-

Google Content Network Has Lots of Potential, Implications

Many of you know that Google has recently begun distributing short animated videos from Seth MacFarlane (creator of TV's "Family Guy") to a wide network of sites that previously only received ads from Google, through their participation in AdSense. The company dubs this the "Google Content Network" (GCN for short), and from my vantage point, it has a lot of potential and implications for other players in the video distribution value chain. Yesterday, I spoke to Alexandra Levy, Google's Director of Branded Entertainment, and the point person for driving this initiative.

The first thing that resonates for me about GCN is that Google's vision for it harmonizes perfectly with my concept of the "Syndicated Video Economy." VideoNuze readers know that last March I introduced the SVE concept to capture a trend that I was noticing: an ecosystem was forming to distribute broadband video widely across the Internet, in contrast to the traditional, narrower distribution model.

Alex echoed the SVE, saying that in her many conversations with content producers, finding an audience is their top challenge. Great content, unwatched, is like the proverbial tree that falls in the forest when nobody is around to hear it.

So enter GCN, which Google rightly sees as a "media distribution platform." To understand its implications fully, you have to evaluate its potential to all relevant constituencies: Users get great updated content served to them at the sites they already visit. Those sites benefit from offering premium content, while also receiving a revenue share on the accompanying ads. The content provider benefits from leveraging Google's vast AdSense network to have video "pushed" to relevant audiences, increasing viewership and engagement. And advertisers' brands benefit from adjacency to premium content that is sought after and compelling.

Of course, last but not least, Google benefits from being the intermediary in this whole process. We all know from Google's massive success in web search that being the intermediary in a model where all constituent interests are neatly aligned creates near-infinite economic value. While Alex concedes the MacFarlane video (which is sponsored by Burger King and was brokered by Media Rights Capital) is still an "experiment," GCN sure does seem to bear a lot of resemblance to Google's traditional search model in the alignment of constituent interests.

Another twist here is that users who click for more video are driven back to MacFarlane's YouTube channel (already the 69th most subscribed channel, with almost 70K subscribers), which drives habituation, a key lever for ongoing video success as any network TV executive will admit. In this light, GCN gives Google a way of finally tying its powerful AdSense engine to YouTube. I'm not suggesting that Google is sweating the ROI on its $1.6 billion YouTube acquisition, but GCN surely looks like a way to move YouTube far beyond its roots as everyone's favorite UGC aggregator.

Alex is quick to point out that GCN does not budge Google from its often-stated position that it is not a content creator. Rather, it's using GCN to connect brands, content producers and users. If that connecting process drives audiences and generates revenues for content producers - and admittedly the proof is not yet in - that would give Google a lot of disruptive capital to help shape the video landscape. Just so nobody gets carried away, Google announced a similar experiment 2 years ago with MTV that fizzled out. So the company has yet to prove its experiment works and that it is fully committed to the GCN model.

Still, I continue to believe that video syndication - and the accompanying benefits to all - is a key, key driver of how the broadband video landscape is going to unfold. As a small teaser, there will be more interesting news on the syndication front early next week. Stay tuned.

(And note that the syndicated video economy will be one of the main topics of discussion at the Broadband Video Leadership Breakfast "How to Profit from Broadband Video's Disruptive Impact" with our A-list group of panelists, including Google's David Eun, on November 10th. Click here to learn more and register for special early bird rate.)

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Indie Video, Syndicated Video Economy

Topics: Google, Google Content Network, Seth MacFarlane, YouTube

-

MTV, Discovery, AccuWeather, Others Push Mobile Video With Transpera

With the recent launch of the iPhone and other smartphones, mobile video delivery is receiving much greater attention. Though still lagging the widespread popularity of broadband-delivered video, mobile video is getting a boost today as MTV, Discovery, AccuWeather, Travel Channel and Next New Networks have all announced new initiatives, to be powered by Transpera, a mobile video services platform.

Mobile has long been an alluring opportunity, but to date most of the activity has been from wireless carriers or their partners' efforts. These so-called "on deck" video offerings were largely subscription-based (Verizon's VCast, MobiTV, etc.) and available on only a minority of all handsets. The limited, carrier-controlled nature of traditional mobile video has been a key differentiator from the open broadband video world.

Further, as Greg Clayman, MTV's EVP of Digital Business Development explained to me on Friday, neither the tools for content providers to manage, publish and monetize mobile video nor the network capacity for delivering mobile video have been in place until recently.

Transpera is one of a number of companies addressing the mobile video opportunity (see also my recent post on upstart Azuki Systems and also another player called Vantrix). I spoke to Transpera's CEO and co-founder Frank Barbieri a few weeks ago, and he noted that given how nascent the mobile video space is, the company is today providing both a full technology platform to content providers and ad sales capabilities. I pointed out that in broadband that integration of technology and ad sales had been tried (most notably by Brightcove), but largely been dropped. Today there is a clear bifurcation in the broadband ecosystem between technology platforms and ad sales networks.

Frank sees the same thing happening in mobile video (in fact, we agreed that comparisons to broadband's development are useful in thinking about how mobile video delivery will shape up). Transpera's longer-term goal is to be a full-fledged mobile ad sales network, so its management/publishing/delivery platform is more of a means to that end. Frank sees Transpera already providing real monetization value to many of its customers; the company has strong reach into media buyers and agencies and credibility in selling this new medium's benefits (it should be noted however that MTV, for one, continues to retain its mobile video ad inventory to sell itself).

With its focus on building out a mobile video ad network, my guess is that eventually Transpera will see competition from today's broadband ad networks, who are arguably well-positioned to play in the mobile space as consumption surges.

For now though, given how early it is in mobile video's evolution, the key is building trial and usage. For many content providers mobile video is brand new and the ROI unproven. Though they've likely maintained so-called WAP sites for mobile browsers, video is a whole new ball game. Driving video consumption and legitimizing the mobile medium - as has happened with broadband - is job #1 for all the players in this exciting new space.

What do you think? Post a comment now!

Categories: Advertising, Mobile Video

Topics: AccuWeather, Azuki, Discovery, MTV, Next New Networks, Transpera, Travel Channel, Vantrix

-

Digging in Further on Broadcast Networks and Broadband

Yesterday's post, "Broadcast Networks' Use of Broadband Video is Accelerating Demise of their Business Model" spurred some great comments on the site, and as usual, a flurry of private emails to me from folks who don't want to comment publicly (this is a recurring VideoNuze phenomenon I've mentioned before...).

Since there's substantial interest in this topic and I thought some of my comments from yesterday needed some clarification, I want to dig in a little further today.

First I want to address the numbers I outlined, especially the benchmark of $1 of ad revenue per viewer per episode that I asserted NBC derives from "Heroes" on-air. I've had some push back that this number is too high and that it more likely is 50-75 cents/viewer/episode. As I refined my assumptions further, I do think I was probably a bit too optimistic, particularly regarding the actual number of ad units NBC sells. I do think all of these numbers are somewhere in the ballpark, but what they actually are on a show-by-show basis is obviously only known only to NBC itself.

