-

Recapping CES '09 Broadband Video-Related Announcements

CES '09 is now behind us. As has become typical, this year's show saw numerous broadband video product and technology announcements. As I wrote often last week, the key theme was broadband-enabled TVs. Assuming TV manufacturers deliver on their promises, Christmas '09 should mark the start of real growth in the installed base of connected TVs.

Here are the noteworthy announcements that I caught, in no particular order (I'm sure I've missed some; if so please add a comment and include the appropriate link):

Intel and Adobe to Extend Flash Platform to TVs

Adobe and Broadcom Bring the Adobe Flash Platform to TVs

Samsung and Yahoo Bring the Best of the Web to Television

Yahoo Brings the Cinematic Internet to Life and Revolutionizes Internet-Connected Television

LG Electronics First to Unveil "Broadband HDTVs" That Instantly Stream Movies From Netflix

LG Electronics Launches Broadband HDTVs with "Netcast Entertainment Access"

Sony Debuts Integrated Networked Televisions

Vizio Announces New and Exciting "Connected HDTV" Platform with Wireless Connectivity

Netflix Announces Partnership with Vizio to Instantly Stream Movies to New High Definition TVs

MySpace Partnerships Bring Web Site to TV Set

Macrovision to Bring Instant Access to Digital Content Directly to Internet-Connected Televisions

Cisco Brings Manufacturers Together to Make Connected Home Products Simple to Set-up and Easy to Use

blip.tv and ActiveVideo Networks Sign Deal to Bring Original Online Shows Directly to Television

Hillcrest Labs and Texas Instruments Showcase RF4CE Remote Controls with Freespace Technology

Categories: Aggregators, Devices

Topics: Ac, Adobe, Amazon, Broadcom, Intel, LG, Macrovision, Move Networks, MySpace, Netflix, Netgear, Roku, Samsung, Sony, Vizio, Yahoo

-

Where Does Advertising Fit In with Broadband-Enabled TVs?

If you haven't noticed, the theme at VideoNuze this week has been broadband-enabled TVs, since this has been one of the main themes of this week's CES. On Monday, when the dust has settled, I'll recap some of the key deals. For today though, I want to inject a small dose of reality into the hype that's starting to build up around broadband-enabled TVs.

First off, I'm thrilled to see an ecosystem of technology leaders, TV set manufacturers, content providers and aggregators taking shape around broadband-enabled TVs. It's looking increasingly inevitable that broadband access is going to be a staple feature of HDTVs in the years to come. Just as you wouldn't consider buying an HDTV without multiple HDMI ports today, at some point in the future you'll be unlikely to buy one without broadband capability. That's pretty cool.

Still, what's missing from the flurry of this week's announcements is how the exciting new broadband path to the TV will actually be monetized by video content providers. I know that mundane questions like this aren't what people tend to focus on at glitzy CES, but they are critical nonetheless. With services like Netflix or Amazon VOD - which have been in the middle of several announcements - it's obvious enough how they'll benefit. The more pertinent question is how video that is ad-supported is going to work, especially since ad-supported video will always represent the lion's share of the average consumer's viewership time.

The broadband video ad model itself is still nascent, and this week's J.P. Morgan report shows that there's no shortage of lingering skepticism still overhanging it. Nonetheless, I'd argue we're at least at a point now where most market participants have a pretty good handle on broadband video advertising's basics - serving technologies/vendors, formats, expected delivery quality, CPMs, user preferences, click-throughs, etc. In short, I believe the foundation is pretty well in place for a strong ramp up of spending (notwithstanding the larger economic issues) as the broadband video world exists today.

But how much of that foundation will still be valid for broadband-enabled TVs vs. how much will need to be re-built (as is the case with mobile video)? Many of the answers are driven by the chips from Intel, Broadcom and others that are going into these TVs. Understanding their respective capabilities and how they'll support broadband video advertising's existing ecosystem is key.

Here's why: in the broadband world to date, the computer's vast processing capabilities (along with the supporting cast of browser, media players, plug-ins, cookies and of course robust broadband access) has played an incredibly important, yet largely unsung role in raising the user experience bar to a point where broadband video has been massively adopted. Of course, this massive adoption has been THE key ingredient for the broadband video ad model to take off. And client-side capabilities only become more important in the highly syndicated broadband video world that I envision in the future. Ad servers need to know which site is playing the video so the right ad is dynamically served and everyone gets compensated properly. The new broadband TV chips need to support all of this and more.

