-

September '08 VideoNuze Recap - 3 Key Themes

Welcome to October. Recapping another busy month, here are 3 key themes from September:

1. When established video providers use broadband, it must be to create new value

Broadband simultaneously threatens incumbent video businesses, while also opening up new opportunities. It's crucial that incumbents moving into broadband do so carefully and in ways that create distinct new value. However, in September I wrote several posts highlighting instances where broadband may either be hurting existing video franchises, or adding little new value.

Despite my admiration for Hulu, in these 2 posts, here and here, I questioned its current advertising implementations and asserted that these policies are hurting parent company NBC's on-air ad business. Worse yet, In "CNN is Undermining Its Own Advertisers with New AC360 Live Webcasts" I found an example where a network is using broadband to directly draw eyeballs away from its own on-air advertising. Lastly in "Palin Interview: ABC News Misses Many Broadband Opportunities" I described how the premier interview of the political season produced little more than an online VOD episode for ABC, leaving lots of new potential value untapped.

Meanwhile new entrants are innovating furiously, attempting to invade incumbents' turf. Earlier this week in "Presidential Debate Video on NYTimes.com is Classic Broadband Disruption," I explained how the Times's debate coverage positions it to steal prime audiences from the networks. And at the beginning of this month in "Taste of Home Forges New Model for Magazine Video," I outlined how a plucky UGC-oriented magazine is using new technology to elbow its way into space dominated by larger incumbents.

New entrants are using broadband to target incumbents' audiences; these companies need to bring A-game thinking to their broadband initiatives.

2. Purpose-driven user-generated video is YouTube 2.0

In September I further advanced a concept I've been developing for some time: that "purpose-driven" user-generated video can generate real business value. I think of these as YouTube 2.0 businesses. Exhibit A was a company called Unigo that's trying to disrupt the college guidebook industry through student-submitted video, photos and comments. While still early, I envision more purpose-driven UGV startups cropping up in the near future.

Meanwhile, brand marketers are also tapping the UGV phenomenon with ongoing contests. This trend marked a new milestone with Doritos new Super Bowl ad contest, which I explained in "Doritos Ups UGV Ante with $1 Million Price for Top-Rated 2009 Super Bowl Ad." There I also cataloged about 15 brand-sponsored UGV contests I've found in the last year. This is a growing trend and I expect much more to come.

3. Syndication is all around us

Just in case you weren't sick of hearing me talk about syndication, I'll make one more mention of it before September closes out. Syndication is the uber-trend of the broadband video market, and several announcements underscored its growing importance.

For example, in "Google Content Network Has Lots of Potential, Implications" I described how well-positioned Google is in syndication, as it ties AdSense to YouTube with its new Seth MacFarlane "Cavalcade of Cartoon Comedy" partnership. The month also marked the first syndication-driven merger, between Anystream and Voxant, a combination that threatens to upend the competitive dynamics in the broadband video platform space. Two other syndication milestones of note were AP's deal with thePlatform to power its 2,000+ private syndication network, and MTV's comprehensive deal with Visible Measure to track and analyze its 350+ sites' video efforts.

I know I'm a broken record on this, but regardless of what part of the market you're playing in, if you're not developing a syndication plan, you're going to be out of step in the very near future.

That's it for September, lots more planned in October. Stay tuned.

What do you think? Post a comment!

Categories: Aggregators, Analytics, Brand Marketing, Broadcasters, Magazines, Partnerships, Syndicated Video Economy, UGC

Topics: ABC, Anystream, AP, CNN, Doritos, Google, Hulu, MTV, NY Times, Taste of Home, thePlatform, Unigo, Visible Measu, Voxant, YouTube

-

Truveo Helps Clear Video Search Fog with New Study

A couple of days ago, Truveo, the big video search engine owned by AOL, released the results of an internal study which concluded that it provides the most comprehensive search results among 5 companies considered. Before you say, "Duh, Will, what else would you have expected Truveo to conclude?!" it's worth spending a few minutes considering the study's methodology, results and implications. Video search is an extremely strategic space, so all credible data has value.

When it comes to search, there are really two key criteria to judge quality - coverage and relevancy. A search engine can return a million results, but if none are relevant, it's pointless. Conversely, just one spot-on result and you'll rejoice, but you still may yearn for additional, relevant options (since video quality can vary, links may be broken, the user experience at certain sites may stink, etc.). So optimizing both coverage and relevancy must be the goal.

In Truveo's study, it has focused solely on coverage, having deemed relevancy too subjective to credibly

measure. To quantify coverage from a competitive standpoint, it chose 4 other search engines, Blinkx, Microsoft Live Video Search, Google Video and Yahoo Video. This limited pool immediately begs the question how the many other video search companies not included would have fared. Truveo explained that the testing was very resource-intensive, so they needed to keep the competitive set relatively small.

measure. To quantify coverage from a competitive standpoint, it chose 4 other search engines, Blinkx, Microsoft Live Video Search, Google Video and Yahoo Video. This limited pool immediately begs the question how the many other video search companies not included would have fared. Truveo explained that the testing was very resource-intensive, so they needed to keep the competitive set relatively small.To measure coverage, Truveo selected 100 top-ranked Alexa sites across 5 categories: news, sports, TV, music and movies. Then they found 10 representative videos from each and ran a query for those videos - using the exact title the site used - on each of the 5 search engines. Scoring was binary - a search engine got a 1 if they returned an accurate result for at least 5 of the 10 queries, a zero if they didn't. Final score from this process, Truveo 86, Blinkx 20, Microsoft Live Video Search 17, Google Video 3, and Yahoo 2.

Having reviewed the test's full methodology and spoken to a Truveo representative, I think for the most part their approach is pretty fair. An obvious limitation is that lots of video search engines (or web search engines like Google) weren't evaluated so the study is by no means conclusive. Further, only premium sites were included (i.e. no UGC, and actually very little indie video either), so one wonders how the results would have changed if sites like Break.com, Heavy and others were also tested. And then there's the small matter of YouTube, the market's 800 pound gorilla, not being included at all. Since for many users video search begins and ends with YouTube, its omission raises a question about just how reflective these results are of real-world user behavior.

Nonetheless, Truveo gets points in my book for shedding further light on a very confusing subject, and also constructing a relatively objective methodology that can be used by others (in fact Truveo is encouraging independent 3rd parties to undertake more testing of this kind).

Video search is one of the most intellectually challenging areas of the broadband video ecosystem, yet as Truveo asserts, there is surprisingly little evaluative data out there. From my standpoint, more data means more informed market participants and therefore continually improving user experiences. That benefits everyone in the broadband ecosystem.

What do you think? Post a comment now.

(Note, the complete methodology can be requested by emailing Josh Weinberg at jweinbergATtruveo.com)

Categories: Video Search

Topics: Blinkx, Google Video, Microsoft Live Video Search, Truveo, Yahoo Video, YouTube

-

Startup Unigo Harnesses "Purpose-Driven" User-Generated Video to Drive Disruption

I was absolutely riveted by an article I read in this past Sunday's NY Times Magazine entitled "The Tell-All Campus Tour," about Unigo, a tiny startup which threatens major disruption to the college guidebook industry. In particular, the company's emphasis on user (i.e. college student) generated video caught my attention. It got me thinking again about the business value that "purpose-driven" UGV has when it is properly channeled.

