-

60Frames Pioneers "Broadband Studio" Model

Last week I had a chance to sit down with Brent Weinstein, CEO/founder of 60Frames, which is among a new group of companies I refer to as "broadband studios." This is a category that has generated a healthy amount of funding and activity recently, including, among others, Next New Networks ($23 million to date), Generate ($6 million), Revision3 ($9 million), Stage 9 (Disney/ABC's in-house unit), Vuguru (Michael Eisner's shop) and a slew of comedy-focused initiatives. 60Frames itself has raised $3.5 million from Tudor, Pilot Group and others.

The impetus for 60Frames came when Brent was heading up digital entertainment at UTA and observed that many clients wanted to create digital/broadband fare but wanted a partner for the same roles they've come to

expect studios to handle (e.g. financing, distribution, legal, creative, etc.). 60Frames aims to differentiate itself from the pack by being "artist-friendly" - allowing greater creative control and more significant ownership and by relying on strong relationships. With an existing staff of 11 and a goal of launching 50 programs by year end, the 60Frames team is no doubt going full tilt.

expect studios to handle (e.g. financing, distribution, legal, creative, etc.). 60Frames aims to differentiate itself from the pack by being "artist-friendly" - allowing greater creative control and more significant ownership and by relying on strong relationships. With an existing staff of 11 and a goal of launching 50 programs by year end, the 60Frames team is no doubt going full tilt.60Frames is following a traditional portfolio approach, working with great talent (Coen brothers, John August, Tom Fontana, others) but recognizing that results in this new medium will vary - there will be some winners and some losers. The goal is obviously to have the best ratio possible. Traditional studios improve their odds by using collective history and data about what types of projects succeed and which ones don't. But no such lengthy track record or data exists in broadband just yet, so it's a lot more speculative pursuit.

I asked Brent if there's any creative formula 60Frames is using to guide its decision-making. He was pretty emphatic that there's no "formula," but did concede 60Frames is focused on short-form (under 5 minutes), is biased toward comedy where episodes can stand alone more readily, and is mainly looking at niche audiences with a bulls-eye of 18-34 men, where consumption is highest.

Nurturing relationships and developing great content is only part of the equation for these budding studios' success. Distribution and monetization are also incredibly important, as broadband necessitates an entirely different model. Regarding distribution, I was encouraged to see 60Frames is solidly in the syndication camp to the point that it has not even set up destination sites for its 7 launched programs yet. 60Frames has a network of partners including Bebo, blip.tv, DailyMotion, iTunes, MySpace, YouTube and others. Gaining access to all the popular online destinations will accelerate success. Meanwhile advertising is being handled by partner SpotRunner, which has deep hooks in the space.

Broadband studios like 60Frames harken back to the original studio moguls in some ways - taking creative and financial risk to explore what works in a new medium. It's way too early to know if or to what extent they'll succeed, but if they do we can expect a gold rush of imitators.

Categories: Indie Video, Startups, Syndicated Video Economy

Topics: 60Frames, ABC, Bebo, blip.TV, DailyMotion, Disney, Generate, iTunes, MySpa, Next New Networks, Revision3, Stage 9, UTA, Vuguru

-

Welcome to the "Syndicated Video Economy"

I am ever mindful of the old adage about "missing the forest for the trees" as I try daily to understand the often minor feature differences between competing vendors or the nuances of startups' market positioning. As we all know, when you get too close to something, it's quite easy to lose the larger perspective. So periodically I think it's essential to take a huge step back to try to identify the larger patterns or trends that crystallize from the daily frenzy of deals and announcements.

As a result, I've come to believe that recent industry activity points to an emerging and significant trend: the early formation of what I would term the "syndicated video economy." By this I mean to suggest that I'm

seeing more and more industry participants' strategies - in both media and technology - start from the proposition that the broadband video industry will only succeed if video assets are widely dispersed and revenue creatively apportioned.

seeing more and more industry participants' strategies - in both media and technology - start from the proposition that the broadband video industry will only succeed if video assets are widely dispersed and revenue creatively apportioned. For content providers the notion of widespread video syndication big change in their business approach. In the past year I think we've observed content providers of all stripes transition from "aggregating eyeballs", to "accessing eyeballs," wherever they may live now or in the future: portals, social networks, portable devices, game consoles, etc. Underlying this shift is the realization that advertising-based revenues are going to fuel the broadband video industry for the foreseeable future. The ad model requires scale and syndication is the best way to deliver it.

This shift by content providers has been accompanied by a loosening of traditional tightly-controlled, scarcity-driven distribution strategies, an acknowledgement that fighting newly-empowered consumers is a futile exercise. The evidence of this shift abounds. Consider the broadcasters like CBS, NBC and Fox, which through their affiliates (Hulu, CBS Audience Network) are syndicating programming to many portals/aggregators (e.g. Yahoo, MSN, AOL, YouTube), social networks (e.g. Facebook, MySpace, Bebo) and others. And Disney's Stage 9 digital studio, which premiered with YouTube and explicitly plans to tap into broadband video hubs. And cable networks like MTV Networks, which is pursuing a plethora of distribution deals. And traditional news-gatherers like local TV stations, newspapers and news services (e.g. Reuters, AP) which have stepped up their activity to scatter their video clips to the Internet's nooks and crannies. And the list goes on and on.

Taking their cue from the media companies' strategy shift, technology entrepreneurs and investors have ramped up their focus on this market opportunity. The prospect of the syndicated video economy blossoming drives news/information distributors such as Voxant, ClipSyndicate, Mochilla, TheNewsMarket and RedLasso, an ad manager such as FreeWheel, and a content accelerator such as Signiant, plus many others. Then there are more established companies guiding areas of their product development process by the prospect of the syndicated video economy's growth: Google, WorldNow, Akamai, thePlatform, Anystream, Maven Networks, Brightcove, PermissionTV and plenty of others (apologies to those I've left out!)

All of this suggests that the eventual "value chain" of the broadband video industry will look quite different than the traditional one (for more on this, I've posted some my slides from late '07 here.) As with all economies, in the nascent syndicated video economy there is vast interdependence among the various players, not to mention shifting market positions and degrees of pricing power and negotiating leverage. It is far too early to gauge who will emerge as the syndicated video economy's winners and losers. But make no mistake, lots of energy and investment will be expended trying to nurture its growth and exploit its opportunities.

Do you see the syndicated video economy forming as well? Post a comment and let us all know!

Categories: Advertising, Aggregators, Broadcasters, Cable Networks, Newspapers, Portals, Startups, Syndicated Video Economy

Topics: Akamai, Anystream, ClipSyndicate, FreeWheel, Google, Mochilla, RedLasso, Signiant, TheNewsMarket, thePlatform, Voxant, WorldNow

-

TidalTV: Another Well-Funded Aggregator Goes For It

(Note: This is the first of a series of posts with companies participating in the 2008 Media Summit, a premier industry event which will be held next week in NYC. VideoNuze has partnered with Digital Hollywood, the Media Summit's producer, to provide select news and analysis coverage.)

