those. If anyone has any ideas for how to determine these numbers, I'd love to hear them.

What do you think? Post a comment now.

Categories: Advertising, Portals, Syndicated Video Economy, Technology

Topics: AOL, Fancast, FreeWheel, MSN, Yahoo, YouTube

-

4 Items Worth Noting (comScore, Viral videos' formula, Netflix, VideoSchmooze) for Sept 26th Week

Following are 4 news items worth noting from the week of Sept. 26th:

1. Summer '09 was a blockbuster for online video - comScore released U.S. online video viewership data early this week, providing evidence of how big a blockbuster the summer months were for each metric comScore tracks. The 3 metrics that I watch most closely each month showed the healthiest gains vs. April, the last pre-summer month comScore reported. Total videos viewed in August were 25.4 billion, a 51% increase over April's 16.8 billion. The average number of videos watched per viewer was 157, up 41% from April's 111. And the average online video viewer watched 582 minutes (9.7 hours), a 51% increase from April's 385 (6.4 hours).

Also worth noting was YouTube crossing the 10 billion videos viewed in a single month mark for the first time, maintaining a 39.6% share of the market. According to comScore's stats I've collected, YouTube has been in the 39% to 44% market share range since May '08, having increased from 16.2% in Jan '07 when comScore first started reporting. Hulu also notched a winning month. While its unique viewers fell slightly to 38.5M from 40.1M in April, its total video views increased from 396M to 488.2M, with its average viewer watching 12.7 videos for a total of 1 hour and 17 minutes. It will be very interesting to see if September's numbers hold these trends or dip back to pre-summer levels.

2. So this is how to make funny viral branded videos - I was intrigued by a piece in ClickZ this week, "There's a Serious Business Behind Funny Viral Videos" which provided three points of view - from CollegeHumor.com, The Onion and Mekanism (a S.F.-based creative production agency) - about how to make branded content funny and then how to make it go viral. The article points out that a whole new sub-specialty has emerged to service brands looking to get noticed online with their own humorous content.

Humor works so well because the time to hook someone into a video is no more than 2-3 seconds according to Mekanism's Tommy Means. Beyond humor, successful videos most often include stunts or cool special effects or shock value. Once produced the real trick is leveraging the right distribution network to drive viral reach. For example, Means describes a network of 100 influencers with YouTube channels who can make a video stand out. After reading the article you get the impression that there's nothing random about which funny videos get circulated; there's a lot of strategy and discipline involved behind the scenes.

3. Wired magazine's article on Netflix is too optimistic - I've had several people forward me a link to Wired magazine's article, "Netflix Everywhere: Sorry Cable You're History" in which author Daniel Roth makes the case that by Netflix embedding its streaming video software in multiple consumer electronics devices, the company has laid the groundwork for a rash of cable cord-cutting by consumers.

I've been bullish for sometime on Netflix's potential as an "over-the-top" video alternative. But despite all of Netflix's great progress, particularly on the device side, its Achilles' heel remains content selection for its Watch Instantly streaming feature (as an example, my wife and I have repeatedly tried to find appealing recent movies to stream, but still often end up settling for classic, but older movies like "The English Patient").

Roth touches on this conundrum too, but in my opinion takes a far too optimistic point of view about what a deal like the one Netflix did with Starz will do to eventually give Netflix access to Hollywood's biggest and most current hits. The Hollywood windowing system is so rigid and well-protected that I've long-since concluded the only way Netflix is going to crack the system is by being willing to write big checks to Hollywood, a move that Netflix CEO is unlikely to make. The impending launch of TV Everywhere is going to create whole new issues for budding OTT players.

Although I'm a big Netflix fan, and in fact just ordered another Roku, I'm challenged to understand how Netflix is going to solve its content selection dilemma. This is one of the topics we'll discuss at VideoNuze's CTAM Summit breakfast on Oct. 26th in Denver, which includes Roku's VP of Consumer Products Tim Twerdahl.

4. VideoSchmooze is just 1 1/2 weeks away - Time is running out to register for the "VideoSchmooze" Broadband Video Leadership Evening, coming up on Tues, Oct 13th from 6-9pm at the Hudson Theater in NYC. We have an amazing discussion panel I'll be moderating with Dina Kaplan (blip.tv), George Kliavkoff (Hearst), Perkins Miller (NBC Sports) and Matt Strauss (Comcast). We'll be digging into all the hottest broadband and mobile video questions, with plenty of time for audience Q&A.

Following the panel we'll have cocktails and networking with industry colleagues you'll want to meet. Registration is running very strong, with companies like Sprint, Google/YouTube, Cox, MTV, Cox, PBS, NY Times, Morgan Stanley, Hearst, Showtime, Hulu, Telemundo, Cisco, HBO, Motorola and many others all represented. Register now!

Categories: Aggregators, Branded Entertainment, Events, FIlms, Studios

Topics: CollegeHumor.com, comScore, Hulu, Mekanism, Netflix, The Onion, VideoSchmooze, Wired, YouTube

-

YouTube Movie Rentals: An Intriguing But Dubious Idea

Last week the WSJ broke the news that YouTube is in talks with Lionsgate, Sony, MGM and Warner Bros. about launching streaming movie rentals. On the surface this is an intriguing proposition: the 800 pound gorilla of the online video world tantalizing Hollywood with its massive audience and promotional reach. However, when you dig a little deeper, I believe it's a dubious distraction for YouTube, which is still trying to prove that it can make its ad model work.

I appreciate all the possible reasons YouTube is eyeing movie rentals. To evolve from its UGC roots, the company has been anxious for more premium content to monetize. But with Hulu locking up exclusive access

to ABC, Fox and NBC shows for at least the next year and a half or longer, full-length broadcast TV shows are largely unavailable. And now TV Everywhere threatens to foreclose access to cable TV programs. All this makes movies even more attractive.

to ABC, Fox and NBC shows for at least the next year and a half or longer, full-length broadcast TV shows are largely unavailable. And now TV Everywhere threatens to foreclose access to cable TV programs. All this makes movies even more attractive. Then there's Google's uber mission to organize the world's information. YouTube executives are savvy enough to know that not all content can be delivered solely on an ad-supported basis - not yet nor possibly ever (for more about the challenges of effectively monetizing broadcast TV shows, let alone movies, see my prior posts on Hulu). To succeed in gaining access to certain content, offering a commerce model is ultimately essential. Since YouTube has already put in place some key commerce-oriented infrastructure pieces like download-to-own and click-to-buy, rolling out a rental option is less of a stretch. Lastly, YouTube can position itself to Hollywood as a more flexible partner and viable alternative to Apple's iTunes.