I've touched on this theme in the past, with respect to brand marketers' UGV contests that have unleashed all kinds of "amateur" creativity (see "Baby Ruth Hits a Home Run..." or "And the Oscar Goes To...Dove"). These contests have demonstrated that, with the proper incentives, users' passions and video know-how can lead to really compelling results. Now, upon reading about Unigo, I've become further convinced that there are bona fide startup opportunities in leveraging purpose-driven UGV.

To put this in context, YouTube struck gold by enabling, for the first time, random, and largely

unmonetizable, user generated video. Now a new generation of startups like Unigo can build on the YouTube phenomenon by focusing on purpose-driven UGV. To succeed, I think these companies will have 3 common elements: a reasonably large existing market that can be disrupted through the use of purpose-driven video (mixed with other web 2.0 features), a critical mass of amateur video creators who are self-motivated to produce high-quality, authentic video, and a group of advertisers eager to reach targeted audiences through new alternatives to traditional channels.

unmonetizable, user generated video. Now a new generation of startups like Unigo can build on the YouTube phenomenon by focusing on purpose-driven UGV. To succeed, I think these companies will have 3 common elements: a reasonably large existing market that can be disrupted through the use of purpose-driven video (mixed with other web 2.0 features), a critical mass of amateur video creators who are self-motivated to produce high-quality, authentic video, and a group of advertisers eager to reach targeted audiences through new alternatives to traditional channels. That's a mouthful, so let me use Unigo to break this down a bit. For starters, the company was founded by a precocious 23 year-old whose can-do energy and deep understanding of the college market is equally matched by his lack of real-world experience and formal company financing. All of that illustrates lesson #1 for purpose-driven UGV entrepreneurs: the barriers to creating these kinds of startups is shockingly low.

Somewhat buried in the 3,400+ word article is what resonated for me: Unigo bought a hundred Flip video cameras ($90 apiece at Amazon, fyi) and strategically distributed them to students at over 100 campuses nationwide, with no clear instructions on what to do next. The resulting student-created videos (which are continually submitted) span the gamut from slice-of-life to panoramic to comedic to everything in between. Unigo features text-based student submissions and photos, which, when combined with the videos, form an unvarnished - and unprecedented - user-generated multimedia guide to the America's campuses.

Simply put, Unigo is a product created by the YouTube/Facebook generation for the YouTube/Facebook generation. It offers a simple, breakthrough value proposition that will no doubt attract a large audience. And that large audience will be extremely interesting to all manner of advertisers.

Unigo's business value could make it a TripAdvisor-like, must have resource that initially augments, but could eventually squeeze traditional guidebooks and ratings services. While it is still way too early to call Unigo a success by any traditional standards, the work it has done to date offers a fascinating window into the emerging purpose-driven UGV-centric business model. That makes it well worth keeping an eye on.

What do you think? Click here to post a comment.

Topics: TripAdvisor, Unigo, YouTube

-

Google Content Network Has Lots of Potential, Implications

Many of you know that Google has recently begun distributing short animated videos from Seth MacFarlane (creator of TV's "Family Guy") to a wide network of sites that previously only received ads from Google, through their participation in AdSense. The company dubs this the "Google Content Network" (GCN for short), and from my vantage point, it has a lot of potential and implications for other players in the video distribution value chain. Yesterday, I spoke to Alexandra Levy, Google's Director of Branded Entertainment, and the point person for driving this initiative.

The first thing that resonates for me about GCN is that Google's vision for it harmonizes perfectly with my concept of the "Syndicated Video Economy." VideoNuze readers know that last March I introduced the SVE concept to capture a trend that I was noticing: an ecosystem was forming to distribute broadband video widely across the Internet, in contrast to the traditional, narrower distribution model.

Alex echoed the SVE, saying that in her many conversations with content producers, finding an audience is their top challenge. Great content, unwatched, is like the proverbial tree that falls in the forest when nobody is around to hear it.

So enter GCN, which Google rightly sees as a "media distribution platform." To understand its implications fully, you have to evaluate its potential to all relevant constituencies: Users get great updated content served to them at the sites they already visit. Those sites benefit from offering premium content, while also receiving a revenue share on the accompanying ads. The content provider benefits from leveraging Google's vast AdSense network to have video "pushed" to relevant audiences, increasing viewership and engagement. And advertisers' brands benefit from adjacency to premium content that is sought after and compelling.

Of course, last but not least, Google benefits from being the intermediary in this whole process. We all know from Google's massive success in web search that being the intermediary in a model where all constituent interests are neatly aligned creates near-infinite economic value. While Alex concedes the MacFarlane video (which is sponsored by Burger King and was brokered by Media Rights Capital) is still an "experiment," GCN sure does seem to bear a lot of resemblance to Google's traditional search model in the alignment of constituent interests.

Another twist here is that users who click for more video are driven back to MacFarlane's YouTube channel (already the 69th most subscribed channel, with almost 70K subscribers), which drives habituation, a key lever for ongoing video success as any network TV executive will admit. In this light, GCN gives Google a way of finally tying its powerful AdSense engine to YouTube. I'm not suggesting that Google is sweating the ROI on its $1.6 billion YouTube acquisition, but GCN surely looks like a way to move YouTube far beyond its roots as everyone's favorite UGC aggregator.

Alex is quick to point out that GCN does not budge Google from its often-stated position that it is not a content creator. Rather, it's using GCN to connect brands, content producers and users. If that connecting process drives audiences and generates revenues for content producers - and admittedly the proof is not yet in - that would give Google a lot of disruptive capital to help shape the video landscape. Just so nobody gets carried away, Google announced a similar experiment 2 years ago with MTV that fizzled out. So the company has yet to prove its experiment works and that it is fully committed to the GCN model.

Still, I continue to believe that video syndication - and the accompanying benefits to all - is a key, key driver of how the broadband video landscape is going to unfold. As a small teaser, there will be more interesting news on the syndication front early next week. Stay tuned.

(And note that the syndicated video economy will be one of the main topics of discussion at the Broadband Video Leadership Breakfast "How to Profit from Broadband Video's Disruptive Impact" with our A-list group of panelists, including Google's David Eun, on November 10th. Click here to learn more and register for special early bird rate.)

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Indie Video, Syndicated Video Economy

Topics: Google, Google Content Network, Seth MacFarlane, YouTube

-

American Political Conventions are Next Up to Get Broadband Video Treatment

As the first "Broadband Olympics" begin to wind down, the American political conventions are next up to get the broadband video treatment. While certainly not Olympian in their popularity, the conventions still have a rabid following among many, and given the particular dynamics of this year's election cycle, they are attracting far broader interest than usual.