Investors continue to show lots of optimism about the broadband video aggregator category. The latest data point is TidalTV, a new entrant that announced last week it has raised $15 million from NEA and Valhalla Partners. This comes on top of a crowd of well-funded startups: Joost ($45M+), Veoh ($40M+ to date), Building B ($17.5M), Vuze ($32M+), Hulu ($100M) and many others who are attacking this space in one way or another.

To better understand how TidalTV will distinguish itself from the pack, yesterday I had a lengthy briefing with CEO Mollie Spilman. She provided her first extensive remarks about TidalTV's game plan since last week's announcement. (Thanks to my old friend Tom MacIsaac, former CEO of Lightningcast, for facilitating the introduction. Tom recently launched Cove Street Partners and is as smart a player in the broadband video ad space as anyone around.)

The first thing to know about TidalTV is that it is pursuing mainstream users, not early adopters. This targeting pervades all its decision-making: site design is clean and approachable (Mollie said Apple is their role model), content is professional/well-branded only (no UGC), user experience incorporates a traditional linear programming sensibility combined with full on-demand access and advertising mimics traditional pods, while also integrating new broadband-only formats.

In short, TidalTV's making a bet that given how nascent broadband video adoption is among mainstream users, there is ample room to become the brand/destination of choice by providing an experience that feels more similar to traditional TV than to online. Though Mollie says that Apple is TidalTV's heaviest influence, I see clear parallels to AOL from the mid-late '90s. Recall that AOL's pervasive consumer-friendly UI, content and marketing (the Steve Case mantra) enabled it to crush all the dial-up ISPs which had more techie, complicated orientations. Watching AOL's rise made me a big believer that consumer-friendliness can indeed be a meaningful competitive differentiator if executed really well.

AOL is an interesting point of comparison because TidalTV's founder Scott Ferber was a co-founder of Advertising.com, which was sold to AOL in 2004, albeit after the Case era ended at AOL. Mollie was at Ad.com for 6 years as well. Other TidalTV executives come from Ad.com, Joost and Fox. The Ad.com lineage helps explain why TidalTV has chosen to invest significantly in optimizing its advertising capabilities rather than building a lot of its own publishing or delivery features (note TidalTV is all Flash-based streaming with no downloads and no P2P).

TidalTV has some interesting challenges ahead. First is content. It sounds like the company has made substantial progress in deals to obtain content from the "top 50 brands" which includes not only broadcast and cable network fare, but also print, online publishers and others who produce professional video. Yet Mollie concedes that "90% of TidalTV's content at launch could probably be found somewhere on-air or online," as content providers increasingly pursue widespread syndication. TidalTV's opportunity is to pull the content together in a neat, intuitive manner that mainstream users appreciate.

TidalTV will do so by using a "faux linear" presentation, which entails it becoming a "digital programmer," assembling its partners' shows into their own channelized formats (e.g. "The CSI Channel"), with traditional linear air times. For example, if you come to the site at 4pm, you'd see "what's on now" on multiple channels. At launch Mollie anticipates offering 10-15 channels, all on a revenue share basis with providers. This presentation approach is meant to appeal to mainstream users by providing a tangible link to a TV-oriented experience. If a user clicks to start watching, a linear "feed" will start playing, including ad breaks. However, TidalTV will also offer all programs on a full, on-demand basis as well.

But to illustrate how complicated the content acquisition terrain is for 3rd parties like TidalTV, consider Hulu, the NBC/FOX JV. It has insisted that prospective syndication partners take the Hulu player if they're to gain access to popular shows like "Heroes" and "24." Doing so could break TidalTV's user-friendly design. Mollie acknowledged this challenge, but felt confident that in examples like these, there should be adequate incentives to work out an arrangement. Then there's ABC, which to date has not pursued syndication aggressively. If it maintains its ABC.com centric approach, simply not making its programs available to 3rd parties, that leaves aggregators with obvious holes in their offerings. This would be especially challenging for a site like TidalTV, which appeals directly to mainstream users. Speaking generically, Mollie said that TidalTV's neutral "Switzerland" approach (i.e. no investments from media companies) should help in all of its content negotiations.

Driving traffic is another key issue. With other players in the market already, they've had a chance to build their traffic, though not necessarily in TidalTV's core target audience. For instance, Veoh alone says it's getting 20M+ unique visitors per month. To jumpstart traffic, Mollie said that TidalTV is prepared to fund an aggressive marketing plan, testing direct marketing, search, offline ads, outdoor, SEO, viral, PR and other tactics.

TidalTV expects to offer a geo-based limited beta in the Maryland, Virginia and DC area in late March, expanding to a national beta in mid-April. I'll be getting a peek at the beta product next week, so I'll have more to say then. Though it's still far too early to make a definitive assessment of TidalTV's chances of success, I like the fact that Mollie repeatedly uses the word "experimental" in her comments. That's a recognition of how early-stage this market space is and suggests TidalTV will stay flexible and open to all approaches to find success.

What do you think of TidalTV's chances? Post a comment and let everyone know!

Categories: Aggregators, Startups

Topics: ABC, AOL, Building B, FOX, Joost, NBC, New Enterprise Associates, TidalTV, Valhalla Partners, Veoh

-

FreeWheel: Helping Monetize the Syndicated Video Economy

Readers of VideoNuze know that for a long time I've been a big proponent of syndication as a key building block for broadband video success. In last week's webinar I explained that I see this trend only accelerating as content providers increasingly shift from aggregating the most eyeballs to accessing the most eyeballs. That means syndicating video far and wide through social networks, portals, broadband aggregators and others is fast-becoming a key success factor.

Yet aggressive syndication presents a complex set of issues around how to control and optimize the advertising to all those dispersed viewers. Absent the right set of tools to administer each deal's terms, there's a bias toward simplicity and hence, under-optimization. For example, I continually hear that all the broadcasters' syndication deals are 90-10 ad revenue splits. In some cases a plain vanilla approach like this may be fine. More likely though, to have a biz dev person's hands tied to very limited deal terms because of a lack of technology solutions significantly constrains the ecosystem.