Regardless, YouTube movie rentals are still a dubious idea for at least 3 reasons: they're a distraction from YouTube's as yet unproven ad model, there are too many competitors and too little opportunity to differentiate itself and the revenue opportunity is relatively small.

Focus on getting the ad model working right - Given its market-leading 40% share of all online video streams, I've long believed that YouTube is the best-positioned company to make the online video ad model work. YouTube has made solid progress adding premium content to the site that it can monetize, but it still has a lot of work ahead to make its ads profitable. As I wrote in June, Google's own senior management cannot yet clearly articulate YouTube's financial performance, causing many in the industry to worry about YouTube's sustainability. Some might assert that YouTube can keep tweaking the ad model while also rolling out rentals but I disagree. With the ongoing ad spending depression, YouTube must stay laser-focused on making its ad model work, and also on communicating its success.

Too many competitors, too little differentiation - It's hard to believe the world really needs another online option for accessing movies, and mainly older ones at that. There's Hulu, iTunes, Netflix, Amazon, Xbox and soon cable, satellite and telcos rolling out movies on TV Everywhere, just to name a few. Maybe YouTube has some secret differentiator up its sleeve, but I doubt it. Rather, it will be just one more comparably-priced option for consumers. And in some ways it will actually be inferior. For example, unlike Netflix and Amazon, YouTube's browser-centric approach means watching movies on YouTube will remain a suboptimal, computer-based experience. Unless YouTube is willing to pay up big-time, there's also no reason to believe it will get Hollywood product any earlier than proven services like Netflix and iTunes.

Revenue upside is small - It's hard to estimate how many movie rentals YouTube could generate, but here's one swag, which shows how limited the revenue opportunity likely is. Let's say YouTube ramped up to .5% of its 120M+ monthly U.S. viewers (assuming it had U.S. rights only to start) renting 1 movie per week (not a trivial assumption considering virtually none of YouTube's users have ever spent a dime on the site and there are plenty of existing online movie alternatives). YouTube's revenue would be 600K rentals/week x $4/movie (assumed price) x 30% (YouTube's likely revenue share) = $720K/week. For the full year it would be $37.4M. With YouTube's 2009 revenue estimates in the $300M range, that's about 12% of revenue. Nothing to sneeze at, but not world-beating either, especially as compared to YouTube's massive advertising opportunity.

Given these considerations, I contend that YouTube would be far better off trying to become the dominant player in online video advertising, replicating Google's success in online advertising. Like all other companies, YouTube has finite resources and corporate attention - it should focus where it can become a true leader. There's enough quality content and brands willing to partner with YouTube on an ad-supported basis to keep the company plenty busy, and on the road to eventual financial success.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, FIlms, Studios

Topics: Hulu, Lionsgate, MGM, Sony, Warner Bros., YouTube

-

comScore's Online Video Data Charts for Jan '07-July '09 Available for Download

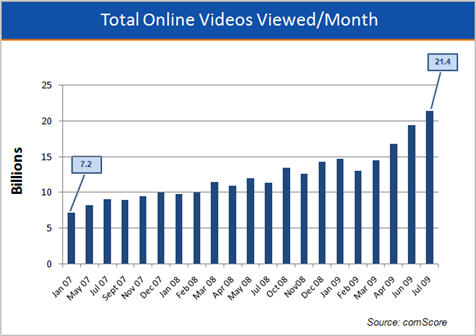

Last Thursday comScore released July 2009 data from its Video Metrix service showing record online video usage for the month. I've been charting comScore's data for 2 1/2 years, making updates each month when comScore provides new data. Today I'm offering these charts as a complimentary download (if you incorporate them into your presentations please identify comScore as the source). Here's an example slide for total online videos viewed per month:

Not surprisingly, a number of content providers have informally told me that their internal data and what comScore reports for them doesn't neatly tie out (anyone who's ever tried to reconcile number from internal analytics, ad servers and external measurement sources can relate to these discrepancies). Nonetheless, comScore's data provides at least one consistently-measured data set on the industry, which is quite useful.

Some of the record July numbers benefit from Michael Jackson's death and also from the lull in original TV episodes. Still, the comScore trendlines are pretty impressive. I share these charts at the beginning of presentations that I often make to industry executives to underscore broadband video's rapid growth. Some of the more noteworthy numbers that are highlighted on the slides include:

- A near tripling of total videos viewed per month from 7.2 billion in Jan '07 to 21.4 billion in July '09.

- A 229% increase in the average number of online videos watched per viewer per month from 59 in Jan '07 to 135 in July '09.

- A 331% jump in the number of minutes of video watched per average viewer per month from 151 minutes (2 hours 31 minutes) in Jan '07 to 500 (8 hours 20 minutes) in July '09.

- Looking just at YouTube, its share of all videos viewed has increased from 16.2% in Jan '07 to 41.9% in July '09. YouTube is the 800 pound gorilla of the market month in and month out. For example, in July '09, the #2 ranked video provider was Viacom Digital with 3.8% share of views, less than a tenth of YouTube's. YouTube accounts for nearly all of Google's 8.9 billion monthly views. To help put that number in perspective, it roughly equals the industry's total views in Sept '07. YouTube is also used more intensively than any other video site, with 74.1 average videos per viewer vs. #2 Viacom Digital with 19.2 average videos per viewer.

- Hulu's monthly videos viewed have increased from 88 million in May '08 to 457 in July '09, a greater than 5x increase in just its first 15 months in existence.

By virtually every measure the industry continues to experience rapid adoption. As I've noted before, in addition to continuing to grow viewership, the industry's key challenge is to further monetize all this video, either through advertising or paid models (subscriptions, pay-per-use or as a value add to other paid services).

What do you think? Post a comment now.

Categories:

Topics: comScore, Hulu, YouTube

-

How I Got Punked by the Megawoosh Waterslide Video

In last Friday's "4 Items Worth Noting..." post, I made a quick reference to the Megawoosh Waterslide video - what I thought was a genuine user-generated video of a German man barreling down a huge waterslide into a small pool. It turns out that I, along with many others, got punked. It's a fake, created through effects by a German marketing firm and sponsored by Microsoft Office. If you want all the details, NewTeeVee has a great write-up.

The waterslide incident contrasts with a second incident that happened to me just two weeks earlier. Taken together, I think the two represent a fascinating, yet unexplored side-effect of the broadband video revolution that all of us as human beings are currently experiencing. Let me explain what I mean.