One needs look no further than cable's VOD experience to date to recognize how important the building blocks for an effective advertising model are. While billions of VOD streams are now consumed, very little of it is monetized due to still-inadequate ad capabilities. Years after VOD's launch, these monetization constraints are curtail content providers' interest in participating in VOD. In fact, I'd argue that broadband has actually been a beneficiary of VOD's deficiencies: faced with a choice of where to allocate resources, many content providers have shifted attention to broadband because its monetization mechanisms are so robust.

Anyway, you get the point. Broadband-enabled TVs are very exciting. But to reach their potential, they must deliver a robust user experience and allow advertising to work effectively. In these penny-pinching, resource-constrained times, something that's cool is no longer enough to gain interest. People need to understand how they'll make money from it.

What do you think? Post a comment now.

Categories: Advertising, Devices

Topics: Amazon, Broadcom, Intel, J.P. Morgan, Netflix

-

Amazon VOD Now On Roku; Battle with Apple Looms Ahead

Amazon and Roku announced yesterday that Amazon's VOD service will soon be available on Roku's $99 Digital Video Player. The deal starts to make good on Roku CEO Anthony Woods's intentions about "opening up the platform to anyone who wants to put their video service on this box."

With Amazon VOD's 40,000+ TV programs and movies added to the 12,000 titles already available to Netflix subscribers via its Watch Instantly service (plus more content deals yet to come), little Roku is starting to look like a potentially important link in the evolving "over-the-top" video distribution value chain.

More interesting though, is that I think we're starting to see the battle lines drawn for supremacy in the download-to-own/download-to-rent premium video category between Amazon on one side and Apple on the other. Though Apple dominates this market today, having sold 200 million TV programs alone, there are ample reasons to believe competition is going to stiffen.

Apple is of course in the video download business for the same reasons it was in the music download business: to drive sales of the iPod and more recently - and to a lesser extent - the iPhone. According to the latest info I could find, iTunes now has 32,000+ TV programs and movies, including a growing number in

HD. For now that's slightly less than Amazon VOD, but my guess is that over time the two libraries will be virtually identical.

HD. For now that's slightly less than Amazon VOD, but my guess is that over time the two libraries will be virtually identical. While Apple has a near monopoly on portable viewing via the iPod and iPhone, it is a laggard in bridging broadband-to-the-TV. Its Apple TV device, introduced in January, 2007, and meant to give iTunes access on the TV, has been an underperformer. Certainly a detractor has been price, with the 40GB lower-end model still running $229. But more importantly, as an iTunes-only box, Apple TV perpetuates a closed, "walled-garden" paradigm that consumers are increasingly rejecting (as companies like Roku astutely understand).

For Amazon, the world's largest online retailer, video downloads are a rich growth market. The company brings significant advantages to the table, starting with tens of millions of existing customer relationships with credit cards or other payment options just waiting to be charged for video downloads. Amazon has strong brand name recognition and trust. And of course, it has a near-limitless ability to cross-promote downloads with DVDs and other products.

Determined not to be left behind in the great race to get broadband delivered video all the way to the TV, it has been integrating its VOD service with 3rd party devices like TiVo, Sony's Bravia Internet Video Link, Xbox 360 and Windows Media Center PCs. Its latest deal with Roku is far from its last.

Amazon VOD's adoption will benefit from the fact that there are many non-Amazon reasons that people will be buying these devices. For example, consider Roku, TiVo and Xbox 360. With Roku, Netflix is fueling sales. As Netflix subscribers realize that new releases are generally not available in Watch Instantly, but are through Amazon VOD on Roku, they'll be prone to give Amazon VOD a try (the Netflix limitation is course due to Hollywood's windowing, and another reason why I believe it's crucial for Netflix to make deals with broadcast networks for online distribution of their hit programs). For TiVo and Xbox 360, each has a well-defined value proposition for consumers to purchase. Amazon VOD's availability is a pure bonus for buyers.