FreeWheel is a new company aimed at unlocking these constraints with its "Monetization Rights Management" or MRM technology platform. MRM is a full ASP platform that empowers content providers'

biz dev teams to cut creative revenue/inventory sharing with syndication partners and then have ad sales teams follow through with far more intelligence about how to implement these deals and sell inventory. The result is revenue optimization for all parties. I caught up with CEO Doug Knopper, co-CEO and co-founder of FreeWheel last week to learn more.

biz dev teams to cut creative revenue/inventory sharing with syndication partners and then have ad sales teams follow through with far more intelligence about how to implement these deals and sell inventory. The result is revenue optimization for all parties. I caught up with CEO Doug Knopper, co-CEO and co-founder of FreeWheel last week to learn more. FreeWheel sits on top of existing ad management systems, as a sort of cross between a digital traffic cop and a green eyeshade - dynamically managing and allocating ad inventory, while keeping track of all ads and revenue across the content provider's syndicated network. MRM interfaces to a content provider's and partner's content management system through FreeWheel's API, allowing MRM to implement its predetermined business rules alongside the content being sent to partners. Clearly there's a huge network affect opportunity for FreeWheel - the more partners its early content provider customers get to implement MRM, the easier FreeWheel's sale will be to subsequent content providers.

FreeWheel reminds me a lot of Signiant, which I wrote about recently. Signiant is more focused on content distribution in a syndicated economy, while FreeWheel is focused on ad management. But both companies share a common purpose of greasing the skids for both content providers and distributors to play ball with each other with the intention of driving more video views and advertising revenue.

FreeWheel has signed up Next New Networks, Joost and Jumpstart Automotive Media as initial clients. The company was founded by three former DoubleClick executives, has 40 employees and has raised 2 rounds from Battery Ventures, though the total is undisclosed.

Categories: Advertising, Startups, Technology

Topics: FreeWheel, Joost, Jumpstart Automotive Media, Next New Networks, Signiant

-

EveryZing: Video Search Meets SEO

As some of you may suspect by now, I've become a little obsessed with understanding the nascent video search space. It's a source of continued fascination for me that there are so many smart people with so many different technology and business strategies pursuing this area. Google's success in web search is surely influencing the massive interest in reaching for the brass ring of video search.

The latest to hit my screen is EveryZing, which is announcing today two new products, ezSEO (Search Engine Optimization) and ezSearch. These two products combine to increase exposure/discoverability of broadband video content (plus, text, audio and images) and drive more monetization opportunities. New customers announced today include boston.com, Dow Jones, Reuters and Entercom. I caught up with CEO Tom Wilde yesterday to learn more.

EveryZing isn't a consumer destination site a la Truveo or blinkx. Instead, it's a pure white-label technology ASP for content providers. It uses proprietary speech-to-text technology to create meaningful text-based descriptions of video and other assets. As Tom says, because "text is the navigation currency of the web" it is essential that video assets be characterized this way for them to be fully discoverable. EveryZing takes a holistic view of search, allowing its content providers to also use its technology for HTML documents and other assets if they choose to. Either way, EveryZing enables universal search across media types. All of this is the role of role of ezSearch.

But EveryZing realizes that just making video more discoverable within web sites doesn't drive a lot of new revenue for content companies. Instead these videos (and other assets) must be packaged and presented in an SEO-friendly way to drive maximum traffic from the search economy (aka Google). More traffic means more ad inventory to monetize. In short, ezSEO addresses the most vexing issue facing all video providers - how to actually make money in broadband video? EveryZing achieves SEO by pouring the results of ezSearch into its publishing system, which in turn creates search-friendly multimedia topic pages that are SEO-friendly. See example below:

EveryZing's focus on creating these search-friendly topic pages reflects a tried and true tactic in SEO. For example, just last week at the FAST Forward '08 conference, the NYTimes.com shared how it does exactly the same thing for 16,000+ topics. (For example, type "Global Warming" into Google and the 8th result will be the NYTimes.com topic page). The pursuit of these kinds of SEO techniques has spawned an entire cottage industry for helping web publishers get their content noticed and monetized.

EveryZing is taking a page from this playbook and applying it to broadband video. It seems like a very sound and logical approach, which is showing a lot of early promise. Tom shared statistics for boston.com. Since it implemented EveryZing's technology last fall, the number of page views for its SEO-friendly pages has increased 37-fold, and the number of videos streamed from these pages 172-fold. Of course all those new video streams yield monetizable ad inventory, but it's important to remember that the SEO pages themselves also yield lots of valuable, context-rich ad inventory for display ads.

When you combine the huge enthusiasm around SEO and video, an obvious question is "why hasn't anyone done this already?" Tom's answer is instructive for all entrepreneurs, and goes to the heart of what increases the odds of success for early-stage companies: it takes a very unique combination of distinctive technology, executives' deep domain expertise, proper market timing, specific strategy/focus and respect for customers' finite resources. I completely agree with his assessment, particularly the importance of executives' domain expertise which I've observed really helps in unearthing subtle market opportunities. EveryZing seems to have all of the above which makes it a company well-worth watching. It has 40 employees and has raised $13.5M to date.

Categories: Startups, Video Search

Topics: EveryZing

-

Veveo: More Innovation in Video Search

Innovation in video search continues apace. A new entrant is Veveo, which, upon my first review, looks poised to raise the bar of innovation in this still-evolving space. I spent a couple of hours with CEO/co-founder Murali Aravamudan to learn more about their approach.

I continue to be fascinated with video search and have previously written about current players such as Truveo, blinkx, ClipBlast, Nexidia and TV Guide. I believe video search is the most intellectually challenging part of the broadband video value chain as well as the one with the greatest potential upside for those who ultimately crack this highly complex nut. Video search presents many of the same issues as web search, but layers on additional challenges around relevancy, metadata, user navigation and monetization. Because of the explosion of video choices, users will increasingly rely on video search providers who can expedite retrieval of desired results.

Veveo approaches the key problem of relevancy by trying to emulate some of what's behind Google's vaunted PageRank. As many of you know, PageRank prioritizes relevancy by relying heavily on the number of referring links to a given page. To try to proxy this referral process in the nascent video world, Veveo has developed its algorithms to account for # of people subscribing to a video channel (at say YouTube), user ratings, viewcount, session length and other factors.

Returning relevant results requires a complete index of available video, which has led Veveo to index approximately 125M videos currently. Murali believes is on a par with the established players. The index spans professional video to UGC and short clips to full-length programs.

Though Murali obviously wasn't going to provide too much detail on Veveo's algorithms (not that I'd understand them anyway), their capabilities are on display when running queries at Veveo's beta site located here. Veveo does something I haven't seen elsewhere - notice as you slowly type your query, the search box not only begins autofilling, but new results are also dynamically served up. Even at Google, while the search box will autofill based on Google's anticipation of your intended query, no results are shown until you're done and click enter. For Veveo to be able to do this means its algorithms are both anticipating your query AND simultaneously matching them against its index. Because there are so many videos, Veveo has had to organize them semantically to accelerate the matching process. And don't forget: because there's no client download, the retrieval process is all happening virtually in real time. Admittedly, this process is not being done at scale yet, but Murali is confident that it will perform similarly even when there are millions of concurrent users.