That all said, the gap between today's "analog dollars" and the revenue being derived from online

distribution (the so-called "digital pennies") may still be pretty close to what I suggested yesterday. That's because I also had push back on my assumption that Hulu is generating an effective CPM of $60 (note, I had characterized that as "generous"). According to some folks, it's possible their eCPM could in fact be closer to $30 - or less. This is all private data, so again, it's really hard to pin this down.

distribution (the so-called "digital pennies") may still be pretty close to what I suggested yesterday. That's because I also had push back on my assumption that Hulu is generating an effective CPM of $60 (note, I had characterized that as "generous"). According to some folks, it's possible their eCPM could in fact be closer to $30 - or less. This is all private data, so again, it's really hard to pin this down. One point I'd like to make again, so nobody's left with any misimpressions: I don't believe networks have been wrong in pursuing online distribution of their shows. I applaud their proactivity. Rather, my problem is that I think the way they've chose to monetize broadband delivery - with such a paucity of ads - is not only under-monetizing and undervaluing their product, but also creating a set of consumer expectations about the online medium that are going to be hard to reverse.

For Hulu to put the equivalent of 1 1/2 minutes of advertising against "Heroes," when NBC can command premium on-air rates for about 20 minutes of ads, strikes me as seriously out of whack. At the risk of sounding anti-consumer, I think Hulu is hurting its parent company's financial interests by over-emphasizing its user experience. The consequences of Hulu's "limited commercial interruptions" policy are really the thesis of yesterday's post: I believe the networks own use of broadband is accelerating the demise of their traditional ad model.

To be clear, I'm not suggesting Heroes on Hulu should carry 20 minutes of ads, but I do think it can carry more than 1 1/2 minutes. As important, its ad model needs to quickly evolve to include better targeting, more engagement, more creative units, etc, to break from a purely CPM-based paradigm. I know that many folks are hard at work on these items.

Net, net, these are incredibly complicated times for networks. As the Portfolio piece says, NBC's Zucker is "unsparingly harsh about the prospects for broadcast television..." And NBC's issues don't end with broadband; as commenters to yesterday's post noted, it's also being buffeted by the effects of DVRs, VOD and fragmentation driven by social networks, mobile and other shifting consumer behaviors.

I love Zucker's sense of honesty and urgency about the network business. I thought NBC's hardheaded approach to obtaining variable pricing from iTunes was terrific. And as many of you know, I think Hulu's site execution has been world-class. But Hulu, NBC, and the other networks must recognize that their current approach to ad-supported broadband delivery is undervaluing their own product and hastening the demise of their traditional P&L.

What do you think? Post a comment now!

Categories: Advertising, Aggregators, Broadcasters

-

Broadcast Networks' Use of Broadband is Accelerating Demise of their Business Model

Last weekend I finally got a chance to read "Zuckervision," the splashy cover page piece about NBCU's CEO and president Jeff Zucker in the September issue of Conde Nast's Portfolio magazine. It's a pretty candid expose of the challenges that Zucker faces turning around the flagship NBC brand. More broadly though, it describes the challenges that all network executives have in trying to profitably navigate the digital era.

Zucker says, "Predicting what the media world is gonna look like in eight years is incredibly daunting. I defy

anybody to that." He's right, and I'm not going to take him up on his offer. What's more salient though is to focus on the here and now - on what networks are doing with ad-supported broadband distribution today. From this perspective I think it's fair to conclude that broadcast networks' current use of broadband is accelerating the demise of their business model.

anybody to that." He's right, and I'm not going to take him up on his offer. What's more salient though is to focus on the here and now - on what networks are doing with ad-supported broadband distribution today. From this perspective I think it's fair to conclude that broadcast networks' current use of broadband is accelerating the demise of their business model. That's right. For all of Zucker's and his compatriots' lament about "analog dollars being turned into digital pennies," as best I can tell, the networks themselves are actually the ones most responsible for turning this fear into a reality. I touched on this in a previous post, but here are the numbers explaining why.

When each of us, watches an episode of NBC's "Heroes," for example, on-air, NBC generates approximately $1.00 of advertising revenue (assuming NBC sells 75% of the 22 minutes of ads at a CPM of $30). That $1/viewer/episode figure obviously varies by program, but it's a good benchmark to use. (Note: per the following post, I think these assumptions are a little high, a more accurate range for NBC's revenue/viewer/episode is probably $.50 - $1.00.)

Now consider what happens when we watch "Heroes" on Hulu, NBC and Fox's well-respected aggregator. There are 5 ad breaks with just one 15 second ad in each break. There's also a 7 second "brand slate" at the beginning of each episode ("The following program is brought to you by....") and a display ad at the conclusion. Rounding up, let's say that totals three 30 second ads. Assuming Hulu sells all the ads at a generous $60 CPM (note that's 2x the on-air rate), the revenue/viewer/episode is 18 cents. That means that when you watch Heroes on Hulu, NBC is generating less than 20% of its customary revenue (hence the "digital pennies" fear).

Hulu's ad implementation is not unique - if you look at the other network sites, their ad models are roughly comparable. I don't know who came up with this ad approach, but I would contend that in their zeal to move prime time programs online, the networks have all gone too far in emphasizing a user-friendly experience over sound business discipline.

Hulu's ad implementation is not unique - if you look at the other network sites, their ad models are roughly comparable. I don't know who came up with this ad approach, but I would contend that in their zeal to move prime time programs online, the networks have all gone too far in emphasizing a user-friendly experience over sound business discipline. Of course, as consumers this new ad model is great. We get high-quality, free content at our fingertips, with minimal interruptions. For the vast majority of consumers, this value proposition beats buying and downloading an episode at iTunes any day (all the more so as popular shows like Heroes are bound to cost even more under NBC's new variable pricing relationship with Apple).

With the current model, NBC needs for Hulu to get more 5x its current CPM (which would be more than 10x NBC's current on-air CPM) just to stay even with its traditional ad model. That's a pipe dream. It doesn't matter how much interactivity or exclusivity Hulu can give an advertiser (and by the way Nissan already had full exclusivity in the Heroes episode I watched) no advertiser is going to pay 10x on-air rates. Simply put, Hulu's and others' minimal quantity of ads cannot be compensated for using higher prices.

Now that the genie is out of the bottle with the networks' online ad model, it's going to be awfully hard to make major modifications to it. As eyeballs inexorably shift from on-air to online, NBC and the other networks' top line ad revenues is going to get pinched. Also poised to bear the brunt is the whole Hollywood community accustomed to benefiting from on-air economics (Zucker's aggressive attempts to reduce expenses are also discussed in the Portfolio piece).

Bottom line: the way NBC and other networks have implemented broadband accelerates the vast change that is buffeting the broadcast business.

What do you think? Post a comment!

Categories: Advertising, Aggregators, Broadcasters

-

August '08 VideoNuze Recap - 3 Key Topics

Welcome to September. Before looking ahead, here's a quick recap of 3 key topics from August:

1. Advertising model remains in flux

Broadband video advertising was a key story line in August, as it seems to be every month. The industry is rightly focused on the ad model's continued evolution as more and more players in the value chain are increasingly dependent on it. This month, in "Pre-Roll Video Advertising Gets a Boost from 3 Research Studies," I noted how recent research is showing that user acceptance and engagement with the omnipresent pre-roll format is already high and is improving. However, as many readers correctly noted, research from industry participants must be discounted, and some of the metrics cited are not necessarily the best ones to use. I expect we'll see plenty more research - on both sides of pre-roll's efficacy - yet to come.