The conventions have evolved a lot over the years. Traditionally they were a high-stakes drama culminating

in a roll call vote whose outcome was often uncertain. They have become a largely drama-free corporate-sponsored schmooze-fest punctuated by a few high-profile keynote and nominee acceptance speeches. Broadcasters have taken note, steadily reducing their coverage and opening the door to cable networks to do the primary convention coverage.

in a roll call vote whose outcome was often uncertain. They have become a largely drama-free corporate-sponsored schmooze-fest punctuated by a few high-profile keynote and nominee acceptance speeches. Broadcasters have taken note, steadily reducing their coverage and opening the door to cable networks to do the primary convention coverage.  In '04 the Internet crashed the conventions, primarily in the form of bloggers reporting on every convention utterance made. The bloggers will be out in full force at the '08 conventions too, but this time around broadband coverage is going to be the big story. Here's a partial list of what's on tap:

In '04 the Internet crashed the conventions, primarily in the form of bloggers reporting on every convention utterance made. The bloggers will be out in full force at the '08 conventions too, but this time around broadband coverage is going to be the big story. Here's a partial list of what's on tap:Democrats plan to deliver live, gavel-to-gavel HD streaming at their site. Republicans plan live streaming as well and announced Ustream.tv as their official partner.

The Democrats also plan a Spanish language simulcast produced by Comcast, to be available online and also on-demand for Comcast subscribers. The Dems are also producing a 15 minute daily show called "Countdown to America's Future" available through Comcast VOD and online.

CBS anchor Katie Couric is taking on broadband assignments, delivering web-only specials for the first time.

Politico.com and Yahoo have partnered with the Denver Post and St. Paul Pioneer Press to host a series of eight political forums which will be streamed live.

Corporate siblings WashingtonPost.com and Newsweek.com will deploy a team of journalists providing live streaming via their cell phones using an application from Comet Technologies.

Meanwhile, in the lead-up to the conventions, the YouTube Convention video contest, asked users to answer the question, "Why are you a Democrat/Republican in 2008?" Winners are here and here.

For those that don't take their politics too seriously, Jon Stewart, Stephen Colbert and many other comedians will no doubt have viral clips flying around the 'net. Going one comedic step further, Generate and MSN announced just this week the premiere of "Republicrats" a satirical broadband-only series with 24 episodes running though Election Day.

I'm sure there's more broadband convention coverage I've missed, so please post a comment regarding further coverage.

Categories: Politics

Topics: Comcast, Generate, MSN, Newsweek.com, Political conventions, WashingtonPost.com, YouTube

-

New Magid Survey: Short-Form Dominates Online Video Consumption and Hurts TV Viewership

Survey results being released this morning by Frank N. Magid Associates, a research consultancy, and video aggregator Metacafe provide fresh evidence that short-form video dominates online video consumption. Notably, the survey also goes a step further, finding that 28% of respondents who watch online video report watching less TV as a result.

Meanwhile though, on the same day earlier this week that I was talking to Mike Vorhaus, managing director at Magid, and Erick Hachenburg, CEO of Metacafe about this new survey, Mediaweek was reporting a separate Magid survey, commissioned by CBS, which found that "35% of the nearly 50,000 streamers surveyed...reported that they are more likely to view shows on the network as a result of having been exposed to content on the web."

As I learned from Mike, there's no actual contradiction in these 2 surveys' findings, but you do have to squint your eyes a bit to make sure you're understanding the data accurately.

First, the findings on short-form's domination. The Metacafe survey asked respondents about the most commonly viewed types of video and presented them with category choices. The top 5 selected were all short-form oriented: Comedy/jokes/bloopers (37%), music videos (36%), videos shot and uploaded by consumers (33%), news stories (31%) and movie previews (28%). TV shows comes in at #6 (25%), followed by more short-form categories of weather, TV clips and sports clips.

First, the findings on short-form's domination. The Metacafe survey asked respondents about the most commonly viewed types of video and presented them with category choices. The top 5 selected were all short-form oriented: Comedy/jokes/bloopers (37%), music videos (36%), videos shot and uploaded by consumers (33%), news stories (31%) and movie previews (28%). TV shows comes in at #6 (25%), followed by more short-form categories of weather, TV clips and sports clips. That short-form, snackable video dominates is not really a huge surprise, given YouTube's market share and the preponderance of virally shared clips. Yet Mike emphasized that short-form does not equal UGC, a point that Erick also highlights. Rather, Mike sees short-form as a legitimate alternative entertainment format that creatives are embracing and audiences are adopting. It is causing further audience fragmentation resulting in the TV audience erosion that the survey also uncovered.

Which of course begs how Magid's CBS survey data squares up. Mike explained that the key here is that the

CBS survey is based solely on users of CBS.com. These people naturally have a greater affinity for CBS programming and their likelihood of watching CBS shows on TV will be far higher than randomly-selected audiences (such as in the Metacafe survey). Here's the CBS press release for more details.

CBS survey is based solely on users of CBS.com. These people naturally have a greater affinity for CBS programming and their likelihood of watching CBS shows on TV will be far higher than randomly-selected audiences (such as in the Metacafe survey). Here's the CBS press release for more details.So the CBS data suggests that networks should be encouraged that streaming their shows builds loyalty and broadcast viewership, and therefore that they should keep on doing it. Nevertheless they need to be mindful that their shows now compete in a far larger universe of video choices, and that short-form - as a new genre - is something they too should be looking to exploit. Appropriately, all the networks, and many studios, are doing exactly that.

There is no shortage of research concerning consumer media behavior floating around these days. As the two Magid surveys show, superficially data may appear to be conflicting, though in reality it is not. Observers need to make sure they're digging in, and taking away the right lessons.

What do you think? Post a comment now!

Categories: Aggregators, Broadcasters

Topics: CBS, Magid, MetaCafe, YouTube

-

Viacom - Google/YouTube Litigation Moves Into Slippery Territory

If you were off the grid last week celebrating the July 4th holiday, there were some important fireworks in the ongoing Viacom - Google/YouTube litigation well worth paying attention to.

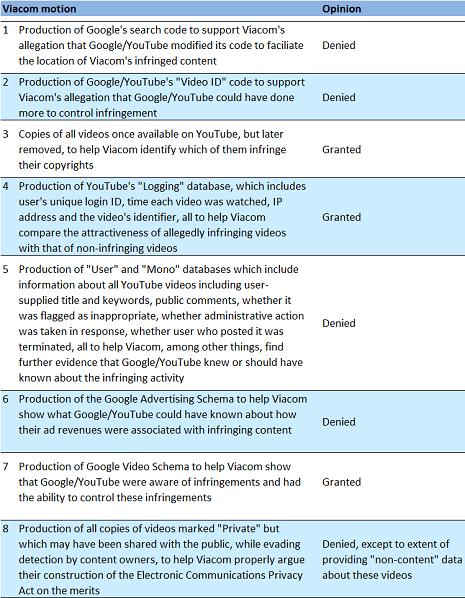

Judge Louis Stanton of the US District Court in New York, who is presiding over the litigation, handed down an opinion that granted and denied some of what each party was requesting. The opinion is here. I have read it and below is my synopsis (remember I'm not a lawyer):

The fourth item is the one that has gained the most attention and controversy. Privacy advocates are ballistic that this is a violation of users' privacy rights. Specifically they have cited Judge Stanton's characterization of Google/YouTube's objection to this particular Viacom request on the basis of privacy concerns as "speculative." A cottage industry of ridicule has broken out across the blogosphere regarding whether the 80 year-old Judge Stanton is sufficiently tech literate to grasp online privacy concerns. Many believe Viacom will use the data to sue individual users for viewing pirated copies of Viacom's programs on YouTube.