To see what I mean, slowly type "Barack Obama South Carolina Victory Speech" into the search box. By the time you've typed the "t" in South, the most accurate clip (from YouTube) is the 2nd result. When you type "v" in victory it becomes the first. Try the same query elsewhere. You'll get the same results when done, but notice how different the experience is. It's critical to understand that in the search business, the provider's algorithms - which drive accuracy and speed of results - are the two defining competitive advantages. That's how Google blew past all the incumbents, though it was very late to the web search game. Users noticed its supremacy and dramatically drove its awareness and traffic.

Veveo's business model is to primarily to partner with mobile device manufacturers (it has recently done a deal with Motorola) and CE companies (e.g. broadband-enabled TVs, etc.) to create a vtap network, against which targeted ads will be sold (hey, that sounds familiar). Murali believes there's more upside in that approach than simply licensing the software. However, it will license opportunistically, and from other sources I understand that vtap is powering search for Verizon's FiOS video service.

Veveo's business model is to primarily to partner with mobile device manufacturers (it has recently done a deal with Motorola) and CE companies (e.g. broadband-enabled TVs, etc.) to create a vtap network, against which targeted ads will be sold (hey, that sounds familiar). Murali believes there's more upside in that approach than simply licensing the software. However, it will license opportunistically, and from other sources I understand that vtap is powering search for Verizon's FiOS video service.Lastly, Murali shared with me a draft of a white paper he's written which provides insights from Veveo's video index. It's filled with fascinating statistics (I needed to dust off my old stats textbook to fully understand) about today's video landscape and usage across key sites. I'll have the final paper available for download at VideoNuze when it's ready in a few weeks. Veveo has done two rounds with Matrix, North Bridge, Norwest and OmniCapital, many of the same investors who backed Winphoria Networks, Murali's last company, which was sold to Motorola for $175M in 2004. Veveo is definitely a company worth keeping an eye on.

Categories: Startups, Video Search

Topics: Veveo

-

How-to Category Gets Crowded

The Internet's low entry barriers are again at work, this time in the video-based "how-to" category, which has recently attracted a rush of well-funded new competitors. It's no surprise: how many of us would rather watch a video of someone explaining how to do something vs. reading a lengthy and often poorly-written guide?

Like many things in the broadband video world, the players' strategies, content approaches and business models are all over the board. In the ad-supported category, the earliest entrants (and their funding) are ExpertVillage (now owned by Demand Media) and VideoJug ($30M from last May), with HowCast ($8M from Tudor/others), 5Min.com ($5M from Spark Capital) and WonderHowTo.com (undisclosed amount from General Catalyst) launching more recently. Of course there's also YouTube and DIYNetwork from Scripps, with its sister cable channel, and scores of other sites that offer free instructional video. Then in the paid download category there is Zipidee (angel round), which recently acquired TotalVid and iAmplify ($6M from Kodiak). plus countless other video download sites.

One of the lines of demarcation for the ad-supported sites is how they acquire content. Does the video come solely from "experts" or also from the community? For now, it appears that ExpertVillage and VideoJug rely on experts while the other ad-supported upstarts rely on the community as well. I spoke with Ran Harnevo, CEO of 5Min.com, who believes its highly community-oriented focus is a real differentiator. In fact, 5Min bills itself as a "Life Videopedia", a spin on the hugely popular Wikipedia, which demonstrates the power of user contributions.

The whole notion that a top-down editorially-driven approach will ever be sufficiently comprehensive seems unlikely, so my guess is that some UGC augment eventually will be required by all players. That means these sites will compete with each other for the best contributors, in the same way that video sharing sites like Metacafe, Veoh, Revver and others compete with each other in general video.

To succeed in this horse race, 5Min's focus is to offer the best overall platform, including a focus on technology. So 5Min provides strong branding opportunities, a revenue share, tools and features and of course, traffic. On the technology side, one differentiator is its "SmartPlayer", which allows zooming, super slow-motion, frame-by-frame and storyboard playback.

One of the main reasons there's so much activity on the ad-supported side is that how-to videos provide highly-targeted and engaged audiences that sponsors crave. At a minimum, marrying these how-to videos to Google AdSense provides a baseline revenue model. But the real opportunity is to aggregate enough traffic in a category to land sponsors who will be prominently featured. So for example, while 5Min already does an impressive 5M views/mo, it will likely need to be in that range per category to appeal to big-name sponsors. The company will begin running ads in Q2, and is focused on display ads and overlays, not pre-rolls, which Ran thinks are too disruptive. To build its traffic it will pursue widgetization, 3rd party distribution and SEO.

All of this how-to activity is clearly going to be a boon for users. Just as the Internet has provided an explosion of information, these video how-to sites will now make doing things a whole lot easier. How to break out of the growing pack will continue to be each how-to site's challenge for the foreseeable future.

Categories: Indie Video, Startups

Topics: 5Min.com, DIY, ExpertVillage, HowCast, Scripps, VideoJug, WonderHowTo.com, YouTube, Zipidee

-

PlatformQ Taps Broadband Video for Virtual Events

While it's easy to fixate on how broadband video delivery is opening up new distribution opportunities for films and TV programming, there is also a ton of innovation happening well outside the professional video space.

I'm always keen to learn about entrepreneurs who are recognizing that broadband video can have a revolutionizing influence on sectors in which they're deeply familiar. A recent example to hit my radar is PlatformQ, which is harnessing broadband to create powerful virtual events in the higher education, energy and health care sectors.

PlatformQ sees itself as a digital media company in the sense that revenues will be derived from sponsorships; another way of thinking about them is as a next-generation, broadband-powered trade show company. I recently caught up with Robert Rosenbloom, CEO/Co-Founder (former VP Biz Dev/Co-Founder of iCongo) and Chris Charron, VP Product Management (former Group VP at Forrester Research) to learn more.

PlatformQ's first event, CollegeWeek Live, was held in November '07 and drew 15,000+ registrations and 100+ participating colleges. More than an aggregation of text/graphic info, CWL featured live, streamed keynotes from 8 admissions experts (originating from studios around the U.S.), 50 hours of live video chat sessions between actual students and prospective applicants, and thousands of hours of chat sessions. For this event, PlatformQ used Unisfair as the key underlying events technology, but it believes there a number of other alternatives for future shows depending on specific requirements.

The key to CWL is that it creates an informative and intimate user experience using broadband video to augment the traditional college search process. It's not just a win for prospective applicants. Bringing this appealing audience together is a magnet for all kinds of marketers, and thus CWL creates tons of sponsorship opportunities, many of which can be video-based as well.