In July 31st VideoNuze Report podcast, Daisy Whitney was very excited to describe the "JK Wedding March" viral video phenomenon (19 million + views to date) and how YouTube was publicizing on its blog that it was generating exceptional click-throughs and revenue for the video's background song "Forever" by Chris Brown through overlay ads.

When I quickly watched the video, my internal "authenticity detector" went off loudly as I wondered whether the wedding march was authentic or simply staged to generated buzz and sales for the song. I expressed this skepticism to Daisy on the podcast, and it wasn't until I did further research, and found the young Minnesota wedding couple interviewed on the "Today" show that my suspicions were allayed.

Meanwhile, when I quickly watched the Megawoosh video I thought, hey, it's an outlandish stunt. I wondered about the engineering involved to pull it off, but my authenticity meter remained relatively quiet.

Here's what I think the difference is: In the JK Wedding March I saw an obvious commercial opportunity that made me suspicious, while with the Megawoosh slide I did not see such opportunities so I was more willing to accept it as genuine. My authenticity lens has been shaped by having watched many broadband videos over the years where brands were involved in subtle and clever ways that I've become very aware. On the flip side, I've seen so many incredible user-generated stunts, that I've become conditioned to thinking that just maybe, anything is possible to pull off and some people's willingness to risk injury and death in the name of fleeting celebrity is unlimited.

The larger point here is that broadband video puts all of us in unchartered waters with respect to understanding if what we're watching is real. In the past, we rarely needed to question this. We knew when we were watching special effects or a documentary, reality programming or scripted fiction. And when authenticity representations were breached, it was a big deal (remember the outcry when NBC's "Dateline" admitted staging a test crash of a GM pickup truck?).

With broadband video however, we often don't even know who the producers are, much less what hidden motivations they may have or what third parties may be involved. Sometimes things are incongruous - for example, why is Microsoft Office even involved in sponsoring this German waterslide stunt?

Bottom line: all of us are on a new learning curve, requiring that we develop entirely new media literacy skills so we can successfully navigate broadband video's unchartered territory.

What do you think? Post a comment now.

Categories: Brand Marketing, UGC, Video Sharing

Topics: Microsoft, NBC, YouTube

-

4 News Items Worth Noting from the Week of July 27th

Following are 4 news items worth noting from the week of July 27th:

New Pew research confirms online video's growth - Pew was the latest to offer statistics confirming that online video usage continues to soar. Among the noteworthy findings: Long-form consumption is growing as 35% of respondents say they have viewed a TV show or movie online (up from 16% in '07); watching video is widely popular, draw more people (62%) than social networking (46%), downloading a podcast (19%) or using Twitter (11%); usage is up across all age groups, but still skews young with 90% of 18-29 year olds reporting they watch online vs. 27% of 65+ year olds; and convergence is happening with 23% of people who have watched online reporting they have connected their computers to their TVs.

FreeWheel has a very good week - FreeWheel, the syndicated video ad management company I most recently wrote about here, had a very good week. On Monday, AdAge reported that YouTube has begun a test allowing select premium partners to bring their own ads into YouTube, served by FreeWheel. Then on Wednesday, blip.tv announced that it too had integrated with FreeWheel, so ads could be served for blip's producers across their entire syndication network. I caught up with FreeWheel's co-CEO Doug Knopper yesterday who added that more deals, especially with major content producers, are on the way. FreeWheel is riding the syndication wave in a big way.

Plenty of action with CDNs - CDNs were in the news this week, as Vusion (formerly Jittr Networks) bit the dust, after going through $11 million in VC money. Elsewhere CDN Velocix (formerly CacheLogic) was acquired by Alcatel-Lucent. ALU positioned the deal as fitting with its "Application Enablement" strategy, supporting customers' needs in a "video-centric world." Limelight announced its LimelightREACH and LimelightADS services for mobile media delivery and monetization (both are based on Kiptronic, which it acquired recently). Last but not least, bellwether Akamai reported Q2 '09 earnings, that while up 5% vs. year ago, were down sequentially from Q1. Coupled with a cautious Q3 outlook, the company's stock dropped 20%.

IAC is making big moves into online video - IAC is making no bones about its interest in online video. Last week the company unveiled Notional, a spin-out of CollegeHumor.com, to be headed by that site's former editor-in-chief Ricky Van Veen. Then this week it announced another new video venture, with NBCU's former co-entertainment head Ben Silverman. IAC chief Barry Diller seems determined to push the edge of the envelope, as IAC talks up things like multi-platform distribution and brand integration. With convergence and mobile consumption starting to take hold, the timing may finally be right for these sorts of plays. At a minimum IAC will keep things interesting for industry watchers like me.

Click here to see an aggregation of all of the week's broadband video news

Categories: Advertising, CDNs, Indie Video, Syndicated Video Economy

Topics: Akamai, Alcatel-Lucent, blip.TV, FreeWheel, IAC, Limelight, Pew, Velocix, Vusion, YouTube

-

VideoNuze Report Podcast #25 - July 31, 2009

Daisy Whitney and I are pleased to present the 25th edition of the VideoNuze Report podcast, for July 31, 2009.

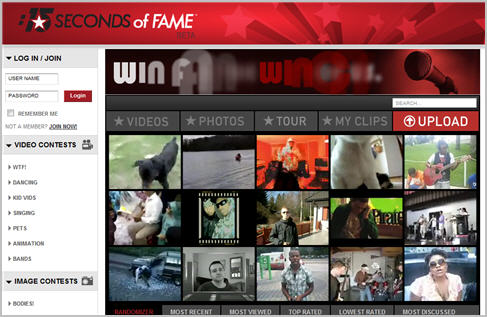

This week I provide some additional thoughts on the new web site 15 Seconds of Fame (http://15sof.com/), which I posted about yesterday. The site is a broadband, social media-based version of "American Idol," offering multiple online contests. Users pay $1 to enter their 15 second (max) video, which then funds the prizes ranging from $25-$100. It's a great example of what I call "purpose-driven" user generated video, meant to appeal to people who have talent and already have experience uploading video to YouTube and other video sharing sites.

Speaking of YouTube, Daisy picks up on her post about its latest sensation, the "JK Wedding Entrance Dance" which has gained over 12 million views. The video shows a wedding party proceeding down the aisle dancing to Chris Brown's "Forever." The video is a blast to watch, but more importantly, YouTube is highlighting on its blog that the video has also become a big money-maker for its rights-holders. By using YouTube's content management tools and "Click-to-Buy" links, there are now overlay ads to buy the song at Amazon and iTunes. YouTube reports that the click-through rate is 2x the average and helped drive the song to #3 on iTunes and #4 on Amazon. It's a nice win for everyone. Think the bride and groom (interviewed here on NBC's Today Show) are getting a cut?

