-

Fox and Netflix Agree to 28-Day Window

Netflix and Fox are announcing this morning an expanded content licensing agreement which creates a 28-day DVD window and gives Netflix streaming access to certain prior season Fox TV shows. The 28-day window, which delays Netflix access to new DVDs until 28 days after their release date is similar to a deal that Netflix struck with Warner Bros. earlier this year.

I continue to be a fan of the 28-day window, as it allows studios a little more time to eke further revenue out of the rapidly-declining DVD sales business, while expanding Netflix's catalog for streaming and reducing its cost on physical DVD purchases. Netflix's Watch Instantly streaming feature has been a game-changer for the company, essentially reinventing the company's value proposition from a DVD subscription business defined by the number of discs out at any time, to one where subscribers get unlimited digital use. The key to its success is building the library of titles for streaming and that's what these 28-day deals are all about.

while expanding Netflix's catalog for streaming and reducing its cost on physical DVD purchases. Netflix's Watch Instantly streaming feature has been a game-changer for the company, essentially reinventing the company's value proposition from a DVD subscription business defined by the number of discs out at any time, to one where subscribers get unlimited digital use. The key to its success is building the library of titles for streaming and that's what these 28-day deals are all about.

Update: Universal also announced a 28-day deal with Netflix this morning. Release is here.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, FIlms, Studios

-

Blockbuster Hangs In with New Fox, Sony and Warner Deals

Netflix wasn't the only distributor modifying how it does business with Hollywood studios this week; Blockbuster also unveiled new deals with Fox, Sony and Warner, giving it "day-and-date" availability of these studios' films for store and mail rental (note, not for its on demand streaming service). Blockbuster also got "enhanced payment terms" from the studios in exchange for giving them a first lien on Blockbuster's Canadian assets (which would imply that if Blockbuster files for bankruptcy, the studios could end up owning/operating a slew of Canadian stores). Seems like steep terms for Blockbuster to hang in there.

for store and mail rental (note, not for its on demand streaming service). Blockbuster also got "enhanced payment terms" from the studios in exchange for giving them a first lien on Blockbuster's Canadian assets (which would imply that if Blockbuster files for bankruptcy, the studios could end up owning/operating a slew of Canadian stores). Seems like steep terms for Blockbuster to hang in there.

As I wrote a few weeks ago in "The Battle Over Movie Rentals is Intensifying," there are multiple distributors jockeying to be the consumer's preferred movie source. That means consumers need to figure out, on a title by title basis what works best for them.

For example, I'm a Netflix subscriber and let's say I want to watch the recently released "Sherlock Holmes" DVD. Netflix doesn't get it until April 27th per its 28-day window with Warner Bros. But when I check online, a local Blockbuster store I've never been to shows that it's in stock (though I'm a little skeptical). Do I want to drive down there to find out? Meanwhile, Comcast is offering it on-demand. But do I want to pay $4.99 for it when I'm already paying a monthly Netflix subscription? Alternatively, there's iTunes and Amazon VOD. But then I need to either watch on my computer or on the TV that's hooked to the Roku or temporarily connect my laptop to the TV. See what I mean about the choices facing consumers?

(Note - online movie distribution is among the topics we'll cover at the next VideoSchmooze on April 26th. Early bird discounted tickets available for just one more week!)

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, FIlms, Studios

Topics: Blockbuster, FOX, Netflix, Sony, Warner Bros.

-

Wal-Mart's Acquisition of Vudu Makes Little Difference

Yesterday's announcement by retailing giant Wal-Mart that it was acquiring Vudu, the on-demand movie service, generated a flurry of reactions from industry commentators. Some think it gives Wal-Mart the juice it needs to finally be a major digital media player. Others believe that Wal-Mart's miserable record in digital media suggests that the deal will be much ado about nothing. I'm in the latter camp, but not because of Wal-Mart's track record, but rather because of Vudu's own shortcomings.

Vudu's problem is that its value proposition is hamstrung by both the deals the Hollywood studios insist on to give Vudu access to their titles and by the current state of technology. Each of Vudu's 2 movie delivery

models - rental and download-to-own - has its own problems that severely curtail its consumer appeal. No matter how slick the service looks or how many CE devices it's embedded in, consumers will readily see these drawbacks and resist embracing Vudu.

models - rental and download-to-own - has its own problems that severely curtail its consumer appeal. No matter how slick the service looks or how many CE devices it's embedded in, consumers will readily see these drawbacks and resist embracing Vudu.The rental model is primarily handicapped by the ongoing provision that the rental period "expires" 24 hours after the movie was started. That means that if real life (e.g. a crying child, a call from an old friend, a household emergency) interrupts the Vudu's users' planned viewing window, they're out of luck. It's an absurd restriction, but all online movie rentals are laboring under it. Then there's the provision that most new releases aren't available for rental until 30 days after they debut on DVD. This kind of delay doesn't mean as much for a subscription service like Netflix (which of course just agreed to a new 28-day "DVD sales window" with Warner Bros.), because it has a huge back catalog to offer. But for Vudu (and Redbox) these delays are very noticeable to users.

The download-to-own model is even more challenged. First off, tech-savvy and value-conscious consumers are increasingly focused on cost-effective rentals or subscriptions, not purchasing films. The demise of DVD sales is ample evidence of this. The idea of creating a movie "collection" in a fully on-demand world is already on the verge of seeming as archaic as creating a CD collection has been for a while. And with download-to-own prices of approximately $20, which are more than a DVD costs, consumers will be even more hesitant.

But the real killer for download-to-own is the technology limitations, more specifically the lack of portability and interoperability. Say you're actually inclined to own movies using Vudu. What do you do, download them to an external hard drive? And when you travel, do you lug that thing around with you? When you get to your destination, what device will actually let you play back your movie from your hard drive? The issues go on. The reality is that ubiquitous, cheap DVD players and the compact size of the discs themselves have created a very high bar for digital delivery to exceed. "Digital locker" concepts like DECE and Disney's KeyChest are desperately needed to move digital downloads along, but even they are just a part of a larger CE puzzle.

So, although the Vudu service is very impressive, with a slick user experience and really nice quality video, the reality is that unless Wal-Mart is able to break through these challenges, the Vudu service is going to be marginally attractive to consumers at best. That means the Wal-Mart acquisition, in fact, makes little difference.

Maybe Wal-Mart has the clout to move the studios, but given mighty Apple's own difficulties doing so, I'm skeptical that Wal-Mart will have better luck. I continue to believe that Netflix's model - which combines the full selection of DVDs with the convenience and growing selection of online delivery (including TV shows by the way) - is a far better approach. Netflix may not have all the HD and user interface bells and whistles that Vudu has, but it's a far better value proposition for consumers. This is partly why Netflix has doubled in size, to 12.3 million subscribers, in the last 3 years.

What do you think? Post a comment now (no sign-in required).

Categories: Deals & Financings, FIlms, Studios

Topics: Apple, DECE, Disney, KeyChest, Netflix, VUDU, Wal-Mart

-

In Trying to Preserve DVD Sales, Studios Are in a Tight Spot

It's not news that DVD sales - the lifeblood of Hollywood studios' P&Ls - are in a freefall. In response, the studios are doing all sorts of things to eke out just a little more profitability from the sales of the shiny discs. But as several news items over the last week underscore, the studios have little wiggle room before their efforts to shore up DVD sales have real or perceived consequences for key business partners.

Exhibit A is the brouhaha over Disney's new plan to release Johnny Depp's "Alice in Wonderland" on DVD 12 1/2 weeks after its theatrical opening, instead of the usual 16 1/2 weeks, regardless of whether it's still playing in theaters. In the past, when a film's "release windows" were distinct and well-separated, everyone in the distribution chain knew they'd have their separate bite of the apple. With collapsing windows, those bites are converging, leaving some feeling they're not going to get their fair share. In the U.S. there has mostly been just grousing about Disney's plan among theater owners, but in Europe there are threats by large theater chains of an all-out boycott of the film.

It's hard not to feel some sympathy for the theater owners as the "Alice" plan isn't a random event. Sony recently ran a misguided promotional campaign giving away "Cloudy with a Chance of Meatballs" DVDs to certain Bravia buyers while the film was still playing in theaters. And it attempted to accelerate the release of the Michael Jackson "This Is It" DVD until theater owners drew the line. No doubt there are plenty of other examples being floated privately in Hollywood.