Like everyone else, I'm concerned about privacy here as well and recognize that Judge Stanton has moved this case into some very slippery territory. Yet, at a higher level, I'm feeling some resentment toward Google and YouTube, especially given its famous "do no evil" mantra. There is no question that they knew pirated versions of key Viacom (and other) programs were showing up on YouTube, yet at the time months went by without them candidly addressing the issue and doing something sufficiently proactive about it. To many, including me, the standoff then was (and continues to be) a high-stakes battle between two multi-billion dollar companies jockeying for negotiating leverage.

When we use various web sites (whether for broadband or other uses), there is an implicit and explicit understanding that our privacy will not be trifled with. Sites have a right to defend their business practices based on their interpretation of the existing laws, but they need to be balanced by what impact their actions may ultimately have for their users. Each of us has our own interpretation of whether Google/YouTube should have done more to protect Viacom's and others' copyrights, but as Judge Stanton's decision shows, to what extent YouTube's users' privacy is protected is now entirely up to his interpretation.

What do you think? Post a comment and let everyone know!

Categories: Cable Networks, Video Sharing

Topics: Google, Viacom, YouTube

-

The Incredibly Growing YouTube

Closing out the week, I missed this blurb from Information Week yesterday reporting YouTube's staggering dominance of broadband video traffic. New numbers out from Hitwise show that in May '08 YouTube garnered 75% of the 10 million visits to 63 video sites that Hitwise is tracking. That's 9 times the traffic of #2 MySpaceTV and more than 20 times that of the #3 site which is Google's other video property (remember it?)

According to Hitwise YouTube's share rose 26% from a year ago compared with drops by all the others in the top 5 sites except Veoh, which rose by 32% from a year ago.

It's just mind-boggling to think that one site could have such market share, particularly when a lot of the

networks' programs cannot be found there. I think it speaks to how strong users' appetites are for UGC and viral content remain, how YouTube has become a de facto video platform for lots of smaller players in the industry (and consumers) and how the company is likely beginning to enjoy some early success with its partners' channels.

networks' programs cannot be found there. I think it speaks to how strong users' appetites are for UGC and viral content remain, how YouTube has become a de facto video platform for lots of smaller players in the industry (and consumers) and how the company is likely beginning to enjoy some early success with its partners' channels. A few months ago, in "YouTube: Over-the-Top's Best Friend" I wrote that YouTube is quickly becoming the perfect ally for all those makers of new broadband-to-the-TV devices. These companies desperately need content and credible brands to help pull through consumer demand. YouTube offers both. In this sense, YouTube has huge value yet to be tapped (of course demonstrating that it can monetize its massive audience wouldn't hurt its partnership value...)

However, looked at another way, YouTube's success should be very encouraging to other players. To start with, YouTube is doing a marvelous job educating the world about the virtues of broadband video. And while YouTube is the market's 800 pound gorilla, it is still leaving key opportunities open for other players to differentiate themselves. Potential areas include high-quality delivery, ad-based and paid monetization and offering content that YouTube simply doesn't have (examples: Comedy Central programs like "The Daily Show" and "Colbert Report")

Volumes are yet to be written about YouTube. Whether it turns its market-leading traffic into a financially-explosive franchise or forever remains a red-ink spewing blip on Google's P&L is yet to be seen. Either way, when the history of broadband video is written, YouTube will be featured prominently.

Categories: Aggregators, UGC, Video Sharing

Topics: Comedy Central, Hitwise, MySpaceTV, Veoh, YouTube

-

MySpace-NBC's Decision '08 Contest: Elevating User Generated Video

Yesterday came a further positive sign that user-generated video may be elevated from the domain of karaoke-singing cats, faux-skateboarding accidents and exploding soda bottles.

That positive sign was MySpace, NBC and MSNBC's announcement of a new citizen journalism initiative dubbed the "Decision '08 Convention Contest." In it, MySpace users are encouraged to submit short videos answering one of three questions, "Why do you vote?" "Why are you the best person for this job?" or "How will you stand out in the crowd and get the scoop no one else can?"

The submissions will first be judged by a panel of experts from MySpace and NBC, with five finalists revealed for the MySpace community to vote on. Two winners will be selected, one to attend the Democratic convention this summer, and the other to attend the Republican convention.

To learn more about the contest and the motivations behind it, yesterday I spoke to Liba Rubenstein, MySpace's Manager of Public Affairs, who is essentially the product manager for the IMPACT channel, MySpace's hub for civic and social engagement. Liba explained that MySpace has used this type of contest frequently, and to much success. MySpace community members love getting involved and expressing their creativity. The two level judging process is meant to balance the experts' high editorial standards with members' passion and enthusiasm. Liba added that in particular MySpace and NBC are gaining insights about how to fuse traditional media with web 2.0. (And in a classic "doing well by doing good" vein, maybe NBC will discover the next Tim Russert in the contest.)

I like the Decision '08 contest for a variety of reasons. First and most importantly, it allows UGV to be directed to an important social use: increasing citizens' involvement in the democratic process. In this way it continues on what YouTube's YouChoose '08 pioneered by allowing its users to upload video questions in the recent primary debates. It may sound somewhat idealistic, but I really like the notion of broadband video doing its part to strengthen the functioning of America's democracy - even more so as we approach July 4th in this election year.

Further, I think the convention contest provides an example for how others outside the political realm might consider harnessing the creativity and passion of their members to use UGV in a directed purpose. One example that comes right to mind is in the education field. For example, wouldn't it be cool if educators uploaded UGV of themselves in action, explaining and demonstrating their proven teaching methods? I got a glimpse of some of this happening already, while doing a project last summer for the George Lucas Educational Foundation. There's no shortage of other examples.

There has been much hand-wringing about whether UGV can ever be monetized through advertising, a debate that will no doubt rage on. Alternatively, I for one would like to see more energy put into purpose-driven UGV projects like the MySpace-NBC convention contest. While I enjoy the cats, skateboarders and soda bottles as much as the next guy, I continue to believe the UGV medium can ultimately be so much more.

What do you think? Post a comment now!

Categories: Broadcasters, Partnerships, Politics, UGC

-

Nike's "Sixty-Million Dollar Man" is Well Worth a Look

A short piece in Brandweek caught my attention yesterday. It was about a new video entitled "The Sixty Million Dollar Man," produced by Phoenix Suns point guard Steve Nash to promote a Nike shoe that Nash has worn since February called the "Trash Talk." The shoe is environmentally-friendly as it is made out of leather scraps and waste. The release of the video coincided with Earth Day.

The video is well-worth checking out, not only because it is a very clever spoof of the original "Six Million Dollar Man" program from 30 years ago and has amazing special effects, but also because it demonstrates the continuing embrace of broadband by brand marketers. This is a trend that I've been covering for a while on VideoNuze (check out here and here for more).