Click here to listen to the podcast (12 minutes, 58 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

-

15 Seconds of Fame (15sof.com): A Broadband, Social Media-Based Version of "American Idol"

Andy Warhol's famous quote that "everyone gets their 15 seconds of fame" is the inspiration behind a new web site called 15sof.com that is like a broadband, social media-based version of the hit show "American Idol," but created and promoted at a fraction of the cost.

15sof.com is meant to capitalize on the growing subculture of society (that tends to skew younger) who are either seeking fame and fortune or want to influence the process of who attains it. These motivations have been the key forces behind the explosion of reality-based contest shows now running and arguably drive many of the most outlandish stunts seen on YouTube.

15sof.com's founder/CEO John Bonaccorso explained to me that the site offers aspiring contestants a simple but novel proposition: pay $1 to submit your 15 second (max) video to one of the myriad contests running at any one time on 15sof.com. The community then votes on the submissions and moves a handful of contestants on to subsequent rounds where lengthier videos are accepted. The prize money is funded from the contestants' fees. Contestants can enter as often as they'd like, but precautions are in place to prevent voting fraud. 15sof uses a white-label social media platform from Reality Digital, which I last wrote about here.

With current top prizes in the $25-$100 range, nobody's going to get rich, but they will gain visibility and of course psychic gratification. As John explained, particularly for the high school and college-aged drama crowd, 15sof.com offers them an opportunity to show their stuff, which is plenty enough.

15sof.com is itself a pure social media creation: John said the site hasn't spent any money yet on conventional marketing. Instead it has built awareness and participation solely through Facebook, MySpace, Twitter and other social media platforms. In the world of 15sof.com - and many other social sites and apps launching today - there's no need for tune-in ads, billboards or other expensive marketing tactics. Sites like 15sof.com grow out of the burgeoning social community, dominated by the young. John wouldn't disclose numbers, but said the site beat its first month traffic goal in the first 3 weeks. That's no indication of future success, but it's a good start.

For me, there are 2 other noteworthy aspects of 15sof.com. First, the site reflects yet another example of "purpose-driven" user-generated video, a concept I've explored in the past in connection with Unigo, a start-up trying to use student-created videos to disrupt the college guidebook industry. The "purpose-driven" video idea is to get the multitudes of amateurs whom YouTube introduced to video to turn their newfound skills and passion toward something more remunerative and possibly productive. Purpose-driven video concepts are proliferating. Most notable are the myriad brand-sponsored consumer video contests and also the many sites featuring user-created how-to videos. I continue to believe there will be many bona fide business opportunities based on purpose-driven video.

Second, 15sof.com also illustrates the evolving interplay between online and on-air programming. We are starting to see how programs born in one of the mediums can create a variation in the other, or where a concept can migrate from one medium to the other. For example, John's vision is that 15sof.com - the spawn of American Idol - could itself eventually become a TV show. Another example of this phenomenon is Scripps Networks' Food2, where new talent being showcased could eventually graduate to programs on the Food Network itself. I suspect some of this multi-platform thinking is behind Ben Silverman's new venture with IAC. My point is that broadband is giving programmers a lot of new flexibility in how they bring their creative concepts to market.

Meanwhile, if you're expecting to find yours truly belting out a song on 15sof.com, you'll have to keep waiting. I'll be here hiding behind my keyboard.

What do you think? Post a comment now.

Topics: 15sof.com, Food2, Reality Digital, YouTube

-

Blip.TV's New Deals Give Broadband Producers a Boost

Broadband-only producers got a boost yesterday as blip.tv, which provides technology, ad sales and

distribution for thousands of online shows, announced a variety of new deals as well as product improvements. The deals offer blip's producers new distribution, new monetization and new access to TVs. In order:

distribution for thousands of online shows, announced a variety of new deals as well as product improvements. The deals offer blip's producers new distribution, new monetization and new access to TVs. In order:Distribution: blip's new deal with YouTube means that producers using blip can deliver their episodes directly to their YouTube accounts, eliminating the two step process. With YouTube's massive traffic, getting in front of this audience is critical to any independent producer. Since my first conversation with blip's co-founder Mike Hudack several years ago, the company's mantra has been widespread syndication. Blip already distributed its producers' shows to iTunes, AOL Video, MSN Video, Facebook, Twitter, and others. Vimeo is another new distribution partner announced yesterday.

Monetization: A new integration with FreeWheel means that ads blip sells can follow the programs it distributes wherever they may be viewed. I've written about FreeWheel in the past, which offers essential monetization capability for the Syndicated Video Economy. With the blip deal, FreeWheel delivered ads can be inserted on YouTube. This follows news earlier this week that YouTube and FreeWheel had struck an agreement which allows content providers that use FreeWheel and distribute their video on YouTube can have FreeWheel insert their ads on YouTube (slowly but surely YouTube is opening itself up to 3rd parties).

Access to TVs - Last but not least is blip's integration with the Roku player which will help bring blip's shows directly to TVs (adding to deals blip already had with TiVo, Sony Bravia, Verizon FiOS, Boxee and Apple TV). While Roku's footprint is still modest, it is positioned for major growth given current deals with Netflix and Amazon, and others no doubt pending. At $100, Roku is an inexpensive and easy-to-operate convergence device that is a great option for consumers trying to gain broadband access on their TVs. Gaining parity access to TV audiences for its broadband producers is a key value proposition for blip.

In addition to the above, blip also redesigned its dashboard and work flow, making it easier for producers to manage their shows along with their distribution and monetization. An additional deal with TubeMogul announced yesterday allows second by second viewer tracking, providing more insight on engagement.

Taken together the new deals help blip further realize its vision of being a "next generation TV network" and provide much-needed services to broadband-only producers. This group has taken a hit this year, given the tough ad sales and funding environments, so they need every advantage they can get.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Analytics, Devices, Indie Video, Syndicated Video Economy

Topics: blip.TV, FreeWheel, Roku, TubeMogul, Vimeo, YouTube

-

4 News Items Worth Noting from the Week of July 20th

Following are 4 news items worth noting from the week of July 20th:

Apple reports blowout iPhone sales in Q2, continuing to drive market - It was another record quarter, as Apple reported selling 5.2 million iPhones, bringing to 21.4 the total sold to date. This despite acknowledging temporary shortages during the quarter. The iPhone continues to revolutionize the mobile market, and from my standpoint is the key catalyst for both recording and consumption of mobile video. This market is poised for significant growth as new smartphones hit the market along with fixed monthly data plans. Apps like MLB.com At Bat 2009, which offers live streams of games, are certain to be hits and emulated widely.