Meanwhile, news also broke this week that Redbox, the $1 a day rental kiosk chain had acceded to Warner Bros.' demand that it not rent any films until 28 days after their DVD release, in order to help preserve initial sales. As part of the deal Warner dropped its lawsuit against Redbox. In return, Redbox got lower pricing on its Warner DVD purchases. The deal mirrors the 28-day deal Netflix did with Warner last month, which I thought was a win for everyone. But the key difference in that deal vs. Redbox's is that Netflix has a huge rental catalog available for its subscribers to choose from, meaning new releases are far less important (Netflix says only 23% of rental requests are for new releases). On the other hand, Redbox's whole value proposition rests on low prices and selection of new releases. What is Redbox's fate if it does similar deals with other studios?

Putting the squeeze on Redbox and its kiosks seems like a dubious strategy by studios. In an age where piracy looms large, studios should be focused on enhancing, not diminishing the accessibility of their product (as a Coke executive once famously explained the company's marketing goal: "always within an arm's length of desire"). While Hollywood doesn't like Redbox's lower margins, focusing on that issue excessively when the product is clearly in decline is missing the forest for the trees.

Studios' desire to preserve DVD sales is going to further intensify, but defending them is only going to get harder. Certainly part of the reason is that the ongoing recession is forcing many consumers to cut back on their discretionary purchases. But the larger issue is that there's huge momentum behind the shift to online subscription/rental and even free models. The data shows that online viewing hit an inflection point in 2009, with free premium sites like Hulu experiencing extraordinary growth.

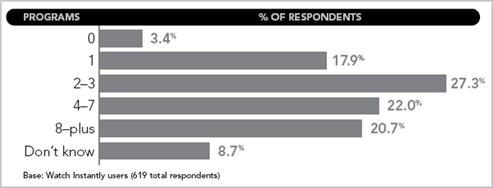

And the data showing online's appeal pours in almost daily; yesterday it was The Diffusion Group reporting results of a study of Netflix users showing that two-thirds of them that have a broadband connection are now using the "Watch Instantly" streaming feature. This week's launch of HBO Go, the premium channel's site for its subscribers, and its distribution deal with Verizon, are evidence that even the mighty HBO can't resist online's allure. Last but not least, in 2010 TV Everywhere rollouts will gain steam.

There's no denying the truth that DVD sales are under assault from all sides. Studios, desperate to hold on to DVDs' precious profits, are increasingly contorting themselves to keep the DVD cash cow alive a little longer. No surprise though, their efforts are not without consequences. At what point do the studios capitulate and throw DVD sales under the bus? We'll have to wait and see.

What do you think? Post a comment now (no sign-in required).

Topics: Disney, Netflix, Redbox, Sony, Warner Bros.

-

It's Official: Netflix Has Entered a "Virtuous Cycle"

Looking at Netflix's Q4 '09 and full year '09 results released late last Wednesday, plus Netflix's performance over the last 3 years, I have concluded the company has officially entered a "virtuous cycle." For those of you not familiar with the term, a virtuous cycle is when a single change or improvement leads to a cascading series of follow-on benefits which both reinforce themselves and add further momentum to the original change (a hyper "one good thing leads to another" scenario, if you will). Virtuous cycles are extremely rare in business, and when they happen they have profound implications.

The start of Netflix's virtuous cycle is obvious: the company's introduction of its free "Watch Instantly" streaming feature in January, 2007. Streaming has fundamentally changed the Netflix service offering and consumers are increasingly aware of this. Traditionally, Netflix subscription plans were defined by limits - 1 DVD out at a time for $8.99/mo, 2-out for $13.99/mo or 3-out for $16.99/mo. But with the company's decision to remove the confusing original caps it placed on streaming consumption and move to an unlimited model, Netflix is now providing enormous new value at the same DVD rental price points. Netflix has also changed how it advertises its services, strongly emphasizing streaming (see its home page for example). The "unlimited streaming" message is breaking through and Netflix subscriber growth momentum over the last 3 years reflects this.

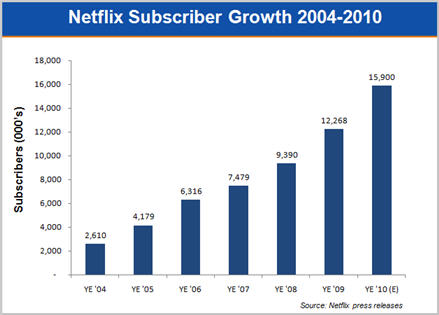

Subscribers grew to 12.3 million at the end of '09, 31% higher than YE '08. To get a sense of Netflix's momentum, '09 growth handily beat '08 (26%) and '07 (18%) growth. The 2.9 million subs added in '09 was 85% above the company's own 2009 beginning year forecast of 1.56 million sub additions. Looking ahead, the mid-point of Netflix's forecast for '10 is for another 30% growth in subs.

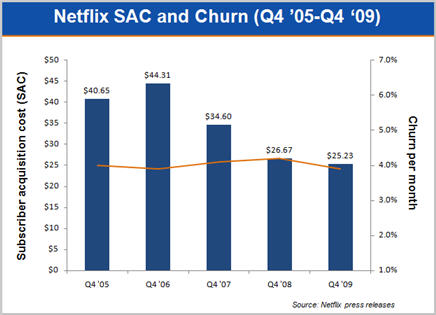

As the streaming benefits have resonated, it's very important to note that subscriber growth is actually getting progressively cheaper for Netflix to accomplish. As the following graph shows, Netflix's subscriber acquisition cost (SAC) has decreased by an impressive 43% from $44.31 in Q4 '06 to $25.23 in Q4 '09 (the 2nd lowest SAC in the company's history). Better still, the quality of these new subs seems high; average monthly churn in Q4 '09 was 3.9%, equal to the lowest churn the company has ever achieved. While Netflix isn't "buying" growth with low-quality additions (an old trick for subscription-oriented businesses), it is however putting more emphasis on the "1-out" service, which, with the addition of unlimited streaming, is an outstanding value for the low-end of the market. Netflix is eager to penetrate this segment, to whom $1 Redbox rentals are very attractive.

While Netflix's financials already reflect the virtuous cycle impact streaming is having on the business, it is likely there is much more to come as streaming takes further hold. Netflix revealed that 48% of its subscribers streamed at least 15 minutes/mo in Q4 '09, up from 41% in Q3 '09 and 26% in Q4 '08 (Incidentally, I think it's conceivable that 80% or more of recently-added subscribers are streaming). But it's just in the last year that Netflix streaming has begun to make the move from computer-only consumption to TV-based consumption, truly making it a mainstream experience. Netflix has inked deals with all the major game consoles (with a Wii marketing campaign beginning in '10), plus numerous CE devices, Blu-ray players, etc. Just ahead is a future where Wi-Fi will be ubiquitous in all new TVs and Netflix's deals with all the major TV manufacturers will ensure it is even more front and center for consumers.

To make streaming attractive, Netflix has had to essentially build a second content library. As I've suggested in the past, this isn't easy, as the company must navigate a thicket of pre-existing Hollywood rights and business relationships. Most notably, Netflix has run into the premium cable networks (HBO, Showtime, Starz and Epix) which have a monopoly on Hollywood's output for their release window. Netflix's deal with Starz was an important first step but still, I've been skeptical that Netflix would land streaming deals with the others.I'm now gaining more confidence that this will indeed happen, especially for these networks' original productions. Netflix is simply getting too big to ignore. It represents a whole new revenue opportunity for premium channels, plus an important loyalty-building outlet. Further out though, while Netflix CEO Reed Hastings says he wants the company to be a distributor for these premium channels, I think it's nearly inevitable that Netflix will compete head-on with them for Hollywood's output. Economics dictate that eventually it makes more sense for Netflix to bid directly for Hollywood rights than work through a premium channel middleman.

In fact, Netflix already has tons of Hollywood relationships, and its recent deal with Warner Bros, creating a 28-day DVD window is emblematic of how Netflix looks at streaming content acquisition going forward. In that superb deal, which was ludicrously criticized by some, Netflix simultaneously helped a critical partner sustain its DVD sales window, while gaining cheaper access to more DVD copies on day 29 and increased streaming rights for catalog titles. As Hastings pointed out on the Q4 earnings call, given the inconsistencies in DVD release strategies, most consumers have little-to-no idea when a title becomes available on DVD, so, while still early, opening up the 28 day window has caused no subscriber complaints. And the company's analysis of subscriber "Queues" indicates, just 27% of requests are for newly-released titles.