Amazon VOD's adoption will benefit from the fact that there are many non-Amazon reasons that people will be buying these devices. For example, consider Roku, TiVo and Xbox 360. With Roku, Netflix is fueling sales. As Netflix subscribers realize that new releases are generally not available in Watch Instantly, but are through Amazon VOD on Roku, they'll be prone to give Amazon VOD a try (the Netflix limitation is course due to Hollywood's windowing, and another reason why I believe it's crucial for Netflix to make deals with broadcast networks for online distribution of their hit programs). For TiVo and Xbox 360, each has a well-defined value proposition for consumers to purchase. Amazon VOD's availability is a pure bonus for buyers.Still, Amazon VOD's Achilles heel that it is missing a portable playback companion on a par with the iPod and iPhone. Users clearly value portability and Amazon needs to solve this problem (hmm, can you say "Kindle for Video?"). Yet another issue is that despite its various 3rd party device deals, the user experience will always be governed by these devices' strengths and weaknesses. In this respect, Apple's ownership of the whole hardware/software/services ecosystem gives it significant user experience advantages (which of course it has masterfully exploited with iTunes/iPod).

Apple and Amazon hardly have the market to themselves though. Others like Microsoft Xbox LIVE, Vudu and Sezmi are vying for a place in the market. And then of course there are the VOD offerings from the cable/satellite/telco video service providers, who have big-time incumbency advantages. Not to be forgotten in all of this is consumer inertia around the robust DVD market, which to a large extent all of these video download options seek to supplant.

In the middle of all this are Joe and Jane Consumer - soon to be overwhelmed by a barrage of competing and confusing offers for how to get on-demand TV program and movie downloads in better, faster and cheaper ways. In this market, I believe simplicity, content choices, brand and especially price will determine the eventual winners and losers. These are front and center considerations for Amazon, Apple and all the others going forward.

What do you think? Post a comment now.

Categories: Aggregators, Devices, Downloads, FIlms, HD

Topics: Amazon, Apple, iTunes, Roku, SezMi, TiVo, VUDU, XBox

-

Reviewing My 6 Predictions for 2008

Back on December 16, 2007, I offered up 6 predictions for 2008. As the year winds down, it's fair to review them and see how my crystal ball performed. But before I do, a quick editorial note: each day next week I'm going to offer one of five predictions for the broadband video market in 2009. (You may detect the predictions getting increasingly bolder...that's by design to keep you coming back!)

Now a review of my '08 predictions:

1. Advertising business model gains further momentum

I saw '08 as a year in which the broadband ad model continued growing in importance as the paid model remained in the back seat, at least for now. I think that's pretty much been borne out. We've seen countless new video-oriented sites launch in '08. To be sure many of them are now scrambling to stay afloat in the current ad-crunched environment, and there will no doubt be a shakeout among these sites in '09. However, the basic premise, that users mainly expect free video, and that this is the way to grow adoption, is mostly conventional wisdom now.

The exception on the paid front continues to be iTunes, which announced in October that it has sold 200 million TV episode downloads to date. At $1.99 apiece, that would imply iTunes TV program downloads exceed all ad-supported video sites to date. The problem of course is once you get past iTunes things fall off quickly. Other entrants like Xbox Live, Amazon and Netflix are all making progress with paid approaches, but still the market is held back by at least 3 challenges: lack of mass broadband-to-the-TV connectivity, a robust incumbent DVD model, and limited online delivery rights. That means advertising is likely to dominate again in '09.

2. Brand marketers jump on broadband bandwagon

I expected that '08 would see more brands pursue direct-to-consumer broadband-centric campaigns. Sure enough, the year brought a variety of initiatives from a diverse range of companies like Shell, Nike, Ritz-Carlton, Lifestyles Condoms, Hellman's and many others.

What I didn't foresee was the more important emphasis that many brands would place on user-generated video contests. In '08 there were such contests from Baby Ruth, Dove, McDonald's, Klondike and many others. Coming up in early '09 is Doritos' splashy $1 million UGV Super Bowl contest, certain to put even more emphasis on these contests. I see no letup in '09.

3. Beijing Summer Olympics are a broadband blowout

I was very bullish on the opportunity for the '08 Summer Games to redefine how broadband coverage can add value to live sporting events. Anyone who experienced any of the Olympics online can certainly attest to the convenience broadband enabled (especially given the huge time zone difference to the U.S.), but without sacrificing any video quality. The staggering numbers certainly attested to their popularity.

Still, some analysts were chagrined by how little revenue the Olympics likely brought in for NBC. While I'm always in favor of optimizing revenues, I tried to take the longer view as I wrote here and here. The Olympics were a breakthrough technical and operational accomplishment which exposed millions of users to broadband's benefits. For now, that's sufficient reward.