Of course, Nike has long been one of the most innovative advertisers, mixing subtle brand promotion with compelling examples of athletic achievement. The new 90 second Nash spot, available on YouTube, follows Nash's first effort, entitled "Training Day," which itself now has about 300K views on YouTube are in keeping with these traditions. (Apparently Nash is an avid film-maker and also an environmentalist.) In both spots, the only Nike promotion is a swoosh in the closing frame. Both are great examples of sponsored, yet engaging entertainment that would be very expensive to execute on-air.

Broadband is opening all kinds of new doors for brand advertisers. Initiatives seem to fall into 2 buckets: original entertainment/informative videos like the Nash spots, and user-generated contests like the recent TideToGo and Heinz Top This efforts. I expect we'll see a lot more broadband experimentation from brands to come.

Categories: Brand Marketing, Indie Video, Sports

-

Insights Aplenty from How-to Video Category

One of the hottest corners of the broadband video market is the ad-supported "how-to" category. How-to lends itself well to video because, if a picture's worth a thousand words, a video is surely worth a million. Recognizing this, there's now a host of start-ups in this category which together have raised tens of millions of dollars. I wrote about some of this a couple months ago.

Several recent calls with industry participants got me to thinking the how-to category actually offers many valuable insights for all broadband industry participants. These fall into 3 key areas: content development, traffic acquisition and monetization.

1. Content: "Build Our Own" or "Offer a Superstore of Others' Videos"?

Players like Expert Village, 5Min, VideoJug and MonkeySee are pursuing the "build our own" video library approach, incenting individual "experts" to contribute to their sites. On the other hand, sites like WonderHowTo (WHT) and SuTree rely primarily on scouring user-generated video sites like YouTube, plus those above to aggregate the best videos available. With how-to being the ultimate "Long Tail" space,

WHT's Stephen Chao told me in a recent briefing that trying to cover the infinite number of niches would be impossible. So to be comprehensive, relevant and high-quality, WHT curates what its crawlers return with a small in-house team and presents the cream of the crop to users, complete with a range of community-building features.

WHT's Stephen Chao told me in a recent briefing that trying to cover the infinite number of niches would be impossible. So to be comprehensive, relevant and high-quality, WHT curates what its crawlers return with a small in-house team and presents the cream of the crop to users, complete with a range of community-building features. Here's one non-statistically significant example that illustrates the two approach's results: I did a search for "bbq steak video" on Expert Village, which bills itself as the "World's Largest How-to Video Site" and on WHT. EV returned 15 results, regrettably not one of which was relevant. WHT returned 357 results, and on the first page of 20 results alone, at least 12 looked relevant. These came from a wide variety of sources. Try doing a few searches and see what you find - my guess is your experience will be consistent with mine.

2. Traffic acquistion: Syndication or SEO?

All of these sites are ad-supported, so traffic is key. The sites with private libraries can syndicate to heavily-trafficked partners. Ordinarily, as a big syndication fan, I'd say that sounds like an advantageous traffic generating plan. But how-to may have a different traffic acquisition dynamic. It may well be that far more traffic will always come to these how-to video sites via searches at Google and other search sites, as compared with the sum of various syndication deals. That's because, absent a household brand-name in how-to, default consumer behavior may well be to simply type their how-to video query into Google.

If that's the case, then it will actually be those sites which have the most highly-optimized pages for all the

niche videos that will gain greater traffic. Though I'm not an SEO expert, it seems to me that, taking my "bbq steak videos" example, WHT, with 357 related videos can optimize better than say EV with 15. And sure enough, when I ran the "bbq steak video" search on Google, right on the first page is a result from WHT, whereas nothing shows up for EV even after 5 pages. Bottom line: more relevant videos = more zero cost, Google-driven traffic.

niche videos that will gain greater traffic. Though I'm not an SEO expert, it seems to me that, taking my "bbq steak videos" example, WHT, with 357 related videos can optimize better than say EV with 15. And sure enough, when I ran the "bbq steak video" search on Google, right on the first page is a result from WHT, whereas nothing shows up for EV even after 5 pages. Bottom line: more relevant videos = more zero cost, Google-driven traffic. 3. Monetization: Video ads or Keyword-driven text/display ads?

Last but not least is monetization. How-to sites have lots of contextual ad potential. In my "bbq steak" example, any company that sells grills, steaks, sauces, etc, would love to advertise to me. It's tempting to believe that those with their own video libraries have more profit potential, because they can sell pre-roll or overlay ads, whereas a superstore site like WHT or SuTree cannot, because they're linking off to the source sites.

But consider this: how many of these potential advertisers will actually have video ads or the budget to create them? Unlike entertainment video, how-to, with its Long Tail character, seems to lend itself more to a low cost keyword ad approach which can be pursued by even the smallest advertiser. So say WHT or SuTree can build traffic in all those video niches and surround the video with keyword-driven text or display ads, all automated through a bidding system. Though yielding lower revenue per ad, my bet is that the total revenue for all ads with the keyword approach would be greater.

Summary

The how-to category is nascent and dynamic. I'm not suggesting for a second that it's a winner-take-all space or that all of the above are strictly "either/or." But I do believe the above analysis raises valuable points all industry participants should consider when developing their content, traffic and monetization strategies.

What do you think? Post a comment now!

Categories: Advertising, Indie Video, Startups, Strategy, Video Search

Topics: 5Min, Expert Village, MonkeySee, SuTree, VideoJug, WonderHowTo, YouTube

-

The Reality of Web Video Advertising Just Doesn't Seem to Add Up

Today's post is from TDG's Mugs Buckley, who discusses the confusing state of video advertising projections.

The Reality of Web Video Advertising Just Doesn't Seem to Add Up

by: Mugs Buckley, Contributing Analyst, The Diffusion Group

I used to think I was pretty good at math, but after trying to make sense of recent forecasts regarding web video advertising, I'm beginning to doubt my skills. Let it be known that I'm a big believer in the growth potential of the Internet video ad business; I'm simply struggling to follow the numbers that have been reported. Since no single analysis offers an "apples-to-apples" industry comparison, I thought I'd offer up some of the available forecasts and offer a few thoughts.

So here's where I'm stuck.

The estimates and forecasts for only video ads are all over the place. For example:

- eMarketer estimates that US marketers spent $775M in 2007 and will spend $1.3B in 2008 for online video streaming and in-page ads.

- Jupiter Research predicts that 2008 online video ads in the US will yield $768M.

- comScore reported that online viewers consumed 9.8B videos in January 2008 (down from December 2007's 10.1B) of which 3.4B were Google/YouTube videos.

- In a November 2007 Financial Times article, a leading media buyer for Starcom Media Group (who is well aware of her buys and rates) predicted that the 2007 market for "The Big Four" broadcast networks was likely to generate around $120M.

So here's where it gets a bit confusing.

- If we use the 3.4B monthly view Google/YouTube view estimate for January and run that out for a 12-month period, add some growth for fun, we come up with about 45B views for all of 2008.