8 minute video of Amazon's Jeff Bezos discussing lessons learned and Zappos acquisition - You couldn't miss news this week of Amazon acquiring Zappos for around $900M, its largest deal ever. Interestingly, Amazon posted a video on YouTube of Bezos discussing the deal, but not until he walked through several maxims of Amazon's success (obsess over customers, think long term, etc.). The video is extremely informal, with Bezos flipping hand-scrawled notes on an easel and improvising funny anecdotes. It has a slightly random feel (until he gets to the Zappos part, you start to wonder, what's the point of all this?), but I give Amazon and Bezos lots of credit for using video in a totally new way to communicate with stakeholders. I'd love to see more CEOs do the same.

Is Disney CEO Bob Iger serious about creating a subscription site for its online video? This week at Fortune's Brainstorm conference, Iger floated the idea that Disney will offer movies, TV shows and games for paying subscribers. The timing seems more than coincidental as Comcast gears up for its On Demand Online trial. Is Iger serious about this, or is it a head fake from Disney so it can try to negotiate incremental payments from Comcast and others seeking to distribute Disney content online? It's hard to tell, but I'd be curious to see what Disney has in mind for its possible subscription service. Consumers hate the idea of paying twice for anything (even paying once is not so popular), so if Disney is somehow going to create another window where they charge for access to content that's still on, or was recently on cable, that would be an awkward model.

"Mad Men" coming to Comcast's On Demand Online trial - Speaking of the Comcast trial, I was thrilled to hear from David Evans, SVP of Broadband at Rainbow Media (owners of AMC, the network behind Mad Men) at yesterday's CTAM Teleseminar that the show will be included in Comcast's trial and presumably in rollout. David is very bullish on online distribution and the larger TV Everywhere concept, though cautioned that there are many rights-related issues still hanging out there. I'm a huge Mad Men fan (whose new season starts on Aug 16th) and the idea that I don't have to worry about recording each episode or managing space on my DVR, and that I can watch remotely when I'm on the road, all underscore TV Everywhere's value.

Categories: Cable Networks, Cable TV Operators

Topics: Amazon, AMC, Apple, Comcast, Disney, iPhone, MLB, Rainbow Media, YouTube, Zappos

-

VideoNuze Report Podcast #24 - July 24, 2009

After several weeks of holidays and vacations, Daisy Whitney and I are back on track this week with our 24th podcast of the year, for July 24, 2009.

This week Daisy and I dig into YouTube from two different angles. Daisy picks up on a piece she wrote that explains the success YouTube is having attracting brands to set up their own channels within the site. These channels can cost up to $200K or more per year. However, there are lots of less expensive ways to work with YouTube, and as Daisy explains, with video helping drive purchase intent, it's a prerequisite that every brand should now have some type of a video presence there.

Despite this, as I wrote earlier this week in "Google is Being Clumsy in Explaining YouTube's Performance," I think YouTube's progress isn't being messaged very well to the market. In its recent Q2 earnings call, a supplementary analyst call and a blog post earlier this week, Google executives sent confusing and sometimes unsupported messages about how far along they are in figuring out to monetize YouTube's premium content-oriented traffic. Given YouTube's bellwether status in the industry, it is being closely watched by many for signs of success or failure.

Click here to listen to the podcast (14 minutes, 6 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Aggregators, Brand Marketing, Podcasts

-

Google is Being Clumsy in Explaining YouTube's Performance

Yesterday's "YouTube myth busting" post on its YouTube Biz Blog had the opposite of its intended effect: rather than providing more transparency about YouTube's performance as it hoped to do, it only set off

another round of frustrated posts in the blogosphere imploring Google to release actual YouTube numbers.

another round of frustrated posts in the blogosphere imploring Google to release actual YouTube numbers. The post came on the heels of last week's Q2 '09 earnings call and supplementary briefing call (transcripts here and here) which were full of optimistic, yet confusing comments about YouTube's "trajectory" from a handful of Google's senior executives.

Here's what CFO Patrick Pichette said on the supplementary call: "I think that it is true that we are pleased with YouTube's trajectory. And in part the reason why we're communicating it to the Street is there's been so much press over the last quarter with all of these documentations of, you know, massive cost and no business models and all kind of negative press that we've read a lot about. And we just wanted to kind of reaffirm to the Street that this is a very credible business model and it's one that's got trajectory. So in that sense it's just to kind of tell everybody that we're on progress on the plan that we had made for it."

But what plan is he referring to? In almost 3 years of owning YouTube, Google has never publicly disclosed a specific plan for YouTube or laid out its business model, so attempts at reaffirming it fall flat because there's nothing against which progress can be judged. Here are other comments, with my reactions in parentheses.

Pichette on the earnings call: "We are really pleased both in terms of its (YouTube's) revenue growth, which is really material to YouTube and in the not long, too long distance future, we actually see a very profitable and good business for us, so from that perspective, we are really pleased with the trajectory." (WR: that sounds pretty bullish)

Jonathan Rosenberg, SVP of Product Management on the earnings call: "I think what I said - or what I meant to say was that monetizable views have tripled in the last year and that we are monetizing billions of views every month." (WR: that sounds bullish too, but wouldn't some actual numbers really bolster this point?)

Rosenberg on the supplementary call: "And that's part of why I think it's taken us time to kind of triangulate toward what works, and I think some of the things that we have now are still in the pretty nascent stages..." (WR: nonetheless, per earlier comment, profitability can already be forecast in the not too distant future?)

Nikesh Arora, President of Global Sales Operations and Business Development on the earnings call: "So we are seeing significant sell-through in most of our major markets where we have YouTube homepage for sale." (WR: of what ad unit - pre-rolls or display?)

Arora on the earnings call: "So I think the next phase of YouTube is going to be toward pre-roll video on short clips and long form video (which we are in the process of doing) various deals in, which we've announced in the past." (WR: that's new news, YouTube's spoken primarily of overlays in the past)

Rosenberg on the supplementary call: "I would not say our overall optimism that we expressed with respect to YouTube is primarily a function of one specific format. We've actually been testing pre-rolls, I think, for quite a while. So if you interpret that one single comment to pre-rolls to imply the broad conclusion with respect to optimism on YouTube, I think that's probably a mistake." (WR: so maybe pre-rolls aren't actually the next big thing?)