In addition, all user behavior in CWL is tracked, so it is a great lead-gen source for the participating colleges and an opportunity for them to shoot their own video to showcase their school in new and innovative ways. Since CWL will be held at least semi-annually, schools can showcase timely events (e.g. football victories, winter scenes, etc.). Taken together, CWL opens up a whole new window for applicants into the overwhelming college selection process by using technologies (video, chat, social networking, etc.) that are already very familiar to them.

Next up for PlatformQ are virtual events in the energy and health care sectors, which the company believes are ripe for broadband video to also add new value. This seems like a great business model to me as it delivers strong value to all the target constituencies. It is also another terrific example of how broadband is stimulating new innovation in areas that traditionally had little or nothing to do with video. PlatformQ is based in Needham, MA and has done one angel round.

Categories: Startups

Topics: PlatformQ

-

Zipidee Buys TotalVid; Guns for Long Tail Video Dominance

This morning Zipidee, a company formed earlier this year, is announcing its acquisition of TotalVid from

Landmark Communications. With the deal Zipidee is gunning to become the king of the long tail, enthusiast video, using a strictly paid model. Yesterday I spoke with Zipidee CEO Henry Wong, and TotalVid President Karl Quist about the deal and the opportunity going forward.

Landmark Communications. With the deal Zipidee is gunning to become the king of the long tail, enthusiast video, using a strictly paid model. Yesterday I spoke with Zipidee CEO Henry Wong, and TotalVid President Karl Quist about the deal and the opportunity going forward.  Zipidee's strategy is to create a digital marketplace for video, audio and ebooks. As Henry puts it, we're "eBay meets iTunes", enabling content providers to set the business rules around how their content can be accessed. Like TotalVid, Zipidee's intent is to open up the broadband distribution market to the many smaller, independent producers who have traditionally relied on inefficient and hard-to-access DVD distribution channels.

Zipidee's strategy is to create a digital marketplace for video, audio and ebooks. As Henry puts it, we're "eBay meets iTunes", enabling content providers to set the business rules around how their content can be accessed. Like TotalVid, Zipidee's intent is to open up the broadband distribution market to the many smaller, independent producers who have traditionally relied on inefficient and hard-to-access DVD distribution channels. I am very familiar with TotalVid, having worked as a part-time biz dev consultant for them for a while, helping pull together a number of distribution deals. TotalVid started up in the relatively early days of broadband video, almost 4 years ago. Karl and his team did a fabulous job gaining access to specialty video in tons of categories such as action sports, martial arts, instruction, etc, eventually aggregating over 500 different content providers providing over 5,500 different titles. This library is very complimentary to Zipidee, which itself has done hundreds of content deals aggregating a library of over 5,000 titles. As Henry explained it, there is virtually zero duplication.

Henry resolutely believes that the paid approach for accessing this type of longer-form, specialty content is preferable to ad-supported. In general I agree with him - this kind of stuff isn't just random low-quality clips and consumers should expect that it won't come free.

However, as many VideoNuze readers know, I believe there are real challenges succeeding with the paid model right now. Chief among them is that the Internet is awash with free video, continuously raising the bar for how to get users to crack open their wallets and pay for anything, no matter how useful or sought after it might be. So this leads to a real marketing and customer acquisition challenge. Meanwhile DVD is a robust format and few people are yet familiar or comfortable with how a paid download works (e.g. is it portable? how does it get moved to other machines, can it be watched on TV?) So there's a big customer education challenge.

Nonetheless, I'm rooting for Zipidee. If they can surmount these and other challenges, they'll have created a hugely valuable digital distribution franchise.

Categories: Aggregators, Deals & Financings, Downloads, Startups

Topics: Landmark Communications, TotalVid, Zipidee

-

Building B Has Cable and Satellite in its Crosshairs

Building B is major league stealthy company with an audacious vision for how consumers will access video content in the future. If it succeeds current multichannel video service providers (namely cable and satellite providers) will feel the brunt.

Building B has a blue chip executive team and pantheon of accomplished investors and advisors. It made headlines a few months ago when it announced a $17.5M funding round led by Morgenthaler Ventures, OmniCapital and Index Ventures.

Last week I had a briefing with Buno Pati, CEO/Co-founder and Phil Wiser (Chairman/President/Co-founder). They are both highly-experienced and successful technology executives who are also quite PR savvy. They know how to stay on message and close to their stealthy script. I needed to use my "virtual crowbar" persistently to try to pry a few new morsels of information out of them. From what I learned, it's a pretty cool story. Following is what I learned about what the company.

The company's plan rests on a number of key assumptions:- TV must be the center of the consumer video experience, and today's service must be redefined

- Access to broadcast content is critical for success

- On demand, high def is in, linear, standard def is out

- Open access to robust wireless networks will be prevalent

- Advertising will be key value driver in the future

- Price of storage is going to virtually zero;

Given all this, in Buno's words, "Building B's opportunity is to unify, simplify and deliver a video experience to consumers at a more palatable price." This simple sounding statement belies an excruciatingly tall order.

The company is creating a next generation set top box of sorts that will deliver the gamut of video: TV, movies and broadband. Buno and Phil don't see their box as comparable to ones from say Akimbo, Vudu or Apple TV. These are really broadband-only augments, whereas Building B aspires to be a full-on substitute for cable or satellite. Their box will be able to access content through both wired and wireless delivery infrastructures. One engineering challenge is to match content with the optimal delivery network. So for example, one-to-many broadcast networks might be delivered over wireless while niche and interactive content would use broadband.

But Building B doesn't see a model selling the box at retail (though Phil concedes this might be a secondary outlet). Others have tried and failed at retail. Rather, its go-to-market strategy contemplates partnering with service providers like telcos and ISPs which want or need to be in the video business, but don't have the stomach or cash to upgrade their networks to do so.

Building B plans to develop a video entertainment service offering incorporating its box which can be made available turnkey to partners. These partners could include smaller telcos, particularly in rural areas, which have traditionally stapled on a satellite offering to fill out their triple play bundle. Or they could be larger telcos like AT&T or Verizon, who might augment their fiber rollouts with Building B's approach. Or they could be broadband ISPs, portals and others who aspire to be in the video business.

A key hurdle for Building B is assembling a fully competitive video lineup to what today video providers offer. This is no easy feat. Cable programmers in particular are reluctant to make advantageous deals with new distributors for fear of antagonizing existing cable and satellite affiliates. Yet Buno feels confident that Building B will gain access to major cable networks' fare, on demand, and on deal terms that are both economic to the company and non-disruptive to these networks' current arrangements. Accomplishing these deals alone would be noteworthy.