Meanwhile, comScore added to the confusion around the ad model by first highly ranking YuMe, a large ad network, very high in its reach statistics, only to then reverse itself by downgrading YuMe, before regrouping entirely by introducing a whole new metric for measuring reach. In this post, "comScore Gets Its Act Together on Ad Network Traffic Reporting," I tried to unravel some of this mini-saga. Needless to say, without trustworthy and universally accepted traffic reporting, broadband video is going to have a tough slog ahead.

2. Broadband Olympics are triumphant, but accomplishments are overshadowed

And speaking of a tough slog, the first "Broadband Olympics" were a huge triumph for both NBC and all of its technology partners, yet their accomplishments were overshadowed by a post-mortem revenue estimate by eMarketer suggesting NBC actually made very little money for its efforts. This appeared to knock broadband video advertising back on its heels, yet again, as outsiders pondered whether broadband is being overhyped.

The Olympics became a hobbyhorse of mine in the last 2 weeks as I tried to clarify things in 2 posts, "Why NBCOlympics.com's Video Ad Revenues Don't Matter" part 1 and part 2. These posts triggered a pretty interesting debate about whether technology/operational achievements are noteworthy, if substantial revenues are absent. My answer remains a resounding yes. But having exhausted all my arguments in these prior posts, I'll leave it to you to dig in there if you'd like to learn more about why I feel this way.

3. Broadband's impact is wide-ranging

VideoNuze readers know that another favorite topic of mine is how widespread broadband's impact is poised to become, and in fact already is. A number of August's posts illustrated how broadband's influence is already being felt across a diverse landscape.

Here's a brief sampling: "Vogue.TV's Model.Live: A Magazine Bets Big on Broadband" (magazines), "Tanglewood and BSO Pioneer Broadband Use for Arts/Cultural Organizations," (arts/culture), "American Political Conventions are Next Up to Get Broadband Video Treatment," (politics), "Citysearch Offering Local Merchants Video Enhancement," (local advertising) and "1Cast: A Legit Redlasso Has Tall Mountain to Climb" (local news).

I expect this trend will only accelerate, as more and more industries begin to recognize broadband video's potential benefits.

That's it for August and for the busy summer of '08. Lots more action to coming this fall!

Categories: Advertising, Analytics, Broadcasters, Magazines, Politics, Sports

Topics: 1Cast, CitySearch, comScore, eMarketer, NBC, RedLasso, Tanglewood, Vogue, YuMe

-

Why NBCOlympics.com's Video Ad Revenues Don't Matter

There was much reporting yesterday of eMarketer's estimate that NBC generated revenue of $5.75 million from its broadband Olympics video. The firm's press release dismissively called the sum "a passable performance." Others, from the blogosphere to mainstream media piled on, characterizing NBC's video revenues as underwhelming, using terms such as "pittance," "piddling," and "unimpressive."

Let's hold on a second here. At the risk of sounding like an irrepressible NBC supporter, I'd like to offer the alternative viewpoint: NBCOlympics.com's video ad revenues actually don't matter.

Don't get me wrong, when it comes to high-stakes Olympics broadcasting - and a sagging economy to boot -

every dime counts. Rather, my point is that by focusing on the broadband ad number (which at virtually any level would have been a mere rounding error on NBC's $1 billion+ of overall Olympic ad revenues) we are getting distracted from NBC's real and very valuable broadband accomplishments.

every dime counts. Rather, my point is that by focusing on the broadband ad number (which at virtually any level would have been a mere rounding error on NBC's $1 billion+ of overall Olympic ad revenues) we are getting distracted from NBC's real and very valuable broadband accomplishments.Consider this: there were more on-demand and live sports choices for Olympics viewers than ever, NBC and its technology partners conquered herculean operational challenges without any major snafus and the foundation was laid for broadband to play an increasingly important and integral role in all future iconic programming events.

Focusing just on the operational achievements for a moment, a conversation I had yesterday with Brick Eksten, President of Digital Rapids, the company that provided all of the video encoding and streaming technology for NBC's live streaming events was a reminder of all the complexities NBC and its partners took on. There were up over 100 live simultaneous feeds that needed to be ingested, encoded in multiple bit-rates and delivered in real time across the globe to the right distribution points. All of this had never been done before.

Unlike domestic implementations or those focusing mainly on on-demand delivery, live broadband delivery from China meant spec'ing out all the delivery systems in advance and then shipping all of the gear well in advance of the event itself. There were many unknown variables, beginning with the vast potential range of concurrent users. So long hours were invested by partners modeling different scenarios to meet targeted delivery quality goals. Compounding matters, Brick explained that due to space, manpower and time limitations, Digital Rapids and others were challenged to push their systems to do things not previously done.

Meanwhile, NBC faced a pioneer's balancing act, simultaneously trying to preserve the value for its on-air broadcast rights/supporting advertisers, while meeting consumers' expectations for broadband on-demand access to everything. NBC could have chosen to charge for broadband access (as CBS originally did with March Madness, and as MLB continues to do) or provide only highlights clips or nothing via broadband at all. Instead, it offered up - at no charge - 2,200 hours of live streaming and 3,000 hours of on-demand.

Some fans on the sidelines have groused this wasn't enough. Now some analysts are saying that NBC could have generated more ad revenue if it had opened the broadband spigot further. These comments miss the bigger point: NBC moved the broadband market dramatically forward with its Olympics coverage. Focusing on what NBC proved with the first "Broadband Olympics," rather than what attributable revenue it generated, is what's most important for all of us to remember.

What do you think? Post a comment now.

Categories: Advertising, Broadcasters, Sports

Topics: CBS, Digital Rapids, MLB, NBC, Olympics

-

Vogue.TV's Model.Live: A Magazine Bets Big on Broadband

I've been writing for a while now that broadband gives non-video media companies a whole new strategic growth opportunity. This is especially true for magazines with well-defined brands, strong advertising relationships and sought-after audiences. Few magazines fit that description as well as Vogue, Conde Nast's high-end fashion bible. So I was pleased to read about a month ago that Vogue intended to launch Model.Live, a 12 episode original broadband-only series, in a partnership with IMG.

Model.Live went live recently, and I've caught the first couple of 8 minute episodes. Shot in a reality/documentary style, Model.Live follows the lives of 3 young and aspiring models. With a budget of $3 million, these productions do not feel like run-of-the-mill low-end indie video. There are multiple camera angles, great lighting, and extensive on-location shoots. Absent are the high-end graphics and faux cliff-hanger moments typically seen on TV contest shows.

While many will find the subject matter and dialogue insipid (19 year-old Dutch model Cato's mildly defiant "I can party when I'm 30..." justification for deferring college is a classic eye-roller); my guess is that for Vogue readers and for those interested in the fashion world, these authentic behind-the-scenes peeks will be quite intriguing. For example, in episode 2 we hear Cato's mother expressing her authentic unease with the modeling world's fame and glamour (of course, her star-struck sister more than offsets these reservations).

The video player allows sharing through email, and easy downloading to iPods. Curiously though, there's no commenting or rating available, two tools now widely used to generate audience interactivity. Also missing is any email or RSS alert function so it's not clear how a fan would know when the next episode will be released. There's not even a teaser for what's coming next, a standard promotional tool for serialized TV shows.