Importantly, Netflix's strategy is to pour savings from its DVD deals into streaming content acquisition. As I noted recently, Netflix's detailed subscriber data and usage analysis gives it a huge asymmetric advantage in negotiating additional streaming licenses from Hollywood. Netflix can surgically concentrate its resources on only those titles it knows its subscribers will value. Over time, as DVD sales continue to collapse, Netflix will be there to offer its subs a broader and broader rental selection.

The biggest challenge to Netflix for streaming content acquisition is how much it chooses to spend. Netflix's relatively small size among giants like Comcast and others is what prompted me to suggest over a year ago that Microsoft would acquire Netflix. I'm officially retracting that prediction now, as 2009 demonstrated how much streaming progress Netflix can make on its own. In fact, I think all rumors of a possible Netflix acquisition are off-base; I see the company remaining independent for some time to come.

Netflix is now riding a serious wave and its executives recognize the mile-wide opportunity ahead of it. The product is immeasurably stronger and more appealing with unlimited streaming included. That's in turn leading to impressive sub growth with much-reduced SAC and improving churn. The number of devices bridging Netflix to the TV is growing and portends ubiquity at some point down the road as these devices further leverage Netflix's platinum consumer brand. Streaming content selection is improving, bringing side benefits of reduced DVD postage and inventory costs. With millions of subscribers Netflix now has both the economics and the scale to be a very significant player in the video ecosystem.

Last but not least is a very favorable competitive climate. Aside from a hobbled Blockbuster, astoundingly, Netflix doesn't have any other direct DVD subscription/online streaming hybrid competitor (Amazon and Apple, are you paying attention?). And while Comcast and other multichannel video programming distributors ("MVPDs") are rolling out TV Everywhere services (5 years later than they should have, in my opinion), these are still early stage, and still encumbered by archaic regional limitations. Indeed, Netflix's growth may well cause these companies to consider their own over-the-top plans, as I've suggested.

For years I have been saying that broadband video is the single most disruptive influence on the traditional video distribution value chain. Netflix's success with streaming and the consequences that are yet to play out are resounding evidence of this. Above and beyond YouTube, Hulu, Amazon, Apple and others, Netflix is by far the most important video distributor to watch.

What do you think? Post a comment now (no sign-in required)

Categories: Aggregators, Devices

Topics: Comcast, Netflix, Warner Bros.

-

4 Items Worth Noting for the Jan 25th Week (Netflix Q4, Nielsen ratings, AOL-StudioNow, Net Neutrality Webinar)

With the new Apple iPad receiving wall-to-wall coverage this week, it was easy to overlook other significant news. Here are 4 items worth noting for the January 25th week:

1. Netflix Q4 earnings increase my bullishness - On Wednesday, Netflix reported blowout results for Q4 '09, adding almost 3 million subscribers during the year (and a million just in Q4), bringing their YE '09 subscriber count to 12.3 million. Netflix also forecasted to end this year with between 15.5 million and 16.3 million subscribers, implying subscriber growth will be in the range of 26% to 33%. Importantly, Netflix also said that 48% of its subscribers used the company's streaming feature to watch a movie or TV show in Q4, up from 41% in Q3 and 28% a year ago. Wall Street reacted with glee, sending the stock up $12 yesterday to a new high of $63.04.

VideoNuze readers know I've been bullish on Netflix for some time now, and the Q4 results make me more so. A key concern I've had has been around their ability to gain further premium content for streaming. On the earnings call, CEO Reed Hastings and CFO Barry McCarthy addressed this issue, offering up additional details of their content strategy and how the recent Warner Bros. 28-day DVD window deal will work. On Monday I'm planning a deep dive post based on what I heard. As a preview, I'm now convinced that Netflix is the #1 cord-cutting threat. Cable, satellite and telco operators need to be watching Netflix very closely.

2. Nielsen announces combined TV/online ratings plan, but still falls short - This week brought news that Nielsen intends to unveil a "combined national television rating" in September that merges traditional Nielsen TV ratings with certain online viewing data. This is data that TV networks have been hungering for as online viewing has surged, potentially siphoning off TV audiences. I pointed out recently that the lack of such a measurement could seriously retard the growth of TV Everywhere, as cable networks hesitate to risk shifting TV audiences to unmeasurable online viewing.

Nielsen's move is welcome, but still doesn't go far enough. As reported, it seems the new merged ratings will only count online views that had the same ads and ad load as on-air. That immediately rules out Hulu, which of course carries far fewer ads than on-air, and sometimes uses custom creative as well. Obviously if the new Nielsen ratings don't truly capture online viewership they'll be worth little in the market. Ratings are a story with many future chapters to come.

3. AOL acquires StudioNow in bid for to ramp up video content - Also not to be overlooked this week was AOL's acquisition of StudioNow for $36.5 million in cash. StudioNow operates a distributed network of 3,000 video producers, creating cost-effective video for small and large companies alike. I'm very familiar with StudioNow, having spoken with their CEO and founder David Mason a number of times.

AOL is clearly looking to leverage the StudioNow network to generate a mountain of new video content, complementing its Seed.com "content farm." In addition, AOL picks up StudioNow's recently-launched Video Asset Management & Syndication Platform (AMS) which gives it video management capabilities as well. For AOL the deal suggests the company is finally waking up to video's vast potential. But with the rise of online video syndication, it's still a question mark whether creating a whole lot of new video is the right strategy, or whether AOL would have been better served by just partnering with a syndicator like 5Min.

Meanwhile, AOL isn't the only portal realizing video is the place to be. In Yahoo's earnings call this week, CEO Carol Bartz said "Frankly, our competition is television" and as Liz wrote, Bartz also said "that makes video really important." Yahoo just partnered with Ben Silverman's new Electus indie video shop, and it sounds like more action is coming. Geez, the prospect of AOL and Yahoo competing on acquisitions? It would be like the old days again.

4. Net Neutrality webinar next Thursday is going to be awesome - A reminder that next Thurs, Feb. 4th at 11am PT/2pm ET The Diffusion Group and VideoNuze will present a complimentary webinar "Demystifying Net Neutrality." The webinar is the first in a series of 6 throughout 2010, exclusively sponsored by ActiveVideo Networks. Colin Dixon from TDG and I will be hosting and we have 2 fabulous guests, who are on opposing sides of the net neutrality debate: Barbara Esbin, Senior Fellow and Director of the Center for Communications and Competition Policy at the Progress and Freedom Foundation and Chris Riley, Policy Counsel for Free Press.

Net neutrality is a critically important part of the landscape for over-the-top video services, and yet it is widely misunderstood. Join us for this one-hour session which promises to be educational and impactful.

Enjoy your weekend!

Categories: Aggregators, Broadband ISPs, Deals & Financings, Portals, Regulation, Webinars

Topics: AOL, Net Neutrality, Netflix, Nielsen, StudioNow, Webinar

-

ActiveVideo Networks Helping Blockbuster on Demand Deliver a Converged Experience

Amid all of the attention Netflix has been receiving for embedding its streaming software in one consumer electronics device after another (the Wii just yesterday) and its recent Warner Bros. deal, it's been easy to overlook the fact that Blockbuster has been getting some online traction itself. One announcement at CES last week, by ActiveVideo Networks, caught my attention as it has the potential to leapfrog Blockbuster On Demand's user experience past Netflix's Watch Instantly.

Much as I'm a big fan of Netflix's Watch Instantly streaming feature, one of its limitations is that the user experience is very segregated between computer and TV. You browse and search online for titles - just as you would for DVDs - and then when you've made your choices, they show up in your Instant Queue online and on your connected TV (via Roku, Blu-ray, Xbox or other device). While it's a perfectly functional approach, wouldn't it be nice if you could do the entire process of search, discovery, previewing, selection and viewing on the TV itself?