Lastly, Building B envisions delivering a personalized and easy-to-access service. Buno speaks of having a "dumbed down approach" aimed at satisfying only primary consumer needs and routines. Given its emphasis on HD, this is the part of the Building B vision that must necessitate a colossal hard drive in the box to cache content for ready access. Indeed, Buno said the company is "betting heavily that the price of storage is going to zero." If this assumption is off the bill of materials on storage alone could bust the box's budget.

Listening to Building B's vision, it's hard not to get enthusiastic about the world it seeks to create. As a consumer it would be thrilling. Yet the technology landscape is littered with ambitious would-be contenders whose aspirations foundered when faced with real-world engineering, marketing and business model challenges. Building B is simultaneously climbing tall mountains in multiple directions. If it succeeds, it will become a big-time disruptor of today's business models. It's going to be fun to watch it try.

Categories: Cable Networks, Cable TV Operators, Devices, Startups, Technology

Topics: Building B, Index Ventures, Morgenthaler Ventures, OmniCapital

-

Adap.tv Improves Broadband Video Ad Targeting with CPC Approach

As the broadband video world continues to coalesce around advertising as its primary business model, there is a flurry of companies seeking to improve the monetization process. As I've written before, this is critical work, because at some point the bloom will be off the broadband video rose if participants can't earn an attractive ROI.

Enter Adap.tv, which is addressing the ad monetization challenge. The company was founded last year and is based in San Mateo, CA. It is backed by Redpoint and Gemini and now has 20 employees.

CEO/co-founder Amir Ashkenazi recently gave me a run-down on Adap.tv's approach and progress. Amir was the founder of Shopping.com, which was acquired by eBay and he has brought together many former colleagues for his experienced management team.

Like its competitors, the heart of Adap.tv's model is its ad targeting and relevance engine. Adap.tv uses a "multi-disciplinary approach": analysis of the video/audio (context, metadata, etc.), analysis of the ad (keyword submission, etc.) and analysis of the user (demographics, location, etc.). This data is then fed to a matching engine to pair ads with the most relevant video. Over time the system optimizes based on actual click behavior.

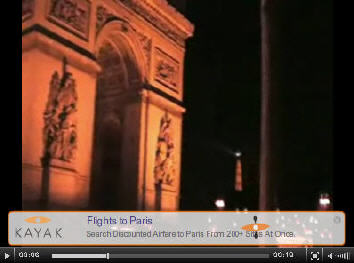

Adap.tv is highly focused on overlays (Amir believes this will be the "de-facto standard" soon), and provides a series of customizable templates for advertisers (see below Kayak overlay). It is also positioning itself as a cost-per-click model, so there's no fixed cost to advertisers. In fact, advertisers can power Adap.tv ads using the same keyword feeds they use for their keyword campaigns.

So far publishers have been responsive to the CPC model because they see overlays as opening up a lot of untapped inventory. Obviously implementing overlays needs to be done judiciously or the viewer experience will become cluttered and broken. Amir believes the whole broadband video ad model will move to CPC over time as advertisers become more sophisticated and focused on performance. This Google-like model would be very good news for advertisers, but would be a brave new world for traditional broadcast and cable networks long accustomed to CPM approaches in their traditional businesses.

While I think a more performance-based broadband ad environment would be welcome, I continue to believe a CPC/overlay approaches will ultimately co-exist with CPM/pre-rolls. There's a lot of interest in overlays, yet there are too many great 15 and 30 second TV spots not be re-used online and the CPMs are way too rich for big branded content providers to walk away from.

Other companies that are in the contextual analysis and/or overlay space include: ScanScout, Digitalsmiths (note: a VideoNuze sponsor), YuMe, blinkx, VideoEgg, YouTube, Brightcove, AdBrite, Viddler (which TechCrunch just wrote about yesterday) and others I'm sure I'm missing or are yet to surface.

Categories: Advertising, Startups, Technology

Topics: Adap.TV, AdBrite, Blinkx, Brightcove, Digitalsmiths, ScanScout, Viddler, VideoEgg, YouTube, YuMe

-

Hulu 1.0 Gets a Solid B+

I'm now back from Digital Hollywood and I've had an opportunity to give Hulu 1.0 a spin as part of its private beta. I've also looked the Hulu offering at AOL which is not yet comparable (less content, fewer features) to the one at Hulu.com. So I think that for now using Hulu through the private beta is the only way to get the full 1.0 experience.

My initial reactions are positive and I give Hulu 1.0 a solid B+, with many of the fundamentals well done, but with certain features needing improvement, as to be expected from a beta launch. All in all, considering the short development window in which Hulu was created, the Hulu team deserves much credit.

Hulu 1.0 should more than silence those who snarkily pre-labeled it "Clown Co" and misunderstood it to be a "YouTube killer", which it is not. Hulu has not embarrassed its primary investors (and content providers) NBC and News Corp in any way, and in fact, has set the stage for taking back control of how its full-length content and clips are distributed online. This was of course the investors' main motivation - creating a legitimate platform for them to control their online destiny and capture the lion's share of the economics.

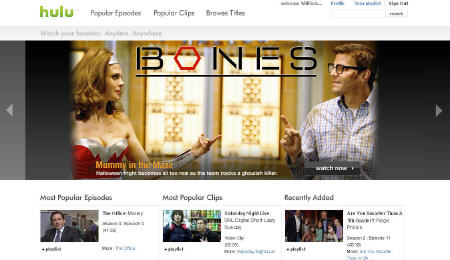

Design and Video QualityHulu sports a clean, open design format, heavy on thumbnail images. It's easy to find your way around, and there's little risk of getting lost in the process. The home page, seen below, offers 3 main branches, Popular Episodes (will number 1 on the list ever be anything but an episode from The Office though?), Most Popular Clips (looks like all provided by Hulu, none by users) and Recently Added (a nice addition here would be to expose the original air date without actually having to click through).Once clicking into a clip or full length video, the video player experience was excellent. Not only is the player consistent for all videos, but the quality was as well. I never experienced any delays, re-buffering, pixelation, audio/video out of synch or other typical video issues. In full screen mode there was a little degradation, but was certainly above the acceptable-quality bar.

ContentCurrently there are 34 individual content providers (though many under common parentage) contributing a broad range of current and older TV programming and films. While the other 2 big broadcasters CBS and ABC are missing, there's plenty of cable network and studio fare available. All is easily navigable through the browse function.

ContentCurrently there are 34 individual content providers (though many under common parentage) contributing a broad range of current and older TV programming and films. While the other 2 big broadcasters CBS and ABC are missing, there's plenty of cable network and studio fare available. All is easily navigable through the browse function.The biggest knock on the content is its inconsistency. For example, click on "24" and you can choose from 3 episodes from Season 1 and one from Season 6. Battlestar Galactica gives all of Season 1, but nothing else. Same for a classic like The Mary Tyler Moore Show. Huh? All of this makes it confusing for the user to know what to expect. If all this is due to rights or other limitations, it would be good for Hulu to signal or explain this somehow.