- YouTube charges $15 CPMs for their in-video overlay ads (down from the initial $20 CPMs used during beta testing).

- If 100% of the 45B Google/YouTube videos were sold at $15 CPMs, that would yield revenue of $675M. But that assumes 100% inventory sold, which won't happen for a variety for reasons (in particular because YouTube only sells overly ads on their contracted partner deals, not user-generated content).

- According to Bear Stearns, YouTube is set to generate $22.6M in revenue for video ads, about 3.3% of the possible $675M at 100% inventory sold.

Hmmm. So if YouTube (at 34% of all web video consumed) could generate $22.6M in revenue in 2008, and the Big Four were running about $120M in 2007, how does one arrive at these impressive near-billion dollar predictions? Where else is this revenue coming from?

Let's not rule out operator error - I'll quickly admit that I may have misinterpreted how these numbers were derived and what they represent. That being said, however, there doesn't seem to be a rational way to reconcile these disparate estimates. Can anyone out there help to square these numbers? Is it simply a matter of under- or over-reporting? Are the measurement systems currently in place so poor and mutually exclusive in methodology that they necessarily offer conflicting estimates?

Something just isn't adding up. Yes, this may seem to be a bit nit-picky on my part; the rambling of an analyst with too much time on her hands. Then again, without accurate revenue and usage estimates, it is impossible to know the real value of any form of advertising, much less an emerging model such as web-based video advertising.

Please let us know what you think!

Categories: Advertising

Topics: comScore, eMarketer, Jupiter Research, The Diffusion Group, YouTube

-

ESPN Capitulates to Syndicated Video Economy

You'd have to have slept through yesterday to miss the big news that ESPN is now syndicating video clips from a cluster of its programs to AOL, its first-ever such deal. I interpret the deal as an extremely strong indicator that the "Syndicated Video Economy" (as I described this trend 3 weeks ago) is inexorable, even for the richest and most powerful video brands.

ESPN is one such brand. In 2007 it generated 1.2 billion video views from its own site, placing it in the top 10 of all sites. In January '08, ESPN generated 81 million views according to comScore, ranking it #9. And much

of ESPN's broadband video (aside from what it shows exclusively on ESPN360, its online subscription service) is essentially re-purposed from on-air, likely making the margins on ESPN's online efforts insanely profitable.

of ESPN's broadband video (aside from what it shows exclusively on ESPN360, its online subscription service) is essentially re-purposed from on-air, likely making the margins on ESPN's online efforts insanely profitable. Yet with the AOL deal, even the mighty ESPN has now capitulated to the lure of the syndicated video model. And the AOL deal is surely the first of many more deals to come. ESPN has likely come to the same conclusion as have scores of other video content providers, including the major broadcast networks: the future broadband video value chain is going to be more about "accessing eyeballs" - wherever they may live, at portals, social networks and devices - than about "acquiring eyeballs" by driving them to one central destination site. As the most stalwart proponent of the latter approach, other market participants should take heed of ESPN's strategy change.

The motivation behind video providers shifting from traditional scarcity-driven distribution strategies lies in the peculiar dynamics of the Internet: while audiences continue to fragment to a bewildering range of sites, they are simultaneously coalescing in a relatively small number of influential new brands such as YouTube, MySpace, Facebook and the traditional portals. Consider the comScore January stats again. The Google sites (dominated by YouTube) drove 3.4 billion video views or 42 times ESPN's video volume. A distant second was the Fox Interactive Media sites, including MySpace, which drove 584 million views, still 7 times ESPN's total.

These dynamics incent established video providers and startups in particular to get their video in front of all those eyeballs with more flexible business models. (For those interested in more detail on how the video distribution value chain is fast-changing due to these emerging players, I've posted slides from late '07 here. I'll have updated slides soon.)

The "Syndicated Video Economy" is creating both unprecedented opportunities and challenges for video providers. I continue to believe the future winners will be relentlessly flexible and willing to adopt new business approaches that keep them in synch with evolving consumer behaviors.

Categories: Cable Networks, Partnerships, Portals, Sports, Syndicated Video Economy

Topics: AOL, comScore, ESPN, Fox Interactive Media, MySpace, Syndicated Video Economy, YouTube

-

Modern Feed Jumps Into Video Navigation Space

With the proliferation of available broadband video comes a massive user navigation challenge. Modern Feed is launching today to address this. It is part search engine, part aggregator, with a specific focus on indexing professionally-produced programming, not user-generated video. It's also focused on actual programs, not promotional clips.

J.D. Heilprin, Modern Feed's founder/CEO told me yesterday that the company is targeting mainstream users providing the easiest way to find available, high-quality video. It employs a team of "Feeders" charged with curating the best videos to include on the site. The result is approximately 550 "networks" and 25,000 pieces of content now indexed, where "networks" is a loose term ranging from traditional broadcasters to indies new entrants like Boston Symphony or Architectural Digest.

Modern Feed is rights-holder friendly, not indexing any illegal or pirated video, and playing the video from the source's site (though sometimes with a thin Modern Feed navigation frame at the top of the screen). I played around with Modern Feed and found it to be easy-to-use and well-laid out. Modern Feed also offers an iPhone implementation that looks pretty cool, other devices are to follow.

The big challenge (and opportunity) for Modern Feed is that it's entering a very noisy space where user behavior is very undefined. There are myriad video search engines (Truveo, ClipBlast, blinkx, Veveo), portals (AOL, Yahoo, MSN), navigation sites (TV Guide, recently-launched PrimeTime Rewind) and of course the networks' own sites (and syndication efforts) offering users the ability to quickly find quality content. Then there's YouTube, the first stop for many users when it comes to video. And YouTube is increasingly moving up market by striking partnerships with premium providers.

Modern Feed's strong user experience, focus on mainstream users and device integrations are differentiators for the company. Whether these are ultimately success factors really depends on how user behavior unfolds in the nascent video navigation space. Modern Feed has raised several million dollars from angels and has 30 full-timers with aggressive growth planned.

What do you think? Post a comment and let everyone know!

See prior posts:

YouTube, C-SPAN Team Up for User-Generated, Multi-Platform Voter Project

Categories: Startups, Video Search

Topics: AOL, Blinkx, ClipBlast, Modern Feed, MSN, PrimeTime Rewind, Truveo, TV Guide, Yahoo, YouTube

-

YouTube, C-SPAN Team Up for User-Generated, Multi-Platform Voter Project

Broadband video's influence on Election Year 2008 grew further with today's announcement of the "YouTube Voter Video on C-SPAN" initiative.

To build momentum toward the Pennsylvania primaries on April 22nd, the companies are inviting viewers to upload to the C-SPAN channel on YouTube videos answering the questions "what issue in this election is most important to you, and why?" C-SPAN will air a selection of the videos on its "Road to the White House" program beginning April 13th.

I think this is a clever, fun idea to help drive awareness and share disparate views on the election. Though participation is completely self-selected, it will certainly offer much-needed dimension to the dry polling results constantly churning through the media. Combined with the CNN/YouTube debates from a couple months ago, Election Year 2008 continues to show how much more dynamic and inclusive the process becomes with broadband video's influence.