That's the experience that ActiveVideo Networks' CloudTV will be helping Blockbuster on Demand deliver to its users. As ActiveVideo's CEO Jeff Miller explained to me yesterday, when deployed, the Blockbuster on Demand app (developed using ActiveVideo's JavaScript/HTML authoring kit), will give Blockbuster's users a web-like experience of search, discovery and previewing on their TVs, via connected devices. In addition, it will present viewing options - streaming, download-to-own and in-store rental (via an API it will even show current availability in selected stores).

The requirements are that ActiveVideo's thin client has been integrated with the device, and that Blockbuster has its own deal with to distribute through the specific device manufacturer. Navigation is via the remote control using an on-screen keypad (see example screen shots below from last week's CES demos).

To date, Blockbuster has announced CE device deals with Samsung, 2Wire, and through its deal with Sonic Solutions, the ecosystem of devices already working with Roxio CinemaNow, such as TiVo. For now, that's small in comparison to Netflix's constellation of device partners, but it's still early in the convergence game. Outside of CE devices - and in a case of somewhat strange bedfellows - Blockbuster is also focused on cable operators. It recently announced partnership deals with top 10 cable operators Suddenlink and Mediacom to enhance their VOD offerings.

To date, Blockbuster has announced CE device deals with Samsung, 2Wire, and through its deal with Sonic Solutions, the ecosystem of devices already working with Roxio CinemaNow, such as TiVo. For now, that's small in comparison to Netflix's constellation of device partners, but it's still early in the convergence game. Outside of CE devices - and in a case of somewhat strange bedfellows - Blockbuster is also focused on cable operators. It recently announced partnership deals with top 10 cable operators Suddenlink and Mediacom to enhance their VOD offerings.Similarly, ActiveVideo is also focused both on CE (currently through a partnership with middleware provider Videon Central) and on cable. It has deployed on set-top boxes with Cablevision and Oceanic Time Warner Cable in Hawaii, reaching an audience of 5 million homes. Content providers that have developed apps include Showtime, HSN and Fox, among others. No doubt ActiveVideo and Blockbuster will synch up their biz dev activities to proliferate the Blockbuster on Demand app as widely as possible.

I have to admit that I haven't been paying too much attention to Blockbuster, as it has worked to re-position itself, aiming to close another 1,000 stores by the end of the year and installing more kiosks to compete with Redbox. Of course, it can ill afford to allow Netflix to get too far out in front of it in digital delivery as DVD rentals are poised to be supplanted by streaming down the road.

But Blockbuster has an ubiquitous, if somewhat dated, brand that could be skillfully leveraged into the digital era, provided it has the right services in its arsenal. In this respect, the potential to bring a converged user experience between online and connected TVs is a meaningful differentiator. No initial joint customers have yet been announced by Blockbuster and ActiveVideo, though I expect that soon. And, as online video and TV continue to converge, ActiveVideo is likely to find itself in the middle of a lot of action. All of this is worth keeping an eye on.

Update: Looks like I'm 1 step behind on Netflix's Xbox implementation. Apparently in Aug '09 it was updated to allow full browsing and search for the Watch Instantly catalog. I'm used to the Roku and Blu-ray experiences. Hat tip to Brian Fitzgerald for bringing to my attention.

What do you think? Post a comment now.(Note - ActiveVideo Networks is a VideoNuze sponsor)

Categories: Aggregators, Devices, FIlms, Partnerships

Topics: ActiveVideo Networks, Blockbuster, Mediacom, Netflix, Suddenlink, Videon

-

Top Rental Data from Netflix is More Evidence that Warner Bros. Deal is a Win

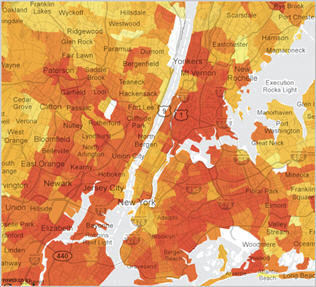

Following my 2 posts late last week (here and here) about how Netflix's new deal with Warner Bros is win for everyone, the NYTimes has posted a terrific interactive map showing the top rentals in 12 geographic areas of the U.S., sorted by zip code. The map is based on data that Netflix provided to the NYTimes. Playing around with the map, you'll quickly hunger for more details, but you'll also get a sense of the mountain of viewership data Netflix maintains on its 11 million+ subscribers. This data, when combined with the Netflix's algorithms for predicting its users' preferences, further demonstrates how valuable a deal like the one with WB could be for Netflix as it emphasizes streaming.

In the digital era, data is king because when used properly, it can dramatically improve the quality of the product delivered, in turn driving user satisfaction and profitability. Netflix has always used data very

effectively; examples include how it has chosen sites for its distribution centers so that most Americans are within 1 day's delivery, or how it has recommended other titles based on yours and others' preferences, or how much inventory of newly-released DVDs it decides to build. Now, as Netflix shifts its business from physical to digital delivery, it has another big opportunity to leverage the data it has collected from its users.

effectively; examples include how it has chosen sites for its distribution centers so that most Americans are within 1 day's delivery, or how it has recommended other titles based on yours and others' preferences, or how much inventory of newly-released DVDs it decides to build. Now, as Netflix shifts its business from physical to digital delivery, it has another big opportunity to leverage the data it has collected from its users. While a lot of attention was focused last week on the new 28-day "DVD window" which precludes Netflix from renting recently-released WB titles, I believe more attention should be paid instead to how effectively Netflix will be able to use its trove of data to selectively tap into WB's catalog of titles to boost its streaming selection. Using the data it has collected on physical rentals and search queries, for example, Netflix should be able to literally request title-by-title streaming rights from WB. That's not to say Netflix will necessarily receive access to those particular titles, but by being able to focus its requests, Netflix avoids wasting energy asking for things that are unlikely to have much appeal to its users.

It's interesting to talk to friends who are Netflix users, including those who don't work in technology-related industries. They have an amazingly high awareness and usage of Netflix's streaming and recognize that it represents the company's future. It's also obvious to them how meager the options are in Watch Instantly as compared with DVD and desperately want more choice. Netflix knows all this, as Netflix CEO Reed Hastings said last week, "our number one objective now is expanding the digital catalog." But Netflix is in a tight position to get new releases due to existing output deals that Hollywood studios maintain with HBO and other premium channels for electronic delivery. So, as with the WB deal, and others likely to follow, Netflix is trying to be clever about how it builds its streaming catalog by tapping into older, but still valuable titles.

It's unclear whether Netflix will conclude similar deals with other Hollywood studios. If it can't then the above-described benefits will be limited. In fact, as a couple of people pointed out to me last week, with Hollywood also highly dependent on cable, it's not readily apparent that helping Netflix build its streaming selection is actually in their interest as TV Everywhere services continue to roll out. WB is actually an interesting example; on the one hand, Time Warner's CEO Jeff Bewkes has been the strongest proponent of TV Everywhere, but on the other hand, WB's deal with Netflix creates more competition for it. In short, Hollywood will have its hands full trying to recast its distribution strategy in the digital era.

DVDs are not going away overnight, but the user data Netflix has will be an enormously valuable tool in helping transition its business to digital delivery and add more value to its subscribers. As long as Netflix complies with its users' privacy expectations, that gives it a big strategic advantage.

What do you think? Post a comment now.

Categories: Aggregators, Studios

Topics: Netflix, Warner Bros.

-

4 Items Worth Noting for the Jan 4th Week (Netflix-WB Continued, comScore Nov. '09 stats, TV Everywhere, 3D at CES)

Following are 4 items worth noting for the Jan 4th week:

1. TechCrunch disagrees with my Netflix-Warner Bros. deal analysis - In "Netflix Stabs Us In The Heart So Hollywood Can Drink Our Blood," (great title btw) MG Siegler at the influential blog TechCrunch excerpts part of my post from yesterday, and takes the consumer's point of view, decrying the new 28 day "DVD window" that Netflix has agreed to in its Warner Bros deal. Siegler's main objection is that "Hollywood thinks that with this new 28-day DVD window deal, the masses are going to rush out and buy DVDs in droves again." Instead, Siegler believes the deal hurts consumers and is going to touch off new, widespread piracy.

I think Siegler is wrong on both counts, and many of TechCrunch's readers commenting on the post do as well. First, nobody in Hollywood believes DVD sales are going to spike because of deals like this. However, they do believe that any little bit that can be done to preserve the appeal of DVD's initial sale window can only help DVD sales which are critical to Hollywood's economics. Everyone knows DVD is a dying business; the new window is intended to help it die more gracefully. And because new releases are not that critical to many Netflix users anyway, Netflix has in reality given up little, but presumably gotten a lot, with improved access for streaming and lower DVD purchase prices.