4. 2008 is the "Year of the broadband presidential election"

With the '08 election already in full swing last December (remember the heated primaries?), broadband was already making its presence known. It only continued as the year and the election drama wore on. As I recently summarized, broadband was felt in many ways in this election cycle. President-elect Obama seems committed to continuing broadband's role with his weekly YouTube updates and behind-the-scenes clips. Still, as important as video was in the election, more important was the Internet's social media capabilities being harnessed for organizing and fundraising. Obama has set a high bar for future candidates to meet.

5. WGA Strike fuels broadband video proliferation

Here's one I overstated. Last December, I thought the WGA strike would accelerate interest in broadband as an alternative to traditional outlets. While it's fair to include initiatives like Joss Wheedon's Dr. Horrible and Strike.TV as directly resulting from the strike, the reality is that I believe there was very little embrace of broadband that can be traced directly to the strike (if I'm missing something here, please correct me). To be sure, lots of talent is dipping its toes into the broadband waters, but I think that's more attributable to the larger climate of interest, not the WGA strike specifically.

6. Broadband consumption remains on computers, but HD delivery proliferates

I suggested that "99.9% of users who start the year watching broadband video on their computers will end the year no closer to watching broadband video on their TVs." My guess is that's turned out to be right. If you totaled up all the Rokus, AppleTVs, Vudus, Xbox's accessing video and other broadband-to-the-TV devices, that would equal less than .1% of the 147 million U.S. Internet users who comScore says watched video online in October.

However, there are some positive signs of progress for '09. I've been particularly bullish on Netflix's recent moves (particularly with Xbox) and expect some other good efforts coming as well. It's unlikely that '09 will end with even 5% of the addressable broadband universe watching on their TVs, but even that would be a good start.

Meanwhile, HD had a banner year. Everyone from iTunes to Hulu to Xbox to many others embraced online HD delivery. As I mentioned here, there are times when I really do catch myself saying, "it's hard to believe this level of video quality is now available online." For sure HD will be more widely embraced in '09 and quality will get even better.

OK, that's it for '08. On Monday the focus turns to what to expect in '09.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Brand Marketing, Devices, HD, Indie Video, Politics, Predictions, Sports, Technology, UGC

Topics: Amazon, Apple, AppleTV, Barack Obama, Hulu, iTunes, NBC, Netflix, Olympics, Roku, VUDU, XBox

-

Notes from Broadband Video Leadership Breakfast

Yesterday, I hosted and moderated the inaugural Broadband Video Leadership Breakfast, in association with the CTAM New England and New York chapters, here in Boston (a few pics are here). We taped the session and I'll post the link when the video is available. Here are a few of key takeaways.

My opening question to frame the discussion centered on broadband's eventual impact on the cable business model: does it ultimately upend the traditional affiliate fee-driven approach by enabling a raft of "over-the-top" competitors (e.g. Hulu, Netflix, Apple, YouTube, etc.) OR does it complement the model by creating new value and choice? As I said in my initial remarks, I believe that how this question is ultimately resolved will be the key determinant of success for many of the companies involved in today's broadband ecosystem and video industry.

I posed the question first to Peter Stern, who's in the middle of the action as Chief Strategy Officer of Time Warner Cable, the second largest cable company in the U.S. I thought his answer was intriguing: he said that it is cable networks themselves who will determine the sustainability of the model, depending on whether they choose to put their full-length programs online for free or not.

Later in the session, he put a finer point on his argument, saying that "a move to online distribution by cable networks would directly undermine the affiliate fees that are critical to creating great content" and that finding ways to offer these programs only to paying broadband Internet access subscribers was a far better model for today's cable networks and operators to pursue (for more see Todd Spangler's coverage at Multichannel News).

Peter's point echoes my recent "Cord-Cutters" post: to the extent that cable networks - which now attract over 50% of prime-time viewership, and derive a third or more of their total revenues from affiliate fees - withhold their most popular programs from online distribution, they provide a powerful firewall against cord-cutting. Speaking for myself for example, the prospect of missing AMC's "Mad Men" (not available online anywhere, at least not yet...) would be a powerful disincentive for me to yank out my Comcast boxes.