Still, Vogue has definitely nailed certain things. It is smartly distributing Model.Live on the social network Bebo, which is sure to gain the show widespread visibility among targeted younger audiences (it is supposed to be available on Hulu and Veoh as well, though searches at both sites yielded no results). And, for a deal in the reported "low seven figures," it signed up Express to be the program's sponsor. Express gets huge visibility in the right panel of the video player, with clothing purchases a few clicks away. Vogue's ability to drive awareness and revenue for Express will certainly influence whether Model.Live continues on after its first season.

Model.Live actually follows several other programs Vogue has released ("Behind the Lens," "The Collections," Trend Watch") yet, it is clearly the most ambitious. These kinds of shows are a natural extension for the brand, and I believe are essential as Vogue seeks to engage an increasingly online audience seeking out video. Other magazines should be taking note.

What do you think? Post a comment.

Categories: Advertising, Indie Video, Magazines

Topics: Bebo, Conde Nast, Express, IMG, Vogue

-

Pre-Roll Video Advertising Gets a Boost from 3 Research Studies

Pre-roll video ads' effectiveness and user acceptability is getting a boost from 3 different research studies this week. Results were released by Break/Panache and Tremor Media and by Jupiter Research, which focused on the European market. Taken together, they are an encouraging sign for the many broadband video providers who have chosen ad-supported over paid as their business model of choice.

A key highlight of all three reports concerns user acceptance and engagement with pre-roll ads. This format, whether 15 or 30 seconds, has accounted for the bulk of video ad revenues to date, and yet has been a key source of tension in the industry. Advertisers like pre-rolls because they feel like the well-understood TV model and in fact, where off-the-shelf TV ads are often just re-used (for better or worse). The downside of the interruptive pre-roll approach is that previous research has shown users hate the format. Contributing to users' feelings was the fact that many content providers have been undisciplined about implementing frequency caps or any sort of targeting (I myself have seen far too many tampon ads!).

Yet the Break/Panache results show that 78% of users viewed pre-roll ads for more than 15 seconds and the click-through rate averaged an impressive 10%. Similarly, the Tremor research showed completion rates for both 15 and 30 second ads of approximately 80%, a level it believes is reached because of its ad targeting and focusing on premium content only.

Meanwhile the story was about the same in Europe. According to Jupiter's research (as reported by AdAge), audience drop-off upon the introduction of pre-rolls is under 5%. Jupiter also makes the important point that at least 10% of users drop off after 15 seconds even when there's no ad present, simply because they're in channel surfing mode. That means some percentage of abandonment is due simply to behavior, not a specific ad type. This makes sense when you think about it.

I attribute much of these new positive results to users recalibrating their expectations about broadband video and the presence of ads. Here's what I think has happened:

Since the Internet's introduction, there's been a sense among users that "content is free." And with the exception of annoying popup ads, I think many users have learned to look past unrelated banner ads on standard web pages so they've come to perceive their whole online experience as largely "ad-free" as well. (If you don't believe me, ask yourself when you last clicked on a banner ad unrelated to your work.)

But as broadband video usage has grown, pre-roll ads that actually did interrupt the content experience felt jarring for many users. Naturally, when asked, users said, "ugh, we hate them." Fair enough. But consumers are smart, and have quickly recognized that, just like TV, to get high-quality video programming, someone has to pay, and since most users would rather that not be them, they've become more accepting of all ads, pre-rolls included. With premium sites employing some targeting now and becoming more judicious in their insertion practices (ABC.com and Hulu are great examples), users have become more accepting. Hence these positive research results.

To the extent that pre-roll business practices continue to improve, I think research will continue to show positive results. Whether you personally love pre-rolls or hate them, I see them very much here to stay.

What do you think? Post a comment.

Categories: Advertising

Topics: Break, Jupiter, Panache

-

Kiptronic Accelerates Video Ad Insertion with DART and Atlas Integrations

Kiptronic, a dynamic ad insertion service provider for broadband-delivered video and audio has announced integrations with the two dominant ad management systems, DoubleClick's DART for Publisher and Microsoft's Atlas Ad Manager. This allows Kiptronic customers to traffic their ads from within these familiar ad management consoles beyond browser/PC-based environments.

Kiptronic plays an important role delivering ads against video that's increasingly consumed outside the

browser/PC. These days video consumption is being fragmented to widgets, smartphones, downloaded apps like Adobe Media Player, gaming devices, Internet-connected TVs and more coming as the syndicated video economy gains steam.

browser/PC. These days video consumption is being fragmented to widgets, smartphones, downloaded apps like Adobe Media Player, gaming devices, Internet-connected TVs and more coming as the syndicated video economy gains steam. While more viewership is obviously a plus for content providers, this new heterogeneity creates headaches for ad operations staff tasked with running the correct ads wherever the video is consumed. Kiptronic's secret sauce is inserting both in-browser and also in these disparate environments after recognizing their specific attributes. I'm only aware of one other company in this space, which is Volo Media, but as I understand it, they only insert in downloaded video.

Last week Bill Loewenthal, Kiptronic's President and CEO, and Jonathan Cobb, the company's founder and CTO briefed me on the new integrations as a follow up to a background call Bill and I had about a month ago. Kiptronic's customers are mainly premium content providers such as divisions of Fox, CBS, Time Warner and Sony BMG who place a high value on control and who have their own sales teams.

Kiptronic's key mantra has been enabling ad insertion to all these new environments without requiring any changes to customers' publishing processes. However, to date Kiptronic had required customers to use its proprietary management tool to insert their ads. For customers who use DART and Atlas, these new integrations now eliminate this step, likely boosting Kiptronic's appeal.

The whole concept of video consumption outside the PC/browser domain is a fascinating topic that content providers need to be mindful of. In the next couple of months Kiptronic is going to make data available showing the breakdown of all the places its ads are served. It's a pretty accurate data set given Kiptronic's role. Bill gave me a preview and it is definitely eye-opening. I'll be sharing the info as soon as it's available.

What do you think? Post a comment.

Categories: Advertising, Technology

Topics: Atlas, DoubleClick, Kiptronic, Microsoft

-

comScore Gets Its Act Together on Ad Network Traffic Reporting

I was pleased to see comScore announce on Tuesday that beginning this month it will report two sets of numbers for online ad networks: "potential reach" and "actual reach."

Potential reach will represent the unduplicated visitors to all sites that an ad network has under contract to

deliver ads to (based on written documentation), while actual reach will represent the number of ads actually served (based on a tagging mechanism that comScore will require the ad networks to implement to be counted). This is a welcome development, particularly in the intensely competitive video ad network space. In fact, it seems such an obvious move, one wonders why comScore has been so tardy in introducing it.

deliver ads to (based on written documentation), while actual reach will represent the number of ads actually served (based on a tagging mechanism that comScore will require the ad networks to implement to be counted). This is a welcome development, particularly in the intensely competitive video ad network space. In fact, it seems such an obvious move, one wonders why comScore has been so tardy in introducing it. Followers of VideoNuze and other industry blogs know that comScore's measurement deficiencies recently set off a tempest after comScore ranked YuMe, one of the large video ad networks, #8 in reach in its Ad Focus report. With YuMe trumpeting its ranking, other industry players challenged it by noting that the full audience of MSN (a site that YuMe serves ads to) had been counted. The confusion was caused by the fact that comScore had not been delineating "potential" from "actual" reach or providing apples-to-apples numbers for all networks. Chastened, comScore re-ranked YuMe, sending it plummeting in the rankings.