The argument about new, widespread piracy by Netflix users is specious. With or without the 28 day window, there will always be some people who don't respect copyright and think stealing is acceptable. But Netflix isn't running its business with pirates as their top priority. With 11 million subscribers and growing, Netflix is a mainstream-oriented business, and the vast majority of its users are not going to pirate movies - both because they don't know how to (and don't want to learn) and because they think it's wrong. Netflix knows this and is making a calculated long-term bet (correctly in my opinion) that enhancing its streaming catalog is priority #1.

2. comScore's November numbers show continued video growth - Not to be overlooked in all the CES-related news this week was comScore's report of November '09 online video usage, which set new records. Key highlights: total video viewed were almost 31 billion (double Jan '09's total of 14.8 billion), number of videos viewed/average viewer was 182 (up 80% from Jan '09's 101) and minutes watched/mo were approximately 740 (more than double Jan '09's total of 356).

Notably, with 12.2 billion views, YouTube's Nov '09 market share of 39.4% grew vs. its October share of 37.7%. As I've previously pointed out, YouTube has demonstrated amazingly consistent market dominance, with its share hovering around 40% since March '08. Hulu also notched another record month, with 924 million streams, putting it in 2nd place (albeit distantly) to YouTube. Still, Hulu had a blowout year, nearly quadrupling its viewership (up from Jan '09's 250 million views). But with 44 million visitors, Hulu's traffic was pretty close to March '09's 41.6 million. In '10 I'm looking to see what Hulu's going to do to break out of the 40-45 million users/mo band it was in for much of '09.

3. Consumer groups protest TV Everywhere, but their arguments ring hollow - I was intrigued by a joint letter that 4 consumer advocacy groups sent to the Justice Department on Monday, urging it to investigate "potentially unlawful conduct by MVPDs (Multichannel Video Programming Distributors) offering TV Everywhere services." The letter asserts that MVPDs may have colluded in violation of antitrust laws.

I'm not a lawyer and so I'm in no position to judge whether any actions alleged to have taken place by MVPDs violated any antitrust laws. Regardless though, the letter from these groups demonstrates that they are missing a fundamental benefit of TV Everywhere - to provide online access to cable TV programming that has not been available to date because there hasn't been an economical model for doing so. In the eyes of people who think that making money is evil, the TV Everywhere model of requiring consumers to first subscribe to a multichannel video service seems anti-consumer and anti-competitive. But to people trying to make a living creating quality TV programming, the preservation of a highly functional business model is essential.

These advocacy groups need to remember that consumers have a choice; if they don't value cable's programming enough to pay for it, then they can instead just watch free broadcast programs.

4. 3D is the rage at CES - I'll be doing a CES recap on Monday, but one of the key themes of the show has been 3D. There were two big announcements of new 3D channels, from ESPN and Discovery/Sony/IMAX. LG, Panasonic, Samsung and Sony announced new 3D TVs. And DirecTV announced that it would launch 3 new 3D channels by June 2010, with Panasonic as the presenting sponsor. 3D sets will be an expensive proposition for consumers for some time, but prices will of course come down over time.

Something that I wonder about is what impact will 3D have on online and mobile video? Will this spur innovation in computer monitors so that the 3D experience can be experienced online as well? And how about mobile - will we soon be slipping on 3D glasses while looking at our iPhones and Android phones? It may seem like a ridiculous idea, but it's not out of the realm of possibility.

Enjoy your weekend!

Categories: 3D, Aggregators, Broadcasters, Cable Networks, Cable TV Operators, FIlms, Studios

Topics: 3D, comScore, Netflix, TV Everywhere, Warner Bros.

-

VideoNuze Report Podcast #45 - January 8, 2010

Daisy Whitney and I are pleased to present the first VideoNuze Report podcast of 2010 (and the 45th edition overall!).

In today's podcast we first discuss my post from yesterday, "Why Netflix's Long-Term Focus in New Warner Bros. Deal is a Win for Everyone," in which I assert that the new 28 day "DVD window" that the deal creates helps Netflix, Hollywood studios and ultimately consumers. There is a lot of consternation in the blogosphere and Twittersphere about whether Netflix is hosing its subscribers with this new policy, but I believe there's actually little risk of that, and the payoff for Netflix is better content for its streaming catalog as well as lower costs for its DVD purchases. While WB surely doesn't expect to sell more DVDs due to the deal, it can only help make the DVD model's demise a little less disruptive.

Switching gears, Daisy then reviews some of eMarketer's predictions for ad spending in 2010, with particular focus on online video advertising, which eMarketer expects to grow from about $1 billion in '09 to $1.4 billion in '10. Listen in to find out more.

Click here to listen to the podcast (12 minutes, 30 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Aggregators, FIlms, Podcasts

Topics: eMarketer, Netflix, Warner Bros.

-

Why Netflix's Long-Term Focus in New Warner Bros. Deal is a Win for Everyone

Netflix's new deal with Warner Bros., in which it agreed to a 28 day "DVD window" for new releases, in exchange for greater access to WB's films for its Watch Instantly streaming feature and reduced pricing on its own DVD purchases, is further proof that Netflix is squarely focused on the long-term. That's not only smart for Netflix, it's also a win for Hollywood studios and also for consumers.

With 11 million subscribers and growing, Netflix has emerged as one of Hollywood's most important home video customers. This dynamic has only increased recently due to slowing sales of DVDs (down another 13% in 2009) and Netflix's dominance in DVD rentals. Yet Netflix is viewed warily by Hollywood, primarily

due to concerns that in the digital age, Netflix could gain too much power over Hollywood's fate. This concern was reinforced by Netflix's deal with premium cable channel Starz, a de facto end-run around Hollywood in which Netflix got streaming access to certain Disney, Sony and Lionsgate films.

due to concerns that in the digital age, Netflix could gain too much power over Hollywood's fate. This concern was reinforced by Netflix's deal with premium cable channel Starz, a de facto end-run around Hollywood in which Netflix got streaming access to certain Disney, Sony and Lionsgate films.As I've pointed out many times (as recently as this past Monday, in item #6), despite the Starz deal and the impressive adoption of Watch Instantly to date, Netflix faces a major challenge in building out its catalog of recent films for streaming use. Part of the challenge is Hollywood's "windowing" approach; in particular, other premium channels like HBO, Showtime and Epix have made significant financial commitments for electronic distribution during certain time periods that effectively preclude Netflix gaining streaming rights. Because much of Netflix's value proposition relies on its vast DVD selection (100K+ titles currently), if its streaming catalog continues to look meager by comparison, then Netflix's goal of migrating its users to streaming delivery over time will be seriously undermined.

That's where the new WB deal comes in. While the companies didn't disclose which titles or how many

would be available, my guess is that the benefits of the deal, when it's fully implemented, will be noticeable to Netflix's subscribers or Netflix wouldn't have signed on. While WB is just one studio, if the new deal can be used as a template, Netflix could have a solid plan for gaining more films without paying big bucks. And the studios would get greater leverage against Redbox, which is viewed with even greater alarm by much of Hollywood.

would be available, my guess is that the benefits of the deal, when it's fully implemented, will be noticeable to Netflix's subscribers or Netflix wouldn't have signed on. While WB is just one studio, if the new deal can be used as a template, Netflix could have a solid plan for gaining more films without paying big bucks. And the studios would get greater leverage against Redbox, which is viewed with even greater alarm by much of Hollywood.Netflix's focus on the long term is smart strategy, and complements well the company's near-term emphasis on riding the convergence wave by embedding its Watch Instantly software in every conceivable living room device (e.g. PS3, Xbox, Roku, Bravia, Blu-ray players, etc.). It's also a strategy that benefits Hollywood. By creating a situation where studios preserve as much of their DVD sales as possible (allegedly 75% of a film's total DVD sales occur in the first 4 weeks following release), Netflix is helping Hollywood gracefully wind down and milk the DVD business.