Yesterday's post: "Myth 5 YouTube is only monetizing 3-5% of the site. This oft-cited statistic is old and wrong, and continues to raise much speculation." (WR: what is the percentage then?)

CEO Eric Schmidt on the earnings call: "The majority of YouTube views are not professional content. They are user generated content because that's the majority of what people are watching." In response to whether YouTube is able to monetize user-generated content: "Has not been our focus." (WR: again, letting us know what percentage is professional and the focus of monetization would be very helpful)

These comments raise lots of questions about how far along Google actually is in understanding YouTube's traffic and its ability/plan to monetize it. I think Google is being clumsy in explaining YouTube's performance because it got nervous about the eye-popping estimates that have been floating around lately about how much money YouTube is losing and rushed to try to mitigate this perception, but without being ready to present real numbers as backup. Further, I don't think it rehearsed its executives very well about what to say or how to say it, so the improvised comments did not convey a clear consistent message.

As someone who believes YouTube has enormous long-term value for Google, my advice is that its executives should just stay mum on YouTube until they're ready to make a logical case backed by facts and data. That may take longer than Google or the market hoped, allowing the rumor mill to continue to churn. But continuing to make unsupported statements will only rile YouTube followers further, and eventually sap Google's credibility.

What do you think? Post a comment now.

Categories: Aggregators, UGC

-

Catching Up on Last Week's Industry News

I'm back in the saddle after an amazing 10 day trip to Israel with my family. On the assumption that I wasn't the only one who's been out of the office around the recent July 4th holiday, I've collected a batch of industry news links below so you can quickly get caught up (caveat, I'm sure I've missed some). Daily publication of VideoNuze begins again today.

Hulu plans September bow in U.K.

Rise of Web Video, Beyond 2-Minute Clips

Nielsen Online: Kids Flocking to the Web

Amid Upfronts, Brands Experiment Online

Clippz Launches Mobile Channel for White House Videos

Prepare Yourself for iPod Video

Study: Web Video "Protail" As Entertaining As TV

In-Stat: 15% of Video Downloads are Legal

Kazaa still kicking, bringing HD video to the Pre?

Office Depot's Circuitous Route: Takes "Circular" Online, Launches "Specials" on Hulu

Upload Videos From Your iPhone to Facebook Right Now with VideoUp

Some Claims in YouTube lawsuit dismissed

Concurrent, Clearleap Team on VOD, Advanced Ads

Generating CG Video Submissions

MJ Funeral Drives Live Video Views Online

Why Hulu Succeeded as Other Video Sites Failed

Invodo Secures Series B Funding

Comcast, USOC Eye Dedicated Olympic Service in 2010

Consumer Groups Push FTC For Broader Broadband Oversight

Crackle to Roll Out "Peacock" Promotion

Earlier Tests Hot Trend with "Kideos" Launch

Mobile entertainment seeking players, payment

Netflix Streams Into Sony Bravia HDTVs

Akamai Announces First Quarter 2009 State of the Internet Report

Starz to Join Comcast's On-Demand Online Test

For ManiaTV, a Second Attempt to be the Next Viacom

Feeling Tweety in "Web Side Story"

Most Online Videos Found Via Blogs, Industry Report

Categories: Advertising, Aggregators, Broadcasters, Cable Networks, Cable TV Operators, CDNs, Deals & Financings, Devices, Indie Video, International, Mobile Video, Technology, UGC

Topics: ABC, C, Clearleap, Clippz, Comcast, Concurrent, Hulu, In-Stat, Invodo, iPod, Kazaa, Nielsen, Office Depot, Qik, VideoUp, YouTube

-

Rhett and Link Are Another Example of YouTube's Franchise Value

If you haven't heard of Rhett and Link, you need to check them out to understand another of the myriad ways that video is being democratized, advertising is being reimagined and value is being built in YouTube. My wife brought Rhett and Link to my attention after hearing a report about them on National Public Radio last night.

Rhett and Link are two engineers and lifelong friends who operate out of a North Carolina basement writing and performing short comedic songs. Emboldened by family and friends they've created over 200 videos that have generated 16 million views and a loyal following on YouTube and their own site rhettandlink.com. No doubt you'll agree their songs and videos are funny, clever and very memorable.

Calling themselves "internetainers" and having generated a signature style, they are now being contracted by advertisers to turn their talent toward developing promotion songs. Their folk song drive-through order for Taco Bell has generated almost 1 million views on YouTube. And their hilarious spot for Red House furniture store in Highpoint, NC, which spoofs race relations, has generated almost 1.5 million views. There will certainly be more of these promotional songs in the hopper. That's because given what these advertisers are probably paying for these spots, their ROIs must be off the charts, especially compared to traditional advertising tactics. And with Rhett and Link's following, all new promotional songs now have a built in viral tailwind.

Rhett and Link remind me of Lee and Sachi LeFever of Common Craft, who I recently wrote about. They are all part of an emerging group of talent who would be considered "non-professionals" by the traditional standards of entertainment, advertising and communications. But with their own authentic and engaging approaches and direct access to audiences, they have been able to break through and attract large followings.

A key linchpin to all of their success is YouTube, whose massive audience and viral sharing is unmatched. Even as it strives for partnerships with premium quality video providers, YouTube's value to the Common Crafts and Rhett and Links of the world is undeniable. If leveraged properly, as it has been by these creators (and by others like Demand Media), it can also lead to genuine businesses opportunities.

When I repeatedly say that YouTube has massive franchise value - even though it is currently unprofitable - it's these kinds of examples, which put YouTube in the center of an emerging grassroots video ecosystem, that I'm thinking of. There's no other site that comes close to YouTube's reach, brand awareness or viral sharing potential.

If you have other examples along these lines, please send them along!

What do you think? Post a comment now.

Categories: Advertising, Indie Video

Topics: Common Craft, Rhett and Link, YouTube

-

4 Industry Items from this Week Worth Noting

YouTube mobile video uploads exploding; iPhones are a key contributor - The folks at YouTube revealed that in the last 6 months, uploads from mobile phones to YouTube have jumped 1,700%, while in the last week, since the new iPhone GS was released, uploads increased by 400% per day. I didn't have access to these stats when I wrote on Monday "iPhone 3GS Poised to Drive User-Generated Mobile Video," but I was glad to see some validation. The iPhone 3GS - and other smartphone devices - will further solidify YouTube as the world's central video hub. I stirred some controversy last week with my "Does It Actually Matter How Much Money YouTube is Losing?" post, yet I think the mobile video upload explosion reinforces the power of the YouTube franchise. Google will figure out how to monetize this over time; meanwhile YouTube's pervasiveness in society continues to grow.