All of this of course only served to create more confusion for media buyers who are trying to cobble together media plans that achieve their broadband video reach and frequency goals within budget, while minimizing their time invested. Though I'm a huge advocate of the ad-supported model dominating the broadband video landscape well into the future, I'm cognizant that the friction media buyers currently encounter is the single biggest challenge the ad model currently faces in its bid to scale and redirect spending from traditional outlets.

So comScore's new reporting is a step forward after two recent steps back. Let's hope for more forward progress.

What do you think? Post a comment.

Categories: Advertising

-

Non-Linear Presentation + Long-form Premium Video = Big Opportunity

I continue to be surprised that more long-form premium content providers have not pursued initiatives to slice and dice their programs into a non-linear user presentation. This is what "The Daily Show" has done at its site, deconstructing every episode into searchable clips. I think it's a big opportunity to drive more fan engagement, new ad inventory and provide insight about new programming ideas.

While this idea is a natural for archived sports and news programming, I think the model applies to scripted programs as well. Here's an example:

As I've written before, my wife and I were huge fans of "The West Wing" during its seven-year run on NBC.

While we now own the full DVD collection, periodically I'll talk to someone about the show and reminisce about a specific moment from years back. (In fact, TWW seems cosmically related to the current election cycle, given the show's last narrative around 2 candidates - one younger and one older - battling to succeed Bartlet.) This spurs many of those, "boy, I'd love to see that scene right now!" moments.

While we now own the full DVD collection, periodically I'll talk to someone about the show and reminisce about a specific moment from years back. (In fact, TWW seems cosmically related to the current election cycle, given the show's last narrative around 2 candidates - one younger and one older - battling to succeed Bartlet.) This spurs many of those, "boy, I'd love to see that scene right now!" moments.So wouldn't it be awesome if NBC or Warner Bros. (its producer), or whoever has the rights, were to create a site where all the episodes were archived and fully indexed for searching? This would go far beyond the show's current lame-o web site. I could type in "Bartlet speeches," "Josh meltdowns" or even "C.J.-Danny fights" and instantly see collections of relevant clips.

Before you accuse me of being geeky, stop and consider that we all have our favorite programs and love to relive memorable lines and moments. I'd argue that a really vibrant community could be built at these sites, attracting traditional advertisers eager to continue their audience relationships. Then of course there's the opportunity to embed clips into Facebook and MySpace pages, extending the community further. And think about what this ongoing loyalty would do to drive up the value of broadcast syndication rights.

The big challenge here is indexing the archive. The process must rely heavily on accurate metadata generation, but in a highly scalable, cost-effective manner. That's a mouthful of requirements, so clearly this isn't easy stuff. Various players are trying to crack this nut; two which I've previously written about are Gotuit (which is announcing a partnership with Move Networks today) and EveryZing, but there are others too. Recently I've had briefings with 2 companies that are investing in this area and will have news in the coming months.

Long-from premium providers are facing an onslaught of competition from short-form alternatives while also commonly experiencing a shortage of available inventory. Non-linear presentations of their content addresses both these issues, while delighting loyal fans. I see this as an emerging and sizable opportunity.

Am I missing something here? Post a comment now!

Categories: Advertising, Broadcasters, Technology

Topics: Daily Show, EveryZing, Gotuit, Move Networks, NBC, Warner Bros., West Wing

-

Citysearch Offering Local Merchants Video Enhancement

Citysearch, the big online local information company, is making an aggressive push into video. The company is currently running a new promotion which allows its merchants to have a complimentary video made for them, which enhances their Citysearch listing, and can also be used on their own web site and on YouTube.

I'm always on the lookout for ways video can drive more revenue, and Citysearch's effort (originally begun in early '07) qualifies on at least two levels. First, it's a valuable enhancement to Citysearch's pay-for-performance ad model, increasing the ARPU the company derives from its merchants. Second, it appears to be a bona fide differentiator for merchants in helping them attract new business. And of course it helps deliver on users' growing expectations for video experiences.

Last week I spoke with Brian McCarthy, Citysearch's VP of Merchant Product to learn more about how the program works. I also spoke to Marc Edward, who runs Marc Edward Skincare in West Hollywood, CA, which is a merchant that's been offering video in its Citysearch listing for over a year.

Under the current promotion, Citysearch will make a 60-90 second video for its merchants for no cost to them. Citysearch has partnered with 3 production firms, TurnHere, StudioNow and GeoBeats to produce the video, which Brian said cost under $1,000 apiece. The merchant is involved in the editing process and then the video is added to the merchant's listing. When a user watches the video for at least 10 seconds, the merchant is charged a fee ranging from $.40 to $2.00, as part of Citysearch's "multimedia package."

Marc was one of the early users of Citysearch video and is quite enthusiastic about the results. He feels that nothing can convey what his business is about better than prospects actually seeing him talk about it, and explaining what they can expect. While he hasn't tracked new business directly to the video he offers, anecdotally he said new clients mention and cite the video as a major reason why they chose his shop over others.

While it's still early days for video enhancements in local listings/search results, it seems like a natural way to extend the model. Other local players like WorldNow, CBS and other broadcasters are on to this as well. The key is getting the financial model right for all parties: who pays to get the video made and how it generates a return over time. Citysearch seems to be making progress proving how the model can work.

What do you think? Post a comment now.

Categories: Advertising

Topics: CBS, CitySearch, GeoBeats, StudioNow, TurnHere, WorldNow

-

comScore Revises YuMe Traffic Down

Back on July 22nd I passed on news from comScore that YuMe had broken into the top 10 ad networks, reaching almost 135 million unique visitors in June. Not so fast it turns out. As reported well by both

NewTeeVee and Online Media Daily over the few days, comScore has quietly revised YuMe's reach down to 59.2 million uniques, which would actually land it at number 32 on comScore's June Ad Focus report.

NewTeeVee and Online Media Daily over the few days, comScore has quietly revised YuMe's reach down to 59.2 million uniques, which would actually land it at number 32 on comScore's June Ad Focus report. The change results from re-assigning some traffic from major YuMe client MSN. comScore had given YuMe credit for all of MSN's page views, when in fact YuMe was only serving ads on certain sections of the portal. So comScore has decided it's more accurate to give YuMe credit solely for those pages.

Needless to say, YuMe is not happy about the change and is protesting the new numbers. Its argument is

that with comScore's revised approach, YuMe traffic is being counted differently than all other ad networks. For now it continues to prominently showcase the original comScore numbers on its home page. YuMe seems determined to see a revision to the revision, so we'll all have to see what comScore does next.

that with comScore's revised approach, YuMe traffic is being counted differently than all other ad networks. For now it continues to prominently showcase the original comScore numbers on its home page. YuMe seems determined to see a revision to the revision, so we'll all have to see what comScore does next. There are many posts on VideoNuze about the various ad networks and how they seek to differentiate from each other. Traffic is certainly one of the key battlegrounds, so it's no surprise this skirmish has broken out over the comScore numbers. One is tempted to feel some sympathy for media buyers...if the measurement firms haven't yet figured out how to accurately count the networks' relevant traffic, how are the agencies expected to buy on behalf of their clients?