AdvertisingCertainly one of the best decisions Hulu made is how it's initially implementing ads, though the implementation doesn't appear consistent across all video, or at least the ones I watched. There are no pre-rolls, though there are 5 second sponsor messages up front, but only for certain shows it seems, not all of them. There are mid-rolls, typically 15-30 seconds, and fortunately these are show only one at a time, not in pods. And there's a countdown so it's clear when video will resume.Of course, the bigger question is whether this limited amount of advertising is sufficient to make Hulu's economic model work, especially if sometime down the road, online consumption cannibalizes on-air consumption.

FeaturesMany of the expected features are offered - embed, share, full screen, create a playlist and user reviews. One feature that has great potential is the "create a custom clip". This allows users to manipulate a timebar to create their own favorite clips. I could see this being very popular, especially for passionate fans. And it allows a whole new range of short form video inventory to be created with no incremental effort by Hulu staff.Yet for now the create a clip capability is buried in the "Share" feature, which seemingly only allows the custom clip to be emailed. And pinning down your desired start and stop points is very tough. Since custom clips are the only UGC-like opportunity in Hulu, these should be given more prominence. Ideas could include showcasing a users' gallery of favorites, allowing them to be saved to playlists, syndicating them to partners' sites and allowing them to be mashed up.

Wrap-upIn general, while I think Hulu1.0 is an admirable starting point, the custom clip situation underlines the one major disconnect I have with Hulu: I sense that in its zeal to become a site focused on premium, non-UGC content, it managed to miss out on emphasizing a community-building, social-networking focus that would help make it feel more interactive and inviting.These are exactly the types of things that have helped make YouTube such a hit. Offering some of these features doesn't mean Hulu becomes a YouTube competitor, vying for UGC supremacy. Rather, it means giving users some of the social tools they love, which they can now use with premium content only Hulu has to offer. If and when Hulu embraces these opportunities as well, an "A" grade will be attainable.UPDATE: Reed Price, MSN Entertainment's Editor-in-Chief emailed me to remind me that MSN (an initial Hulu distribution partner) has already rolled out a relatively extensive integration of Hulu video. He provided a number of links including these 4:

Thanks for the heads-up Reed. When I see that other distribution partners have integrated Hulu I intend to write another post comparing/contrasting the distributors' various approaches. I have a hunch they'll vary widely.Categories: Broadcasters, Startups

Topics: Hulu, NBC, News Corp.

-

The Fifth Network Poised to Emerge

Today I had a pretty interesting meeting with The Fifth Network, a company which I'd only been minimally

aware of. TFN's been focused on media services for the past couple of years, but is now poised to launch a pretty comprehensive solution for broadband video delivery.

aware of. TFN's been focused on media services for the past couple of years, but is now poised to launch a pretty comprehensive solution for broadband video delivery.We didn't get into too much detail or extensive demos, but what I did see looked impressive, especially from a video quality perspective. They shared a preview of a deal being implemented for a big brand advertiser and also for a potential film studio.

I thought all the companies that had planted their flag in the content/ad management and content publishing spaces were now declared, but TFN shows that there are still some stealthy efforts out there, which when released will continue to push further innovation in this space. I'll have more details on TFN's deals just before they go live.

Categories: Startups, Technology

Topics: The Fifth Network

-

Magnify.net: A Long Tail Matchmaker

Yesterday I had a chance to catch up with Steve Rosenbaum, CEO and Co-Founder of Magnify.net.

Yesterday I had a chance to catch up with Steve Rosenbaum, CEO and Co-Founder of Magnify.net.One of the things I really enjoy about being an analyst in the burgeoning broadband video industry is getting first-hand exposure to all the clever innovation that's going on. I find it endlessly fascinating to hear directly from entrepreneurs on the front lines where the kernel of their idea came from which led to their business plan. A user experience issue? A technology deficiency? A business model flaw? Over the years I've heard many stories. Some kernels have real weight, while some don't quite resonate for me.

Magnify.net falls into the former category. My read is that this is a company trying to solve a real problem with a very clever solution and the right "corporate attitude" to make it a likely winner.

Magnify is actually solving a number of real problems, many of which relate to the highly distributed or "Long Tail" nature of the Internet and broadband video. First is that while consumers love broadband video, finding what they want is problematic. Novelty quickly turns to frustration when rummaging through big video sharing sites to find something relevant. No matter how much users want choice, some level of editorial or "curation" is essential to optimize their experience.

Magnify enables existing enthusiast or vertical web sites (whether independent or major media) to obtain video from the best video sharing sites (YouTube, Metacafe, etc.) and coherently present a screened assortment to their users. The sites' use their editorial skills to sort the wheat from the chafe, with easy-to-use admin tools ensuring that no offending video slips through the cracks.

So the second problem Magnify solves is enabling thousands (17,500 and counting to be exact) of sites to provide quality video to their users without the hassle and expense of creating it themselves (the "matchmaker" role). These sites get 50% of the revenue from the ads Magnify sells around the video (or they can keep up to 50% of the inventory to sell themselves), leveraging their audience and subject matter expertise. Incorporating video into web sites is becoming online table stakes. I agree with Steve, in the years ahead, sites without video are going to look "charming".

The only real hole I can find in Magnify's model is that it doesn't currently compensate the content creators themselves (a la Revver for example). However I'd expect that to change as creators upload directly to Magnify and the company's network and traffic builds out over time.

Lastly, I like Steve's attitude. He views the market as an incredibly expanding pie, and not "winner take all." As a result, while there are others who touch on Magnify's space (Brightcove, ROO, VideoEgg, Ning, KickApps, etc.), he's less concerned about competition per se and matching feature-for-feature, but rather on responding to the needs and wants expressed directly by their own user base. Companies that do this ultimately win, regardless of competition.

The Magnify story plays into a number of areas I follow closely - the changing role and power of video distributors, the continued "nichification" of video, the challenge of video discovery and the reliance on ads, not subscription fees. To the extent that their approach succeeds it will further morph traditional video models. For a 10 person company that's only done an angel round, they've accomplished a lot in addressing genuine Long Tail issues in the broadband video industry. (Btw, TechCrunch has 2 great reviews, here and here).

Categories: Aggregators, Indie Video, Startups, UGC, Video Sharing

Topics: Brightcove, KickApps, Magnify.net, Ning, ROO, VideoEgg

-

Black Arrow Shoots for Multiplatform Ad Success

Black Arrow has an ambitious goal of managing and serving ads across broadband video, DVR and VOD platforms. With audience fragmentation causing chaos in the advertising world, such a solution, when fully implemented, would have enormous value to content companies and service providers (cable, satellite, telco).