Not surprisingly, consumers' first reaction to the deal was sour. Yesterday the Twittersphere was alight with grousing about the 28 day DVD window and how Netflix was "selling out its customers." Some even talked about canceling their Netflix service. I think most of this is idle chatter. Netflix has publicly said that just 30% of its DVD rentals come from recent releases (though it is likely that for Netflix's heaviest DVD renters, recent releases are far more important). In the end, Netflix is making a calculated bet that it can manage the potential subscriber consequences of creating the DVD window in order to benefit its larger goal of migrating its business to online delivery.

If Netflix is right, and it can sign on additional studios to similar deals, then ultimately consumers will win. That's because, as Netflix proves in the value of streaming, it will be able to offer improved terms to studios, resulting in Netflix getting better and better access to films. But this will be a gradual process that unfolds over time. Whereas consumers always "want everything yesterday," the reality is that if Hollywood and Netflix can avoid disruption and instead preserve most of their economics by gracefully transitioning their businesses to digital delivery, consumers stand a better chance of continuing to receive the kind of premium-quality (i.e. expensive to produce) films they value. The demise of the newspaper industry is a cautionary example of what happens when disruption instead prevails and an industry's traditional economics are destroyed.

We are still on the front end of seismic shifts that will alter how Hollywood's films are distributed to consumers. By focusing on the long-term, as evidenced by its WB deal, Netflix is playing an important role in increasing the odds of a successful transition.

What do you think? Post a comment now.

Categories: Aggregators, FIlms, Studios

Topics: Netflix, Starz, Warner Bros.

-

Back from the Vacation? Here Are 7 Video Items You May Have Missed

Happy New Year. If you're just back from a holiday vacation and have been partially or totally off the grid for the last week or two, here are 7 video-oriented items you may have missed:

1. Time Warner Cable and News Corp fight over fees, then settle - Two behemoths of the cable and broadcast TV ecosystem spatted publicly during the holidays over the size of "retransmission consent" fees that News Corp (owner of the Fox Broadcast Network and cable channels like Fox News) wanted TWC (the 2nd largest U.S. cable operator) to pay to carry its 14 local stations. While a last minute deal averted the channels going dark, broadcasters' interest in dipping into cable's monthly subscription revenues will only intensify as audience fragmentation accelerates and ad revenues are pressured.

For my part I wish Fox and other broadcasters were as focused on building new and profitable digital delivery models for their programs as they were on trying to redistribute cable's revenues. Even as Rupert Murdoch continues advocating the paid content model, the freely-available Hulu is seeing its traffic skyrocket (see below). But if Hulu's viewership isn't incrementally profitable, then all that growth is pointless. Urgency is mounting too; in '10 convergence devices that bridge broadband to the TV are going to get a lot of attention. In the wake of their adoption, consumers are going to want Hulu on their TVs. If Hulu doesn't allow this it will be marginalized. But if it does without first solidifying its business model, it could hurt broadcasters further.

2. Hulu has a big traffic year, but no further information provided on its business model - Hulu's CEO Jason Kilar pulled back the curtain a bit on the company's strong progress in 2009, citing 95% growth in monthly users, to 43 million, 307% growth in monthly streams, to 924 million (both as measured by comScore) and a doubling of available content, to 14,000 hours. While noting that its advertisers increased from 166 to 408 during the year, with respect to performance, Jason only said that "we are extremely excited about atypically strong results we have been able to drive for our marketing partners."

Though Hulu is under no obligation to disclose details of its business model, I think it would dramatically increase the company's credibility if it shared some metrics about how its lighter ad load model is working (e.g. improved awareness, click throughs, leads, conversions, etc.). Per the 1st item above, as Hulu grows, a lot of people have a lot at stake in understanding what effect it may have on broadcast economics. In addition, as I pointed out recently, it is important to understand whether Hulu thinks it may have already saturated its U.S. audience. After a jump in Q1 '09 from 24.6 million to 41.6 million users, traffic actually dipped below 40 million until October. What does Hulu do from here to gain significantly more users?

3. Cable networks' primetime audience is nearly double broadcasters' - Punctuating the ascendancy of cable over broadcast, this Multichannel News article pointed out that in 2009, ad-supported cable networks as a group captured 60.7% of primetime audience vs. 32% for the 4 broadcast networks. That's a major change from 2000 when the broadcasters had a 46.8% share vs. cable's 41.2%. Cable increased its share every single year of the last decade, powered by its innovative original programming. NBCU's USA Network in particular has become the real standout performer, winning its second consecutive ratings crown, with 3.2 million average primetime viewers, up 14% vs. 2008.

The surging popularity of cable programming is a crucial barrier to consumers cutting the cord on cable. Since cable networks are highly invested in the monthly multichannel subscription model, they are unlikely to disrupt themselves by offering their best shows to others under substantially different terms than how they're offered today. So to the extent cable programs are either unavailable to over-the-top alternatives or offered less attractively (e.g. less choice, higher cost, delayed availability), little cord-cutting can be expected. And if TV Everywhere achieves its online access goals, the cable ecosystem will only be further strengthened.

4. YouTube is working to drive higher viewership - Amidst the turmoil in the traditional ecosystem and Hulu's growth, YouTube, the 800 pound gorilla of the online video world, is working hard to deepen the site's viewership. As this insightful NYTimes article explains, a team of YouTube developers is analyzing viewing patterns and tweaking its recommendation practices to encourage more usage. YouTube says time on the site has increased by 50% in the last year, and comScore reports that the average number of clips viewed per user per month jumped to 83 in October, up from 53 a year earlier. Still, as comScore also reports, duration of an average session has yet to crack 4 minutes, meaning video snacking on YouTube is still the norm. YouTube's moves must be watched closely in '10.

5. Showtime's "Weeds" available online before on DVD - This WSJ article (reg req'd) pointed out that Lionsgate, producer of Showtime's hit "Weeds" series is offering episodes online before they're available on DVD. By putting the digital "window" ahead of DVD's, Lionsgate is further pressuring DVD's appeal. We've seen periodic experimentation in this regard, and I anticipate more to come, especially as the universe of convergence devices expands and consumers can watch on their TVs instead of just their computers. Until a tipping point occurs though, "Weeds" like initiatives will be the exception, not the rule.

6. Netflix goes shopping in Hollywood - And speaking of reversing distribution windows, this Bloomberg Businessweek piece was the latest to highlight Netflix's efforts to woo studios into giving it more recent releases. Netflix has of course made huge progress with its Watch Instantly streaming feature, but its appeal to heaviest users will slow at some point unless it can dramatically expand its current slate of 17K titles available online. Hollywood is understandably wary of Netflix given all the variables in play and a desire to avoid Netflix becoming master of Hollywood's post-DVD, digital future. Whether Netflix will spend heavily to obtain better rights is a major question.

7. Get ready for Google's Nexus One and Apple's "iSlate" - Unless you've really been off the grid, you're probably aware by now that two very significant mobile product releases are coming this month. Tomorrow (likely) Google will unveil the Nexus One, its own smartphone, powered by its Android 2.1 operating system. The Nexus One will be "unlocked," meaning it can operate on multiple providers using GSM networks. The device will further fuel the mobile Internet, and mobile video consumption along with it. Separately, Apple is widely rumored to introduce its tablet computer later in the month, which many believe will be called the "iSlate." The tablet market is completely virgin territory, and while it's early to make predictions, I believe Apple could have most of the ingredients needed to make the product another big hit. The prospect of watching high-quality video on a thin, light, user-friendly device is extremely compelling.

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Devices, Mobile Video, Studios

Topics: Apple, FOX, Google, Hulu, Lionsgate, Netflix, News Corp, Showtime, Time Warner Cable, YouTube

-

Goodbye 2009, Hello 2010

It's time to say goodbye to 2009 and begin looking ahead to 2010.

2009 was yet another important year in the ongoing growth of broadband and mobile video. There were many exciting developments, but several stand out for me: the announcement and launches of initial TV Everywhere services, the raising of at least $470 million in new capital by video-oriented companies, YouTube's and Hulu's impressive growth to 10 billion streams/mo and 856 million streams/mo, respectively, the iPhone's impact on popularizing mobile video, the Comcast-NBCU deal, the maturing of the online video advertising model, the proliferation of Roku and other convergence devices and the growth of Netflix's Watch Instantly, just to name a few.