Nielsen study debunks mythology around teens' media usage - Nielsen released a new report this week "How Teens Use Media" which tries to correct misperceptions about teens' use of online and offline media. The report is available here. On the one hand, the report underscores prior research from Nielsen, but on the other it reveals some surprising data. For example, more than a quarter of teens read a daily newspaper? Also, 77% of teens use just one form of media at one time (note, data from 2007)? I'm not questioning the Nielsen numbers, but they do seem out of synch with everything I hear from parents of teens.

Paid business models resurfacing - There's been a lot of talk from media executives about the revival of paid business models in the wake of the recession's ad spending slowdown and also the newspaper industry's financial calamity. For those who have been offering their content for free for so long, putting the genie back in the bottle is going to be tough. Conversely for others, like those in the cable TV industry, who have resisted releasing much content for free, their durable paid models now look even more attractive.

Broadcast TV networks diverge on strategy - Ad Age had a good piece this week on the divergence of strategy between NBC and CBS. The former is breaking industry norms by putting Leno on at 10pm, emphasizing cable and avidly pursuing new technologies. Meanwhile CBS is focused on traditional broadcast network objectives like launching hit shows and amassing audience (though to be fair it is pursuing online distribution as well with TV.com). Both strategies make sense in the context of their respective ratings' situations. Regardless, broadcasters need to eventually figure out how to successfully transition to online distribution, something that is still unproven (as I wrote here).

Categories: Aggregators, Broadcasters, Mobile Video, UGC

Topics: Apple, CBS, iPhone, NBC, Nielsen, YouTube

-

VideoNuze Report Podcast #21 - June 19, 2009

Below is the 21st edition of the VideoNuze Report podcast, for June 19, 2009.

Daisy discusses highlights from the OMMA Video conference that she organized in NYC this week. Daisy recaps the keynote from Eileen Naughton, Google's director of media platforms in which she said that child YouTube sensation "Fred" is pulling down a six-figure income. She also reviews comments by Andy Markovitz, Kraft's digital marketing and media director who recommended the online video ad industry needs more scale, better targeting and more format choices. Those sentiments were echoed by other speakers. Daisy has more details here.

This week I discuss my post from yesterday, "Does It Actually Matter How Much Money YouTube is Losing?" I recognize I took a somewhat contrarian standpoint here, and admit it feels a bit irresponsible to suggest that YouTube's losses don't matter much (except to Google of course). It's always been great sport to debate how much money YouTube is losing. But the fact is, as long as Google has the financial wherewithal to sustain YouTube's losses (whatever they actually are), and deems the site strategic in the long run (which I strongly believe it is), then the size of its losses is really pretty much irrelevant. I know lots of you disagree with my assessment; feel free to post a comment and explain why!

Click here to listen to the podcast (15 minutes, 40 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Aggregators, Podcasts

Topics: Google, Podcast, YouTube

-

Does It Actually Matter How Much Money YouTube is Losing?

Guestimating how much money YouTube loses has been heavily debated since the company first burst on the scene. And even though YouTube has been part of Google for close to three years now, there are no signs the debate is letting up.

For example, this past April, Credit Suisse analyst Spencer Wang got a lot of attention asserting YouTube might lose $470M in 2009. Using these numbers, Fliqz CEO Benjamin Wayne generated a lot of buzz for his Business Insider post "YouTube is Doomed." Then earlier this week, in a much-noticed white paper, the IT outsourcing firm RampRate said the company's annual loss is closer to $174M, given a more accurate analysis of YouTube's true bandwidth costs.

No doubt the debate will continue to rage on. But does it really matter how much money YouTube is losing? I'd argue the answer is mainly no, with two caveats: first, that Google has the financial wherewithal to sustain YouTube's losses (whatever they may be), and second, that Google believes in YouTube's long-term strategic value.

With respect to Google's financial wherewithal, I think it's pretty much indisputable that Google can afford YouTube's losses, even if they exceeded Credit Suisse's estimate. In 2008 Google generated almost $8B in cash flow from operations, 36% more than in 2007. It currently has over $17B in cash. Its stock has bounced back from its $257/share low in the dark days of Dec. '08 to $415/share as of yesterday, translating to a market cap of over $130 billion and a P/E just north of 30. To be sure, Google is still a one-trick pony, relying on advertising alone to power its business model. But that pony has proven itself durable in the down economy and in the face of competitors, and the market has justifiably rewarded Google. If anyone thinks Google is being penalized for YouTube's estimated losses, I ask, where's the evidence?

Google's financial prowess gives it license to do what very few public companies are able to do: focus on the long-term. And that brings us to the second caveat, Google's belief in YouTube's long-term strategic value. Of course, none of us is privy to exactly what Google's executives believe on this front, but for my part, there's ample reason Google should be bullish, notwithstanding YouTube's current financial challenges.

First, and most important, YouTube maintains a dominant 40%+ share of online video viewership month in and month out, according to comScore. As I said in this recent post, YouTube has the best-known brand-name, deepest catalog, and best promotional reach of any online video site. In UGC it is in a rare "winner-take-all" position (even deep-pocketed Microsoft this week threw in the towel on Soapbox, its YouTube competitor). It would be unthinkable for anyone looking to upload video to not upload to YouTube, which is why the site gets an incredible 20 hours of video uploaded every minute.

What are these all worth in a market growing as fast as online video, where significant business model disruption lies ahead? A lot. YouTube would be the first partner of choice for any number of consumer and technology heavyweights now starting to slug it out for market share in the broadband era. Meanwhile, YouTube is well-entrenched in the cultural zeitgeist. It is the go to resource for presidential candidates, community organizers and lately, Iranian election protesters.

Sure, YouTube has its challenges. Hulu is crowding it out for access to premium content. UGC is a monetization drag (though a significant traffic driver). It doesn't have a bona fide or clearly articulated convergence strategy, as its recent YouTube XL initiative underscored. And it hasn't settled on an ad format that works. Regardless, YouTube has massive long-term strategic value. As long as Google recognizes this and has the financials to support it, then even in these recessionary times, how much money YouTube loses is largely irrelevant.

What do you think? Post a comment now.

Categories: Aggregators

Topics: Credit Suisse, Google, RampRate, YouTube

-

VideoNuze Report Podcast #19 - June 5, 2009

Below is the 19th edition of the VideoNuze Report podcast, for June 5, 2009.