-

March '08 Recap - 3 Key Themes

As I mentioned at the end of February, each month I plan to step back and recap a few key themes from recent VideoNuze posts. Here are three from March '08. (And remember you can see all of March's broadband news, aggregated from across the web, by clicking here)

The Syndicated Video Economy: An Introduction

In March I introduced the concept of the "Syndicated Video Economy" ("SVE") to describe how the broadband video providers are increasingly coalescing on a strategy for widespread distribution of video through myriad outlets. In the SVE media companies shift their focus from "aggregating eyeballs" in a centralized destination to "accessing eyeballs" wherever (and whenever) they live. The SVE is a big departure from traditional tightly-controlled, scarcity-driven distribution approaches. Investors have responded by funding SVE-oriented content and technology startups.

In March I provided several examples of SVE initiatives. CBS launched its Local Ad Network to distribute content to local bloggers and web sites. 60Frames, a new broadband studio, is explicitly focused on partnerships for distribution, and is not even building destination web sites for its programs. And FreeWheel is developing management tools so that content can be optimally monetized across a content provider's sprawling network of syndication partners.

The SVE resonated strongly with VideoNuze readers; many are focused on it and vested in its further development. Expect to hear a lot more about the SVE from me in coming posts. I'll also have supporting slides I'm developing for upcoming webinars on the topic.

Over-the-Top: Getting Broadband Video to the TV

Bringing broadband video all the way to the TV by bypassing existing service providers (so-called "over-the-top") continues to be the big elusive prize for many. This past month YouTube and TiVo announced a partnership to let a subset of TiVo owners gain full YouTube access on their TVs, a welcome move.

Following that, in "YouTube: Over-the-Top's Best Friend" I suggested the YouTube, with its dominant market position and brand loyalty could in fact be the linchpin to over-the-top devices gaining a foothold with consumers. Google-YouTube executives' vision for YouTube as a video platform, powering experiences wherever they are, lends support to my proposition. Lastly on over-the-top, new contributor Michael Greeson, founder of market researcher TDG, proposed that adapting low-cost devices like DVD player may well be the best way to bridge broadband and TV.

Social media and video: 2 sides of the same coin

This past month also continued an escalation of interest in the intersection of social media and broadband video. At the Media Summit there was intense focus on engagement, and how broadband can uniquely create new user experiences that deeply involve the user. These social experiences include sharing, personalization, commenting, rating and so on. In this vein, Maginfy.net introduced new social features to support its specialized user-created channels, a smart evolution of its product.

And in a follow-up to "The Intersection of UGC and Brand Marketing?" I clarified the opportunities that brand marketers may or may not have to get involved with this hot space. For those interested in more on this subject, new VideoNuze sponsor KickApps provided an informative webinar which is still available here.

So that's March's recap. There will be plenty more on all of these and other broadband video topics in April and beyond!

Categories: Brand Marketing, Devices, Syndicated Video Economy, Video Sharing

Topics: 60Frames, CBS, FreeWheel, KickApps, Magnify.net, Media Summit, Syndicated Video Economy, TDG, TiVo, YouTube

-

YouTube: "Over-the-Top's" Best Friend

The announcement a couple of weeks ago that YouTube was partnering with TiVo got me to thinking that YouTube is probably the best friend that so called "over-the-top" or "cable bypass" aspirants could have.

As a quick refresher, "over-the-top" and "cable bypass" refer to the emerging category of devices and service providers seeking to bring broadband video to the consumer's TV, but without the involvement of existing video providers such as cable and satellite. Some of these efforts (Apple TV, Vudu and Internet-enabled TVs) are positioned as augmenting incumbent providers, while some (Building B, others) are meant to compete directly.

Today's players share the common trait of being closed, "walled gardens," offering only certain content that they select. This contrasts with the open Internet/broadband model, where users are able to access any content they choose. Many of you know that I have been a strong proponent that open is the winning competitive path for aspiring over-the-top players.

If the over-the-top crowd adopts the open approach, YouTube is their perfect ally; it is the best-known brand name in broadband video, has the largest library of both user-generated and increasingly premium

video and has huge loyalty. Positioned properly it could be a killer value proposition for over-the-top players. I've previously argued that Apple missed the boat by not adopting this positioning for Apple TV.

video and has huge loyalty. Positioned properly it could be a killer value proposition for over-the-top players. I've previously argued that Apple missed the boat by not adopting this positioning for Apple TV.I talked last week with David Eun, VP of content partnerships at Google and Chris Maxcy, head of biz dev for YouTube, and they both made clear that the goal is to morph YouTube from a consumer destination site to a full-fledged video platform distributing video everywhere - devices, mobile, web sites, others. To this end, YouTube recently published an expanded set of APIs to allow 3rd parties to gain easier access to YouTube's content. This of course is great news for over-the-top devices, who should have considerable flexibility for how to incorporate YouTube into their offering. For now TiVo is leading the way in offering YouTube, albeit to a very small audience.

If you were wondering whether YouTube or Google itself will enter the device business, that seems unlikely. David and Chris were clear in saying that devices are not their core competency, and they'll leave it to others to decide how to implement the YouTube APIs and create and test various user experiences. Meanwhile with more premium content flowing into YouTube, its value as an over-the-top partner only increases.

What do you think? Post a comment!

Categories: Aggregators, Devices

Topics: Apple, Apple TV, Google, TiVo, VUDU, YouTube

-

Hurray for TiVo-YouTube

Hurray for TiVo and YouTube, which yesterday announced a partnership to allow certain TiVo users to watch YouTube videos on their TVs. While the actual number of homes which have the right TiVo model

and have it connected to broadband numbers under a million, TiVo-YouTube shows there is still hope that the worlds of broadband video and TV will indeed converge.

and have it connected to broadband numbers under a million, TiVo-YouTube shows there is still hope that the worlds of broadband video and TV will indeed converge.Some of you will remember that in December '07 I wrote a post entitled "Broadband Video on TV is a Mirage" in which regrettably concluded that the mass availability of broadband video on TVs was nowhere on the horizon. In that post I wrote:

"The minority of consumers who will actually see broadband video on their TVs will either (1) shell out big bucks to buy a broadband appliance such as Vudu or Apple TV, (2) tackle the challenge of connecting their TVs via wireless networks (3) use a device built for another primary purpose, such as Xbox 360 or TiVo, to selectively augment their viewing with broadband-delivered choices or (4) use a service provider that has decided to throw in a few morsels of broadband video."

With the YouTube deal, TiVo continues to deliver on option 3, augmenting an already impressive array of broadband video available on select TiVo models. TiVo enhances its overall reputation for innovation

(although still absent resounding market success or profitability), with a particular focus on broadband video. TiVo has previously offered up Amazon Unbox, TiVoCast, Music Choice, Home Movies, etc. Providing access to YouTube, the world's most popular video site, is another notable accomplishment for TiVo.