These thoughts were amplified by the other panelists, Deanna Brown, President of SN Digital, David Eun, VP of Content Partnerships for Google/YouTube, Roy Price, Director of Digital Video for Amazon and Fred Seibert, Creative Director and Co-founder of Next New Networks, who held fast to a highly consistent message that broadband should be thought of as expanding the pie, thereby creating a new medium for new kinds of video content. David, in particular cited the massive amount of user-uploaded and consumed video at YouTube (amazingly, about 13 hours of video uploaded every minute of every day) as strong evidence of the community and context that broadband fosters.

Still, our audience Q&A segment revealed some very basic cracks in the panelists' assertions that the transition to the broadband era can be orderly and managed (not to mention that afterwards, I was privately barraged by skeptical attendees). First and foremost these individuals argued the idea that the cable industry can maintain the value of its subscription service by using the control-oriented approach typified by the traditional windowing process flies in the face of valuable lessons learned by the music industry.

Of course most of us know that sorry story well by now: an assortment of entrenched, head-in-the-sand record labels forcing a margin rich, but speciously valued product (namely the full album or CD) on digitally empowered audiences, who decided to take matters into their own hands by stealing every song they could click their mouses on. Consequently, a white knight savior (Apple) offering a legitimate and consumer-friendly purchase alternative (iPod + iTunes), which would grew to be so popular that it has made the record labels beholden to it, while simultaneously hollowing out the last vestiges of the original album-oriented business model.

Does history repeat itself? Are Peter and the other brightest lights of the cable industry deluding themselves into thinking that a closed, high-margin, windowed platform like cable can ever possibly morph itself into a flexible, must-have service for today's YouTube/Facebook generation?

I've been a believer for a while that by virtue of their massive base of broadband-connected homes, high-ARPU customer relationships and programming ties, cable operators have enormous incumbent advantages to win in the broadband era. But incumbency alone does not guarantee success. Instead, what wins the day now is staying in tune with and adapting to drastically changed consumer expectations, and then executing well, day after day. One look at the now gasping-for-breadth behemoth that was once proud General Motors hammers this point home all too well.

As Fred succinctly wrapped things up, "The reason I love capitalism is that it forces all of us to keep doing things better and better." To be sure, broadband and digital delivery are unleashing the most powerful capitalistic forces the video industry has yet seen. What impact these forces ultimately have on today's market participants is a question that only time will answer.

What do you think? Post a comment now!

Categories: Aggregators, Broadband ISPs, Cable Networks, Cable TV Operators, Indie Video

Topics: Amazon, CTAM, Google, Next New Networks, Scripps, SN Digital, Time Warner Cable, YouTube

-

Comcast's Fancast Becomes Hub for Premieres; But Where's Project Infinity?

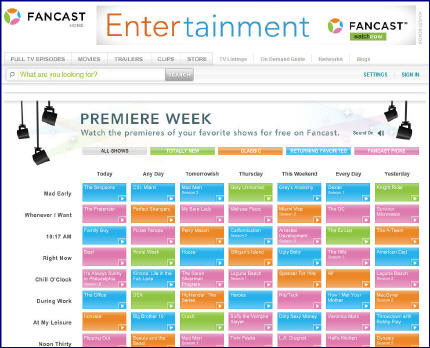

Here's a clever move from Comcast's Fancast broadband portal to create new value for users and generate excitement in the broadband market: this week it is running "Premiere Week," an aggregation of 168 premiere TV episodes. The episodes span series premieres ("Desperate Housewives," "Dexter," "The Office"), season premieres ("Fringe," "Sons of Anarchy," "Crash") and classic pilots ("Dynasty," "The A-Team," "Miami Vice"). It's great fun and a visitor could get lost on the site for hours, as I nearly did.

These are the kinds of promotions that Comcast should be all over. Given its extensive reach and programming muscle, the company has definite - though not insurmountable - advantages over other aggregators to pull this kind of promotion together.

The competition for aggregating premium programming continues to intensify. Business models are all over the board as are approaches for getting video all the way to the TV. For example, last week Amazon launched its pay-per-use VOD initiative which includes a page of info for how to watch using TiVo, Sony Bravia Internet Video Link, Xbox 360, etc. Then yesterday, Netflix announced that it will incorporate about 2,500 of Starz's movies, TV shows and concerts in its Watch Instantly feature, along with a feed of its linear channel. Still other moves are forthcoming.