Daisy was in New York this week for the "NewFronts," a day-long meeting that Digitas sponsored, mainly for independent online video creators and media buyers/agencies. The goals were to educate the market and fuel advertiser interest. Daisy reports that despite the mixed news coming out of the independent video world this year, it was an upbeat gathering.

I provide additional detail on Microsoft's announcement this year of new entertainment-oriented features for XBox 360. The gaming console continues to take on more of a convergence positioning, with new instant-on 1080p video, live streams, Zune integration, etc. With an installed base of 30 million users, Microsoft has a prime opportunity to drive convergence and get a video foothold. The new Xbox 360 features coincide with last week's Hulu Desktop announcement and this week's YouTube XL unveiling.

Click here to listen to the podcast (14 minutes, 47 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Aggregators, Devices, Indie Video, Podcasts

Topics: Digitas, Hulu, Microsoft, NewFronts, Podcast, XBox, YouTube

-

YouTube XL Reflects Google's Browser-Centric Worldview

YouTube's announcement this week of "YouTube XL," an optimized version of its site meant for viewing on larger screens caught my attention as it appeared to be another building block in broadband-to-the-TV convergence. I spoke with Chris Dale, a YouTube spokesman to learn more.

On the one hand YouTube XL is a great offering for early adopters who have connected their computers directly to their TVs. XL offers large, easy-to-use navigation that scales depending on the size of your display and HD video quality. And Chris added that given Chrome and Android compatibility, XL creates some very cool functionality. Some video isn't yet rights-cleared, that will likely change over time. XL builds on the "YouTube for Television" initiative introduced in January for Sony PS3 and Nintendo Wii.

On the other hand, long-term, XL is a limited-appeal offering, because it reflects Google's browser-centric worldview. As Chris explained, from CEO Eric Schmidt on down, there's a conviction that the "browser as the platform" is going to dominate entertainment and information distribution. This is certainly the way the online world works today, as practically all of broadband-delivered video is consumed within a browser context. (In fact, this is one of the things that made last week's Hulu Desktop announcement so noteworthy, a large aggregator introducing an app that breaks the browser-only paradigm.)

The problem is that historically at least, the non-online, TV world hasn't been browser-based. Instead, various set top boxes (whether from cable/satellite/telco or from newer convergence players) rely on their own applications to present and manage video. Given this disconnect, new convergence devices and services will instead need to rely on YouTube APIs if they want to access YouTube's vast trove of content, unless they start building in browsers. This is how AppleTV, Sony Bravia, TiVo and others have worked with YouTube in the past. My concern is how much investment attention will convergence-oriented APIs be getting from YouTube when the company's emphasis is clearly on the browser.

Back in March '08, I wrote, "YouTube: Over-the-Top's Best Friend" in which I asserted that for emerging convergence devices and video service providers, YouTube would be the perfect partner. It has the best-known video brand, the largest catalog and the best promotional reach. I still believe that. YouTube could be a formidable disruptive force in over the top if it had a strategy to do so. With its browser focus though, it's hard to see that happening.

In these tough economic times, I don't blame YouTube, or others, from prioritizing. However, my sense is that by taking a more passive approach to convergence, YouTube is opening the door a little wider for others like Netflix who are more aggressively pursuing convergence opportunities, as well as incumbents like Comcast and Time Warner Cable who are just getting going on bridging broadband video to their set-top boxes. As the clear online video market share leader, YouTube has a pretty golden opportunity to aggressively chart new ground and cause likely market disruption. That it's choosing not to means others have a little less pressure on them.

What do you think? Post a comment now.

Categories: Aggregators, Devices

-

May '09 VideoNuze Recap - 3 Key Themes

Following are 3 key themes from VideoNuze in May:

1. Hulu Moves to Center Stage

Already on a roll, Hulu gained lots of mind share in May. After YouTube it is clearly the most-buzzed about video site - not a bad accomplishment for a site that just celebrated its one year anniversary.

The month began with the announcement that Disney would invest in Hulu, at last making available ABC and other programs in Hulu's ever-growing portal. Hulu gained stature during the month as the statistic from comScore released in late April - that Hulu was now the #3 most-popular video site, with 380 million video views in March - was repeatedly recirculated. (Hulu was separately disputing data released from Nielsen showing a far-smaller audience.)

In addition to the Disney content, Hulu also announced its first live event, tonight's concert from the Dave Matthews Band. Capping the month was last week's Hulu Labs announcement, showcasing the desktop app that moves Hulu one step closer to being TV-ready.

Hulu's growth and top-notch user experience continue to set the pace in the online video world. Still, as I noted in my post about the Disney deal, what's still unproven is the Hulu business model and how it plans to navigate the convergence of broadband and TV. The spin coming from its owners is that financial progress is being made, yet Hulu's per program viewed revenues continue to be a fraction of those derived from on-air viewership. Sooner than later, I predict the Hulu growth story is going to start to give way to the Hulu financial story, which may yet include subscriptions.

2. Susan Boyle Shows Power and Conundrum of Viral Video

It was hard to miss the Susan Boyle phenomenon in May. As of last Thursday (before the finale of "Britain's Got Talent" in which she placed second) her original video had generated over 235 million views, according to tracking firm Visible Measures. Ms. Boyle's sensational performance has mainstreamed the term "viral video." The idea that you can become a worldwide personality is truly a broadband-only invention.

Yet 3 1/2 years after SNL's "Lazy Sunday" video became the first bona fide big media YouTube hit (despite NBC's efforts), the process for copyright holders and distributors to monetize these viral wonders remains immature. The NY Times described the interplay over the Boyle viral videos between YouTube, Fremantle, ITV and others, and why those hundreds of millions of views are still under-monetized. But with broadband distribution's increasing importance, this won't last; viral monetization rights are inevitably going to become a key part of the upfront negotiating mix.

3. Mobile video growth

Mobile video continued to get a lot of attention from content providers, service providers and handset makers in May, with initiatives from NBC, NBA, E!, Samsung, Sling, among others (a full listing of mobile video news is here). The mobile video ecosystem is responding to data indicating surging consumer acceptance, primarily driven by the iPhone. In May Nielsen released a report indicating mobile user growth from Feb '07 to Feb '09 was 74%, and that iPhone users are 6 times more likely to consume mobile video. The crush of new smartphones coming in the 2nd half of '09 promises that mobile video usage is going to continue growing rapidly. Limelight's acquisition of mobile ad insertion company Kiptronic is likely the tip of the deal iceberg as companies position themselves for mobile.

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Mobile Video, Video Sharing

Topics: Disney, Hulu, iPhone, Kiptronic, Limelight, NBC, YouTube