(although still absent resounding market success or profitability), with a particular focus on broadband video. TiVo has previously offered up Amazon Unbox, TiVoCast, Music Choice, Home Movies, etc. Providing access to YouTube, the world's most popular video site, is another notable accomplishment for TiVo.I continue to believe that whichever company cracks the code on how to deliver wide open broadband video access to the TV - coupled with a strong user experience - is going to hit it big. At the risk of looking too far backward, at the end of 2006 I conjectured that Apple's then still-to-be-launched Apple TV product could be a resounding success if it got the content strategy right (i.e. offering open broadband access and even focusing particularly on easy YouTube access through the device). Instead Apple TV has turned into yet another walled garden and to date has been a market failure. Apple continues to miss the open broadband market opportunity which is sitting right in front of it with a big bulls-eye plainly visible.

The TiVo-YouTube partnership will hopefully have the effect of accelerating the wake up call to other market participants that this gigantic opportunity awaits. Broadband video to the TV is a natural. It simply extends the cable/satellite model of the last 30 years: offering ever more video choices right to the TV.

As I've often said, as amazing as the growth curve has been for broadband video consumption over the last 5 years, even more amazing is that virtually all of this consumption has happened on the computer - a completely parallel world to the traditional TV viewing platform. Nobody could have imagined this level of consumer adoption for a non-TV viewing platform. So then look forward and imagine the possibilities when broadband video and the TV are fused for the masses.

Categories: Devices, Partnerships

Topics: Apple, Apple TV, TiVo, YouTube

-

Disney/ABC's Stage 9 Launches, With YouTube

Disney/ABC Television Group's official announcement this morning of Stage 9 Digital Media, an experimental new media content studio, is another key milestone in the fast-moving broadband video industry.

I got a short briefing about Stage 9 late yesterday from Disney/ABC because it asked me to provide some analyst context to the LA Times' Dawn Chmielewski, who's done a great piece here. Stage 9 is Disney/ABC's key initiative to reach the coveted 18-34 audience in synch with this audience's unique media consumption patterns. Programming will be short, funny, well-produced, episodic, and widely distributed through popular broadband sites, social networks, mobile and download services.

I interpret Disney/ABC's move, when coupled with recent initiatives by other big media companies into original broadband video production, as further evidence of two key trends: that broadband video has come of age as a key priority for the largest media companies and that it is impossible to appeal to today's younger audiences simply by hewing to the traditional rules of the media game.

Also of significance is that Disney/ABC announced that "Squeegees," which is Stage 9's first release, will be co-exclusively premiered on ABC.com and YouTube starting today and sponsored by Toyota. Yes, you read that right. YouTube! The scruffy user-generated phenom that big media was threatening to sue out existence not so long ago, and which of course is now owned by Google, big media's most anxiety-inducing "frenemy," has been elevated to launch partner status for Stage 9's first program.

The "Squeegees" co-premiere is quite an accomplishment for YouTube. It shows that YouTube's methodical efforts to gain legitimacy (and a business model!) by establishing partner channels with media companies are beginning to pay off. David Eun, Google's VP of Content Partnerships has repeatedly explained this game plan to me, and others over the last year. The Stage 9 launch partnership should certainly be regarded as a major win for the young company. It is also another data point I'd use to support my contention that in the broadband age, traditional conceptions about copyright monetization need to be radically re-thought (Viacom, are you listening?).

I'm enthusiastic about the Stage 9 initiative, as I believe it holds lots of potential for Disney/ABC. It gives the company inroads to the elusive 18-34 set, offers the prospect of innumerable and invaluable insights about how to effectively program in the broadband age, provides a whole new internal breeding ground for developing new on-air programming (a possible double win, as this might help fix the broken and expensive traditional pilot process, though my enthusiasm on this point is tempered by news today of Quarterlife's NBC ratings fiasco) and creates new and exciting multi-platform sponsorship opportunities.

In short, the strategy is sound and the upside significant. Now for the hard part: Stage 9 needs to execute and actually deliver on all this potential.

What do you think? Post a comment now!

Categories: Broadcasters, Indie Video, UGC

Topics: ABC, Disney, Stage 9, Toyota, Viacom, YouTube

-

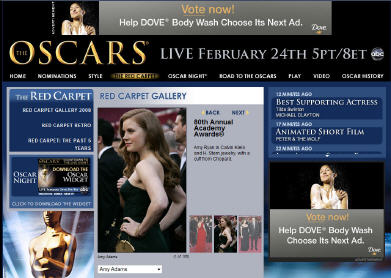

And the Oscar Goes To.....Dove

Obviously there is no Oscar category for "Most Effective Advertisement at Oscar.com," but if there were, the hands-down winner last night would have been Unilever's "Dove Supreme Cream Oil Body Wash Ad Contest" display ads.

As many of you know, I'm a big believer that brand advertisers need to evolve their mindsets, which have traditionally called for making the cutest or the funniest or the quirkiest ad and then spending big money on placing it on popular programs, in the hopes of driving audience awareness and recall.

Instead, advertisers need to be focusing on user engagement, reinforcing brand authenticity, leveraging multiple platforms and extending the campaign's life. Dove did all of these and more with its "Cream Oil" campaign, and the resulting lessons for other brand marketers and their agencies are abundant.

Dove kicked the "Cream Oil" campaign off late last year, with a user-generated video contest asking women "how does showering yourself in everyday luxury with Dove Supreme Cream Oil Body Wash make you feel?" There were 3,500 entries received for the 30 second spot between Dec. 5th and Jan. 9th, which were winnowed to 5 semi-finalists on Jan 30th who were invited to LA for a private Oscars party. The 2 finalists were presented for viewing on Oscar.com. Dove's display ads on the site prompted visitors to click and vote for the best spot, which would become Dove's new ad. This voting process created an even larger user engagement opportunity than the original UGC contest. Capping it all off was actress Amy Brenneman, announcing the winning ad during a spot Dove bought during the Oscar telecast.

In my post last week, "An Intersection of UGC and Brand Marketing?" I proposed that brand marketers should create opportunities for passionate customers interested in expressing themselves to submit user-generated video supporting or explaining products. Dove's marketing people were clearly in synch with this thinking. The campaign shows their belief that the authenticity of the Cream Oil product could best be conveyed by real women using video to creatively express themselves. That sense of authenticity in turn resonates really well with other prospective customers. The YouTube age has conditioned many of us to appreciate each other's video more than the professionally produced, because its rough edges make it feel far more real.

Lastly, by having Ms. Brenneman announcing the winner in the on-air spot, Dove recognized that if it is going to spend $1.7 million + for a 30 second ad (last year's price), it better do more than just offer another cute, funny, or quirky spot. Instead it created anticipation, and capped off 3 months of contest excitement. I've argued in the past that these expensive on-air spots should reinforce or continue campaigns begun before and/or extended after in the broadband medium. Doing so increases their ROI, and will only raise the value of this on-air time in the future.

In the past I've been critical of brand marketers and their agencies for being abysmally slow in recognizing new opportunities broadband video presents. Yet there have been exceptions, and Dove's "Cream Oil" campaign is certainly one. Hopefully we'll see more like it in the future.

What do you think? Post a comment and let us all know!

Categories: Brand Marketing, UGC