Comcast's real lever though is unifying its currently siloed worlds of digital TV, broadband Internet access and Fancast. When converged they're a blockbuster; companies like Netflix, Amazon and others cannot replicate this combination. In particular, Comcast, and other cable operators are ideally positioned to bridge broadband all the way to the TV. That's the last big hurdle to unlock broadband's ultimate value. Whether they'll do so is an open question.

Earlier this year Comcast CEO Brian Roberts unveiled the company's "Project Infinity" which suggested Comcast was looking to unify its various video offerings and bring broadband to its subscribers' TV. It seemed like a promising move, though there was no timeline disclosed. Now, nearly 9 months later I can't find any updates on the status of Project Infinity. It would be great for the company to publicly release a progress report or sense of upcoming milestones.

Promotions like "Premiere Week" are a positive step from Comcast, but real competitive advantage for the company lies in launching services which are truly impossible for others to match.

What do you think? Post a comment.

Categories: Aggregators, Cable TV Operators, Portals

Topics: Amazon, Comcast, Fancast, Netflix, Starz, TiVo

-

An Intersection of UGC and Brand Marketing?

(Quick correction - there was a technical problem with the link in yesterday's email to register for the Feb. 28th webinar. The correct link to register is here).

Lately I've been thinking a lot about where there may be potential points of intersection between user-generated video and brand marketing.

On the one hand, YouTube and others have demonstrated there's huge interest among amateur producers in creating and posting video content. Since the overwhelming majority of these producers do not make any meaningful money from these videos, their motivation is emotional. On the other hand, brands are grappling with things like how to break through the clutter, deepen consumer engagement, create more authenticity and build loyalty.

So it seems like there should be a natural point of intersection if brands could incent their passionate customers to create videos which not only sang the praises of their favorite products but actually provided valuable information sought by other prospective customers. Offering these videos would enable customers to show off their favorite products in action and also provide a valuable service to prospects. The concept is sort of like a video-based TripAdvisor, but not limited to travel.

Here's an example from a personal experience. Recently I've been in the market for a 50+ inch HDTV. If you've been in this mode recently you know the drill - lots of online research, reading users' comments, going to stores to see different models, etc. Even after doing all this, I still felt like I was missing something. I really wanted to see the intangibles - what distance seemed right, what's the right height for the stand, what were the ambient issues, how were accessories connected and so on.

In short, I was looking for actual owners to provide short, but informative videos showcasing how the TV actually worked out when brought into their homes. To be sure, there's no shortage of text comments to this effect. But the best I could find beyond text was a link at Amazon to "Share your own customer images." It seems like such a natural to me that online retailers, review sites and TV manufacturers should all provide a user-generated video platform for consumers to upload videos providing further information on their TVs.

What I'm describing is not another brand-sponsored UGC contest, but rather solid consumer-contributed product information. T-Mobile has something like this running with Current TV right now, but seems to really be the exception. I looked at the web sites of Sony, Samsung, Panasonic, Sharp, Philips and Mitsubishi and, although in some cases there are buying guides and FAQs, none of them seek to harness the enthusiasm of their actual customers by enabling video contributions.

Maybe I'm missing something, but I think this is a big untapped opportunity. I know companies like ViTrue and StashCast are pursuing opportunities like this, and then there are countless private label social network platforms like KickApps, Ning and others (TechCrunch has a good list here) that also enable some flavor of this. But I just haven't seen this concept clearly or pervasively implemented yet. If you have, please post a comment. I just have to believe that some smart brands - particularly those selling complex, expensive products that benefit from video-based information - are going to realize their passionate customers are incredible assets just waiting to be empowered to speak out through user-generated video.

Categories: Brand Marketing, UGC

Topics: Amazon, Current TV, KickApps, Ning, Stashcast, T-Mobile, ViTrue

-

One Pleasant Experience with Amazon Unbox

Last night I watched "Thank You For Smoking" (great movie by the way) courtesy of Amazon Unbox and TiVo. I took advantage of the companies' recent announcement which lets TiVo owners choose to have their Unbox videos delivered directly to their TiVos. The whole experience was seamless - linking my Amazon and TiVo accounts, selecting the movie in Unbox, downloading it, watching it, etc. My only complaint is that it was available for only 24 hours after starting it, which is obviously a studio issue, not an Amazon or TiVo issue. However, for the sheer "video-on-demand" spontaneity of finding a movie while already online, and then watching it shortly after, it's hard to beat this.Categories: Aggregators, Devices, Downloads

Posts for 'Amazon'

Previous |