Looking ahead to next year, there are plenty of reasons to be optimistic about video's growth: the rollout of TV Everywhere by multiple providers, the proliferation of Android-powered smartphones and buildout of advanced mobile networks, both of which will contribute to mobile video's growth, the launch of Apple's much-rumored tablet, which could create yet another category of on-the-go content access, the introduction of new convergence devices, helping bridge video to the TV for more people, new made-for-broadband video series, which will help expand the medium's appeal, and wider syndication, which will make video ever more available.

In the midst of all this change, monetization remains the fundamental challenge for broadband and mobile video. More specifically, for both content providers and distributors, the challenge is how to ensure that the video industry avoids the same downward revenue spiral that the Internet itself has wrought on print publishers.

Regardless of all the technology innovations, high-quality content still costs real money to produce. If consumers are going to be offered quality choices, a combination of them paying for it along with advertising, is essential. While it's important to be consumer-friendly, this must always be balanced with a sustainable business model. In short, no matter what the size of the audience is, giving something away for free without a clear path for effectively monetizing it is not a strategy for long-term success.

VideoNuze will be on hiatus until Monday, January 4th (unless of course something big happens during this time). I'll be catching my breath in anticipation of a busy 2010, and hope you will too.

Thank you for finding time in your busy schedules to read and pass along VideoNuze. It's incredibly gratifying to hear from many of you about how important a role VideoNuze plays in helping you understand the disruptive change sweeping through the industry. I hope it will continue to do so in the new year.

A huge thank you also to VideoNuze's sponsors - without them, VideoNuze wouldn't be possible. This year, over 40 companies supported the VideoNuze web site and email, plus the VideoSchmooze evenings and other events. I'm incredibly grateful for their support. As always, if you're interested in sponsoring VideoNuze, please contact me.

Happy holidays to all of you, see you in 2010!

Categories: Advertising, Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Devices, Mobile Video

Topics: Android, Comcast, Hulu, iPhone, NBCU, Netflix, YouTube

-

Scoring My 2009 Predictions

As 2009 winds down, in the spirit of accountability, it's time to take a look back at my 5 predictions for the year and see how they fared. As when I made them, they're listed below in the order of most likely to least likely to pan out.

1. The Syndicated Video Economy Accelerates

My least controversial prediction for 2009 was that video would continue to flow freely among content providers numerous third parties, in what I labeled the "Syndicated Video Economy" back in early 2008. The idea of the SVE is that "destination" sites for online audiences are waning; instead audiences are fragmenting to social networks, mobile devices, micro-blogging sites, etc. As a result, the SVE compels content providers to reach eyeballs wherever they may be, rather than trying to continue driving them to one particular site.

Video syndication continued to gain ground in '09, with a number of the critical building blocks firming up. Participants across the ecosystem such as FreeWheel, 5Min, RAMP, YouTube, Visible Measures, Magnify.net, Grab Networks, blip.TV, Hulu and others were all active in distributing, monetizing and measuring video across the SVE. I heard from many content executives during the year that syndication was now driving their businesses, and that they only expected that to increase in the future. So do I.

2. Mobile Video Takes Off, Finally

When the history of mobile video is written, 2009 will be identified as the year the medium achieved critical mass. I was bullish on mobile video at the end of 2008 primarily due to the iPhone's success and my expectation that other smartphones coming to market would challenge it with ever more innovation. The iPhone has continued its amazing run in '09, on track to sell 20 million+ units. Late in the year the Droid, which Verizon has relentlessly promoted, began making inroads. It also benefitted from Verizon highlighting AT&T's inadequate 3G network. Elsewhere, 4G carrier Clearwire continued its nationwide expansion.

While still behind online video in its development, mobile video is benefiting from comparable characteristics. Handsets are increasingly video capable, just as were computers. Mobile content is flowing freely, leaving the closed "on-deck" only model behind and emulating the open Internet. Carriers are making significant network investments, just as broadband ISPs did. A range of monetization companies have emerged. And so on. As I noted recently, the mobile video ecosystem is healthy and growing. The mobile video story is still in its earliest stages, we'll see much more action in 2010.

3. Net Neutrality Remains Dormant

Given all the problems the Obama administration was inheriting as it prepared to take office a year ago, I predicted that it would not expend energy and political capital trying to restart the net neutrality regulatory process. With broadband ISP misbehavior not factually proven, I also thought Obama's predilection for data in determining government action would prevail. However, I cautioned that politics is a tough business to predict, and so anything can happen.

And indeed, what turned out is that in September, new FCC Chairman Julius Genachowski launched a vigorous net neutrality initiative, despite the fact that there was still little data supporting it. With backwards logic, Genachowski said the FCC would be guided by data it would be collecting, though he was already determined to proceed. In "Why the FCC's Net Neutrality Plan Should Go Nowhere" I argued, among other things, that the FCC is way off the mark, and that in the midst of the gripping recession, to risk the unintended consequences that preemptive regulation carries, was foolhardy. Now, with Comcast set to acquire a controlling interest in NBCU, net neutrality advocates will say there's even more to be worried about. It looks like we can expect action in 2010.

4. Ad-Supported Premium Video Aggregators Shakeout

The well-funded category of ad-supported premium video aggregators was due for a shakeout in '09 and sure enough it happened. Players were challenged by little differentiation, hardly any exclusive content and difficulty attracting audiences. The year's biggest casualty was highflying Joost, which made a last ditch attempt to become a white label video platform before being quietly acquired by Adconion. Veoh, another heavily funded player, cut staff and changed its model. TidalTV barely dipped its toe in the aggregation waters before it became an ad network.

On the positive side, Hulu, YouTube and TV.com continued their growth in '09. Hulu benefited from Disney coming on board as both an investor and content partner, while YouTube improved its appeal to premium content partners and brought on Univision and PBS, among others. Aside from these, Fancast and nichier sites like Dailymotion and Babelgum, there isn't much left to the aggregator category. With TV Everywhere services starting to launch, the opportunity for aggregators to get access to cable programming is less likely than ever. And despite their massive traffic, Hulu and YouTube have significant unresolved business model issues.

5. Microsoft Will Acquire Netflix

This was my long ball prediction for '09, and unless something happens in the waning days of the year, I'll have to concede I got this one wrong. Netflix has remained independent and is charging along with its own streaming "Watch Instantly" feature, now used by over half its subscribers, according to recent research. Netflix has also broadened its penetration of 3rd party devices, adding PS3, Sony Bravia TVs and Blu-ray players, Insignia Blu-ray players this year, in addition to Roku, XBox and others. Netflix is quickly becoming the most sought-after content partner for "over-the-top" device makers.

But as I've previously pointed out, Netflix's number 1 challenge with Watch Instantly is growing its content selection. Though it has a deal with Starz, it is largely boxed out of distributing recent hit movies via Watch Instantly by the premium channels HBO, Showtime and Epix. My rationale for the Microsoft acquisition is that Netflix will need far deeper pockets than it has on its own to crack open the Hollywood-premium channel ecosystem to gain access to prime movies. For its part, Microsoft, locked in a pitched battle with Google and Apple on numerous fronts, could gain advantage with a Netflix deal, positioning it to be the leader in the convergence era. Meanwhile, others like Amazon and YouTube continue to circle this space.

The two big countervailing forces for how premium video gets distributed in the future are TV Everywhere, which seeks to maintain the traditional, closed ecosystem, and the over-the-top consumer device-led approach, which seeks to open it up. It's hard not to see both Netflix and Microsoft playing a major role.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Broadband ISPs, Deals & Financings, Mobile Video, Regulation, Syndicated Video Economy

Topics: Apple, AT&T, Fancast, FCC, Hulu, iPhone, Joost, Microsoft, Netflix, Veoh, Verizon, YouTube

-

Sony Gets It Wrong with "Meatballs" Promotion

On Monday, Sony Electronics announced a holiday promotion in which buyers of select Internet-connected Sony Bravia TVs and Blu-ray players would receive a free 24 hour rental of the Columbia/Sony Pictures film

"Cloudy with a Chance of Meatballs." In addition, current owners of these devices would be able to rent the film for $24.95. For all of these consumers, the film would be available from Dec. 8th to Jan 4th, the month leading up to the film's DVD release.