Categories: Advertising

-

YuMe Ad Network Breaks Into comScore's Ad Focus Top 10

Another sign of video advertising's continued growth is that video ad network YuMe has broken into

comScore Media Metrix's Ad Focus top 10, reaching almost 135 million unique visitors in June. The full stats are in this comScore release. While obviously a big win for YuMe (which I've previously written about here), a larger point that I think is worth noting is that this demonstrates how pervasive broadband video is becoming for all publishers. Going forward I expect YuMe's reach to continue to rise, and also for other video ad networks to keep moving up comScore's list.

comScore Media Metrix's Ad Focus top 10, reaching almost 135 million unique visitors in June. The full stats are in this comScore release. While obviously a big win for YuMe (which I've previously written about here), a larger point that I think is worth noting is that this demonstrates how pervasive broadband video is becoming for all publishers. Going forward I expect YuMe's reach to continue to rise, and also for other video ad networks to keep moving up comScore's list. Categories: Advertising

-

Google, Others Syndicating Video Into the Long Tail

The trend toward widespread video syndication to small-to-medium sized web sites continues to gain momentum.

Two recent initiatives - plus others I expect are still to come - point to the increasing likelihood that broadband video's eventual distribution model will look far different from traditional, tightly-controlled approaches. I'm becoming more convinced that "syndicated video economy" concept I sketched out in March is where the market is heading.

The first initiative, covered in a recent NYTimes article, "Google and Creator of 'Family Guy' Strike a Deal" suggests that Google may finally be ready to point its powerful AdSense engine toward video distribution.

AdSense, as many of you likely know, essentially created a "long tail of advertisers" by dispersing targeted pay-for-performance keyword-based ads to tens of thousands of small-to-medium sized web sites. Including Google Ads has become a no-brainer for many sites seeking to easily pick up a few extra bucks by allocating some on-site real estate to AdSense.

AdSense, as many of you likely know, essentially created a "long tail of advertisers" by dispersing targeted pay-for-performance keyword-based ads to tens of thousands of small-to-medium sized web sites. Including Google Ads has become a no-brainer for many sites seeking to easily pick up a few extra bucks by allocating some on-site real estate to AdSense.Now instead of distributing ads, Google is looking to take the AdSense model a step further by distributing video content (along with ads) to myriad web sites hungry for video, and cash. First up are comedic webisodes from Seth MacFarlane (creator of Fox's "Family Guy"). Google's proposition to small, and even larger sites, makes sense: we'll give you free high-quality video content, all supported by pay-for-performance ads. You get great content and can make money at it. What's not to like? Not much in my opinion. It seems like such a compelling model that one wonders why Google hasn't done this earlier. In fact, they did. Back in August 2006, Google announced a test with MTV to do exactly the same thing (the ensuing YouTube-Viacom litigation no doubt scotched the test). Hopefully this time around Google will have more luck.

Meanwhile, hyper video syndication is not just for the mighty like Google. Consider Jambo Media, a two year-old company with 12 employees which has built out a syndication network now generating over 2 million video views per day. Web sites like BestCelebGossip.com, Epigee.org and MensTech.com may not be household names, but, as Jambo's CEO and co-founder Rob Manoff explained to me, they are representative of virtually unlimited long tail web publishers eager for video, but unable or unwilling to create it themselves.

Rob and his team of ex-affiliate marketing and advertising veterans have created the Jambo Video Network by licensing video from sources such AP, iVillage, Ivanhoe Broadcast News, and then packaging them into "channels" for distribution in a Jambo video player. Of course ads come along with the video content (though Jambo has a separate ad-free "JamboCast" white label solution in the works too).

Affiliate sites can login to their Jambo account to select which channels to receive while customizing the look and feel of the video player. Over 100 sites have affiliated, which Rob believes will grow to several hundred by the end of '08, driving a projected 5 million views/day. Rob said that sites earn $2-4 effective CPM with revenue per day ranging from $10-30 on the low end all the way up to $1,000/day on the high end.

Jambo is pursuing a space that syndicators like Roo, Voxant, ClipSyndicate, Newsmarket and others have been in for a while. All of these players, along with now Google, are doing what Rob articulates well: creating video ad inventory where none previously existed. Such is the power of syndication in the frictionless Internet environment. And why smart content providers - from startups to established TV networks - are recognizing that increasingly, syndication is where the broadband market is heading.

Note: if you want to learn more about syndication and how one big content provider is succeeding with it, please join me for a webinar entitled, "Profiting from the Syndicated Video Economy." The webinar is sponsored by Akamai and will feature a presentation from Greg Clayman, Executive VP, Digital Distribution and Business Development, MTV Networks and me. Registration is free.

Categories: Advertising, Indie Video, Syndicated Video Economy

Topics: ClipSyndicate, Google, Jambo Media, Newsmarket, ROO, Voxant

-

New TDG Research Provides Details of Broadband Video Advertising's Growth

The Diffusion Group, a leading analytics and advisory firm specializing in broadband media and the digital home, is releasing a new report tomorrow entitled, "Online TV and the Future of Digital Video Advertising." VideoNuze is offering half a dozen slides as a complimentary download (note, VideoNuze has no financial interest in this report).

Though I haven't seen the full report, in a conversation with Mugs Buckley, the report's author (and also periodic VideoNuze contributor), I got a sneak peek at some of its key conclusions. The report is based on TDG's proprietary consumer research and modeling, interviews with industry executives, data from other firms and other secondary research. In sum, the report pegs '08 video ad revenue at $590 million, growing to $9.98 billion in 2013.

To establish some order, Mugs first identifies four types of video, estimating each one's current market share

in terms of stream count and ad revenue and then forecasting them through 2013. The four types are "user generated video," "long-form," "short clips" and "other" (which includes all paid models, adult content, corporate and educational videos, etc.).

in terms of stream count and ad revenue and then forecasting them through 2013. The four types are "user generated video," "long-form," "short clips" and "other" (which includes all paid models, adult content, corporate and educational videos, etc.). No surprise, UGV currently accounts for 42.4% of streams, but only 3.7% of ad revenues. Conversely, long-form accounts for only 2.2% of streams but 41.6% of ad revenues. Note the disparity would be lower if, instead of using streams (where one 40 minute TV show stream is equivalent to one 10 second clip stream on YouTube), the report used "minutes viewed" or another consumption-centric metric. I agree with Mugs though - in either case, the underlying point would still be true - long-form, higher-quality video is going to be where ad dollars are and will be concentrated.

The report's forecast reinforces the point: by 2013, long-form's stream share will roughly double to 4.1%, with its share of ad revenue growing to 69.4%. Conversely UGV's stream share grows a little bit, but its ad share shrinks to 1.8% . A wildcard in this mix is the role of short-clips, defined as 2-5 minute videos including everything from news/entertainment/sports videos to webisodes. Mugs is bullish on this segment, with its lower costs to produce and ability for users to watch spontaneously. This is where a lot of market activity and original programming is happening and it's still early to gauge its acceptance by users and advertisers.

A key input to the revenue forecast is the underlying CPM forecast. Mugs said her approach was to be relatively conservative with CPM's predicting little more than inflation-adjusted growth. For long-form that means CPMs growing from $40 today to $46 in 2013, which feels pretty modest, especially if targeting and engagement tactics pay off (see more on Disney's efforts in this post). On the UGV CPM forecast, it's important to note the $15 CPM refers to YouTube's announced CPM target for partners' video, NOT pure UGV.