Black Arrow has an ambitious goal of managing and serving ads across broadband video, DVR and VOD platforms. With audience fragmentation causing chaos in the advertising world, such a solution, when fully implemented, would have enormous value to content companies and service providers (cable, satellite, telco).Black Arrow has been around for a while but went under the radar for the past few months. Now it's re-emerging, with new CEO Dean Denhart installed about 6 months ago.

Dean briefed me last week on news the company announced today, which included closing a $12M B round from existing investors Comcast, Cisco, Intel, Mayfield and Polaris and officially launching their ad platform.

The company is trying to differentiate itself from many others serving ads in the broadband video space by tackling the thorny problem of also inserting in both the DVR and VOD environments. DVR insertion today is non-existent and for VOD it's not scalable. To succeed, the company will need to integrate its servers with the service providers, which is no easy feat. As many of you know, the rap on cable operators - and I've experienced this first-hand - is that selling into them wears out early-stage companies, using up precious time and capital in long drawn-out testing, selling and negotiation cycles.

If Black Arrow survives this process and proliferates its gear into headends, it will have a formidable competitive advantage against competitors. And on the encouraging side, in the cable world at least, a nascent set of standards dubbed "DVS 629" governing digital ad insertion is now being worked on. Black Arrow is following these closely. Dean explained that the company has proven in its technology and in 2008 it will be pursuing field trials and initial rollouts with major operators. Certainly having Comcast as a lead investor can't hurt its chances.

Black Arrow's real appeal to content companies will only begin when it has significant deployments. Dean explained that while the cable sell-in process continues to unfold, it will follow a parallel track of managing ads for broadband, with the longer-term value prop of multi-platform support. And it's taking a wait-and-see approach on which business model to use to fund the capex for proliferating its servers. An analogous and interesting approach is the one Akamai has mastered - i.e. not charging ISPs. Instead it positions its gear contributing to top-line growth and opex reductions. This strategy has been a massive success for Akamai, helping it achieve widespread deployments and a huge entry barrier for competitors.

I really like this company's vision; however achieving it in full is going to take tenacity, patient and deep-pocketed investors and a few good breaks.

Categories: Advertising, Cable TV Operators, Deals & Financings, Startups

Topics: Black Arrow, Cisco, Comcast, Intel, Mayfield, Polaris

-

Broadband Video Contextual Ad Space Heats Up, Digitalsmiths Lands Series A Round of $6M

Tomorrow Digitalsmiths, an entrant in the budding broadband video contextual advertising space, will announce a $6M Series A round from The Aurora Funds, Chrysalis Ventures and individual investors. I got a briefing from Digitalsmiths's CEO Ben Weinberger and CTO Matt Berry along with the new investors. The company's new Videosense product builds off of their existing automated video indexing and search product known as InScene which Hollywood studios have been using for years to index and search stock footage.Videosense introduces a contextual ad matching process that matches ads to the content of videos based on an index of metadata that was extracted from the audio track and visual cues (scenery, characters, props, etc.). This matching and metadata gathering process is the company's secret sauce. As with all contextual approaches, the intention is to insert the appropriate ad at just the right moment. So say, for example, you're watching ‘24' online, when Jack Bauer pulls out his smartphone, a discreet ad for Treo pops up. The company can support all types of ads (video, text, banners, etc.) Digitalsmiths can do this across multiple video formats (Flash, WMV, Real, etc.) and plans to serve multiple devices as well.While they haven't announced any customers yet, Weinberger said they're in multiple live customer trials and should be announcing something soon. There's been lots of energy and top tier VC funding in the contextual video ad serving space recently. Other companies that we're aware of in this space include ScanScout, YuMe, Adap.TV, and Gotuit (which has been more focused on indexing than ads), along with blinkx, which just announced its "AdHoc" product today.Over the past year, vendors' efforts to improve upon today's vibrant, yet much maligned, pre-roll format have intensified. There are many different initiatives out there, such as new formats, interactivity, targeting, etc. Improvements in contextual targeting are part of this mix of innovation. All this activity isn't surprising as broadband video content providers have embraced advertising as their business model of choice.Since pre-rolls are still the lifeblood of the broadband video industry and will be for a while, smart vendors will seek to build on its momentum, while gracefully introducing new formats. And since much of the pre-roll delivery infrastructure is now in place, it's also essential for the new crop of contextual vendors to integrate seamlessly with existing ad networks. Digitalsmiths seems to be adhering to this game plan, and so their development is worth keeping an eye on.

Tomorrow Digitalsmiths, an entrant in the budding broadband video contextual advertising space, will announce a $6M Series A round from The Aurora Funds, Chrysalis Ventures and individual investors. I got a briefing from Digitalsmiths's CEO Ben Weinberger and CTO Matt Berry along with the new investors. The company's new Videosense product builds off of their existing automated video indexing and search product known as InScene which Hollywood studios have been using for years to index and search stock footage.Videosense introduces a contextual ad matching process that matches ads to the content of videos based on an index of metadata that was extracted from the audio track and visual cues (scenery, characters, props, etc.). This matching and metadata gathering process is the company's secret sauce. As with all contextual approaches, the intention is to insert the appropriate ad at just the right moment. So say, for example, you're watching ‘24' online, when Jack Bauer pulls out his smartphone, a discreet ad for Treo pops up. The company can support all types of ads (video, text, banners, etc.) Digitalsmiths can do this across multiple video formats (Flash, WMV, Real, etc.) and plans to serve multiple devices as well.While they haven't announced any customers yet, Weinberger said they're in multiple live customer trials and should be announcing something soon. There's been lots of energy and top tier VC funding in the contextual video ad serving space recently. Other companies that we're aware of in this space include ScanScout, YuMe, Adap.TV, and Gotuit (which has been more focused on indexing than ads), along with blinkx, which just announced its "AdHoc" product today.Over the past year, vendors' efforts to improve upon today's vibrant, yet much maligned, pre-roll format have intensified. There are many different initiatives out there, such as new formats, interactivity, targeting, etc. Improvements in contextual targeting are part of this mix of innovation. All this activity isn't surprising as broadband video content providers have embraced advertising as their business model of choice.Since pre-rolls are still the lifeblood of the broadband video industry and will be for a while, smart vendors will seek to build on its momentum, while gracefully introducing new formats. And since much of the pre-roll delivery infrastructure is now in place, it's also essential for the new crop of contextual vendors to integrate seamlessly with existing ad networks. Digitalsmiths seems to be adhering to this game plan, and so their development is worth keeping an eye on.Categories: Advertising, Startups

Topics: Adap.TV, Blinkx, Digitalsmiths, Gotuit, ScanScout, YuMe

Posts for 'Startups'

Previous |