"Cloudy with a Chance of Meatballs." In addition, current owners of these devices would be able to rent the film for $24.95. For all of these consumers, the film would be available from Dec. 8th to Jan 4th, the month leading up to the film's DVD release. Ordinarily I would applaud any move by Hollywood to modify its rigid release "windows" to benefit broadband delivery of films. Yet in this case I think Sony's promotion is ill-conceived and is extremely unlikely to contribute any real momentum to studios' future broadband delivery plans. In fact, it may actually have the opposite effect and further stunt the broadband medium's emergence. Here's why:

The release window is too tight - Release windows allow Hollywood studios to mine new value from the same content given each successive distribution medium's unique attributes and audience. But by trying to squeeze in this promotional window, Sony is exacerbating an already very tight windowing plan for "Meatballs" that called for DVD release less than 2 months following its theatrical run. Remarkably, even as Sony is trumpeting this new promotion, the film is actually still playing in theaters nationwide. Given it's already only 27 days until Dec 8th, there will be virtually no gap between theatrical and promotional windows. That undermines the theatrical value proposition, in turn ticking off exhibitors who are threatening to pull the film early, according to The Hollywood Reporter.

Theatrical to DVD windows have been getting progressively tighter as studios have sought to bolster sagging DVD sales. The problem is that like a good wine, lengthy windows allow a film to age and increase in value for both those consumers who saw the movie and those who did not. With this promotion, Sony is giving consumers an in-home opportunity to see the film immediately adjacent to the DVD's availability. That can do nothing but also hurt the DVD's sales.

The promotional offer isn't strong enough - For Sony Electronics, trying to differentiate its devices in a brutally competitive landscape is key. But do the marketing pros at Sony really believe that giving away a 24 hour rental is going to have a big impact? Personally I doubt it. The prices of the Sony TVs in the promotion are in the $1,000-$2,000 range, so a $25 incentive is easily swamped by the rampant deep discounts found in Sunday circulars (not to mention even deeper online deals). Further, I don't see any retailer incentives included in the promotion that would influence the sales process.

The "Meatballs" offer might have a stronger effect on sales of Sony's Blu-ray players, though here too, it's unlikely to be profound. With Blu-ray player sales lagging, manufacturers and retailers have largely decided that hitching their wagons to Netflix's Watch Instantly streaming is the best way to bump up sales. But with sub-$100 Netflix-capable Blu-ray players now available, a "Meatballs" rental valued at $25 on a $200-250 Sony player will have a hard time breaking through. Last but not least, it's important to remember, Sony's promotion is for a 24 hour rental. Not offering consumers ownership of "Meatballs" makes the promotional value ephemeral. And with Walmart, Target and Amazon now offering top DVDs for just $10 apiece, a 24 hour rental valued at $25 is underwhelming, not to mention somewhat specious, given it is Sony that's setting the "price." Given all of this, I suspect Sony would have done better by just offering a free "Meatballs" DVD with purchase.

Device audience too small to prove broadband delivery's appeal - Looked at differently, the small base of connected Sony Bravia and connected Blu-ray players, plus the new device sales over the promotional period, is unlikely to generate a large volume of "Meatballs" streaming anyway. That means that the promotion will do little to encourage Sony or other studios to more strongly embrace broadband delivery of their films. In fact, when the weak results of the promotion come in (as I expect they will), "Meatballs" could become future industry shorthand for "broadband delivery isn't ready for prime-time." That would be a shame, because I believe consumers very much want on-demand access to films in their homes. Netflix's success with Watch Instantly certainly proves that, as does the success VOD is having.

From my perspective, rather than setting up half-baked promotions like this one, studios should take a step back and think through how to do broadband delivery (for both rental and download-to-own) correctly. There are a lot of moving pieces, but clearly addressing what to do about the DVD window is critical. Studios are rightfully worried about killing off this cash cow. But compressing the DVD window and then trying to insert a new broadband delivery window isn't going to be the answer. Rather than seeing more "Meatballs" like promotions, I'd prefer to see a cohesive strategy out of Hollywood for how it can fully tap into broadband delivery's potential.

What do you think? Post a comment now.

Categories: Devices, FIlms, Studios

-

4 Items Worth Noting for the Nov 2nd Week (Q3 earnings review, Blu-ray streaming, Apple lurks, "Anywhere" coming)

Following are 4 items worth noting for the Nov 2nd week:

1. Media company and service provider earnings underscore improvements in economy - This was earnings week for the bulk of the publicly-traded media companies and video service providers, and the general theme was modest increases in financial performance, due largely to the rebounding economy. The media companies reporting - CBS, News Corp, Time Warner. Discovery, Viacom and the Rainbow division of Cablevision - showed ongoing strength in their cable networks, with broadcast networks improving somewhat from earlier this year. For ad-supported online video sites, plus anyone else that's ad-supported, indications of a healthier ad climate are obviously very important.

Meanwhile the video service providers reporting - Comcast, Cablevision, Time Warner Cable and DirecTV all showed revenue gains, a clear reminder that even in recessionary times, the subscription TV business is quite resilient. Cable operators continued their trend of losing basic subscribers to emerging telco competitors (with evidence that DirecTV might now be as well), though they were able to offset these losses largely through rate increases. Though some people believe "cord-cutting" due to new over-the-top video services is real, this phenomenon hasn't shown up yet in any of the financial results. Nor do I expect it will for some time either, as numerous building blocks still need to fall into place (e.g. better OTT content, mass deployment of convergence devices, ease-of-use, etc.)

2. Blu-ray players could help drive broadband to the TV - Speaking of convergence devices, two articles this week highlighted the role that Blu-ray players are having in bringing broadband video to the living room. The WSJ and Video Business both noted that Blu-ray manufacturers see broadband connectivity as complementary to the disc value proposition, and are moving forward aggressively on integrating this feature. Blu-ray can use all the help it can get. According to statistics I recently pulled from the Digital Entertainment Group, in Q3 '09, DVD players continue to outsell Blu-ray players by an almost 5 to 1 ratio (15 million vs. 3.3 million). Cumulatively there are only 11.2 Blu-ray compatible U.S. homes, vs. 92 million DVD homes.

Still, aggressive price-cutting could change the equation. I recently noticed Best Buy promoting one of its private-label Insignia Blu-ray players, with Netflix Watch Instantly integrated, for just $99. That's a big price drop from even a year ago. Not surprisingly, Netflix's Chief Content Officer Ted Sarandros said "streaming apps are the killer apps for Blu-ray players." Of course, Netflix execs would likely say that streaming apps are also the killer apps for game devices, Internet-connected TVs and every other device it is integrating its Watch Instantly software into. I've been generally pessimistic about Blu-ray's prospects, but price cuts and streaming could finally move the sales needle in a bigger way.

3. Apple lurks, but how long will it stay quiet in video? - The week got off to a bang with a report that Apple is floating a $30/mo subscription idea by TV networks. While I think the price point is far too low for Apple to be able to offer anything close to the comprehensive content lineup current video service providers have, it was another reminder that Apple lurks as a major potential video disruptor. How long will it stay quiet is the key question.

While in my local Apple store yesterday (yes I'm preparing to finally ditch my PC and go Mac), I saw the new 27 inch iMac for the first time. It was a pretty stark reminder that Apple is just a hair's breadth away from making TVs itself. Have you seen this beast yet? It's Hummer-esque as a workstation for all but the creative set, but, stripped of some of its computing power to cost-reduce it, it would be a gorgeous smaller-size TV. Throw in iTunes, a remote, decent content, Apple's vaunted ease-of-use and of course its coolness cachet and the company could fast re-order the subscription TV industry, not to mention the TV OEM industry. The word on the street is that Apple's next big product launch is a "Kindle-killer" tablet/e-reader, so it's unlikely Steve Jobs would steal any of that product's thunder by near-simultaneously introducing a TV. If a TV's coming (and I'm betting it is), it's likely to be 2H '10 at the earliest.

4. Get ready for the "Anywhere" revolution - Yesterday I had the pleasure of listening to Emily Green, president and CEO of tech research firm Yankee Group, deliver a keynote in which she previewed themes and data from her forthcoming book, "Anywhere: How Global Connectivity is Revolutionizing the Way We Do Business." Emily is an old friend, and 15 years ago when she was a Forrester analyst and I was VP of Biz Dev at Continental Cablevision (then the 3rd largest cable operator), she was one of the few people I spoke to who got how important high-speed Internet access was, and how strategic it would become for the cable industry. 40 million U.S. cable broadband homes later (and 70 million overall) amply validates both points.