There's lots more info in the slides, and if you're interested in the whole report, it's best to contact sales@thediffusiongroup.com or 469-287-8050.

Categories: Advertising

Topics: The Diffusion Group

-

Disney/ABC's Cheng is Confident About Broadband Video Advertising

Though broadcast TV networks have been aggressively pushing their shows online, there has been simmering angst about what impact this will ultimately have on their traditional economics.

I have explored this issue recently in "Does Broadband Video Help or Hurt Broadcast TV Networks?" and in two posts on Fox's "Remote-Free TV" initiative here and here. NBCU's CEO Jeff Zucker has helped to stoke this concern, publicly calling broadcasters' #1 challenge the risk of exchanging "analog dollars for digital pennies."

Thus I was both a bit surprised, but also encouraged, to hear Albert Cheng, Disney/ABC's EVP of Digital

Media tell me in a recent briefing that despite the fact that online revenue per program per eyeball is currently less than it is for on-air, he's confident that online will eventually catch up and surpass on-air. I don't regard these comments as idle boasts. A thick PowerPoint deck covering its online video strategy, which Disney/ABC shared with me, reveals the meticulous thought and in-depth audience research that is guiding Disney's online video initiatives. Not to mention ABC.com is the most-used network web site.

Media tell me in a recent briefing that despite the fact that online revenue per program per eyeball is currently less than it is for on-air, he's confident that online will eventually catch up and surpass on-air. I don't regard these comments as idle boasts. A thick PowerPoint deck covering its online video strategy, which Disney/ABC shared with me, reveals the meticulous thought and in-depth audience research that is guiding Disney's online video initiatives. Not to mention ABC.com is the most-used network web site.Cheng is quick to point out that Disney/ABC has followed a careful and consistent strategy since it moved into online distribution a few years ago (note Disney/ABC was the first network to work with iTunes and first to offer programs for free. Other networks quickly followed). The focus has been on continued learning and refinement.

From a strategy standpoint, Disney/ABC's video player, powered by Move Networks, is the centerpiece. The focus is on delivering a high-quality, consistent user experience in which ads are engaging, but not intrusive. While other networks have received more ink for their syndication efforts Cheng is quick to point out that access to Disney/ABC's player has always been open, allowing other sites to refer their users, if not actually integrate the player.

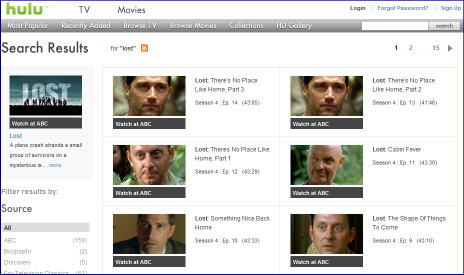

By making an RSS feed available of its online programs' meta-data, Cheng believes Disney/ABC can achieve much of what others gain through syndication deals (see how Hulu displays results for a "Lost" search below, subtly noting "Watch at ABC" This is the same concept I noted in my recent Hulu vs. Comcast post), while avoiding the downsides of ad sales conflicts, business rules implementation and delivery overhead.

By controlling their own ad inventory, Disney/ABC avoids the sometimes one-sided revenue sharing deals widely-discussed in the industry (Hulu alone is rumored to keep 90%) and the channel conflict that inevitably results from having two sales teams calling on the same media buyers. Cheng does see a role for online aggregators, but mainly for library or off-network product, especially as a backstop for traditional syndication.

Cheng's rationale for broadband's eventual revenue superiority to on-air ultimately boils down to this: since broadband can offer both superior targeting and engagement vs. on-air, by definition it deserves higher pricing. But getting to that vision from today's reality is where Disney/ABC's hard work of evangelizing to advertisers and ongoing testing is key (and where the company's recently announced "Ad Lab" comes in).

Here again, by controlling its own inventory and player experience, Cheng believes Disney/ABC is better positioned than other networks. He surmises that, public comments notwithstanding, other networks are not selling out their inventory and are getting lower CPMs than Disney/ABC. Maybe this helps explain the "analog dollars, digital pennies" angst?

Disney/ABC's efforts to fully monetized broadband delivery will be closely watched as an indicator of broadband's true impact on broadcasters. And while I believe Cheng's regard for broadband's potential is correct, broadcasters still face the very real headwinds of consumer distaste for ads in general, the proliferation of ad-skipping through DVRs, and the expectations being set with limited ads in current online implementations.

While I'm rooting for Disney/ABC and others to succeed in broadband video advertising, I think they have their work cut out for them.

What do you think? Post a comment and let everyone know!

Categories: Advertising, Broadcasters

-

Visible Measures: Ultimate Broadband Video Measurement

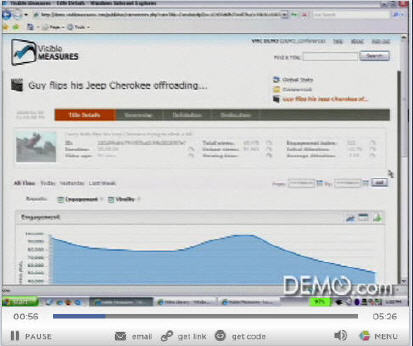

If you've ever hungered for insight about a specific video's performance beyond just how many views it has received, Visible Measures is a company after your heart. An independent firm that measures the reach and engagement of broadband video across the Internet, VM heralds an era of ultimate insight into how each and every video performs when it enters the Internet's fast-moving current.

By integrating its code with the video player, VM collects data on session length, drop-out points, rewind activity, click-throughs, viral distribution, geographic usage and other metrics. Think of VM as "big brother-esque" (in a positive way) in tracking a video's "true reach" as VM puts it, supplying a dizzying array of data to content providers and advertisers. The data is presented in intuitive, graphical formats that analysts can parse and sort to understand the video's ROI and what can be done to improve performance next time around. The company is already tracking over 80 million videos in its database.

I recently spent time with Matt Cutler, VM's VP of Marketing and Analytics who gave me a demo of the system and how it's being brought to market. VM is targeting established and early stage media companies, advertisers and ad agencies, all of whom have a critical stake in developing business cases for video deployments and ad campaigns. VM's tracking capabilities are especially meaningful given how pervasive the "syndicated video economy" is becoming.

None of this is to suggest that VM's data will replace programmers' and advertisers' creative instincts, but it would surely provide some real world augments to help offset the inherent guesswork involved in the creative process. (for more specifics about how VM works, see the below video from DEMO '08)

For advertisers specifically, today VM is announcing both its "VisibleCampaign" solution to measure ad campaigns' performance and also a collaboration with Dynamic Logic to track how these campaigns affect a brand's perception. Both initiatives are important in helping advertisers and agencies gain more insight about the broadband video medium and why it's important to invest. As someone who has expressed concern that the broadband ad business needs to mature quickly to support the myriad startup and established media companies relying on it, VM's will surely help decision-makers across the board gain comfort in shifting over more of their budgets.

VM is a perfect example of innovation needed to help optimize a new medium as it takes root. The company has raised $19 million through three rounds and is based in Boston. Based on what I've seen I'm quite enthusiastic about its odds of success.

Categories: Advertising, Startups, Technology

Topics: Dynamic Logic, Visible Measures

-

Hulu Out-Executing Comcast in On-Demand Programming?

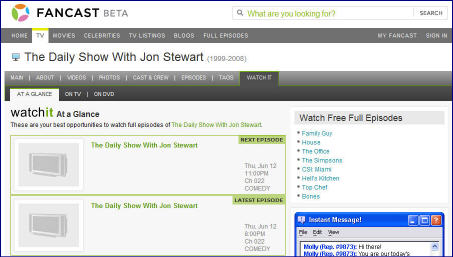

The crew over at Hulu must be gleefully fist-bumping each other this week as Hulu scored a key strategic and public relations coup in adding to its lineup two of Comedy Central's most popular programs, "The Daily Show with Jon Stewart" and "The Colbert Report." Though officially positioned as a test, Hulu still deserves big-time kudos as the deal is an endorsement of its value proposition.

The deal and Hulu's execution illustrate a larger point that I've been making for a while: one of broadband's three key disruptions is that it enables new aggregators to gain an edge on larger incumbents by changing the dynamics of competition. To be more specific, in this case, I think that Hulu has out-executed Comcast, America's #1 cable operator by delivering new value to consumers and gaining important PR momentum. Here's why:

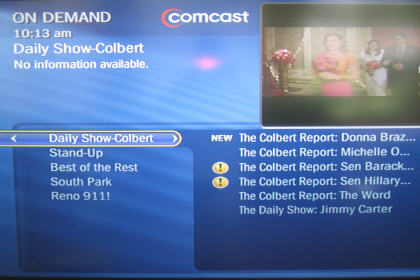

Fancast, which is Comcast's online portal (in beta), actually announced a deal with Comedy Central back on May 19th for access to these same programs and others. Yet go to Fancast and search for "Daily Show" and, as shown below, you won't find any Daily Show full episodes available, just an assortment of short clips and times when it's on TV. A Comcast spokesperson told me that Comcast's implementation is imminent, but its delay in getting the programs up and running is accentuated when you consider that Comedy Central must have done its distribution deal with Fancast BEFORE its deal with Hulu.

Second, and more concerning is that, as a Comcast digital subscriber, when I tried to find The Daily Show and Colbert in Comcast's VOD menu, all that is available are five older Colbert clips and 1 older Daily Show clip. My guess is these haven't been updated in a while. No full-length Daily Show or Colbert programs are available at all in VOD.

While the Comcast spokesperson told me that the company works closely with its programming partners like Viacom to figure out the optimal mix of programming to make available on VOD, I think an unavoidable conclusion here is that Comcast (and other cable operators) is constrained by its inability to monetize VOD programming with advertising (what this week's "Project Canoe" is meant to address) and to easily add new programming on the VOD menu. These programming gaps create opportunities for upstarts like Hulu to capitalize on.

It may be unfair to zero in so narrowly on Comcast's execution with Daily Show/Colbert, yet things weren't much different when I searched for MTV's popular "The Hills" on Hulu, Fancast and Comcast's VOD. While Hulu doesn't appear to have a deal for full episodes of "The Hills" it masks this cleverly by providing thumbail images and easy navigation back to MTV's site where the video lives, for over 50 episodes (this is tactic Hulu uses for ABC's shows as well). On the other hand, Fancast displays just 5 full episodes, 2 from this season and 3 from last. And on VOD there are also just 5 episodes, though all from this season.

I think it's pretty significant that Hulu, a site that only went live 3 months ago can not only gain access to hit Comedy Central programs like Daily Show/Colbert, but can execute quickly. Hulu is using its advantages - flexible technologies, interactive features (clipping, embedding, sharing), monetization capability, savvy PR and startup pluck to compete with far-larger incumbents like Comcast.

Of course Comcast racks up billions of VOD views each year and has vast resources, making it an important player in on-demand programming. Yet Hulu has managed to make Comcast's advantages look a little less intimidating. I asked the Comcast spokesperson about this. She acknowledged Hulu's progress, but maintained that Comcast believes its mulit-platform approach is stronger.

In the big picture that's true, but when it comes to winning consumers' hearts and minds, it's often execution, not broad strategy that carries the day. And don't forget, when Hulu is unshackled from the PC - with its content freely riding Comcast's broadband pipes all the way to the TV - execution will matter even more.

This week Hulu provided a textbook example of how broadband-only aggregators can gain a foothold against well-established incumbents. Comcast and other incumbents should be taking notice and getting their game on.

What do think? Post a comment and let everyone know!

Categories: Advertising, Aggregators, Cable Networks, Cable TV Operators

Topics: Comcast, Comedy Central, Fancast, Hulu, The Colbert Report, The Daily Show, Viacom

-

More on Heavy's Spinout of Husky Media

Late last week, news broke that Heavy Media, which operates Heavy.com, one of the leading destination sites for men 18-34 was spinning off its Husky Media unit as a standalone ad management and network company. I found the deal intriguing and followed up with David Carson, co-CEO to learn more and see how it plays into larger trends I've been tracking.

Broadband ad networks already compete vigorously with each other to build out their publisher networks and cultivate brands and agencies to obtain a share of their spending. The networks are continuously enhancing their technology and trying to optimize their various ad units to demonstrate the superiority of their approach. And as I recently wrote in "Tremor, Adap.tv Introduce New Ad Platforms," some firms are now enabling ad aggregation in an effort to improve their publishers' effective CPMs.

Broadband ad networks already compete vigorously with each other to build out their publisher networks and cultivate brands and agencies to obtain a share of their spending. The networks are continuously enhancing their technology and trying to optimize their various ad units to demonstrate the superiority of their approach. And as I recently wrote in "Tremor, Adap.tv Introduce New Ad Platforms," some firms are now enabling ad aggregation in an effort to improve their publishers' effective CPMs.With this context in mind, a key question is "does the world really need another video ad management and network?" David patiently explained that they've received a lot of outside interest in their units, namely the "barn doors" that are shown before the video plays, the subsequent skin that remains on the sides while the video plays, and the playlist-like queuing of video with ads judiciously interspersed (which Heavy calls its Video Guide). Heavy has avoided pre-rolls entirely. This interest spurred them to separate Husky.

David believes that each of these units offers superior value. As compared with pre-rolls, where David said "bounce" or early termination rates can be 50% (resulting in the actual content never being seen), with Husky's approach, there's a 90% completion rate, and particularly when users come through the Husky "Video Guide", the number of videos consumed can be 3-6 times greater. David also said they're seeing click-throughs averaging 1.6%, above industry norms.

So of course the next question is, if these units perform so well, what's to stop others from introducing them as well? In fact, David would encourage this, as he believes it would help educate the market and maybe help establish these as preferred units. As long as Husky continues to get its fair share that would be a win. Husky has patents on the skin, and how it works with various video players.

David said investor meetings are underway and he anticipates the company completing its own financing. Husky will have its own separate management team. Heavy also announced last week a syndication deal for its Burly Sports show to CBSSports.com, and, no surprise, Husky will be the ad platform. To the extent that Heavy can do other syndication deals where Husky gets included, that will help it gain market share.

Clearly there continues to be a huge amount of experimentation in the broadband video ad market. The Husky deal further shows that sometimes developing technology for your a site's own use can, if successful, end up creating larger financial value.

Categories: Advertising, Deals & Financings, Indie Video

Topics: Adap.TV, CBSSports.com, Heavy.com, Husky, Tremor